- China

- /

- Electronic Equipment and Components

- /

- SZSE:300088

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainty, smaller-cap indexes have notably underperformed amid broad-based losses. With the Fed's recent rate cut and ongoing concerns around government shutdowns influencing market sentiment, investors are keenly observing high-growth tech stocks that may offer potential opportunities in this volatile environment. In such conditions, a good stock often demonstrates resilience through strong fundamentals and innovative capabilities that can thrive despite economic headwinds.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

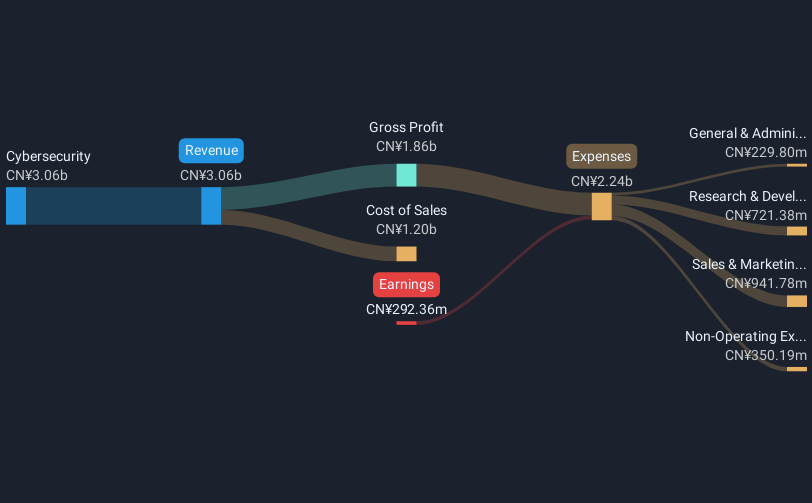

Overview: Topsec Technologies Group Inc., with a market cap of CN¥8.04 billion, operates in China offering cybersecurity, big data, and cloud services through its subsidiaries.

Operations: Topsec Technologies Group generates revenue primarily from its cybersecurity segment, which accounts for CN¥3.06 billion. The company focuses on providing specialized services in the cybersecurity domain within China.

Despite recent setbacks, including its removal from several Shenzhen Stock Exchange indexes, Topsec Technologies Group demonstrates a robust potential for growth with an expected annual revenue increase of 15%, outpacing the Chinese market's 13.8%. The company is navigating through unprofitability with strategic shifts, evidenced by a significant reduction in net loss to CNY 169.28 million from CNY 248.31 million year-over-year and is forecasted to turn profitable within three years. This trajectory is underpinned by aggressive R&D investments aimed at innovation and market adaptation, positioning Topsec favorably against slower-moving competitors in the tech sector.

Wuhu Token Sciences (SZSE:300088)

Simply Wall St Growth Rating: ★★★★★☆

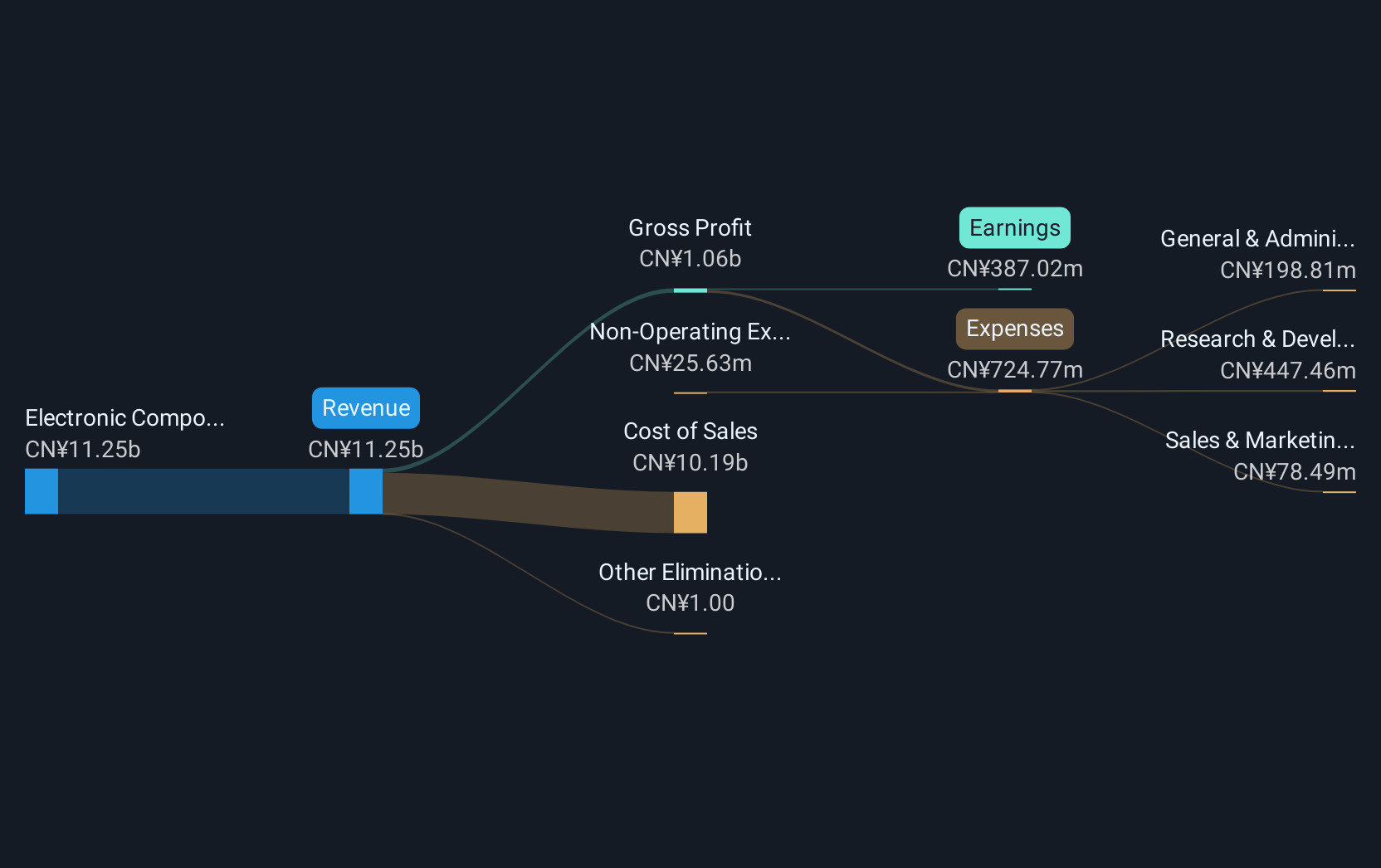

Overview: Wuhu Token Sciences Co., Ltd. is involved in the research, development, processing, manufacture, sale, and service of key touch display device materials in China with a market cap of CN¥16.60 billion.

Operations: Wuhu Token Sciences focuses on the production and sale of electronic components and parts, generating revenue primarily from this segment, which amounts to CN¥11.23 billion. The company's operations are centered around key touch display device materials in China.

Wuhu Token Sciences has demonstrated a notable stride in financial performance, with its revenue surging to CNY 8.64 billion, up from CNY 6.30 billion year-over-year, reflecting an aggressive growth trajectory. This increase is coupled with a robust earnings forecast, expecting a significant annual growth of 43.6%. The company's commitment to innovation is evident from its recent R&D initiatives and share buyback strategy, repurchasing shares worth CNY 150.18 million to boost shareholder value and invest in future growth avenues through equity incentive plans. These strategic moves underscore Wuhu Token Sciences' potential to leverage technological advancements and market opportunities effectively.

- Unlock comprehensive insights into our analysis of Wuhu Token Sciences stock in this health report.

Gain insights into Wuhu Token Sciences' past trends and performance with our Past report.

NSFOCUS Technologies Group (SZSE:300369)

Simply Wall St Growth Rating: ★★★★☆☆

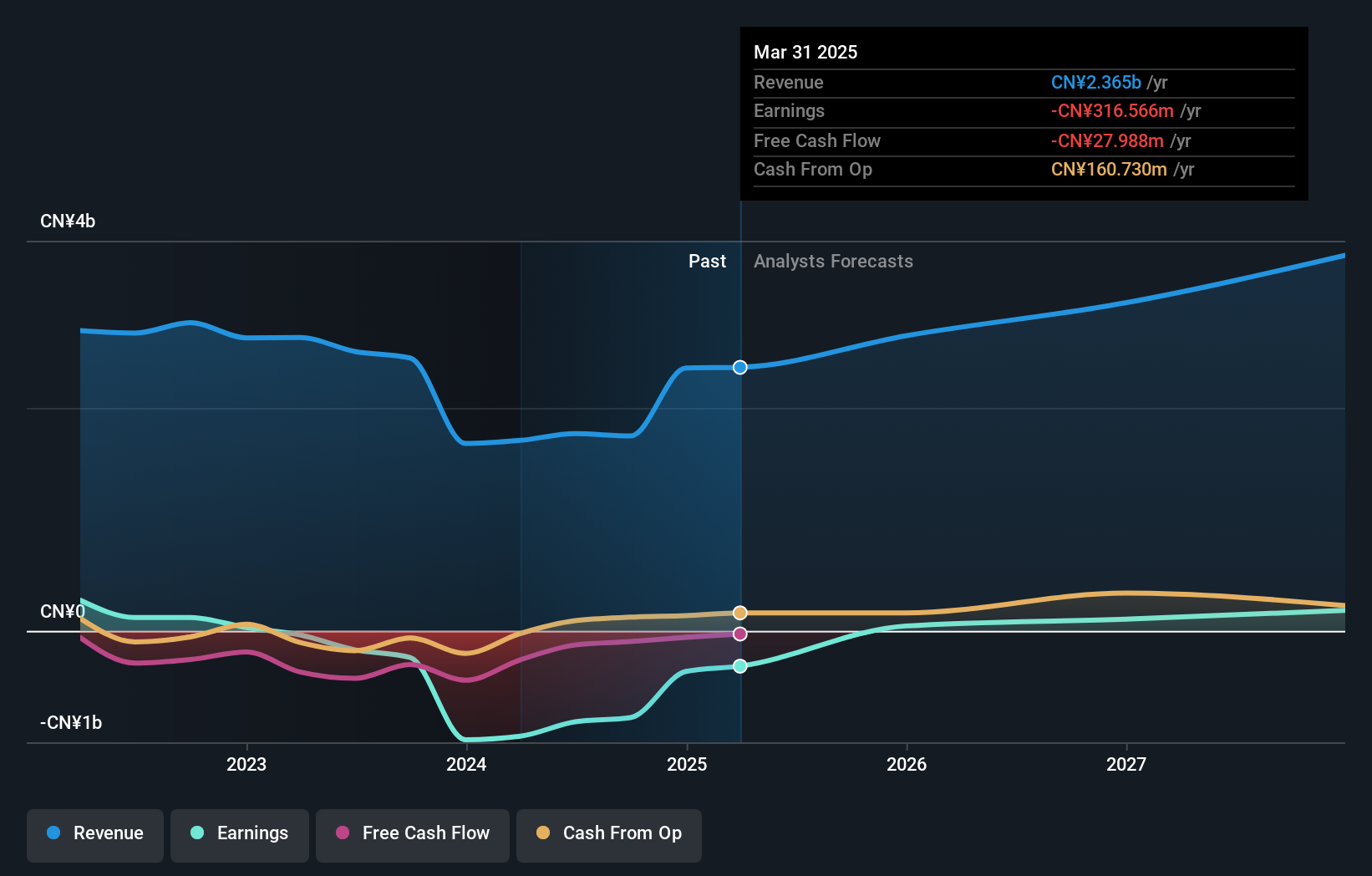

Overview: NSFOCUS Technologies Group Co., Ltd. offers Internet and application security services globally, with a market capitalization of CN¥6.03 billion.

Operations: The company generates revenue primarily from the Information Security Industry, amounting to CN¥1.75 billion. The business focuses on delivering comprehensive security solutions for Internet and application protection worldwide.

NSFOCUS Technologies Group has shown resilience and adaptability in a challenging market, with its recent financials revealing a narrowing net loss to CNY 326.02 million from CNY 524.28 million year-over-year, reflecting an improved operational efficiency. Despite currently being unprofitable, the company's revenue growth stands at an annual rate of 18.1%, showcasing its potential in capturing market share. Moreover, NSFOCUS is expected to pivot into profitability within three years, with earnings projected to surge by 127.3% annually, signaling robust future prospects as it continues to refine its technological offerings and market strategy amidst a volatile share price environment.

- Click to explore a detailed breakdown of our findings in NSFOCUS Technologies Group's health report.

Learn about NSFOCUS Technologies Group's historical performance.

Turning Ideas Into Actions

- Take a closer look at our High Growth Tech and AI Stocks list of 1273 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhu Token Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300088

Wuhu Token Sciences

Engages in the research and development, processing, manufacture, sale, and service of key touch display device materials in China.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives