- China

- /

- Communications

- /

- SZSE:002313

Even after rising 16% this past week, Sunsea AIoT Technology (SZSE:002313) shareholders are still down 50% over the past five years

It is doubtless a positive to see that the Sunsea AIoT Technology Co., Ltd. (SZSE:002313) share price has gained some 38% in the last three months. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 50%, which falls well short of the return you could get by buying an index fund.

While the last five years has been tough for Sunsea AIoT Technology shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Sunsea AIoT Technology

Because Sunsea AIoT Technology made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Sunsea AIoT Technology reduced its trailing twelve month revenue by 9.2% for each year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 8% per year in that time. This loss means the stock shareholders are probably pretty annoyed. Risk averse investors probably wouldn't like this one much.

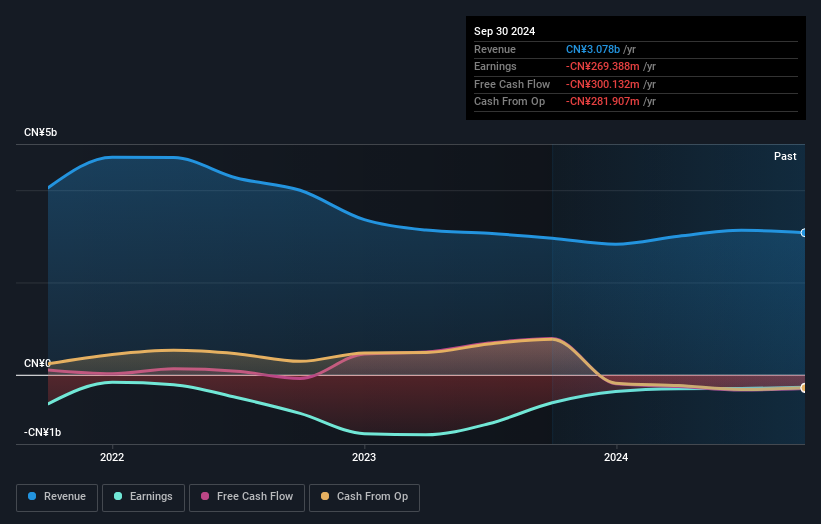

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Sunsea AIoT Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Sunsea AIoT Technology shareholders have received returns of 11% over twelve months, which isn't far from the general market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 8% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. It's always interesting to track share price performance over the longer term. But to understand Sunsea AIoT Technology better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Sunsea AIoT Technology you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002313

Sunsea AIoT Technology

Provides Internet of Things products and services to telecom operators, ICT equipment vendors, system integrators, and enterprise customers in China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)