Strong week for Bright Oceans Inter-Telecom (SHSE:600289) shareholders doesn't alleviate pain of three-year loss

It is doubtless a positive to see that the Bright Oceans Inter-Telecom Corporation (SHSE:600289) share price has gained some 39% in the last three months. But that is small recompense for the exasperating returns over three years. Tragically, the share price declined 51% in that time. So the improvement may be a real relief to some. While many would remain nervous, there could be further gains if the business can put its best foot forward.

While the stock has risen 10% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Bright Oceans Inter-Telecom

Given that Bright Oceans Inter-Telecom didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Bright Oceans Inter-Telecom saw its revenue shrink by 29% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 15% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. It could be a while before the company repays long suffering shareholders with share price gains.

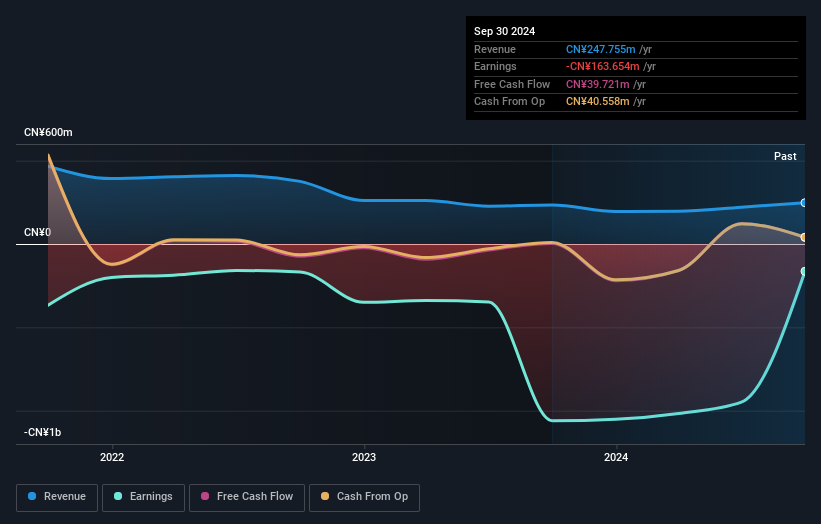

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Bright Oceans Inter-Telecom's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Bright Oceans Inter-Telecom had a tough year, with a total loss of 9.2%, against a market gain of about 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 8% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Bright Oceans Inter-Telecom that you should be aware of before investing here.

We will like Bright Oceans Inter-Telecom better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bright Oceans Inter-Telecom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600289

Bright Oceans Inter-Telecom

Researches and develops basic and application software in the field of information and communication technology operation management worldwide.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)