Exploring Fujian Foxit Software Development And 2 Other High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade uncertainties and shifting economic policies, smaller-cap indexes such as the S&P MidCap 400 and Russell 2000 have shown resilience with recent gains, contrasting with declines in larger indices like the S&P 500 and Nasdaq Composite. In this environment of mixed market sentiment, exploring high-growth tech stocks in Asia, such as Fujian Foxit Software Development and others, can offer insights into opportunities where innovation meets potential for robust expansion amidst broader economic challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.04% | ★★★★★★ |

| Zhongji Innolight | 25.13% | 25.49% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Fujian Foxit Software Development (SHSE:688095)

Simply Wall St Growth Rating: ★★★★☆☆

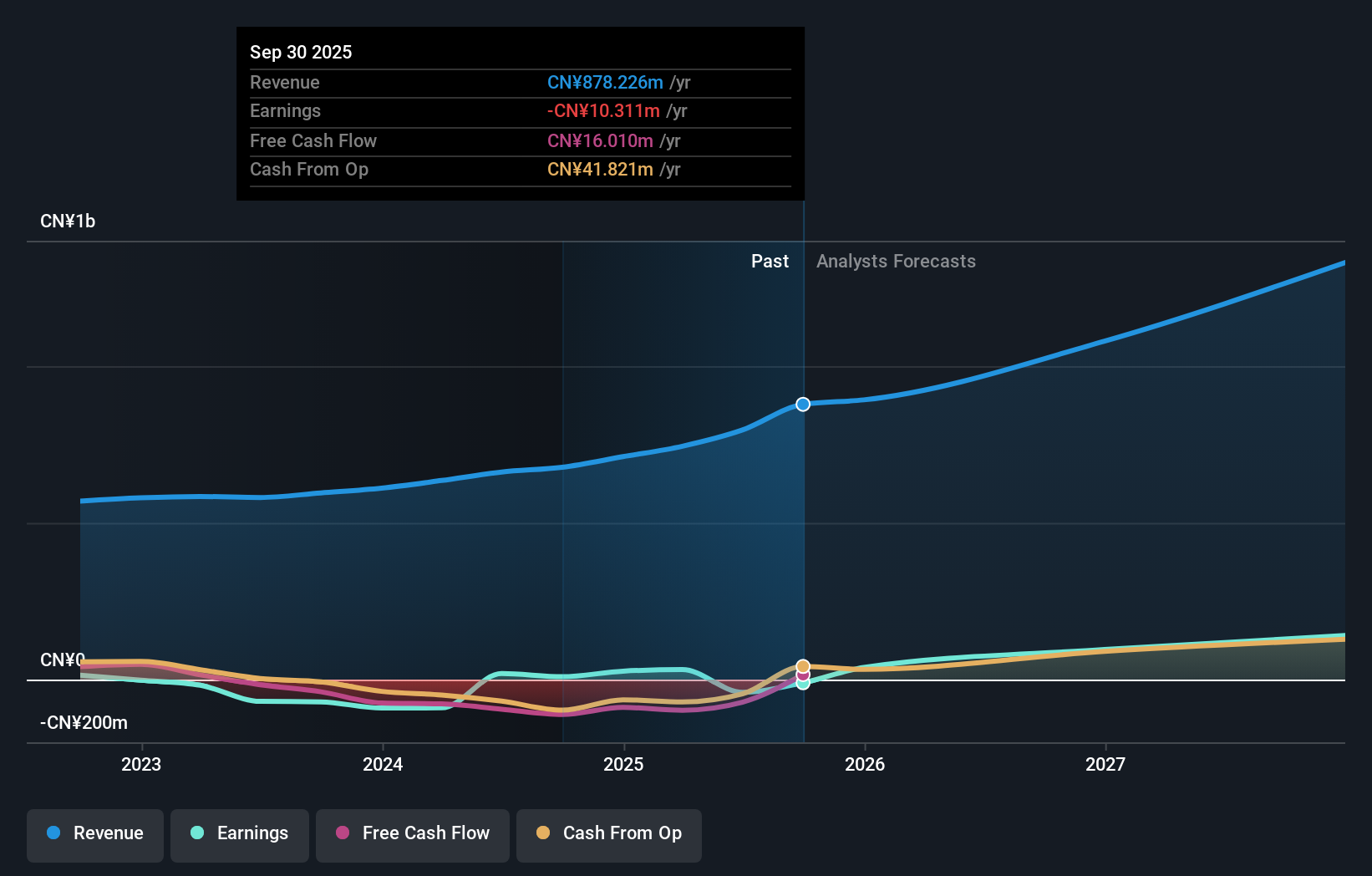

Overview: Fujian Foxit Software Development Joint Stock Co., Ltd. is a company focusing on software and programming solutions, with a market cap of CN¥5.83 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to CN¥711.37 million.

Fujian Foxit Software Development has demonstrated a robust turnaround, transitioning from a net loss of CNY 90.94 million to a net income of CNY 25.64 million in the latest fiscal year. This shift is underscored by a significant sales increase from CNY 610.76 million to CNY 711.37 million, reflecting an annualized revenue growth rate of 17.9%. The company's earnings are also projected to surge by approximately 68.2% annually, outpacing the broader Chinese market's growth expectations. Despite challenges such as highly volatile share prices and low forecasted return on equity at just 3.9%, these figures highlight Fujian Foxit’s potential in leveraging its recent profitability towards sustained financial health and market competitiveness within the tech sector.

Tongyu Communication (SZSE:002792)

Simply Wall St Growth Rating: ★★★★★☆

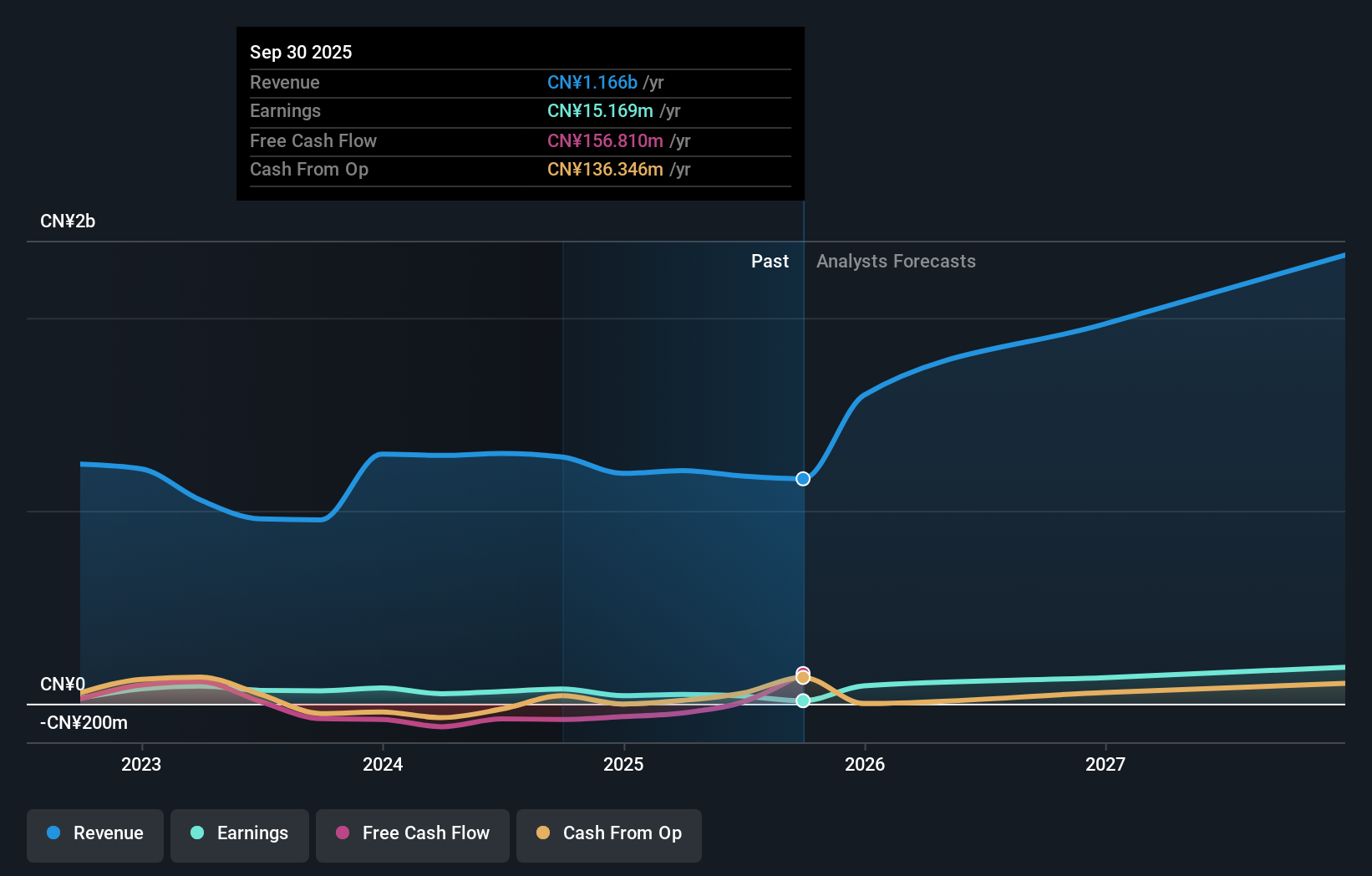

Overview: Tongyu Communication Inc. is engaged in the research, development, manufacturing, sales, and servicing of mobile communication antennas, RF devices, optical modules, and other products globally with a market cap of CN¥7.76 billion.

Operations: Tongyu Communication focuses on producing and distributing mobile communication antennas, RF devices, and optical modules across global markets. The company generates revenue primarily through the sale of these technological products.

Tongyu Communication is carving out a significant niche in the high-growth tech sector in Asia, with its earnings forecast to surge by 50.1% annually. This growth trajectory is bolstered by an impressive annual revenue increase of 21.2%, positioning it well above the Chinese market's average. Despite some financial fluctuations due to one-off gains of CN¥31.5M, the company's strategic focus on expanding its technological capabilities and market reach promises robust future prospects, especially considering its revenue growth outpaces the industry average by over 26%.

- Click here to discover the nuances of Tongyu Communication with our detailed analytical health report.

Gain insights into Tongyu Communication's past trends and performance with our Past report.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★☆

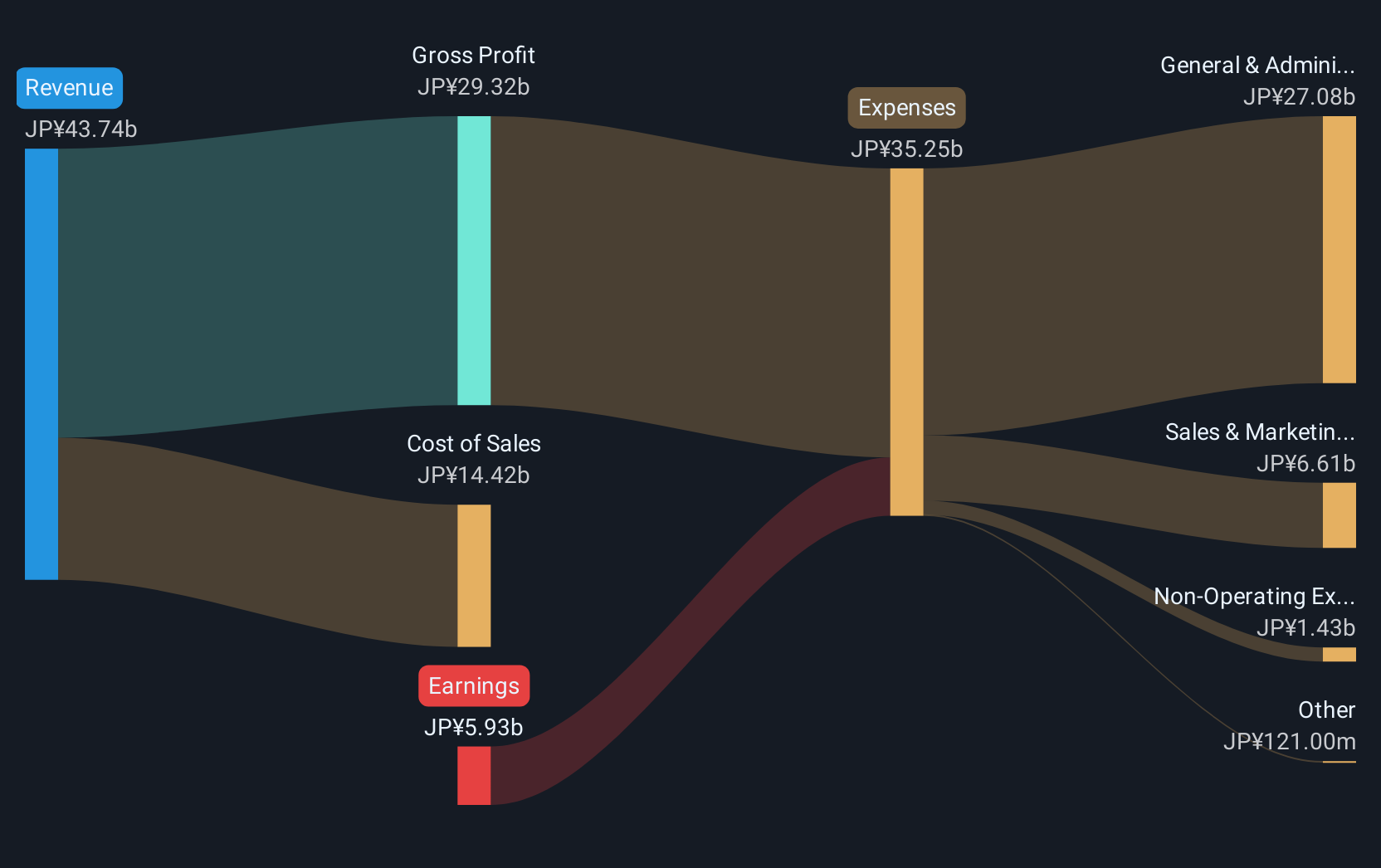

Overview: Money Forward, Inc. offers financial solutions tailored for individuals, financial institutions, and corporations primarily in Japan with a market capitalization of ¥236.89 billion.

Operations: The company generates revenue through its Platform Services Business, which reported ¥42.53 billion.

Despite recent adjustments in its financial outlook, Money Forward remains a compelling narrative in the Asia tech landscape. The company recently revised its revenue expectations to JPY 49.5 billion, slightly down from JPY 50 billion, amid strategic shifts including the exclusion of Nexsol Co. Ltd. from consolidation post-share transfer. This move aligns with its broader agenda to streamline operations and enhance focus on core areas such as SaaS models which promise more stable subscription-based revenues. Moreover, with an annualized revenue growth forecast at 18.8% and a robust return on equity expected at 22% in three years, Money Forward is navigating through current volatilities with strategic foresight aimed at long-term profitability and market relevance.

- Dive into the specifics of Money Forward here with our thorough health report.

Understand Money Forward's track record by examining our Past report.

Key Takeaways

- Click this link to deep-dive into the 494 companies within our Asian High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688095

Fujian Foxit Software Development

Fujian Foxit Software Development Joint Stock Co., Ltd.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)