Amid escalating geopolitical tensions in the Middle East and trade-related uncertainties, global markets have experienced volatility, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 seeing notable declines. Despite these challenges, certain high-growth tech stocks continue to capture investor interest due to their potential for innovation and resilience in adapting to shifting economic landscapes.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

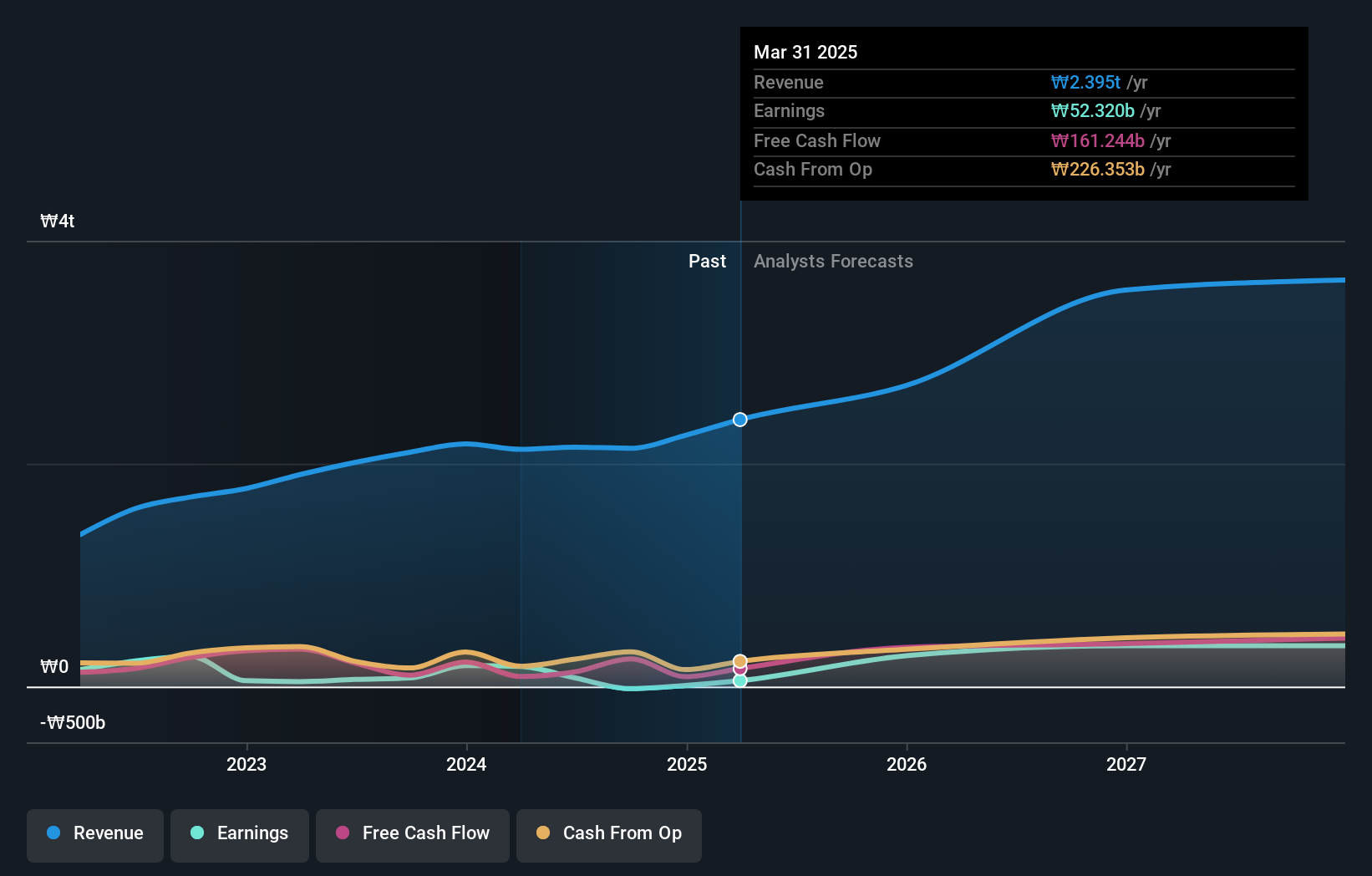

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management with a market capitalization of ₩12.50 trillion.

Operations: The company generates revenue primarily from its platform segment, which contributes ₩338.85 billion. The business focuses on music production, publishing, and artist management.

HYBE's recent performance underscores its resilience and growth potential in a challenging market. With a significant increase in Q1 sales to KRW 8,024.73 million from KRW 86.49 million year-over-year and net income surging to KRW 60,173.3 million from KRW 17,232.75 million, the company demonstrates robust financial health. Despite a large one-off loss of ₩74.5B impacting the last fiscal year's results, HYBE is poised for substantial earnings growth with forecasts suggesting an annual increase of 38.6%, outpacing the Korean market's average of 21%. However, it’s crucial to note that while revenue is expected to grow by 15.5% annually, this is below the high-growth threshold of 20% per year, indicating potential areas for strategic enhancement.

- Click here to discover the nuances of HYBE with our detailed analytical health report.

Gain insights into HYBE's past trends and performance with our Past report.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

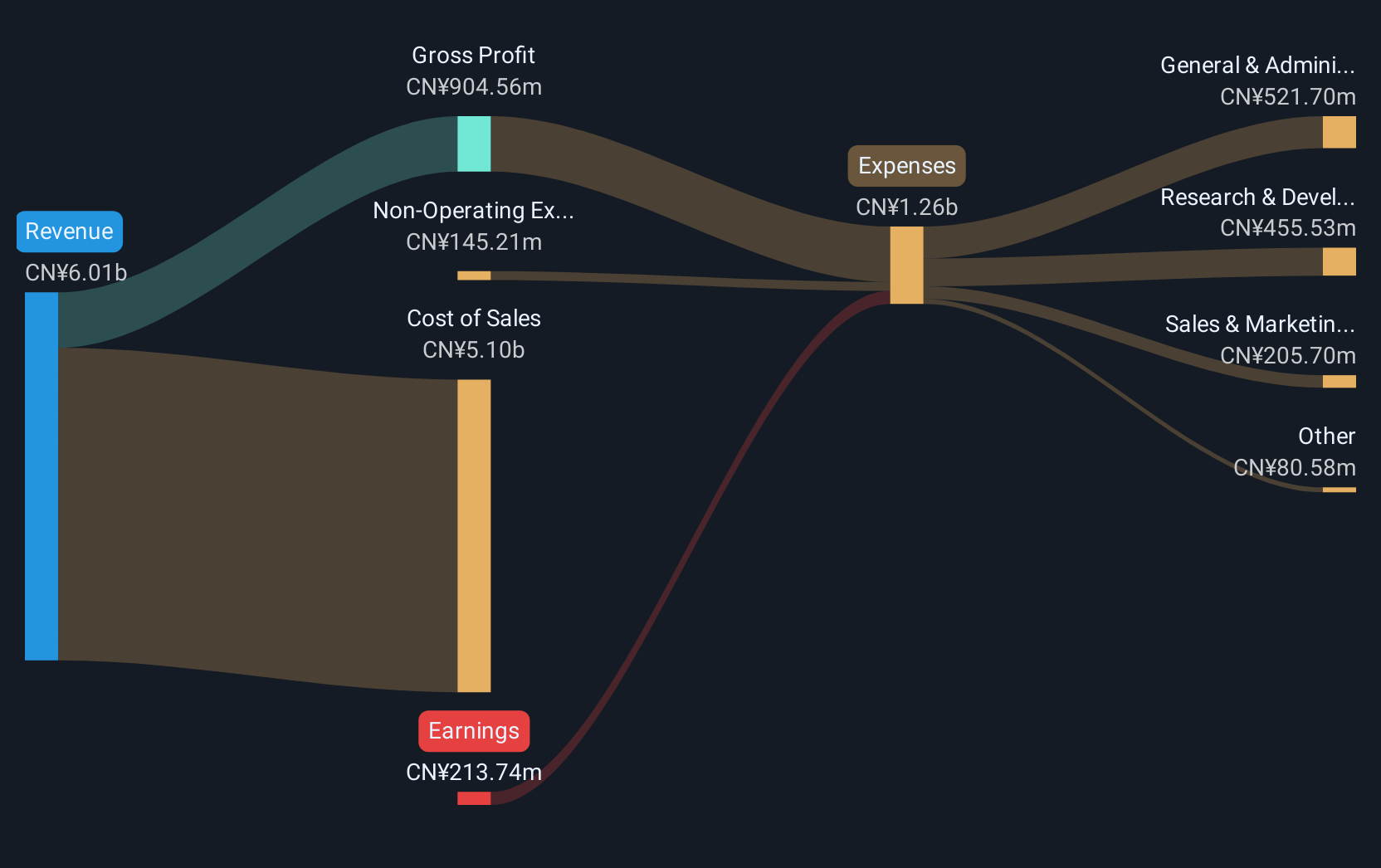

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. is engaged in the manufacturing and sale of printed circuit boards (PCBs) both domestically in China and internationally, with a market cap of CN¥20.09 billion.

Operations: Fastprint Circuit specializes in producing and distributing printed circuit boards (PCBs) across domestic and international markets. The company operates with a market capitalization of CN¥20.09 billion, focusing on leveraging its manufacturing capabilities to serve a diverse client base globally.

Shenzhen Fastprint Circuit TechLtd. is navigating a competitive landscape with a 19.5% annual revenue growth, outpacing the Chinese market average of 12.4%. Despite recent challenges, including a dividend decrease to CNY 0.27 per 10 shares and a dip in Q1 net income to CNY 9.37 million from CNY 24.82 million year-over-year, the firm is poised for future profitability with earnings expected to surge by an impressive 97.83% annually. This potential turnaround is underpinned by strategic adjustments and ongoing innovation efforts that could redefine its market standing amidst evolving industry demands.

Oracle Corporation Japan (TSE:4716)

Simply Wall St Growth Rating: ★★★★☆☆

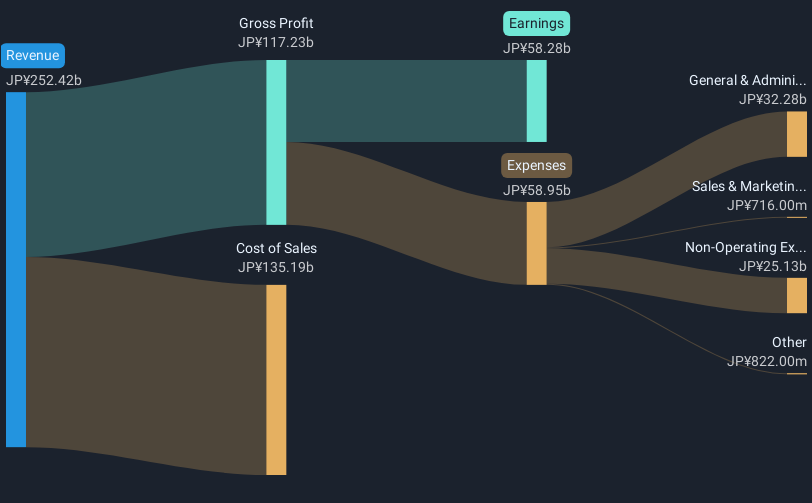

Overview: Oracle Corporation Japan focuses on developing and selling software and hardware products and solutions within Japan, with a market capitalization of ¥2.24 trillion.

Operations: Oracle Corporation Japan generates revenue primarily through the sale of software and hardware products, as well as related solutions in the Japanese market. The company operates with a market capitalization of approximately ¥2.24 trillion.

Oracle Corporation Japan, demonstrating resilience in a competitive tech landscape, has maintained a steady growth trajectory with an annual revenue increase of 7.7% and earnings growth of 7.4%. The company's strategic emphasis on R&D is evident from its substantial investment, allocating ¥5 billion annually to this sector, representing about 10% of their total revenue. This focus not only underscores their commitment to innovation but also aligns with broader industry trends where software companies are increasingly pivoting towards SaaS models to secure recurring revenue streams. With recent activities including a dividend payout at ¥187 per share, Oracle Japan is poised to capitalize on evolving market demands while reinforcing its position through continuous technological advancements and client-focused solutions.

Make It Happen

- Gain an insight into the universe of 751 Global High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4716

Oracle Corporation Japan

Provides software, hardware, and cloud products and solutions in Japan.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)