- China

- /

- Communications

- /

- SZSE:000561

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

In December 2024, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, with U.S. stocks experiencing broad-based declines and smaller-cap indexes particularly affected. As investors assess the impact of rate cuts and economic indicators such as strong consumer spending and job growth, identifying high-growth tech stocks becomes crucial for those seeking opportunities in an environment where market sentiment is influenced by both monetary policy decisions and broader economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Shaanxi Fenghuo Electronics (SZSE:000561)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shaanxi Fenghuo Electronics Co., Ltd. focuses on developing and producing military communications equipment and electroacoustic products in China, with a market cap of CN¥4.98 billion.

Operations: The company generates revenue primarily through its military communications equipment and electroacoustic products. It operates within the defense sector in China, leveraging its expertise in these specialized technologies.

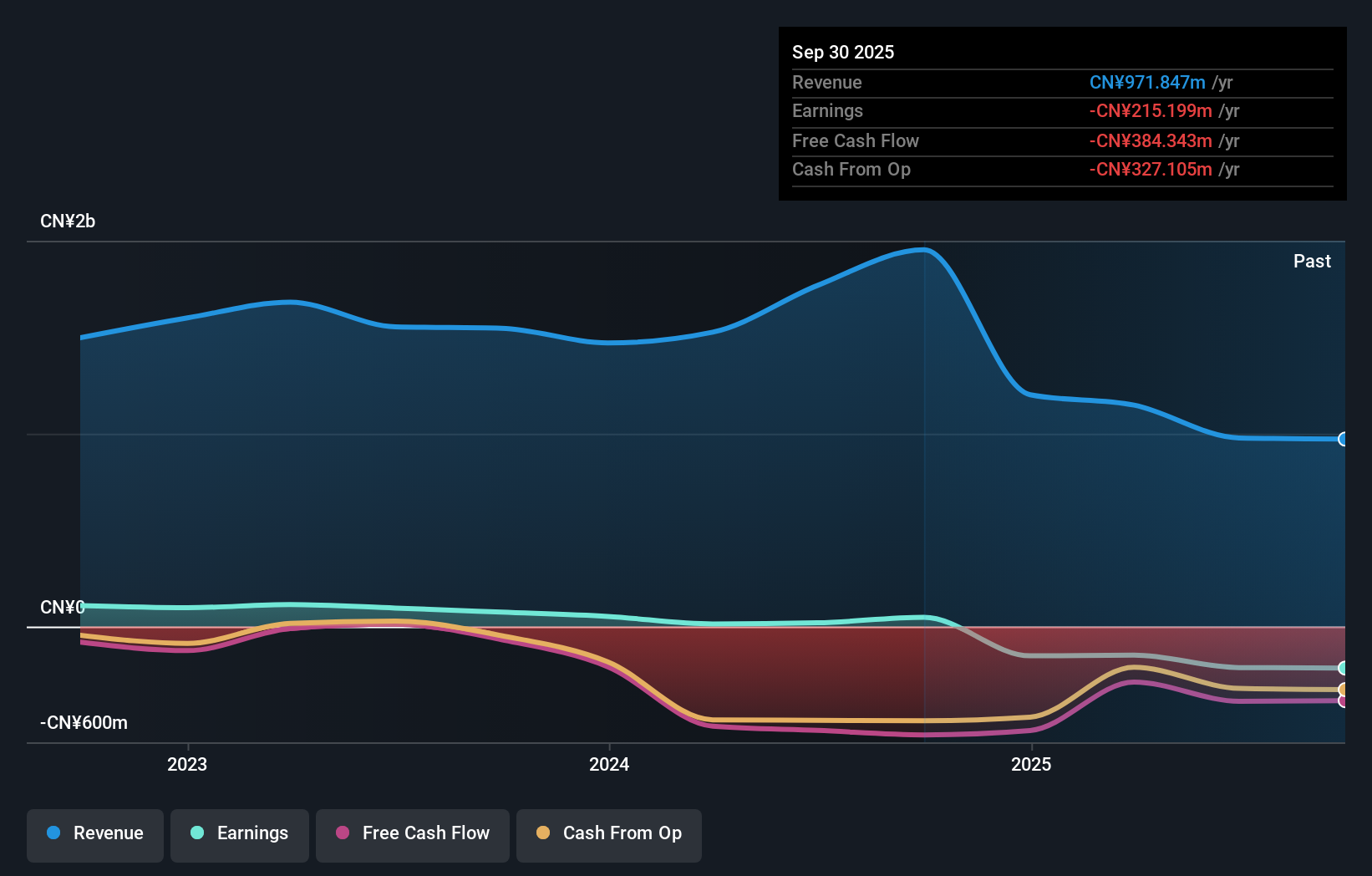

Shaanxi Fenghuo Electronics, amid a challenging fiscal period, reported a significant downturn with sales dropping to CNY 715.43 million and net losses widening to CNY 58.65 million for the nine months ending September 2024. Despite these setbacks, the company actively repurchased shares, completing transactions worth CNY 3.84 million within the year, signaling confidence in its strategic direction. Looking ahead, Shaanxi Fenghuo is poised for robust growth with expected annual revenue increases of 24.5% and earnings growth forecasted at an impressive rate of 44% per year, outpacing the broader Chinese market projections significantly. This anticipated growth is underpinned by innovative R&D investments and strategic market positioning that could potentially reshape its financial landscape and fortify its standing in the tech sector.

Bona Film Group (SZSE:001330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bona Film Group Co., Ltd. is a company focused on film production and distribution in China, with a market cap of approximately CN¥9.30 billion.

Operations: Bona Film Group Co., Ltd. operates in the film production and distribution sector within China. The company generates revenue primarily through its film-related activities, contributing to its market presence with a capitalization of around CN¥9.30 billion.

Bona Film Group's recent financial performance reflects a challenging phase, with revenue dropping to CNY 960 million and net losses deepening to CNY 354.36 million over the past nine months. Despite these hurdles, the company has not halted its strategic share repurchases, completing buybacks worth CNY 47 million this year. This indicates a strong belief in its recovery potential, supported by an expected surge in annual revenue growth at 55.3% and earnings growth at an impressive 105.2%. These figures suggest that Bona is positioning itself for a significant turnaround, leveraging robust market demand and strategic initiatives to potentially outpace broader industry growth rates.

- Delve into the full analysis health report here for a deeper understanding of Bona Film Group.

Gain insights into Bona Film Group's past trends and performance with our Past report.

Sichuan Jiuyuan Yinhai Software.Co.Ltd (SZSE:002777)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Jiuyuan Yinhai Software Co., Ltd specializes in offering medical insurance, digital government affairs, and smart cities services to government departments and industry ecosystem entities in China, with a market cap of CN¥7.28 billion.

Operations: Jiuyuan Yinhai Software focuses on delivering services related to medical insurance, digital government affairs, and smart cities within China. The company primarily serves government departments and industry ecosystem entities.

Sichuan Jiuyuan Yinhai Software.Co.Ltd has navigated a challenging period, with a revenue drop to CNY 668.15 million from CNY 803.4 million year-over-year and a significant decrease in net income from CNY 114.22 million to CNY 18.81 million. Despite these setbacks, the company's strategic focus on innovation is evident in its R&D investments, maintaining robust expenditure despite financial pressures, which underscores its commitment to advancing its software solutions in the competitive tech landscape. This strategy aligns with industry trends towards more integrated and advanced software services, potentially setting the stage for recovery and growth as market conditions improve, highlighted by an anticipated earnings growth of 39.3% per annum.

Next Steps

- Unlock our comprehensive list of 1273 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000561

Shaanxi Fenghuo Electronics

Researches, produces, and sells of communications and electroacoustic equipment in China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives