As global markets navigate a mixed landscape, with major U.S. indexes like the S&P 500 and Nasdaq hitting record highs while small-cap indices such as the Russell 2000 face declines, investors are keenly observing how growth stocks are outperforming their value counterparts by a significant margin. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience amid economic shifts, making them compelling to watch in December 2024.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1293 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK15.93 billion.

Operations: BioArctic AB specializes in developing biological drugs targeting central nervous system disorders, generating revenue primarily from its biotechnology segment, which reported SEK167.14 million. The company operates within the Swedish market and focuses on innovative treatments in its field.

BioArctic's recent advancements in neurological therapies underscore its potential within the biotech sector, despite its current unprofitability. With a projected revenue growth of 49.2% annually, BioArctic is outpacing the broader Swedish market significantly. The company's commitment to R&D is evident as it channels substantial resources into groundbreaking projects like exidavnemab for Parkinson’s and lecanemab for Alzheimer’s, which recently received approval in multiple countries including Mexico. These developments not only highlight BioArctic's innovative approach but also position it favorably for future profitability, with earnings expected to surge by 62.5% per year. This strategic focus on neurodegenerative diseases could set a new standard in treatment efficacy and patient care globally.

- Get an in-depth perspective on BioArctic's performance by reading our health report here.

Understand BioArctic's track record by examining our Past report.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. operates in the optoelectronics industry and has a market capitalization of CN¥7.99 billion.

Operations: Wuxi Taclink Optoelectronics Technology Co., Ltd. specializes in the optoelectronics sector, focusing on producing and selling optical communication devices. The company generates revenue primarily from its range of optical modules and components, which serve various applications in telecommunications networks.

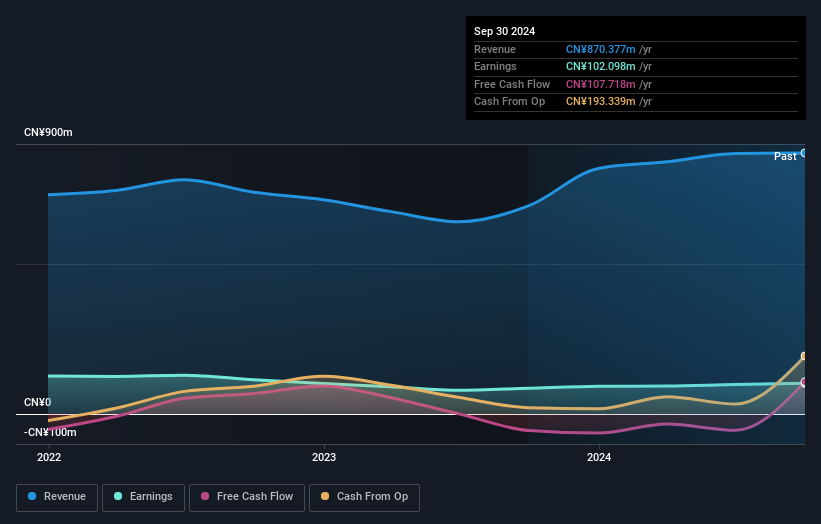

Wuxi Taclink Optoelectronics Technology has demonstrated robust growth, with earnings surging by 19% over the past year and revenues expected to climb by 27.9% annually, outpacing the Chinese market's 13.7%. This momentum is underpinned by significant R&D investments, aligning with their strategic focus on advanced optoelectronic components. Despite a volatile share price, the company’s forward-looking initiatives suggest sustained growth, particularly as their earnings are projected to increase by 33.7% annually. These figures reflect a potent blend of operational excellence and market foresight in a competitive tech landscape.

- Click here to discover the nuances of Wuxi Taclink Optoelectronics Technology with our detailed analytical health report.

Learn about Wuxi Taclink Optoelectronics Technology's historical performance.

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA offers out-of-home media and online advertising solutions both in Germany and internationally, with a market capitalization of €2.75 billion.

Operations: The company generates revenue primarily from three segments: Out-Of-Home Media (€942 million), Digital & Dialog Media (€867.49 million), and Daas & E-Commerce (€352.26 million). The business model focuses on leveraging these diverse advertising platforms to cater to both domestic and international markets.

Ströer SE & Co. KGaA's recent financial performance underscores its resilience and potential in the tech sector, with a notable increase in net income to EUR 34.75 million from EUR 27.19 million year-over-year for Q3, and a robust annual sales growth of 7.6%. This growth trajectory is complemented by an aggressive R&D strategy, highlighted by their commitment to innovation which has bolstered their market position in Germany—a market growing at only 5.7% annually. Moreover, the company's earnings are expected to surge by an impressive 28% per annum, significantly outpacing the German market's forecast of 20.8%, signaling strong future prospects despite a high debt level that warrants cautious optimism.

- Navigate through the intricacies of Ströer SE KGaA with our comprehensive health report here.

Assess Ströer SE KGaA's past performance with our detailed historical performance reports.

Key Takeaways

- Unlock our comprehensive list of 1293 High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ströer SE KGaA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAX

Ströer SE KGaA

Provides out-of-home (OOH) media and digital out-of-home advertising services in Germany and internationally.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives