High Growth Tech And 2 Other Exciting Stocks With Promising Potential

Reviewed by Simply Wall St

In a week marked by cautious sentiment following the Federal Reserve's rate cut and hawkish commentary, U.S. stocks experienced broad declines, with small-cap indexes facing the brunt of investor skepticism. Amid this backdrop of market volatility and economic uncertainty, identifying promising stocks often involves looking for companies with robust growth potential and innovative capabilities that can navigate such challenging environments effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China National Software & Service Company Limited operates as a software company in China with a market capitalization of CN¥41.98 billion.

Operations: The company generates revenue primarily from its Software Service Business, which amounted to CN¥5.49 billion.

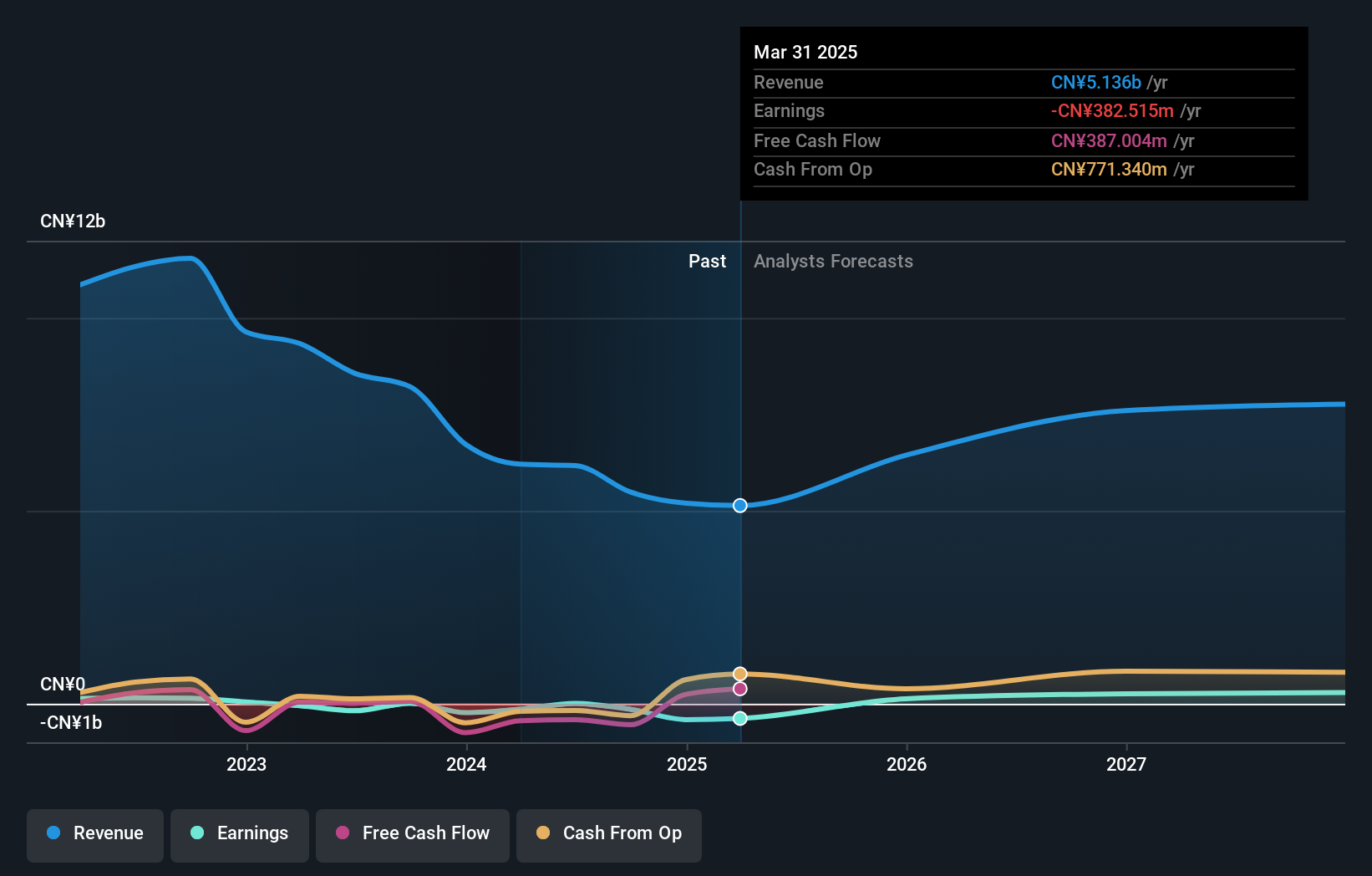

China National Software & Service, amidst a challenging backdrop, is navigating its path toward profitability with expected annual earnings growth of 88.5%. Despite current unprofitability, the company's revenue growth forecast at 16.6% annually outpaces the Chinese market prediction of 13.8%, highlighting its potential in a competitive landscape. Recent strategic shareholder meetings suggest active management engagement to steer future directions effectively. With R&D expenses not specified but crucial for tech firms aiming for market leadership, their investment in innovation will be pivotal for transitioning from losses to gains in the coming years.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co. Ltd, with a market cap of CN¥18.18 billion, is engaged in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally.

Operations: H&T Intelligent Control focuses on developing and selling intelligent controller products, leveraging its expertise in R&D and manufacturing to serve both domestic and international markets.

Shenzhen H&T Intelligent Control Co. Ltd has demonstrated robust financial performance, with revenue soaring to CNY 7.04 billion, up 28.3% year-over-year, driven by strategic market positioning and innovative product offerings. This growth is complemented by a net income increase to CNY 355.37 million, reflecting a solid earnings improvement of 6.3%. Notably, the company's commitment to innovation is underscored by its R&D investments which are crucial for sustaining its competitive edge in the rapidly evolving tech landscape. The recent shareholders meeting focused on pivotal governance changes promises further strategic refinement, enhancing its prospects in high-tech industries.

- Dive into the specifics of Shenzhen H&T Intelligent ControlLtd here with our thorough health report.

Shenzhen Everwin Precision Technology (SZSE:300115)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Everwin Precision Technology Co., Ltd. operates in the precision manufacturing industry with a market capitalization of CN¥21.94 billion.

Operations: The company generates revenue primarily from precision manufacturing activities. It has a market capitalization of CN¥21.94 billion, reflecting its scale within the industry.

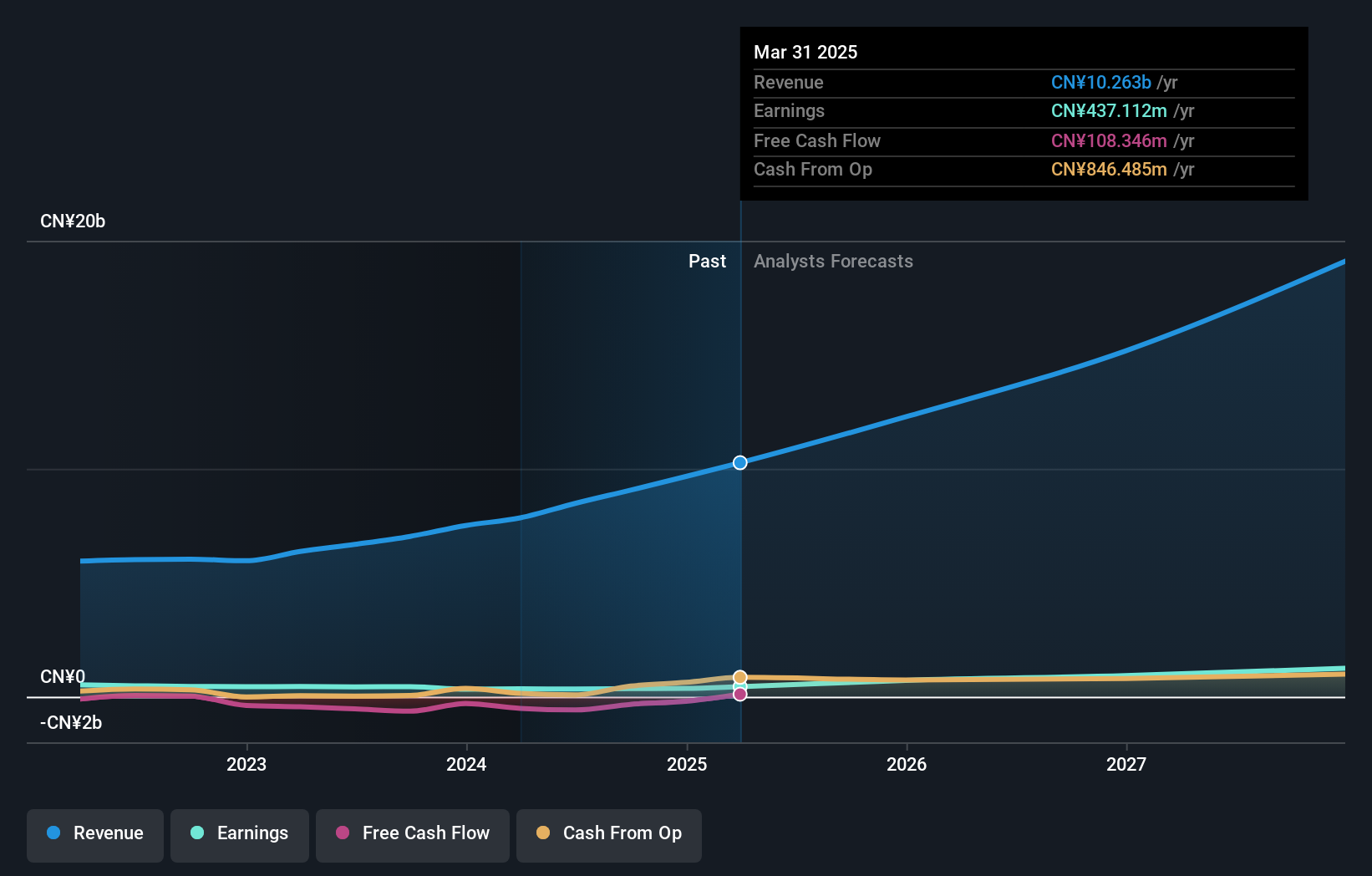

Shenzhen Everwin Precision Technology has showcased a remarkable financial trajectory, with its revenue surging by 23.6% to CNY 12.1 billion in the last nine months, significantly outpacing the industry average growth of 1.9%. This performance is bolstered by an exponential increase in net income from CNY 1.55 million to CNY 594.2 million within the same period, reflecting a strategic enhancement in operational efficiency and market reach. The company's aggressive focus on R&D, essential for maintaining technological leadership, is evident from its substantial investment in innovation, aligning with its robust earnings growth forecast of 27.6% annually and revenue projection to outstrip the market at a rate of 15.8% per year.

- Click to explore a detailed breakdown of our findings in Shenzhen Everwin Precision Technology's health report.

Understand Shenzhen Everwin Precision Technology's track record by examining our Past report.

Summing It All Up

- Embark on your investment journey to our 1273 High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600536

China National Software & Service

Operates as a software company in China.

Reasonable growth potential with adequate balance sheet.