- China

- /

- Electronic Equipment and Components

- /

- SHSE:600183

High Growth Tech Stocks in Asia to Watch This April 2025

Reviewed by Simply Wall St

As the global markets navigate a complex landscape marked by mixed performances across major indices and ongoing trade tensions, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have shown resilience with recent gains. In this environment, identifying high growth tech stocks in Asia requires a focus on companies that can adapt to shifting economic conditions and leverage technological advancements to drive innovation and expansion.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 32.80% | 30.38% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Accton Technology | 23.22% | 27.16% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company that designs, develops, manufactures, and sells optical modules and systems integration products for smartphones and other mobile devices across China, India, Korea, and internationally with a market cap of HK$19.19 billion.

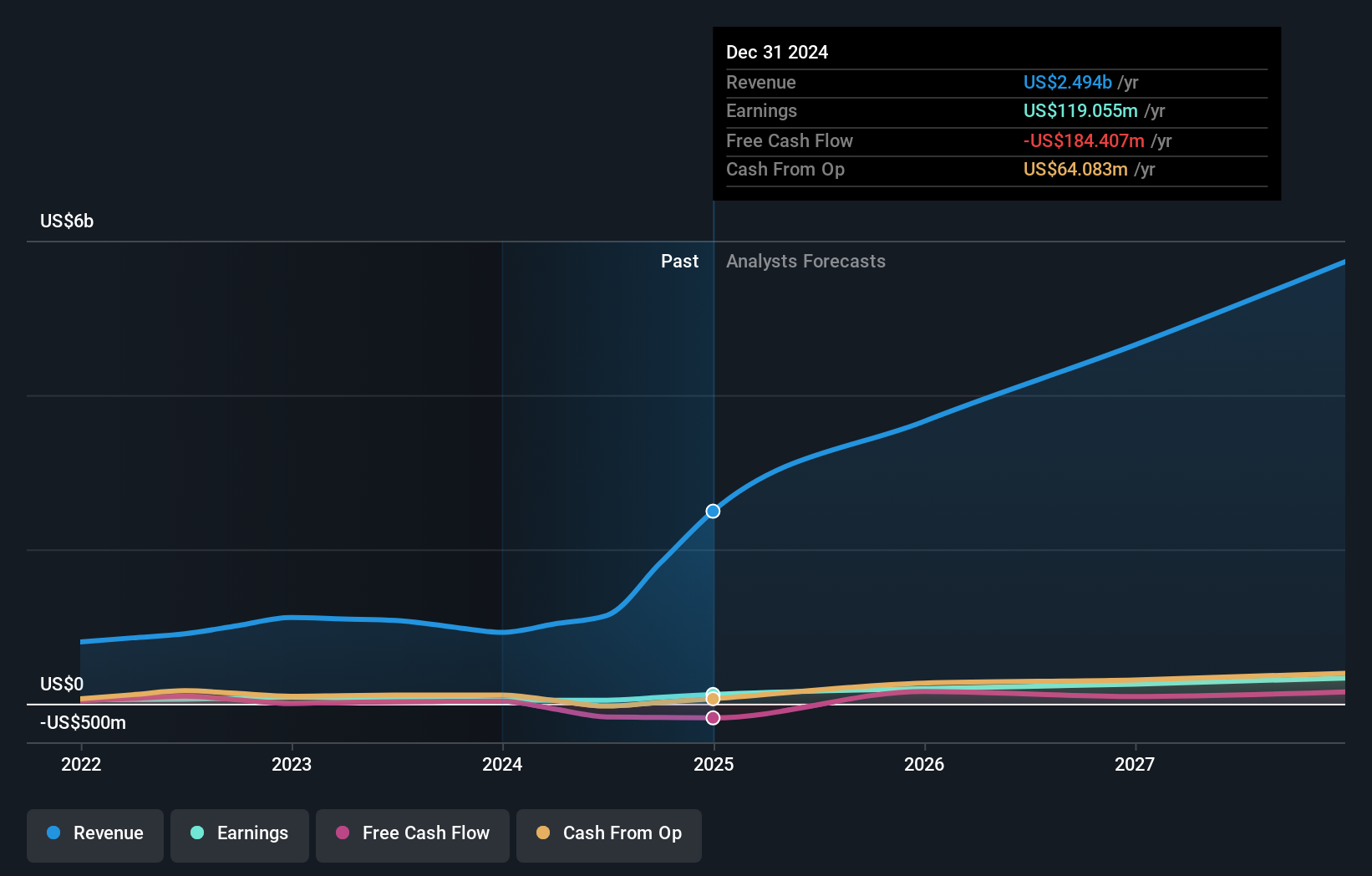

Operations: Cowell e Holdings generates revenue primarily from the sale of photographic equipment and supplies, amounting to $2.49 billion. The company operates in markets including China, India, and Korea, focusing on optical modules and systems integration for smartphones and other mobile devices.

Cowell e Holdings, amidst a robust financial performance, reported a substantial increase in sales to USD 2.49 billion from USD 923.85 million and net income surged to USD 119.06 million from USD 46.59 million year-over-year. This growth trajectory is underpinned by a significant annual earnings growth rate of 24.6%, outpacing the Hong Kong market's average of 10.4%. The company's commitment to innovation is evident in its R&D investments, crucial for maintaining its competitive edge in the high-stakes tech industry, particularly as it navigates through market volatilities and one-off financial impacts like the recent $50.5 million loss. Looking ahead, Cowell e Holdings is poised for continued expansion with revenue expected to grow at an annual rate of 20.2%, significantly above the Hong Kong market forecast of 8.1%. This optimistic outlook is supported by their strategic focus on sectors with high customer impact and ongoing enhancements in operational efficiencies which are likely to bolster future profitability and shareholder value.

- Get an in-depth perspective on Cowell e Holdings' performance by reading our health report here.

Understand Cowell e Holdings' track record by examining our Past report.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs in oncology and immunology, with a market cap of HK$67.86 billion.

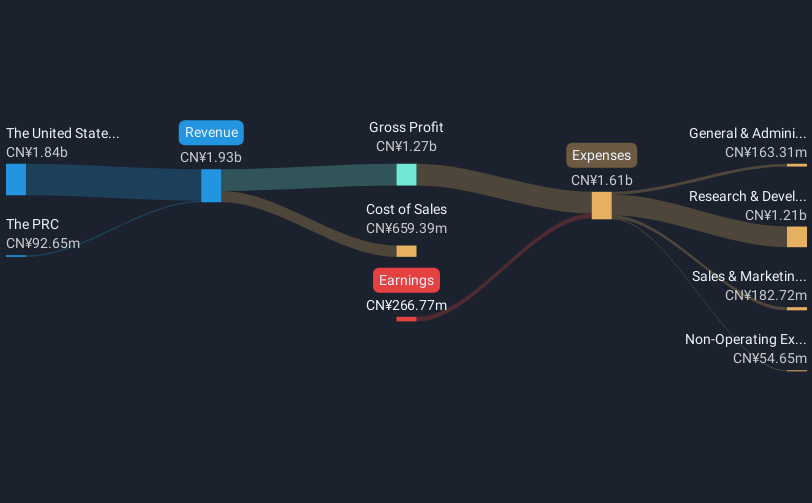

Operations: Kelun-Biotech primarily generates revenue from its pharmaceuticals segment, amounting to CN¥1.93 billion. The company is active in both domestic and international markets, focusing on oncology and immunology therapies.

Sichuan Kelun-Biotech Biopharmaceutical has demonstrated a robust growth trajectory, with revenue soaring by 28.5% annually, outpacing the Hong Kong market's average of 8.1%. This surge is underpinned by its aggressive R&D strategy, which allocates significant resources to groundbreaking projects like the TROP2 ADC sac-TMT, now approved for multiple cancer treatments in China. The firm’s recent FDA clearance to initiate clinical trials for another innovative drug underscores its commitment to expanding its global footprint in high-stakes biopharmaceutical innovation.

Shengyi TechnologyLtd (SHSE:600183)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shengyi Technology Co., Ltd. is a Chinese company that focuses on developing, manufacturing, and selling laminates, with a market capitalization of CN¥57.82 billion.

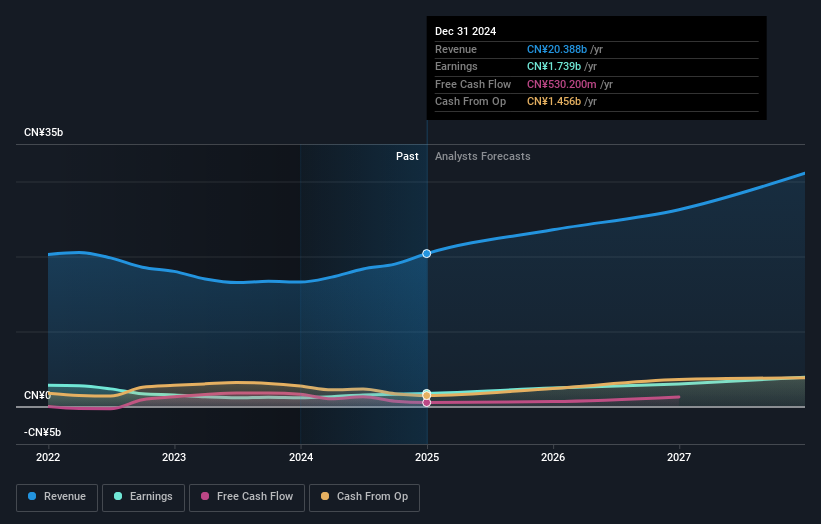

Operations: Shengyi Technology primarily generates revenue through its CCL Business, which accounts for CN¥15.52 billion, and the Circuit Board Business, contributing CN¥4.68 billion.

Shengyi Technology Co., Ltd. has shown remarkable financial performance, with a 23% increase in sales reaching CNY 20.39 billion and a significant leap in net income to CNY 1.74 billion, up from CNY 1.16 billion last year. This growth is supported by robust R&D investments that fuel innovation in its core electronic segments, aligning with industry demands for advanced tech solutions. The company's earnings growth of 49.4% this past year notably surpasses the electronics industry average of 7.3%, highlighting its competitive edge and potential for sustained expansion amidst evolving market dynamics. The firm's strategic focus on research has not only enhanced product offerings but also positioned it favorably within Asia's high-growth tech landscape, where continuous innovation is key to staying ahead. With earnings expected to grow by an impressive 24.3% annually over the next three years, Shengyi Technology stands out for its commitment to leveraging cutting-edge technology to maintain a strong market presence and drive future growth, evidenced by recent approvals at their Annual General Meeting held in their R&D-centric facility in Dongguan.

- Unlock comprehensive insights into our analysis of Shengyi TechnologyLtd stock in this health report.

Evaluate Shengyi TechnologyLtd's historical performance by accessing our past performance report.

Next Steps

- Access the full spectrum of 500 Asian High Growth Tech and AI Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600183

Shengyi TechnologyLtd

Develops, manufactures, and sells laminates in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives