- Japan

- /

- Semiconductors

- /

- TSE:6920

3 Growth Companies With High Insider Ownership Expecting Up To 38% Revenue Growth

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape of trade policies and technological advancements, major indices like the S&P 500 have reached record highs amid optimism around AI developments and softened tariff threats. In this environment, growth stocks have shown resilience, outperforming their value counterparts as investors seek companies with strong potential for revenue expansion. High insider ownership can be a positive indicator of confidence in a company's future prospects, making such stocks appealing in today's market where strategic growth is highly valued.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Let's dive into some prime choices out of the screener.

Shanghai Sanyou Medical (SHSE:688085)

Simply Wall St Growth Rating: ★★★★★☆

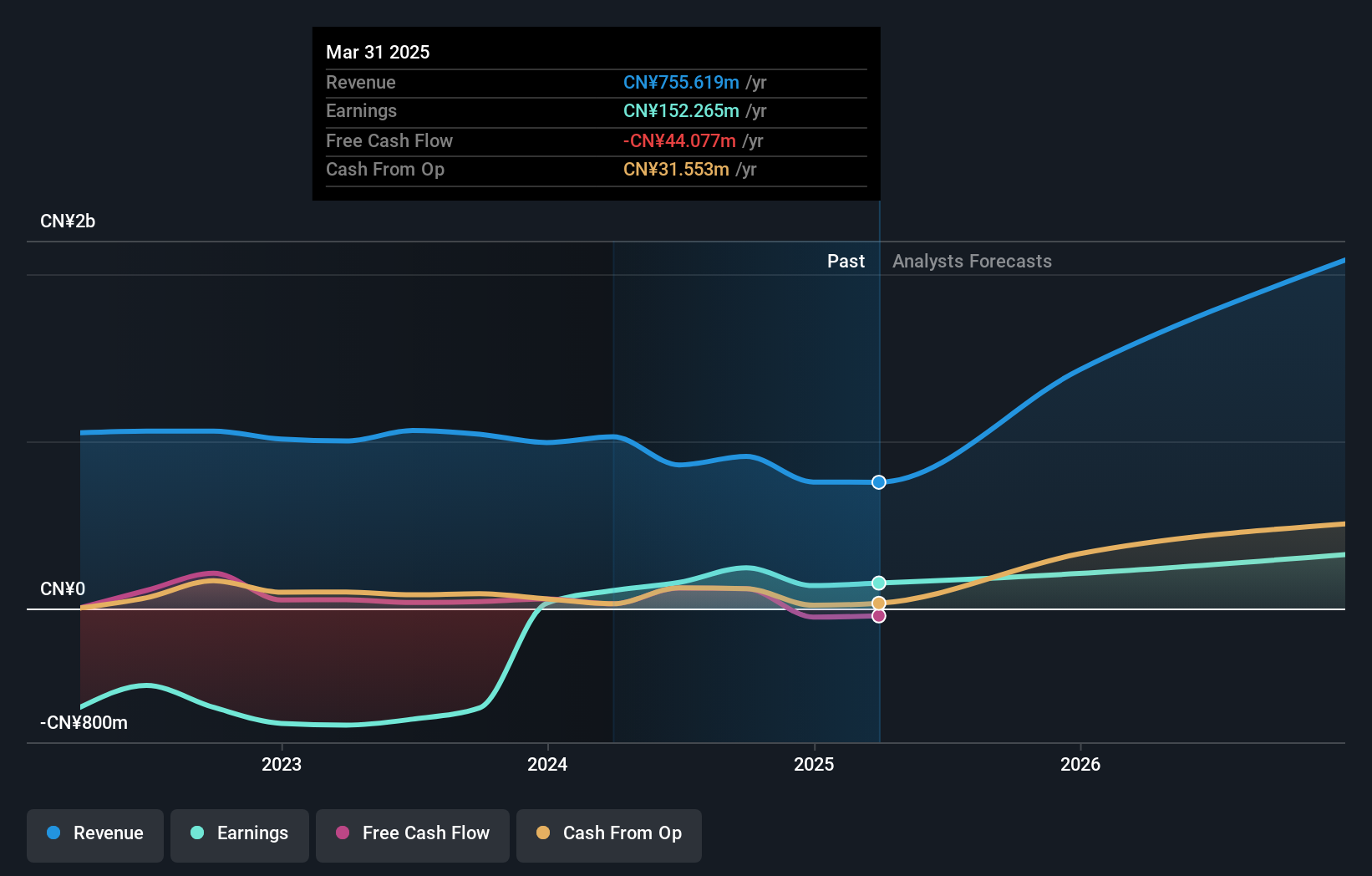

Overview: Shanghai Sanyou Medical Co., Ltd. focuses on the research, development, manufacturing, and sale of orthopedic implants in China with a market cap of CN¥4.65 billion.

Operations: The company's revenue primarily comes from its activities related to orthopedic implants in China.

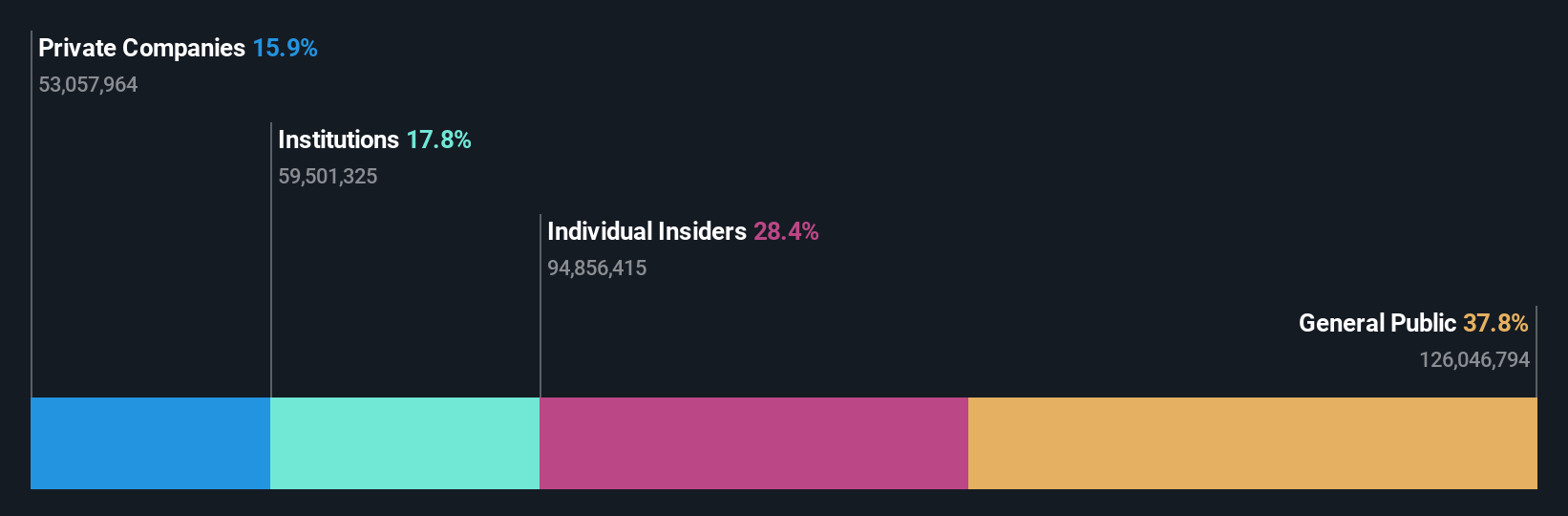

Insider Ownership: 31.6%

Revenue Growth Forecast: 28.4% p.a.

Shanghai Sanyou Medical is poised for significant growth, with earnings projected to increase by 66.16% annually, outpacing the broader Chinese market's 25% growth rate. Revenue is also expected to rise at a robust 28.4% per year, exceeding the market average of 13.3%. However, recent financial results were impacted by large one-off items and profit margins have decreased from last year’s figures. There has been no substantial insider trading activity in the past three months.

- Click here to discover the nuances of Shanghai Sanyou Medical with our detailed analytical future growth report.

- According our valuation report, there's an indication that Shanghai Sanyou Medical's share price might be on the expensive side.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doushen (Beijing) Education & Technology operates in the education and technology sector, with a market cap of CN¥16.08 billion.

Operations: The company generates revenue from its Information Technology Service segment, amounting to CN¥910.10 million.

Insider Ownership: 24.1%

Revenue Growth Forecast: 38.4% p.a.

Doushen (Beijing) Education & Technology is expected to experience significant revenue growth of 38.4% annually, surpassing the Chinese market's 13.3%. Despite its high-quality earnings, projected annual profit growth of 23.8% lags behind the market's 25%. The company's price-to-earnings ratio of 66x is favorable compared to the software industry average of 88.7x, though its share price has been highly volatile recently and no substantial insider trading activity has been reported in the past three months.

- Unlock comprehensive insights into our analysis of Doushen (Beijing) Education & Technology stock in this growth report.

- In light of our recent valuation report, it seems possible that Doushen (Beijing) Education & Technology is trading beyond its estimated value.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

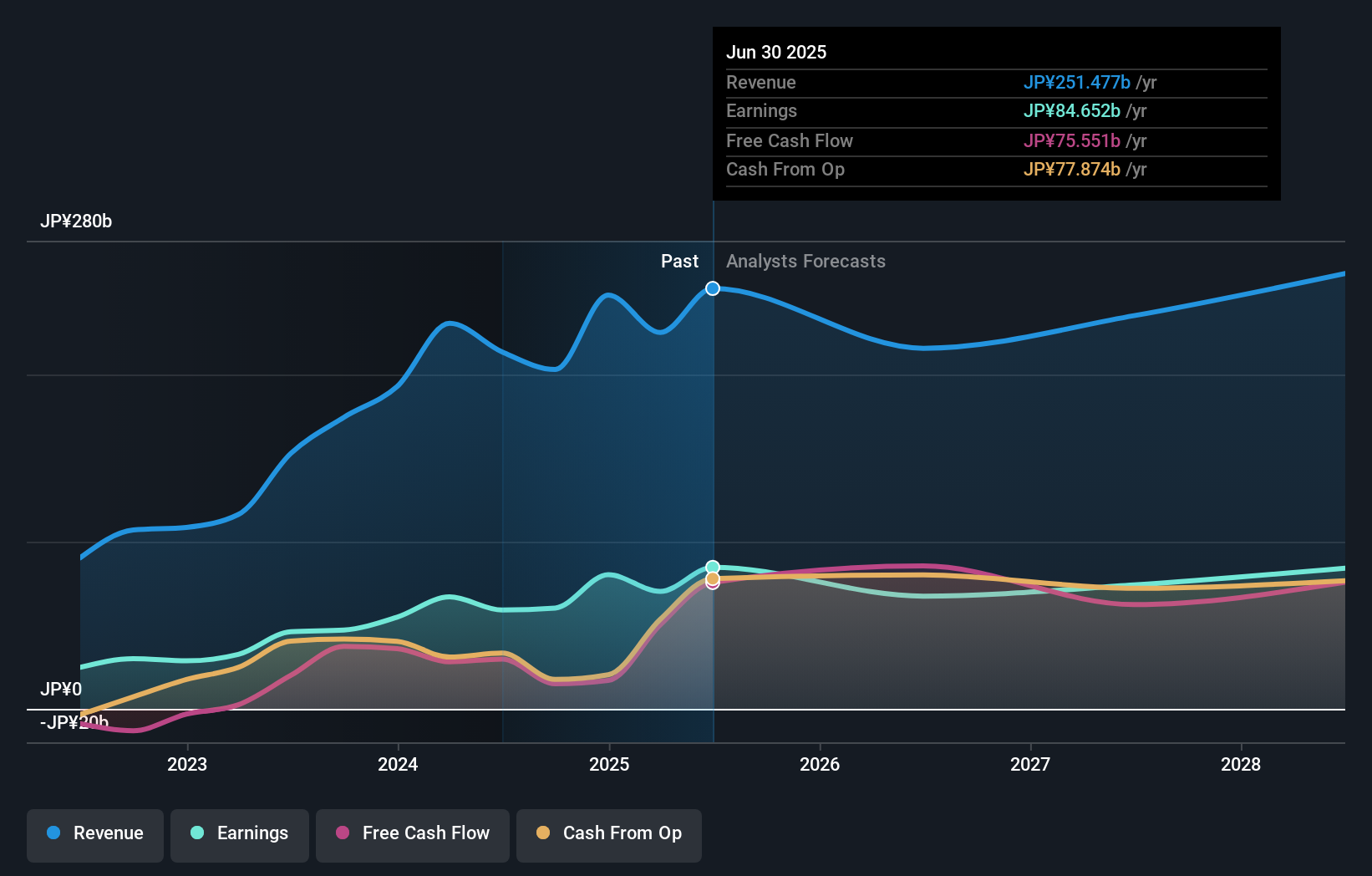

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally with a market capitalization of ¥1.36 trillion.

Operations: The company's revenue primarily comes from its ¥202.94 billion segment focused on the design, manufacture, and sale of inspection and measurement equipment.

Insider Ownership: 11.1%

Revenue Growth Forecast: 11.6% p.a.

Lasertec's earnings are forecast to grow 12.4% annually, outpacing the Japanese market's 8%, with revenue growth projected at 11.6% per year, faster than the market's 4.3%. The stock trades at a slight discount to its estimated fair value and boasts high-quality earnings despite recent share price volatility. While no significant insider trading has been reported recently, Lasertec's return on equity is expected to reach a robust 32.7% in three years.

- Get an in-depth perspective on Lasertec's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Lasertec is priced higher than what may be justified by its financials.

Key Takeaways

- Click here to access our complete index of 1475 Fast Growing Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives