- China

- /

- Consumer Durables

- /

- SHSE:603313

Top Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with fluctuating consumer confidence and moderate gains in major stock indexes, investors are increasingly focusing on growth companies that demonstrate resilience and potential for long-term success. In particular, stocks with high insider ownership can offer unique insights into management's confidence in their business strategies, making them appealing options amid current economic uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 79.6% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

Let's take a closer look at a couple of our picks from the screened companies.

iFAST (SGX:AIY)

Simply Wall St Growth Rating: ★★★★☆☆

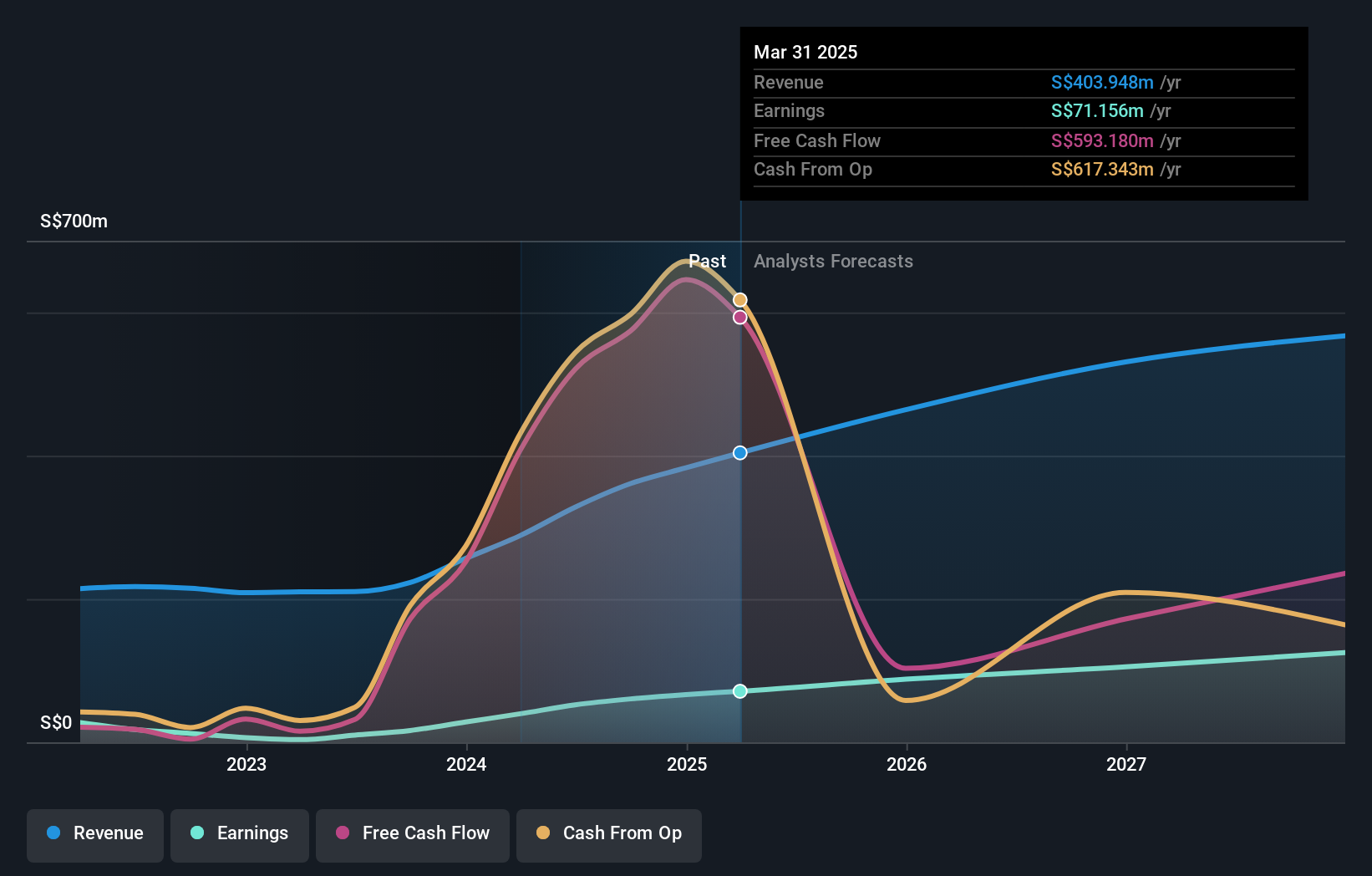

Overview: iFAST Corporation Ltd. offers investment products and services across Singapore, Hong Kong, Malaysia, China, and the United Kingdom with a market capitalization of SGD2.21 billion.

Operations: iFAST Corporation Ltd. generates its revenue from providing a range of investment products and services across its key markets in Singapore, Hong Kong, Malaysia, China, and the United Kingdom.

Insider Ownership: 28.7%

Earnings Growth Forecast: 14.8% p.a.

iFAST Corporation has demonstrated strong growth, with recent earnings showing a net income increase to S$16.81 million for Q3 2024, up from S$8.52 million the previous year. The company's revenue is expected to grow at 9.1% annually, surpassing the Singapore market's average of 3.7%. Insider ownership remains stable with no substantial insider trading activity reported recently. iFAST trades at approximately 13.2% below its estimated fair value, indicating potential undervaluation in the market.

- Click here and access our complete growth analysis report to understand the dynamics of iFAST.

- Our comprehensive valuation report raises the possibility that iFAST is priced higher than what may be justified by its financials.

HealthcareLtd (SHSE:603313)

Simply Wall St Growth Rating: ★★★★☆☆

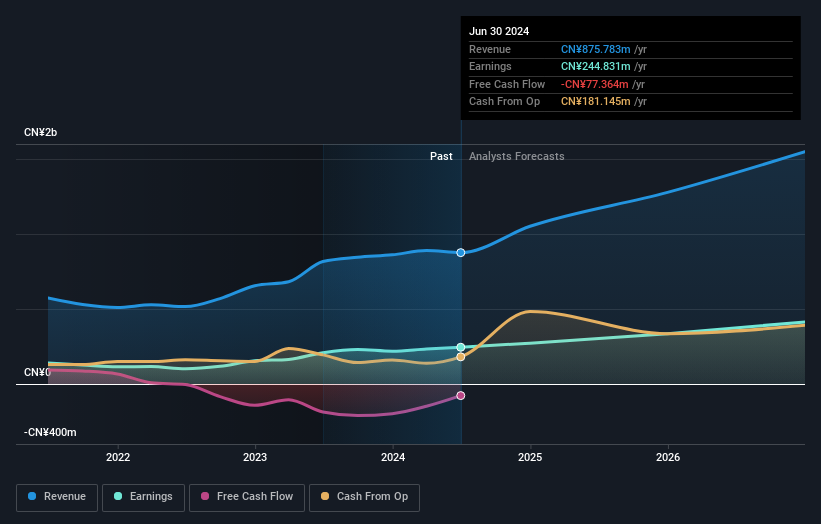

Overview: Healthcare Co., Ltd. engages in the research, development, production, and sale of memory foam mattresses, pillows, sofas, and other household products in China with a market cap of CN¥3.85 billion.

Operations: The company generates revenue of CN¥8.39 billion from its household products segment, which includes memory foam mattresses, pillows, and sofas.

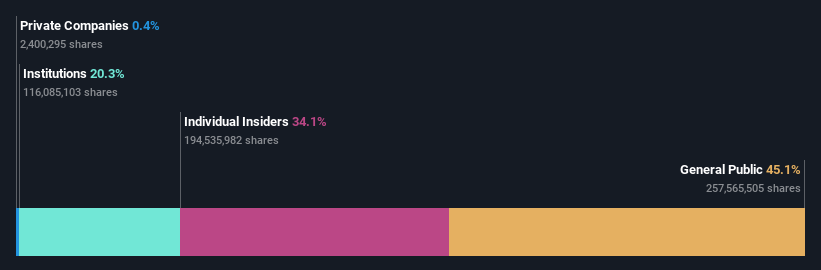

Insider Ownership: 34.1%

Earnings Growth Forecast: 94.7% p.a.

HealthcareLtd has seen a revenue increase to CNY 6.13 billion for the first nine months of 2024, yet reported a net loss of CNY 152.98 million compared to last year's profit. Despite being dropped from the S&P Global BMI Index, its earnings are forecasted to grow significantly at 94.73% annually and it is expected to become profitable in three years. However, interest payments remain poorly covered by earnings and insider trading activity is minimal recently.

- Delve into the full analysis future growth report here for a deeper understanding of HealthcareLtd.

- Insights from our recent valuation report point to the potential undervaluation of HealthcareLtd shares in the market.

Jiangsu Jibeier Pharmaceutical (SHSE:688566)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Jibeier Pharmaceutical Co., Ltd. is a pharmaceutical company involved in the research, development, production, and sale of chemical pharmaceutical preparations, Chinese medicine, and drugs with a market cap of CN¥4.47 billion.

Operations: The company's revenue is primarily generated from its pharmaceutical manufacturing segment, which amounts to CN¥887.17 million.

Insider Ownership: 20%

Earnings Growth Forecast: 23.7% p.a.

Jiangsu Jibeier Pharmaceutical reported sales of CNY 643.21 million and net income of CNY 174.56 million for the first nine months of 2024, showing modest growth compared to the previous year. Despite shareholder dilution over the past year, its earnings are forecasted to grow significantly at 23.75% annually, outpacing market revenue growth expectations. The company trades at a favorable price-to-earnings ratio (18.7x) compared to the CN market average (34.8x).

- Unlock comprehensive insights into our analysis of Jiangsu Jibeier Pharmaceutical stock in this growth report.

- Our valuation report here indicates Jiangsu Jibeier Pharmaceutical may be undervalued.

Key Takeaways

- Click here to access our complete index of 1502 Fast Growing Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade HealthcareLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HealthcareLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603313

HealthcareLtd

Research, develops, produces, and sells memory foam mattresses, pillows, sofas, and other household products in China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives