3 Growth Companies With High Insider Ownership And Up To 93% Earnings Growth

Reviewed by Simply Wall St

In the current global market landscape, investor sentiment has been influenced by cautious commentary from the Federal Reserve and political uncertainties, leading to declines in major U.S. stock indexes despite some recovery efforts. Amidst these fluctuations, identifying growth companies with high insider ownership can be a strategic approach for investors seeking potential resilience and alignment of interests between company insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

APT Medical (SHSE:688617)

Simply Wall St Growth Rating: ★★★★★★

Overview: APT Medical Inc. is involved in the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China with a market cap of CN¥34.07 billion.

Operations: The company's revenue primarily comes from its medical products segment, totaling CN¥1.96 billion.

Insider Ownership: 22%

Earnings Growth Forecast: 28.8% p.a.

APT Medical demonstrates robust growth potential, with revenue and earnings forecasted to grow significantly faster than the market, at 29.1% and 28.8% per year respectively. Recent earnings results show a strong performance, with net income rising from CNY 403.25 million to CNY 528.15 million year-over-year. The company's high return on equity forecast of 29.7% in three years underscores its efficient capital use, although recent insider trading data is unavailable for further insights into insider confidence levels.

- Take a closer look at APT Medical's potential here in our earnings growth report.

- Our valuation report unveils the possibility APT Medical's shares may be trading at a premium.

Beijing Dabeinong Technology GroupLtd (SZSE:002385)

Simply Wall St Growth Rating: ★★★★☆☆

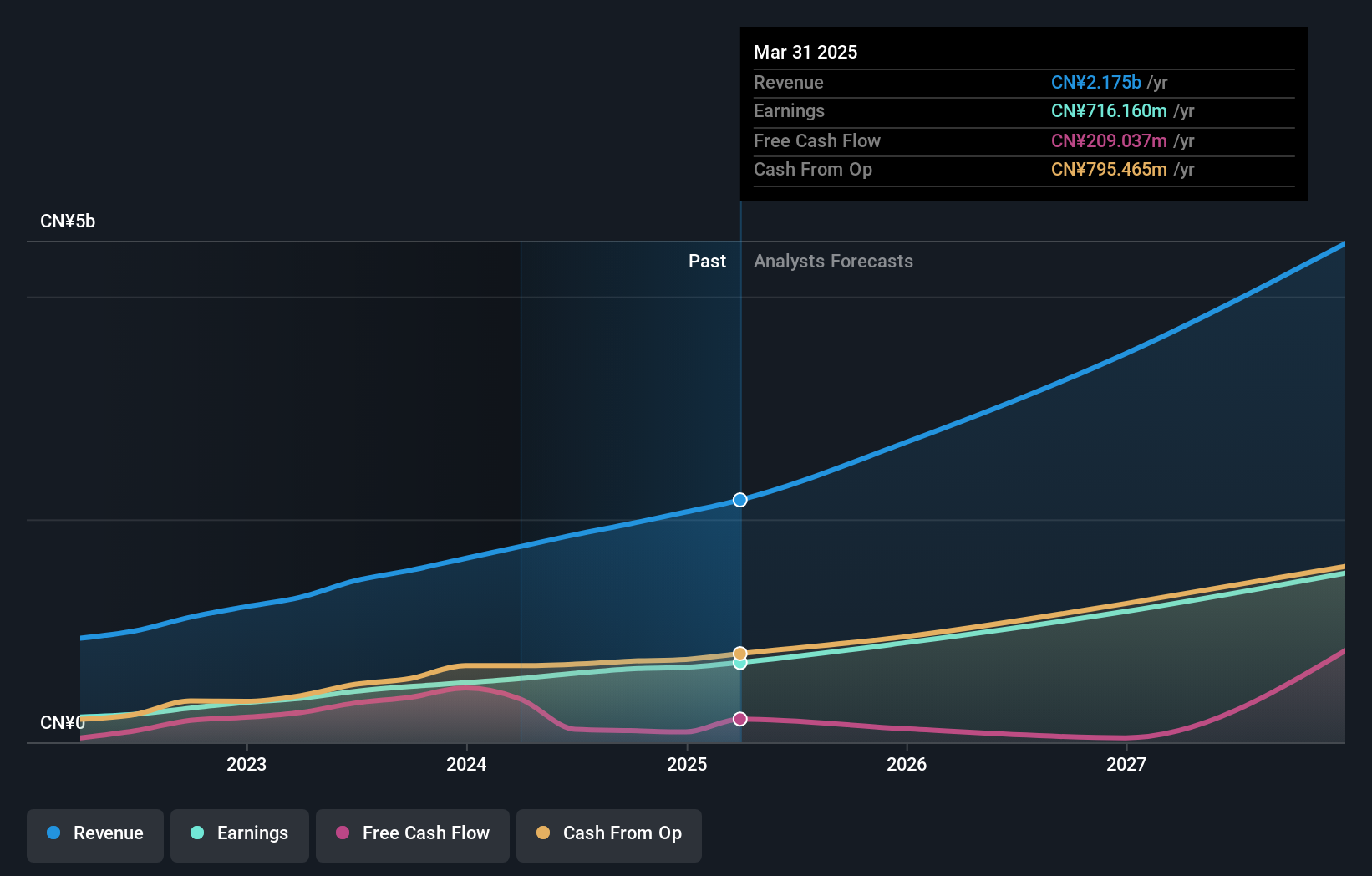

Overview: Beijing Dabeinong Technology Group Co., Ltd. operates in the agricultural technology sector, focusing on animal nutrition and crop protection products, with a market cap of CN¥18.38 billion.

Operations: Unfortunately, the provided Business operations text does not include specific revenue segment data for Beijing Dabeinong Technology Group Co., Ltd.

Insider Ownership: 27.3%

Earnings Growth Forecast: 93.6% p.a.

Beijing Dabeinong Technology Group shows potential for growth, with earnings forecasted to increase by 93.65% annually, despite revenue growth projections of 14% lagging behind the ideal threshold. The company recently reported a net income turnaround from a loss last year, suggesting improving profitability prospects. However, financial concerns exist as interest payments are not well covered by earnings and past shareholder dilution has occurred. Insider ownership details over the past three months remain unclear.

- Get an in-depth perspective on Beijing Dabeinong Technology GroupLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Beijing Dabeinong Technology GroupLtd shares in the market.

Nidec (TSE:6594)

Simply Wall St Growth Rating: ★★★★☆☆

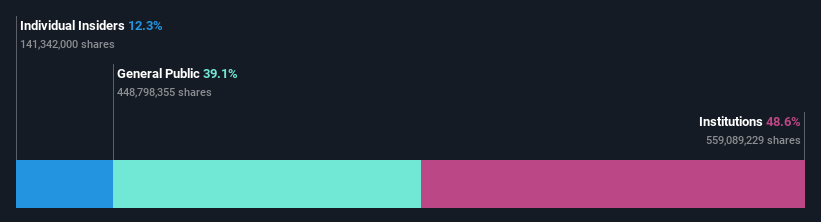

Overview: Nidec Corporation, along with its subsidiaries, is engaged in the development, manufacturing, and sale of motors, electronics and optical components, and other related products both in Japan and internationally; it has a market cap of ¥3.14 trillion.

Operations: The company's revenue segments include motors, electronics, and optical components, as well as related products sold domestically and internationally.

Insider Ownership: 12.3%

Earnings Growth Forecast: 21% p.a.

Nidec Corporation's earnings are forecast to grow significantly at 21% annually, outpacing the Japanese market average. Despite slower revenue growth projections of 5.5%, the company is trading below its estimated fair value, indicating potential undervaluation. Recent collaboration with Renesas Electronics on an innovative E-Axle system for EVs highlights Nidec's strategic initiatives in cutting-edge technology sectors. Insider ownership details remain unclear, but no substantial insider trading activity has been reported recently.

- Click to explore a detailed breakdown of our findings in Nidec's earnings growth report.

- In light of our recent valuation report, it seems possible that Nidec is trading beyond its estimated value.

Summing It All Up

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1513 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Beijing Dabeinong Technology GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Dabeinong Technology GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002385

Beijing Dabeinong Technology GroupLtd

Beijing Dabeinong Technology Group Co.,Ltd.

Undervalued with reasonable growth potential.