- China

- /

- Electronic Equipment and Components

- /

- SZSE:001298

Shenzhen Best of Best HoldingsLtd's (SZSE:001298) Dividend Will Be Reduced To CN¥0.20

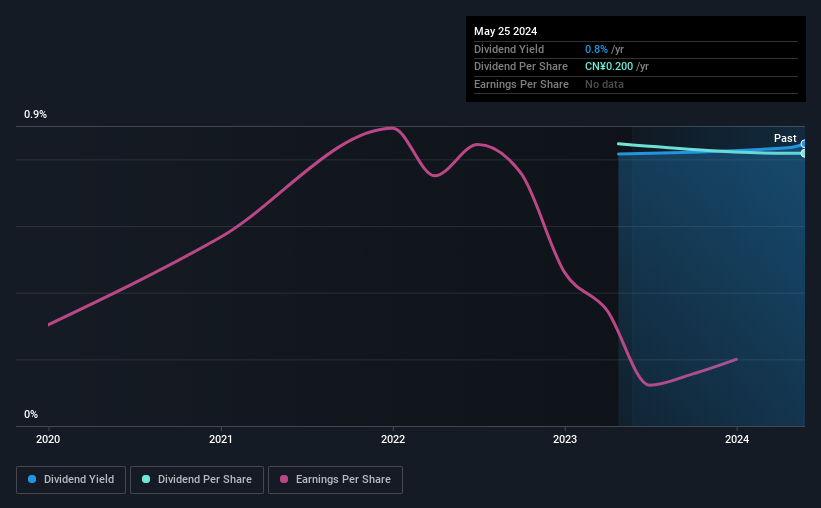

Shenzhen Best of Best Holdings Co.,Ltd. (SZSE:001298) has announced that on 29th of May, it will be paying a dividend ofCN¥0.20, which a reduction from last year's comparable dividend. This means that the dividend yield is 0.8%, which is a bit low when comparing to other companies in the industry.

View our latest analysis for Shenzhen Best of Best HoldingsLtd

Shenzhen Best of Best HoldingsLtd's Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, Shenzhen Best of Best HoldingsLtd was earning enough to cover the dividend, but it wasn't generating any free cash flows. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

EPS is set to fall by 29.6% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 72%, which is definitely feasible to continue.

Shenzhen Best of Best HoldingsLtd Doesn't Have A Long Payment History

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Over the past three years, it looks as though Shenzhen Best of Best HoldingsLtd's EPS has declined at around 30% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Shenzhen Best of Best HoldingsLtd has 3 warning signs (and 1 which can't be ignored) we think you should know about. Is Shenzhen Best of Best HoldingsLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001298

Shenzhen Best of Best HoldingsLtd

Distributes electronic component in the People's Republic of China.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026