As global markets navigate mixed performances and economic indicators show signs of both resilience and contraction, investors are increasingly seeking opportunities in less prominent areas such as small-cap stocks. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for uncovering hidden value amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

We'll examine a selection from our screener results.

ComNav Technology (SHSE:688592)

Simply Wall St Value Rating: ★★★★★★

Overview: ComNav Technology Ltd. is engaged in the development, manufacturing, and sale of GNSS original equipment manufacturer boards, receivers, and solutions for high precision positioning applications globally with a market cap of CN¥2.24 billion.

Operations: The primary revenue stream for ComNav Technology comes from its wireless communications equipment segment, generating CN¥445.95 million. The company's financial performance is reflected in its market capitalization of CN¥2.24 billion, indicating its valuation in the marketplace.

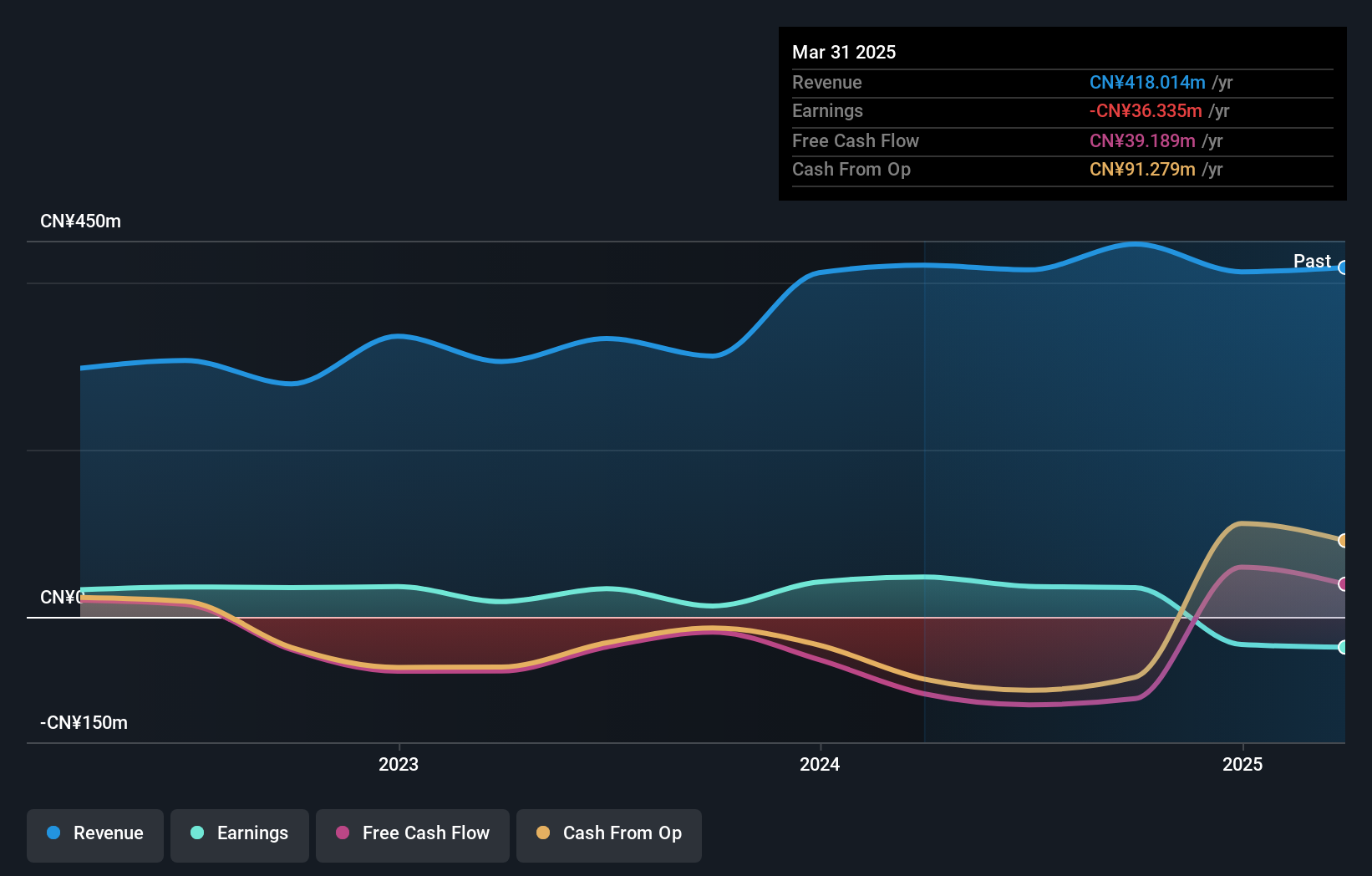

ComNav Technology, a smaller player in its field, has demonstrated impressive earnings growth of 167% over the past year, outpacing the Communications industry's -3%. The company is debt-free now, a significant improvement from five years ago when its debt-to-equity ratio stood at 21.5%. Despite this progress, ComNav reported a net loss of CNY 7.88 million for the nine months ending September 2024, compared to CNY 0.99 million last year. Sales increased to CNY 195.94 million from CNY 161.68 million over the same period, reflecting strong top-line performance amidst challenges in profitability and free cash flow generation.

Zhongtong Bus HoldingLTD (SZSE:000957)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongtong Bus Holding Co., LTD focuses on the manufacture and sale of buses in China, with a market capitalization of CN¥6.20 billion.

Operations: Zhongtong Bus Holding Co., LTD generates revenue primarily from its bus manufacturing segment, which reported CN¥5.69 billion. The company's financial performance is influenced by its net profit margin, which has shown variability over recent periods.

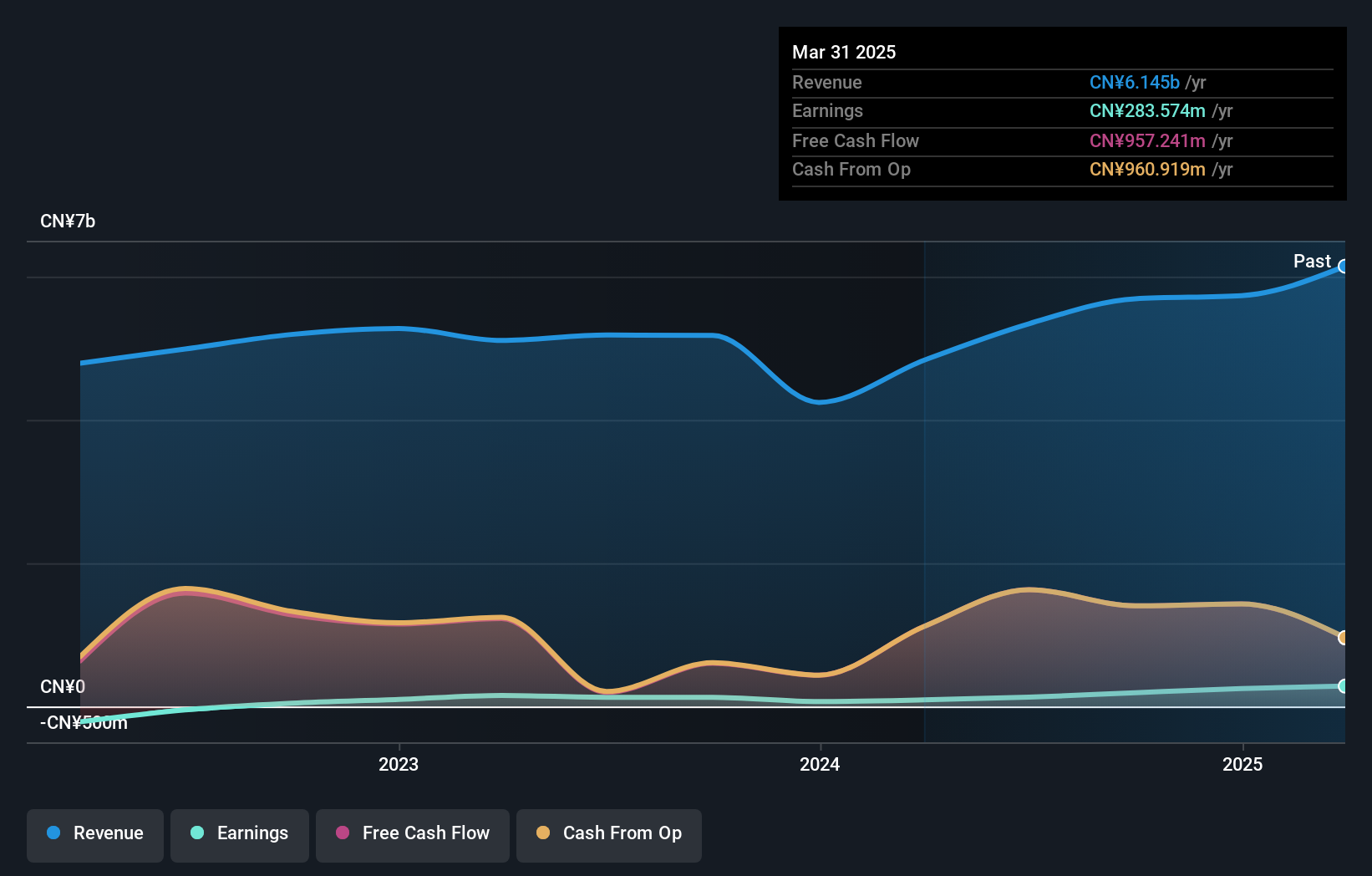

Zhongtong Bus Holding, a nimble player in the transportation sector, seems to be undervalued, trading at 78.5% below its estimated fair value. The company has demonstrated robust growth with earnings surging 48.9% over the past year, outpacing the Machinery industry's -0.06%. With no debt on its books now compared to a debt-to-equity ratio of 90.5% five years ago, Zhongtong appears financially sound and capable of covering interest payments effortlessly. Recent financials reveal net income for nine months ending September 2024 at CNY 195 million against CNY 74 million last year, reflecting strong operational performance and high-quality earnings potential.

Motic (Xiamen) Electric GroupLtd (SZSE:300341)

Simply Wall St Value Rating: ★★★★★★

Overview: Motic (Xiamen) Electric Group Co., Ltd focuses on the research, development, production, and sale of insulation products and related components for electrical transmission and distribution networks in China's power industry, with a market cap of CN¥8.33 billion.

Operations: Motic (Xiamen) Electric Group Co., Ltd generates revenue primarily through the sale of insulation products and components for electrical networks in China. The company's financial performance is highlighted by a notable net profit margin trend, which provides insight into its profitability within the power industry sector.

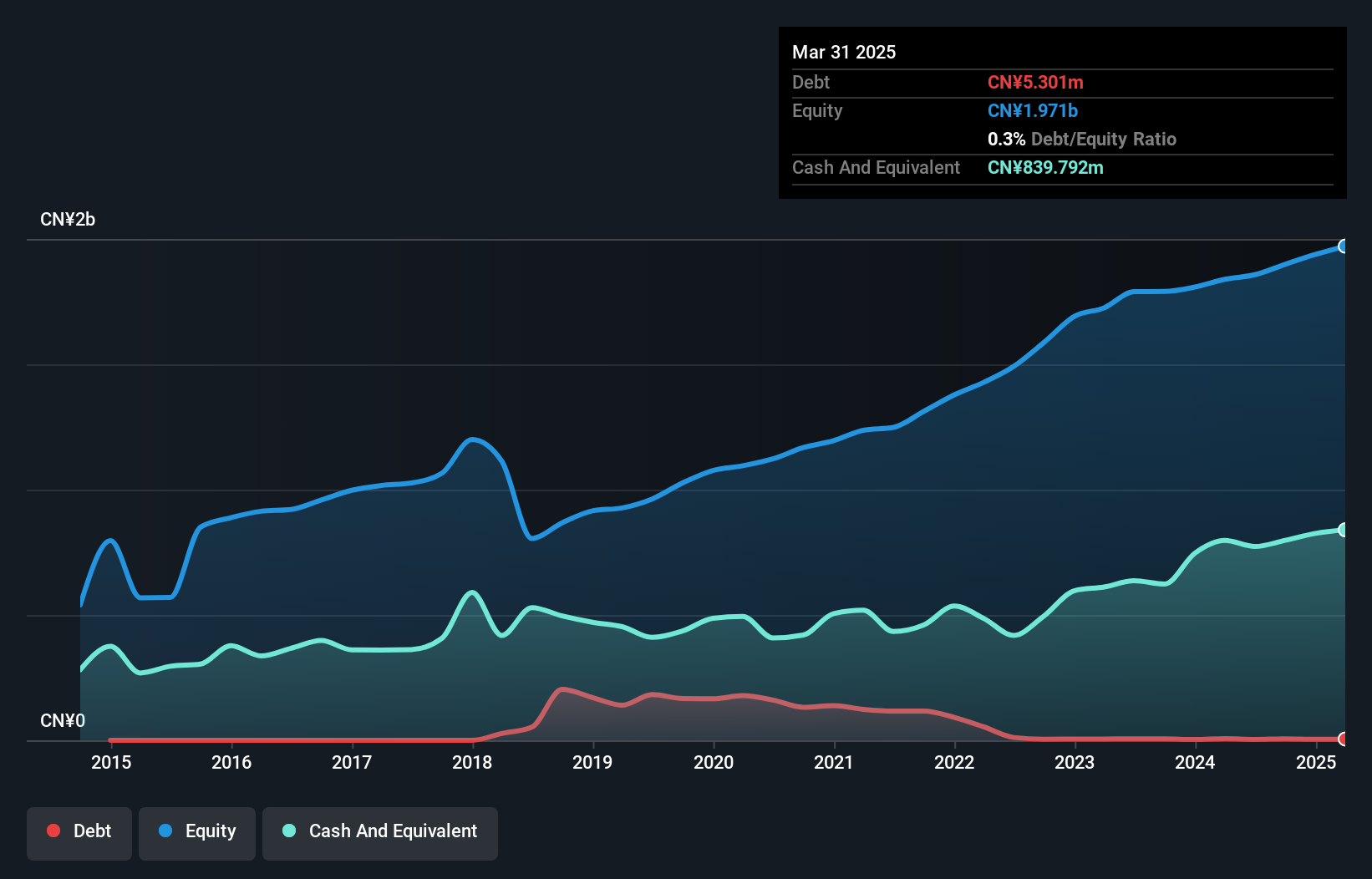

Motic Electric, a nimble player in its sector, has seen its share price fluctuate significantly over the past three months. Despite this volatility, the company boasts high-quality earnings and a strong financial position with cash surpassing total debt. Over five years, Motic's debt to equity ratio impressively dropped from 16.3% to 0.3%, reflecting prudent financial management. However, recent earnings show a slight dip in sales to CNY 996 million from CNY 1 billion last year, though net income rose slightly to CNY 122 million. The upcoming shareholders meeting could signal strategic shifts for future growth potential.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4648 more companies for you to explore.Click here to unveil our expertly curated list of 4651 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongtong Bus HoldingLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000957

Zhongtong Bus HoldingLTD

Engages in the manufacture and sale of buses in China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives