- Japan

- /

- Semiconductors

- /

- TSE:6920

Asian Growth Companies With Up To 27% Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of global market volatility and economic uncertainties, Asian markets are navigating complex challenges, with China's industrial output showing resilience despite trade tensions. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, suggesting potential stability and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Schooinc (TSE:264A) | 29.6% | 68.9% |

| Laopu Gold (SEHK:6181) | 22% | 40.5% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

Let's uncover some gems from our specialized screener.

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. focuses on the research, development, production, and sale of new display device testing equipment in China with a market cap of CN¥7.32 billion.

Operations: The company's revenue primarily comes from its activities in the research, development, production, and sale of testing equipment for new display devices in China.

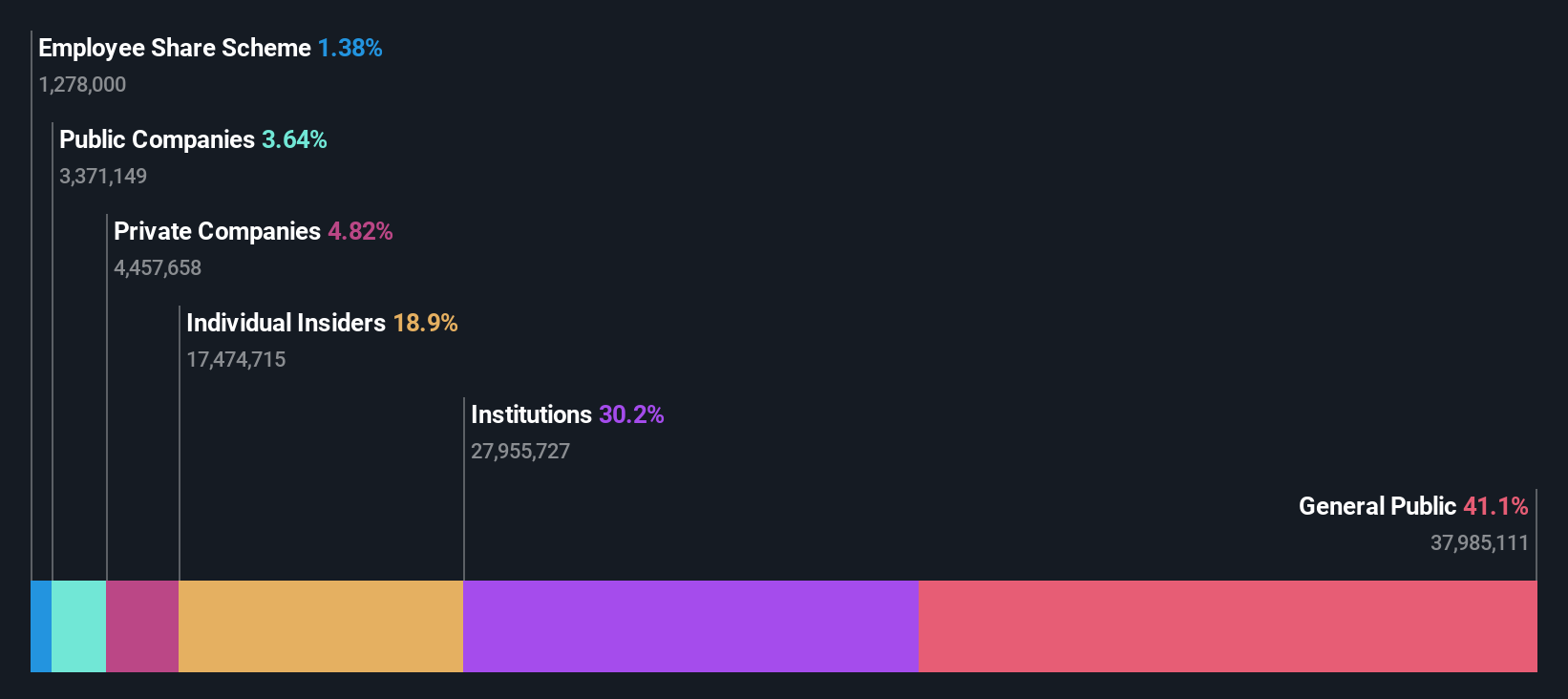

Insider Ownership: 18.9%

Shenzhen SEICHI Technologies demonstrates substantial growth potential, with forecasted revenue and earnings growth significantly outpacing the market. Despite a net loss of CNY 16.22 million in Q1 2025, sales increased to CNY 152.11 million from CNY 83.05 million year-on-year. The company has initiated a share buyback program worth up to CNY 50 million, aimed at enhancing employee incentives and promoting long-term development, reflecting strong insider confidence in its future prospects.

- Get an in-depth perspective on Shenzhen SEICHI Technologies' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen SEICHI Technologies shares in the market.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. focuses on the research, development, production, and sale of infrared thermal imaging technology in Asia with a market cap of CN¥37.50 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 27.1%

Wuhan Guide Infrared shows promising growth potential with forecasted revenue growth of 27.7% annually, outpacing the Chinese market average. Recent Q1 2025 results reveal a significant improvement in net income to CNY 83.55 million from CNY 8.38 million year-on-year, despite a previous annual net loss of CNY 447.19 million in 2024. The absence of substantial insider trading activity over the past three months suggests stability in insider sentiment amidst these positive developments.

- Click to explore a detailed breakdown of our findings in Wuhan Guide Infrared's earnings growth report.

- Our comprehensive valuation report raises the possibility that Wuhan Guide Infrared is priced higher than what may be justified by its financials.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally, with a market cap of ¥1.32 trillion.

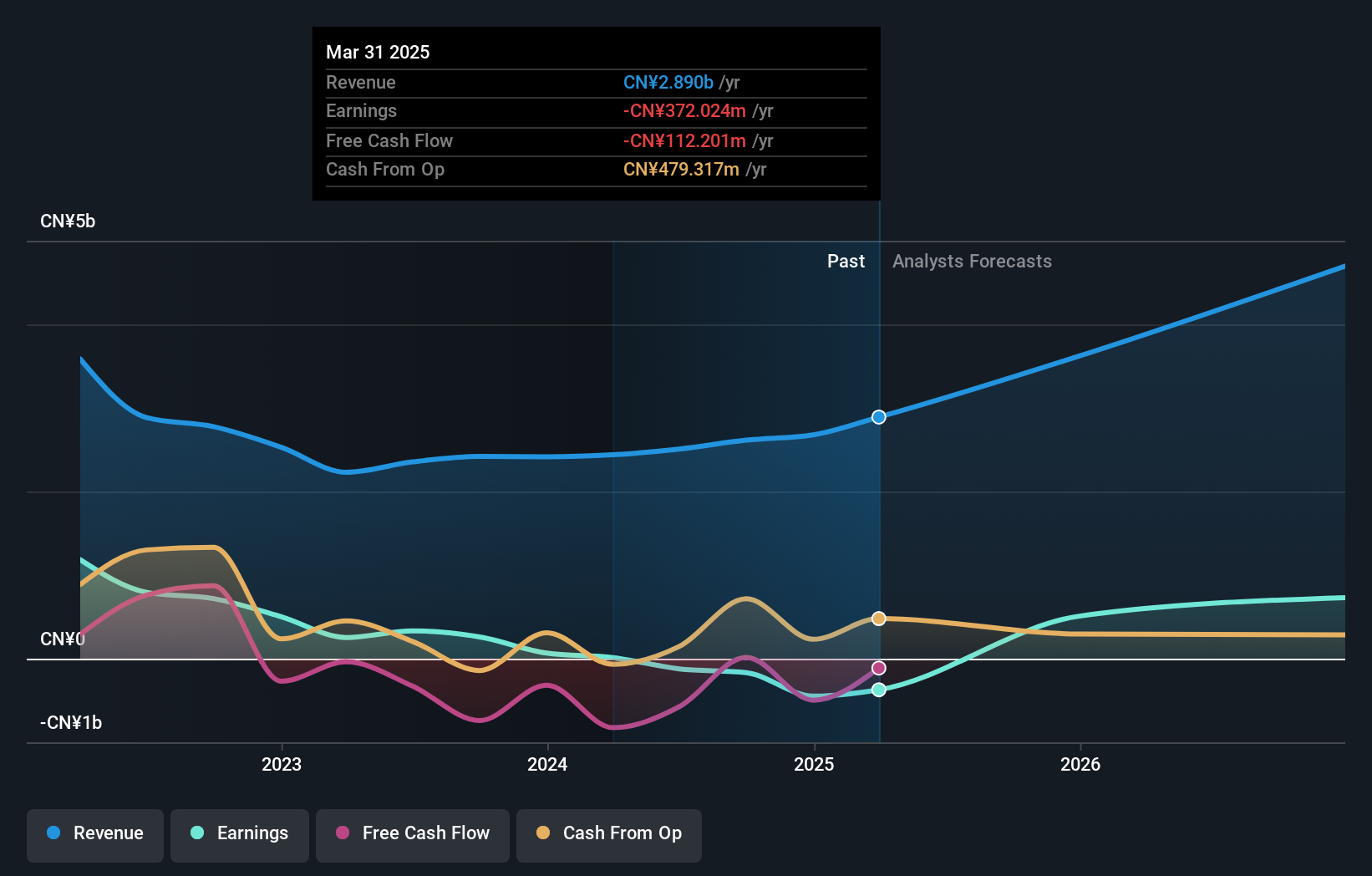

Operations: The company's revenue of ¥225.14 billion is derived from its activities in designing, manufacturing, and selling inspection and measurement equipment globally.

Insider Ownership: 11.1%

Lasertec's high insider ownership aligns with its growth trajectory, as analysts forecast revenue growth of 8.7% annually, surpassing the Japanese market average. Despite recent share price volatility, the company's return on equity is projected to be very large in three years. Earnings are expected to grow at 7.76% per annum, slightly outpacing the market. Recent executive changes may impact strategic direction; however, no substantial insider trading activity has been reported recently.

- Take a closer look at Lasertec's potential here in our earnings growth report.

- Our valuation report here indicates Lasertec may be overvalued.

Key Takeaways

- Explore the 626 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Interested In Other Possibilities? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives