As global markets navigate a busy earnings season, with major indexes like the Nasdaq Composite and S&P MidCap 400 experiencing fluctuations amid cautious earnings reports from tech giants, small-cap stocks have demonstrated resilience compared to their larger counterparts. In this environment of mixed economic signals and market volatility, identifying high-growth tech stocks requires a focus on companies that can sustain innovation and adapt to changing conditions while maintaining strong fundamentals.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

AisinoLtd (SHSE:600271)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aisino Co. Ltd. offers information security solutions both in China and globally, with a market capitalization of CN¥19.14 billion.

Operations: Aisino Ltd. specializes in delivering comprehensive information security solutions across domestic and international markets. The company generates revenue primarily from its security services, which are integral to various sectors requiring robust protection measures.

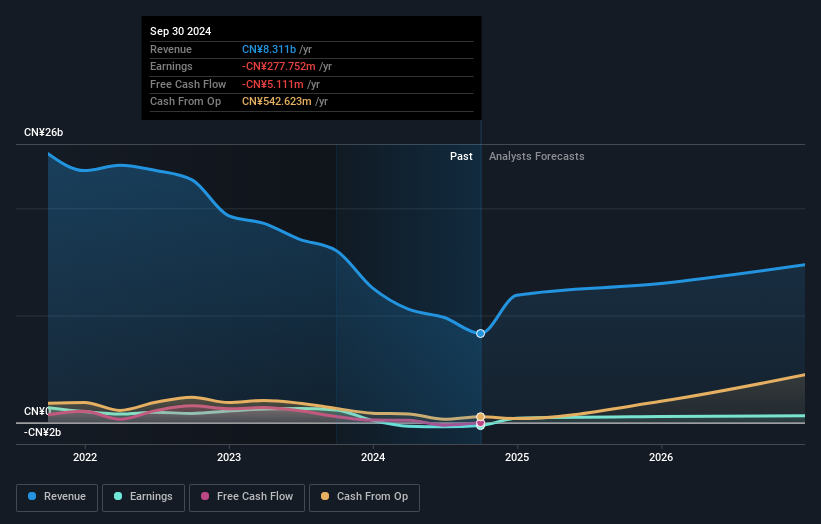

Despite a challenging year where Aisino Ltd. saw its sales drop from CNY 10.04 billion to CNY 5.78 billion, the company is navigating through a transformative phase with significant investments in R&D, which amounted to an impressive 19.5% of its revenue. This focus on innovation is critical as it aligns with industry shifts towards more integrated tech solutions, potentially setting the stage for recovery and future growth. Moreover, with earnings expected to grow by 65.7% annually, Aisino's aggressive strategy could well position it to capitalize on expanding market demands if it successfully turns around its current financial trajectory.

- Click to explore a detailed breakdown of our findings in AisinoLtd's health report.

Gain insights into AisinoLtd's past trends and performance with our Past report.

Beijing Tricolor Technology (SHSE:603516)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Tricolor Technology Co., Ltd is a global manufacturer and seller of professional audio and video products, with a market cap of CN¥6.10 billion.

Operations: Tricolor Technology generates revenue primarily from the display control industry, with sales amounting to CN¥484.76 million. The company's business model focuses on manufacturing and selling professional audio and video products globally.

Beijing Tricolor Technology has shown a robust growth trajectory with earnings surging by 188.4% over the past year, significantly outpacing the industry's 1.7% growth. This performance is underpinned by a strategic emphasis on R&D, which commands 32.3% of its revenue, reflecting a deep commitment to innovation amidst competitive market pressures. The company's recent financials reveal an uplift in net income to CNY 51.51 million from CNY 11.59 million year-over-year, driven by tactical advancements and operational efficiency improvements despite slight revenue contraction from CNY 337.34 million to CNY 326.52 million in the latest reporting period.

- Take a closer look at Beijing Tricolor Technology's potential here in our health report.

Learn about Beijing Tricolor Technology's historical performance.

Changchun BCHT Biotechnology (SHSE:688276)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changchun BCHT Biotechnology Co. Ltd. is a biopharmaceutical company focused on the research, development, production, and sale of human vaccines both in China and internationally, with a market cap of CN¥11.09 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥1.61 billion.

Changchun BCHT Biotechnology has demonstrated resilience and adaptability in a challenging market, with a notable earnings growth of 37.7% this past year, surpassing the biotech industry's average of just 0.08%. This growth trajectory is supported by an aggressive R&D investment strategy, which is evident from the recent financials showing a significant commitment to innovation and development despite a revenue dip to CNY 1.026 billion from CNY 1.243 billion year-over-year. Looking ahead, the company's revenue and earnings are expected to grow at an impressive rate of 30.1% and 40.8% per year respectively, signaling robust future prospects in a rapidly evolving sector.

Where To Now?

- Get an in-depth perspective on all 1282 High Growth Tech and AI Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688276

Changchun BCHT Biotechnology

Changchun BCHT Biotechnology Co. Ltd., a biopharmaceutical company, engages in the research and development, production, and sale of human vaccines in China and internationally.

Flawless balance sheet with high growth potential.