- China

- /

- Electronic Equipment and Components

- /

- SZSE:301589

High Growth Tech Stocks None Highlighted For Strong Potential

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence declining and major stock indexes experiencing moderate gains, the focus on high-growth tech stocks remains pertinent amid these fluctuating conditions. In such an environment, identifying strong tech stocks often involves assessing their resilience to economic shifts and their capacity for innovation in response to market demands.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1264 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. is involved in the R&D, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market cap of CN¥20.74 billion.

Operations: Raytron focuses on developing and selling uncooled infrared imaging and MEMS sensor technology. The company's operations encompass research, design, manufacturing, and sales primarily within the Chinese market.

Raytron TechnologyLtd has demonstrated robust financial performance with a significant uptick in sales, reaching CNY 3.15 billion, up from CNY 2.66 billion year-over-year, and an enhanced net income of CNY 483.4 million. This growth is underpinned by a strategic emphasis on R&D, crucial for maintaining its competitive edge in the tech sector. Notably, the company's earnings are projected to surge by approximately 27% annually, outpacing the broader Chinese market forecast of 25.2%. Additionally, Raytron's recent share buyback initiative underscores a strong confidence in its future prospects, having repurchased shares worth CNY 49.43 million within five months. This financial trajectory is complemented by Raytron’s above-market revenue growth rate of 18.2% per annum compared to the national average of 13.6%, signaling robust business expansion strategies and market penetration efforts that are likely to sustain its upward trajectory in the technology landscape.

- Click here and access our complete health analysis report to understand the dynamics of Raytron TechnologyLtd.

Gain insights into Raytron TechnologyLtd's past trends and performance with our Past report.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company operating in China and internationally, with a market cap of CN¥16.28 billion.

Operations: Leyard Optoelectronic focuses on the development and sale of audio-visual technology products, serving both domestic and international markets. The company generates revenue primarily through its diverse range of display solutions, including LED displays and related systems.

Leyard Optoelectronic has faced challenges, with a notable decrease in sales from CNY 6.02 billion to CNY 5.46 billion and a sharp decline in net income from CNY 460.9 million to CNY 181.38 million over the last nine months of 2024. Despite these setbacks, the company's commitment to innovation is evident as they continue investing in R&D, crucial for staying competitive in the tech industry. The recent buyback of shares worth CNY 22.4 million signals confidence in its strategic direction while navigating through market fluctuations and internal adjustments like appointing a new audit firm during their extraordinary shareholders meeting scheduled for November 2024.

- Delve into the full analysis health report here for a deeper understanding of Leyard Optoelectronic.

Understand Leyard Optoelectronic's track record by examining our Past report.

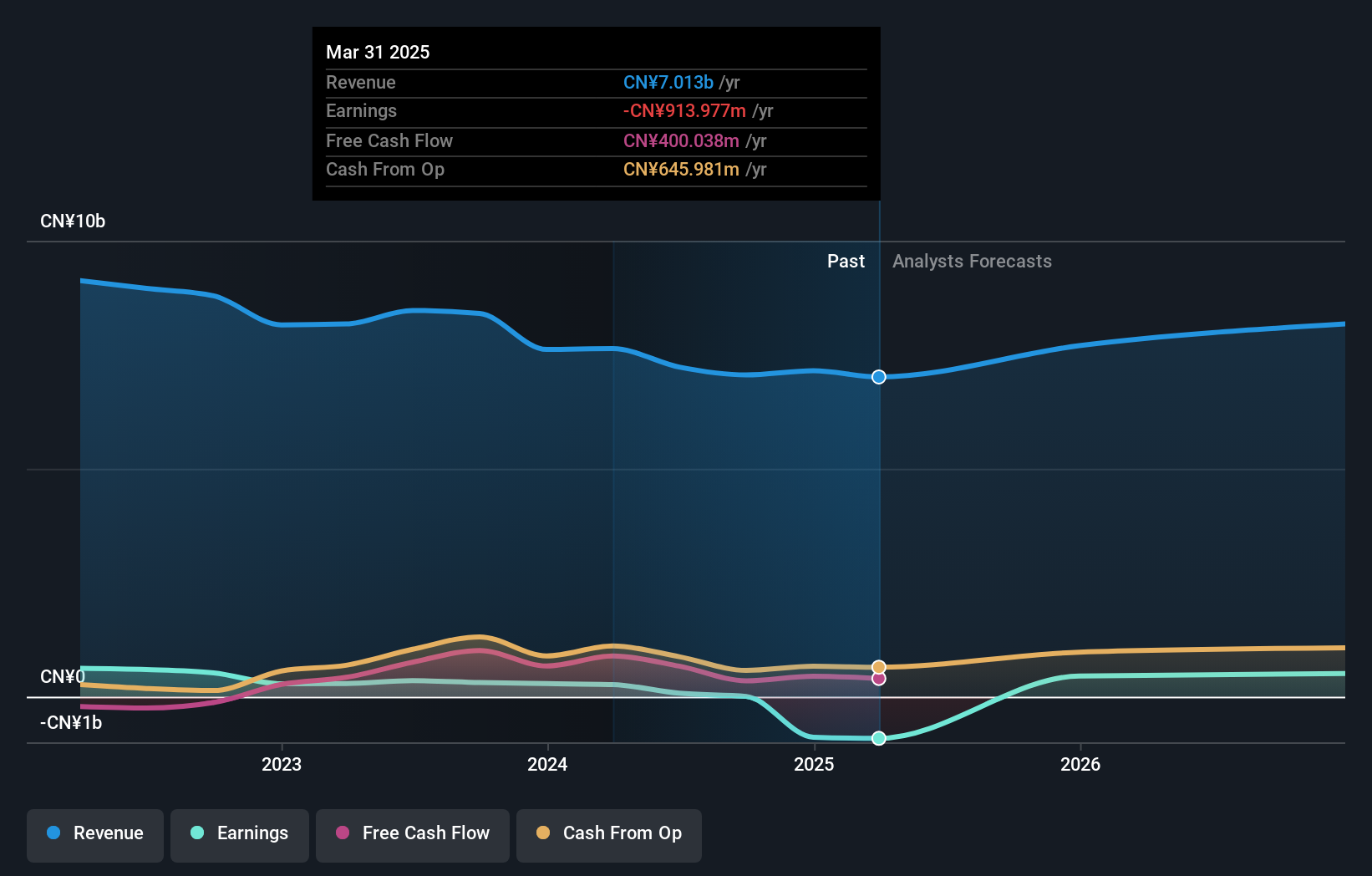

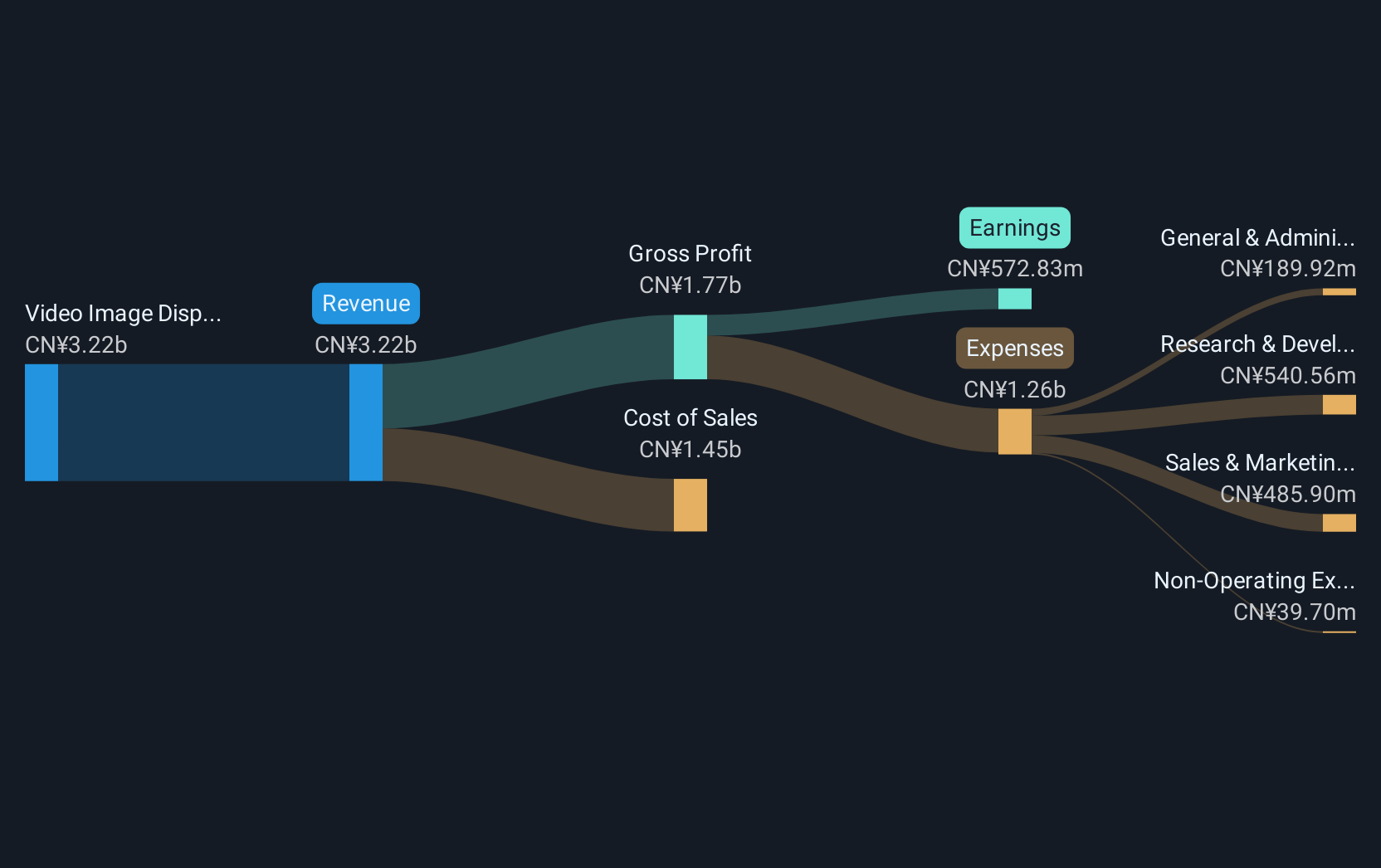

Xi'an NovaStar Tech (SZSE:301589)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an NovaStar Tech Co., Ltd. specializes in providing LED display control solutions in China and has a market cap of CN¥16.05 billion.

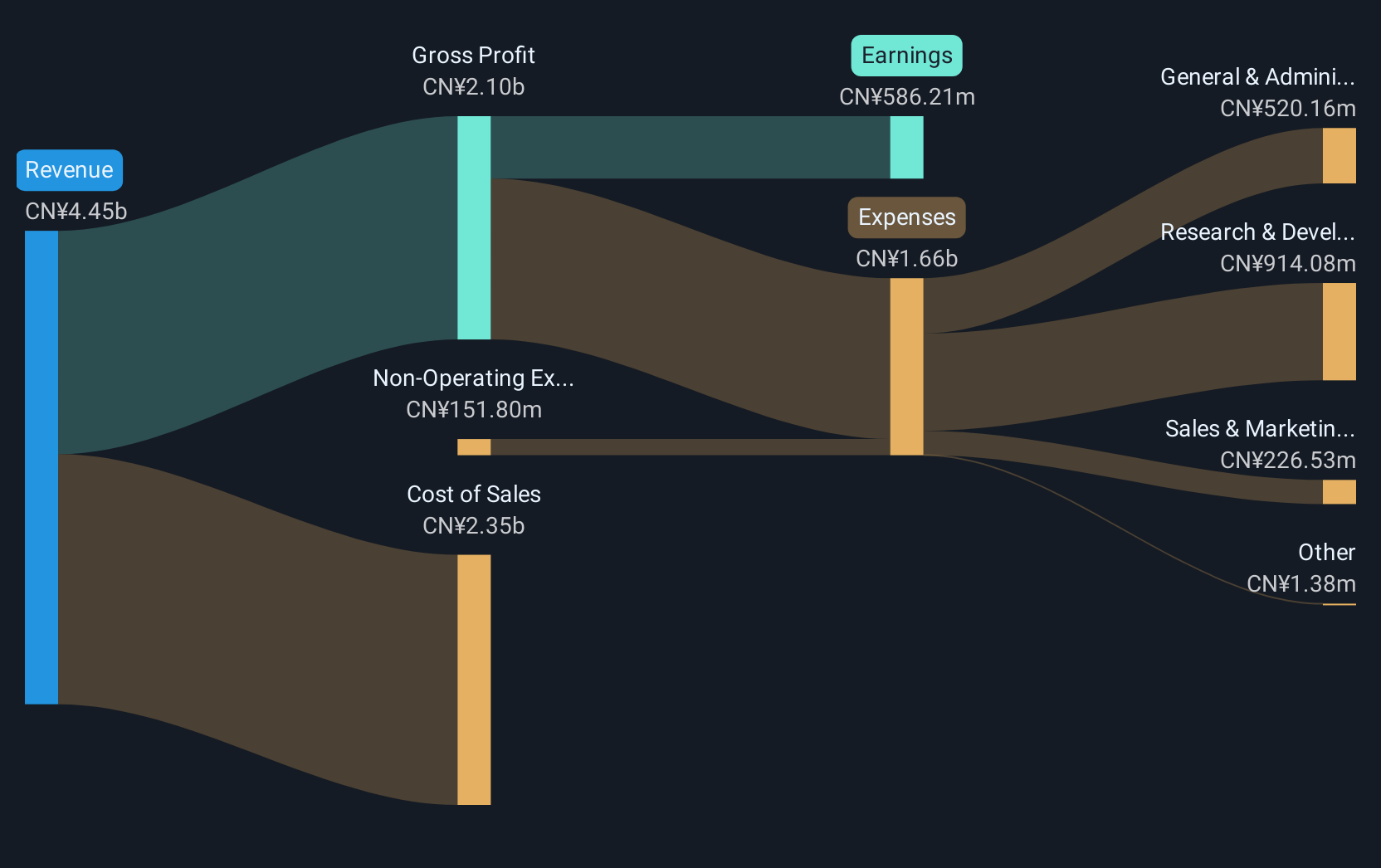

Operations: Xi'an NovaStar Tech Co., Ltd. generates revenue primarily from electronic components and parts, totaling CN¥3.28 billion. The company focuses on LED display control solutions within the Chinese market.

Xi'an NovaStar Tech's recent inclusion in the Shenzhen Stock Exchange Indexes underscores its growing prominence. With a robust forecast for revenue and earnings, expected to surge by 30.2% and 35.3% annually, the firm is strategically positioned within China's tech sector. Significant investments in R&D underscore its commitment to innovation, vital for sustaining growth amidst fierce competition. The company also demonstrated confidence through a share repurchase plan valued at CNY 150 million, reinforcing its commitment to shareholder value amidst expanding market operations.

Summing It All Up

- Discover the full array of 1264 High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301589

Xi'an NovaStar Tech

Designs and develops light-emitting diode (LED) display control solutions in China and internationally.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion