- China

- /

- Electronic Equipment and Components

- /

- SZSE:002658

High Growth Tech And 2 Other Promising Stocks With Potential For Expansion

Reviewed by Simply Wall St

In the current global market landscape, major stock indexes have shown mixed results with growth stocks leading the charge, as evidenced by the significant outperformance of growth shares over value stocks and record highs in indices like the S&P 500 and Nasdaq Composite. Amidst this backdrop, identifying promising stocks for expansion involves looking at sectors that are gaining momentum such as consumer discretionary and information technology, which have recently demonstrated strong performance.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Kexing Biopharm (SHSE:688136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kexing Biopharm Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs and microbial preparations both in China and internationally, with a market cap of CN¥3.44 billion.

Operations: Kexing Biopharm generates revenue primarily from pharmaceutical manufacturing, amounting to CN¥1.33 billion. The company is involved in the development and sale of recombinant protein drugs and microbial preparations across domestic and international markets.

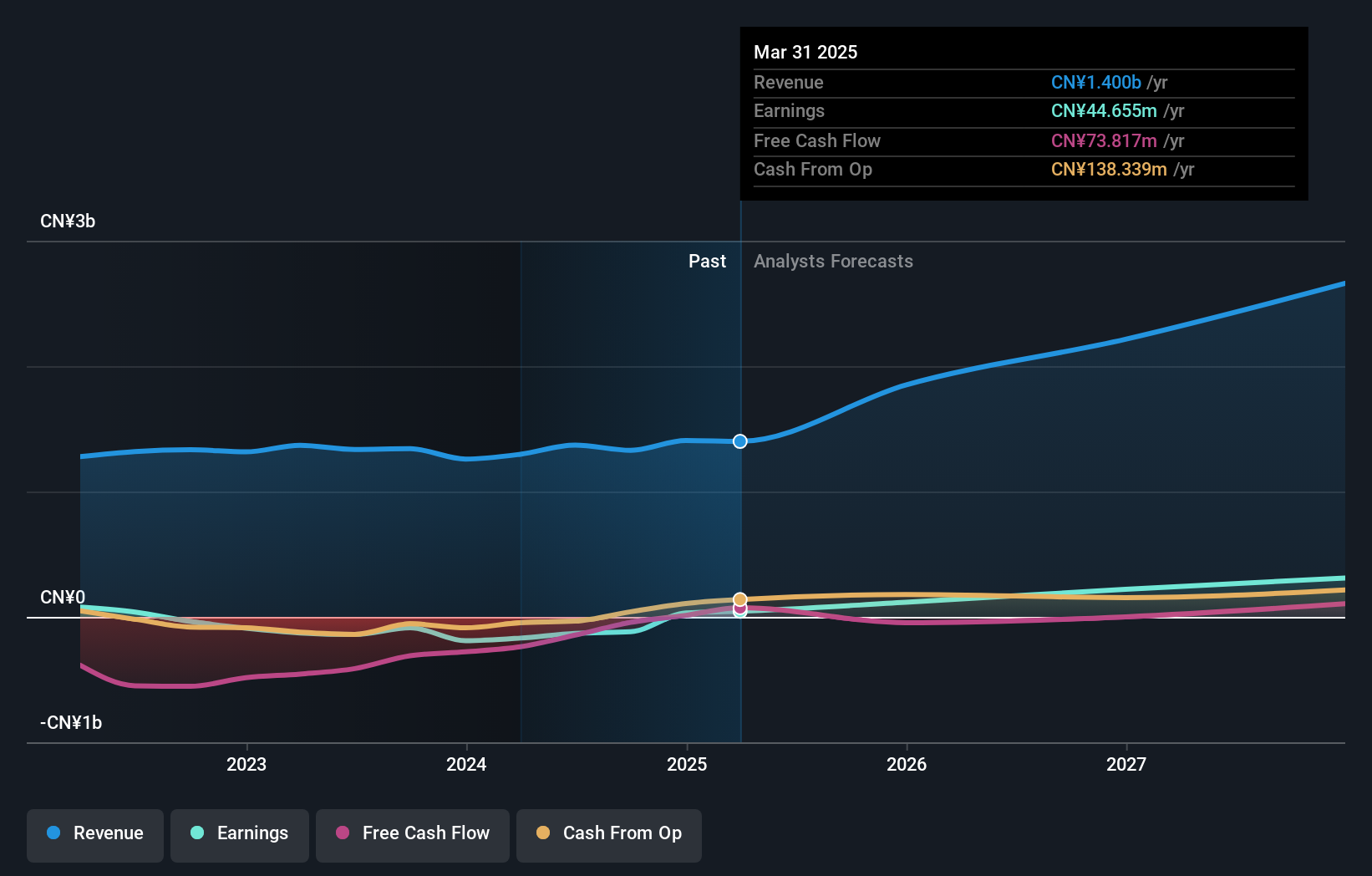

Kexing Biopharm has demonstrated a notable turnaround in its financial performance, with recent earnings showing a shift from a net loss of CNY 54.31 million to a net income of CNY 17.18 million year-over-year. This improvement is underpinned by a significant revenue increase to CNY 1,038.26 million from CNY 969 million, reflecting an annual growth rate of approximately 27.9%. The company's commitment to innovation is evident in its R&D efforts, although specific expenditure figures are not disclosed; such investment is critical for sustaining long-term growth in the competitive biotech landscape. Moreover, forecasts suggest an impressive potential profit surge at an annual rate of about 103.2%, positioning Kexing Biopharm well above average market expectations and signaling robust future prospects despite current profitability challenges and below-average debt coverage by operating cash flow.

- Get an in-depth perspective on Kexing Biopharm's performance by reading our health report here.

Examine Kexing Biopharm's past performance report to understand how it has performed in the past.

Beijing SDL TechnologyLtd (SZSE:002658)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing SDL Technology Co., Ltd. develops and sells environmental monitoring equipment and solutions both in China and internationally, with a market cap of CN¥4.42 billion.

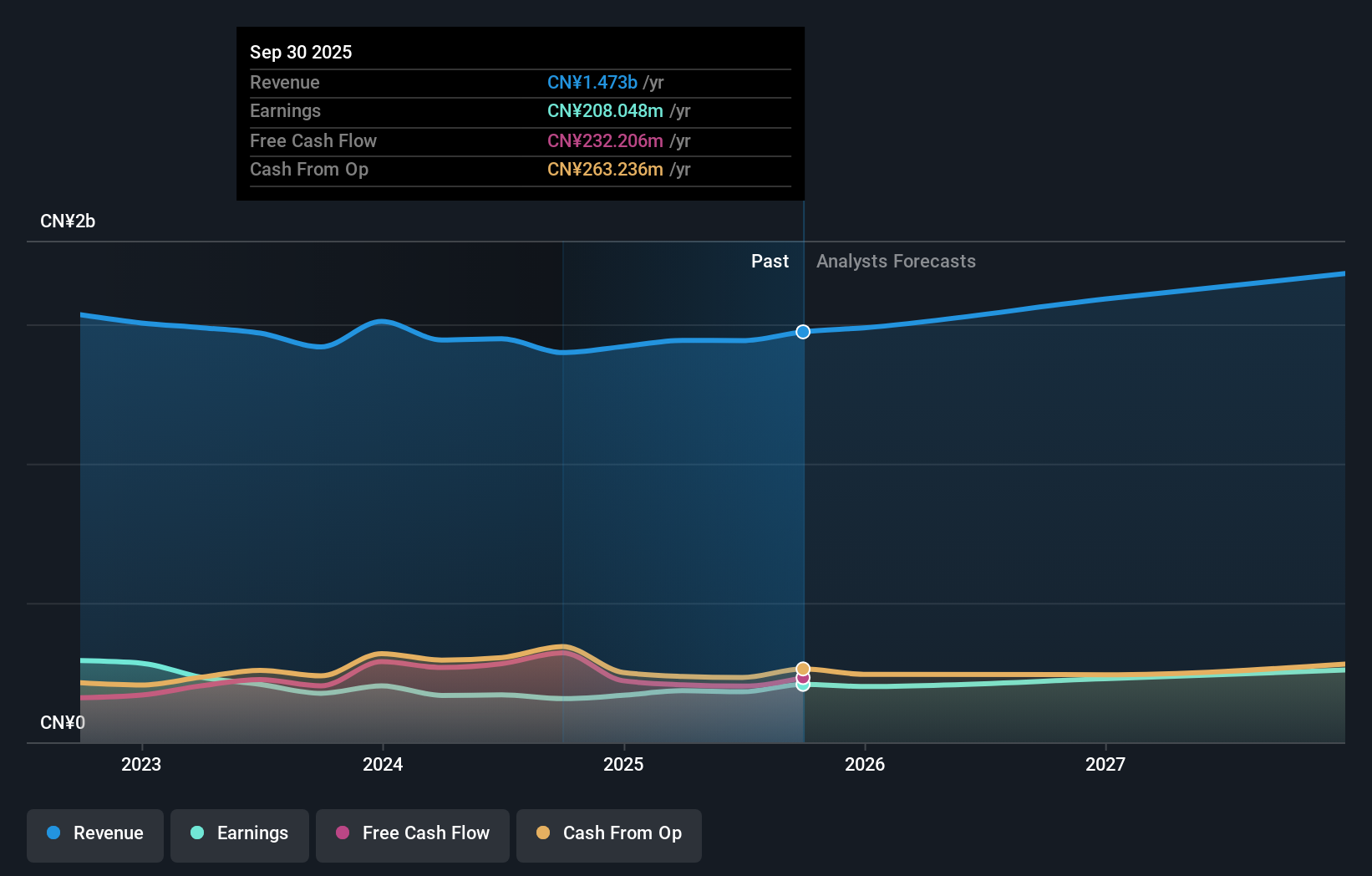

Operations: Beijing SDL Technology Co., Ltd. focuses on environmental monitoring equipment and solutions, catering to both domestic and international markets. The company generates revenue primarily through the sale of these products and services.

Beijing SDL TechnologyLtd. is navigating a challenging landscape with its recent revenue dip to CNY 835.35 million from CNY 947.21 million, reflecting the intense competition in tech sectors. Despite this, the firm's commitment to innovation remains robust, as evidenced by a notable R&D expenditure that aligns with its strategic focus on growth through technological advancements. Impressively, earnings are expected to surge by 27.1% annually, outpacing the broader Chinese market's growth rate of 25.9%. This trajectory suggests Beijing SDL is not only recovering but potentially positioning itself as a stronger competitor in its field through sustained investment in research and development initiatives.

SIIX (TSE:7613)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SIIX Corporation primarily engages in the sale and distribution of electronic components in Japan and internationally, with a market cap of ¥54.48 billion.

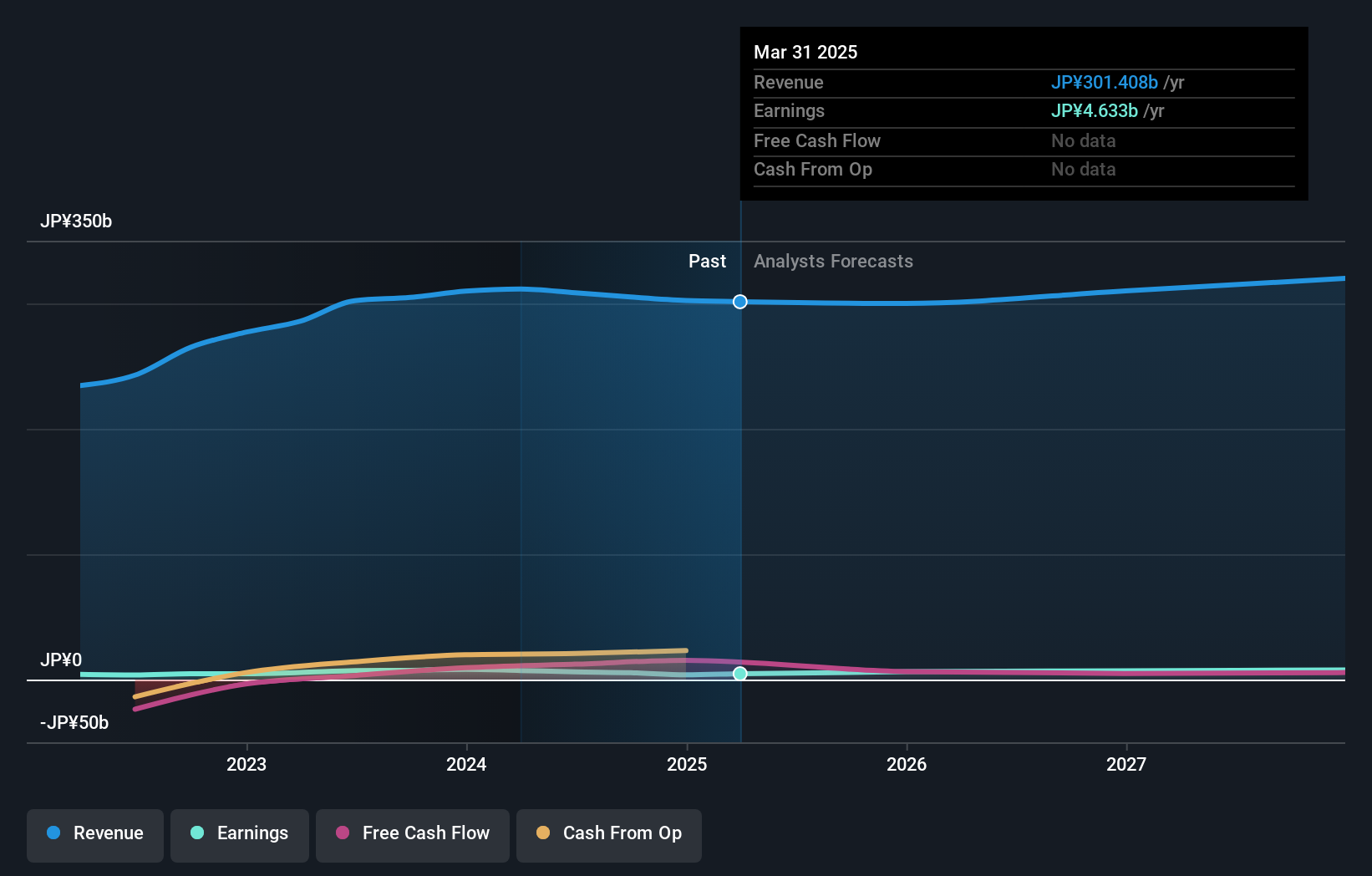

Operations: The company generates revenue through the sale and distribution of electronic components across various regions, including Japan, Europe, the Americas, Greater China, and Southeast Asia. Notably, Southeast Asia contributes ¥115.45 billion to its revenue stream.

SIIX Corporation stands out in the tech sector with its strategic emphasis on R&D, dedicating substantial resources to innovation. This commitment is reflected in their R&D spending, which aligns closely with their growth trajectory. Despite a challenging market environment, SIIX's earnings are set to climb by 22.6% annually, surpassing the Japanese market's average growth of 7.8%. Moreover, the company’s revenue is expected to increase by 4.4% yearly, slightly outpacing the broader market projection of 4.1%. These figures underscore SIIX’s potential to leverage its research-driven approach for sustained growth and competitiveness within high-growth tech sectors.

- Unlock comprehensive insights into our analysis of SIIX stock in this health report.

Gain insights into SIIX's historical performance by reviewing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 1286 High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SDL TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002658

Beijing SDL TechnologyLtd

Develops and sells environmental monitoring equipment and solutions in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.