- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Asian Growth Stocks With Strong Insider Ownership For July 2025

Reviewed by Simply Wall St

As Asian markets navigate through a complex landscape of global economic shifts, with China showing modest growth and Japan experiencing political uncertainty, investors are increasingly focused on identifying resilient opportunities. In this environment, stocks with strong insider ownership often stand out as promising candidates for growth, suggesting confidence from those closest to the business in its potential trajectory.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 61% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 25.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiaomi Corporation is an investment holding company involved in the development and sales of smartphones both in Mainland China and internationally, with a market cap of approximately HK$1.50 trillion.

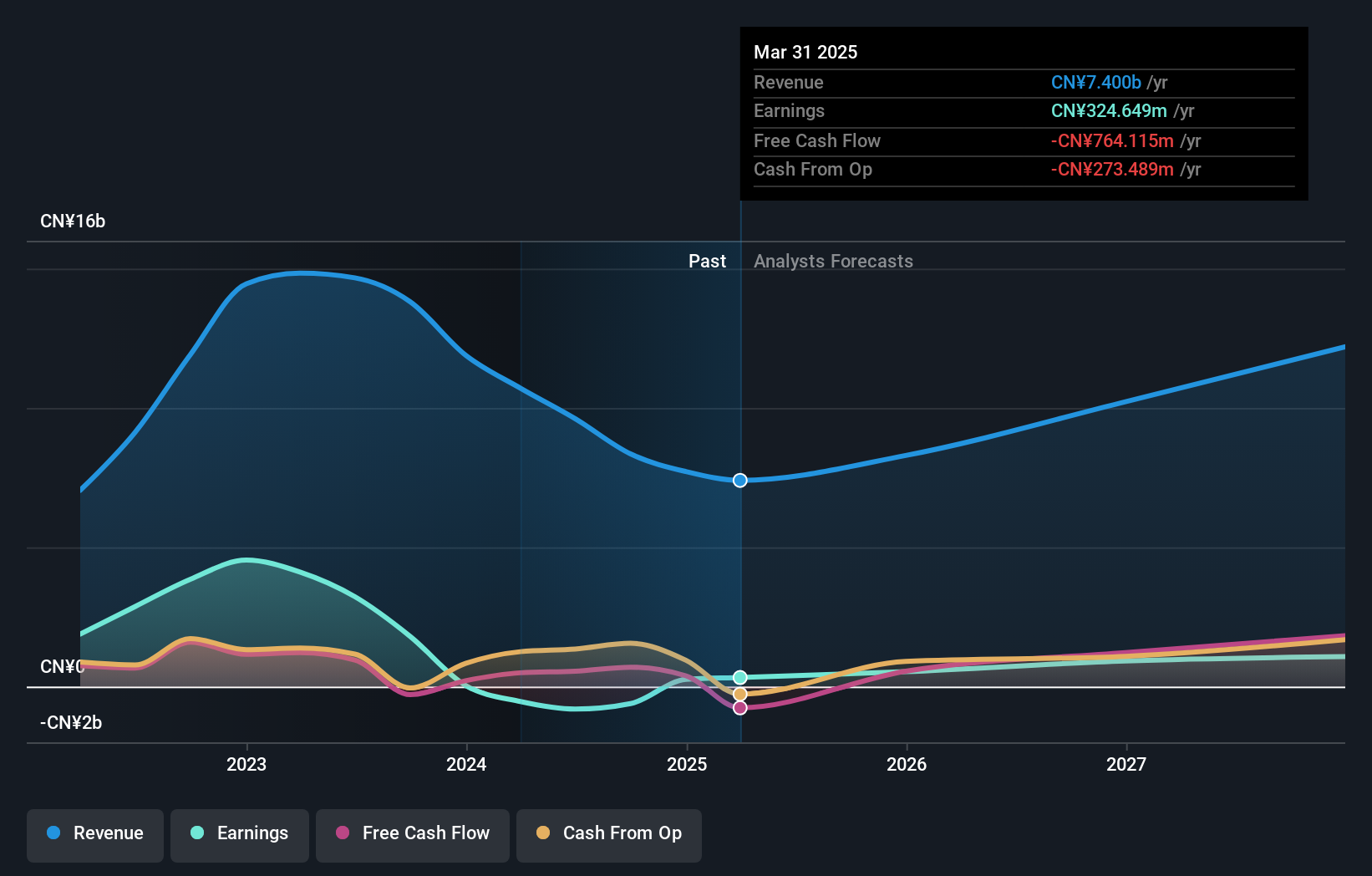

Operations: The company's revenue segments include CN¥195.89 billion from smartphones, CN¥35.14 billion from internet services, CN¥116.07 billion from IoT and lifestyle products, and CN¥51.31 billion from smart EV and other new initiatives.

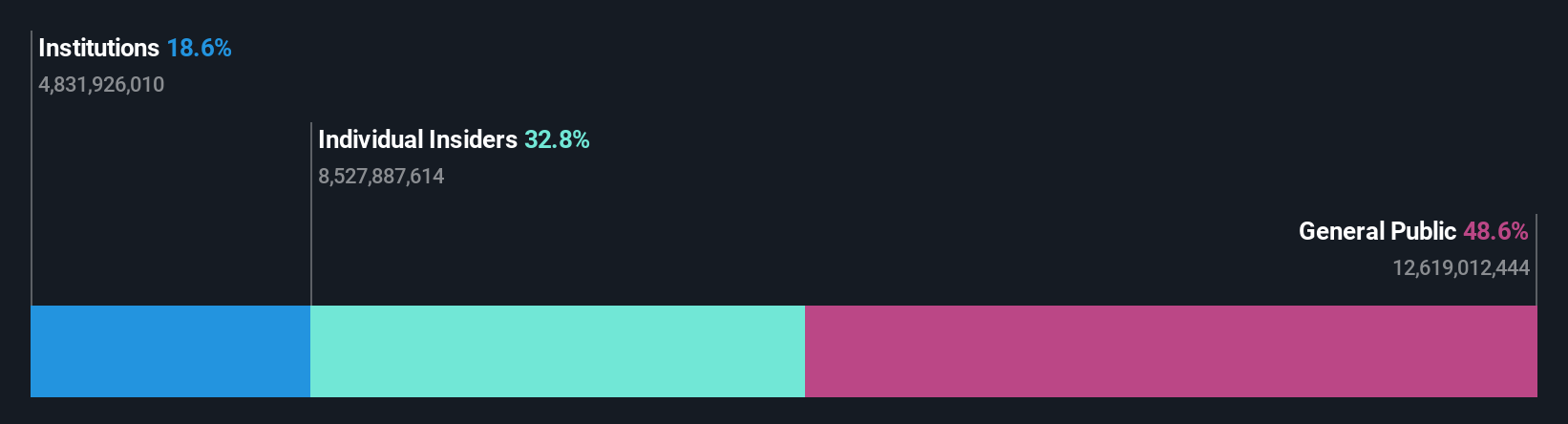

Insider Ownership: 32.8%

Earnings Growth Forecast: 21.1% p.a.

Xiaomi's growth trajectory is marked by its strategic expansion into electric vehicles and innovative partnerships. The recent launch of the YU7 SUV highlights Xiaomi's diversification efforts, leveraging advanced electrochromic technology. Despite a forecasted revenue growth of 17% annually, slightly below 20%, earnings are expected to grow significantly at over 21% per year. With no substantial insider trading activity in recent months, Xiaomi remains a key player in Asia's tech landscape with strong market positioning and high insider ownership.

- Get an in-depth perspective on Xiaomi's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Xiaomi shares in the market.

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Olympic Circuit Technology Co., Ltd manufactures and sells rigid PCBs with a market cap of CN¥23.17 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, totaling CN¥5.15 billion.

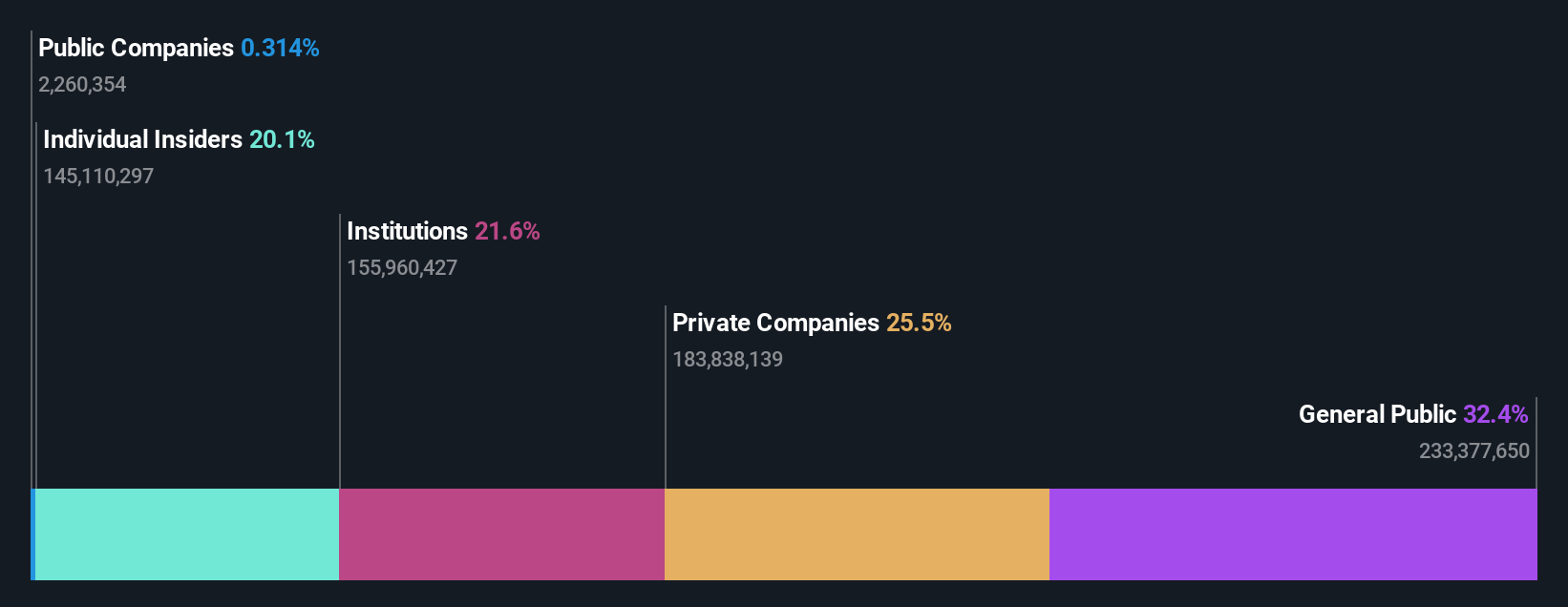

Insider Ownership: 20.1%

Earnings Growth Forecast: 21.6% p.a.

Olympic Circuit Technology is experiencing robust growth, with earnings projected to increase by 21.6% annually, surpassing the Chinese market's revenue growth rate of 12.5%. The company's price-to-earnings ratio of 31.1x suggests it is a better value compared to the broader market at 41x. Despite no significant insider trading activity recently, high insider ownership aligns management interests with shareholders, bolstering confidence in its strategic direction amidst competitive pressures.

- Click here to discover the nuances of Olympic Circuit Technology with our detailed analytical future growth report.

- Our valuation report here indicates Olympic Circuit Technology may be overvalued.

Sichuan Yahua Industrial Group (SZSE:002497)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Yahua Industrial Group Co., Ltd. engages in the research, production, and sale of civil explosive equipment and provides blasting engineering services both in China and internationally, with a market cap of CN¥15.10 billion.

Operations: The company's revenue is derived from its activities in the civil explosive equipment sector and the provision of blasting engineering services, both domestically and internationally.

Insider Ownership: 17.4%

Earnings Growth Forecast: 40.9% p.a.

Sichuan Yahua Industrial Group's earnings are forecast to grow significantly at 40.9% annually, outpacing the Chinese market's growth rate of 23.4%. The company recently reported a substantial increase in net income for Q1 2025, despite a decline in sales. High insider ownership suggests alignment between management and shareholder interests, though there has been no recent significant insider trading activity. A cash dividend of CNY 0.04 per share was approved for distribution in June 2025.

- Delve into the full analysis future growth report here for a deeper understanding of Sichuan Yahua Industrial Group.

- Upon reviewing our latest valuation report, Sichuan Yahua Industrial Group's share price might be too pessimistic.

Summing It All Up

- Dive into all 589 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Seeking Other Investments? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives