High Growth Tech And 2 Other Promising Stocks For Future Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and economic indicators, the technology sector continues to capture investor interest, with indices like the Nasdaq Composite leading gains despite recent volatility. In this context, identifying stocks with strong growth potential involves assessing their ability to adapt and thrive amid shifting market dynamics and economic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1264 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Qi An Xin Technology Group (SHSE:688561)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company that offers products and services to government, enterprises, and other institutions both in China and internationally, with a market cap of CN¥18.30 billion.

Operations: The company generates revenue primarily from the information security industry, amounting to CN¥5.47 billion.

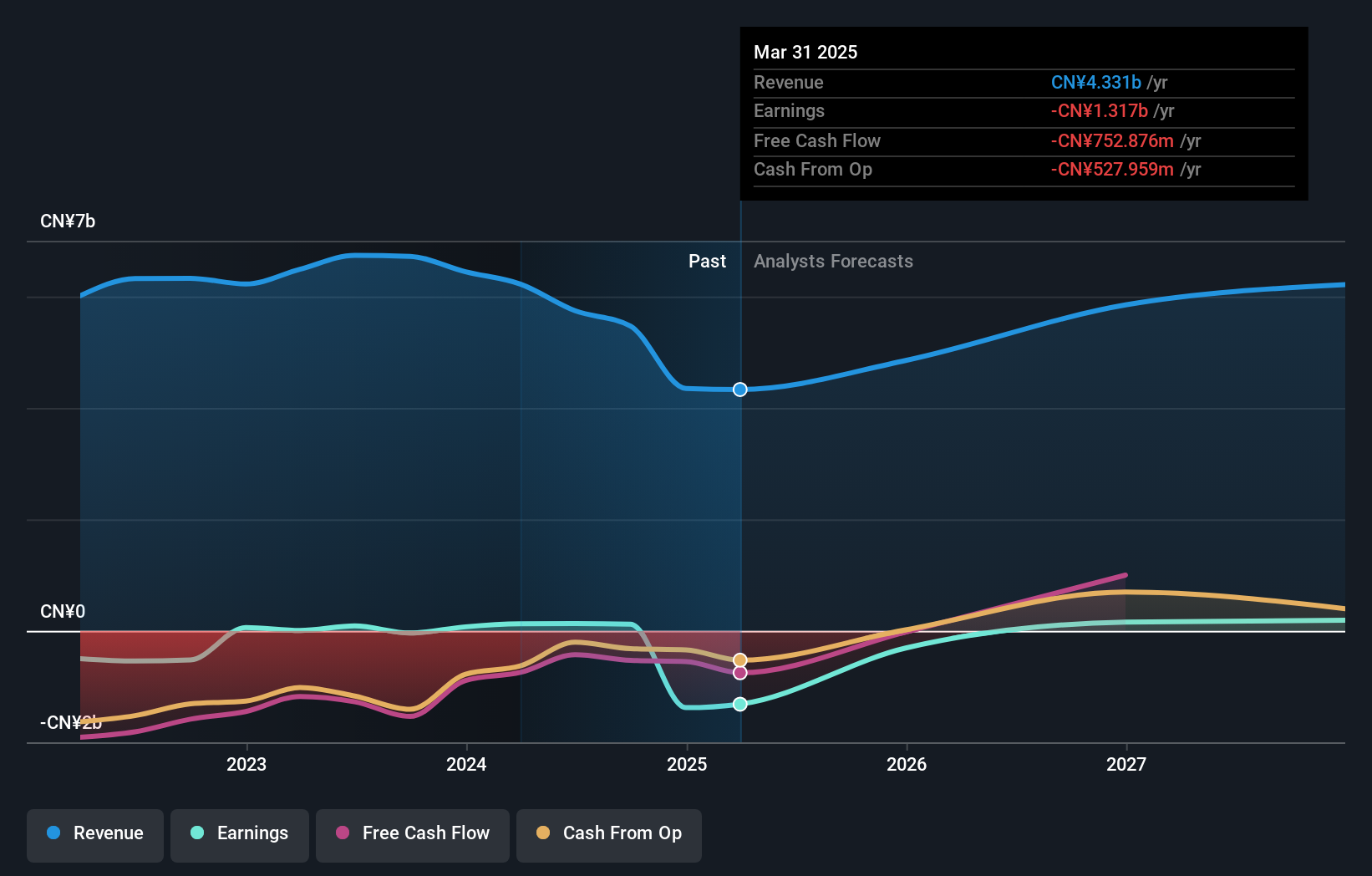

Qi An Xin Technology Group has demonstrated resilience and adaptability in a challenging market, with recent earnings showing a reduction in net loss from CNY 1,222.92 million to CNY 1,175.98 million year-over-year. Despite a dip in sales to CNY 2,710.68 million from the previous year's CNY 3,686.3 million, the company's strategic R&D investments are poised to foster innovation and maintain competitiveness within the tech sector. Impressively, Qi An Xin is expected to outpace the Chinese market with an annual revenue growth rate of 14.7% and an even more robust earnings growth forecast at 38.2% per annum, highlighting its potential amid economic pressures and evolving industry dynamics.

- Click to explore a detailed breakdown of our findings in Qi An Xin Technology Group's health report.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd engages in the research, development, production, and sale of display, semiconductor, and new energy detection systems with a market capitalization of CN¥17.58 billion.

Operations: Wuhan Jingce Electronic Group Co., Ltd focuses on the production and sale of electronic products, generating revenue primarily from its electron product segment, which amounts to CN¥2.72 billion.

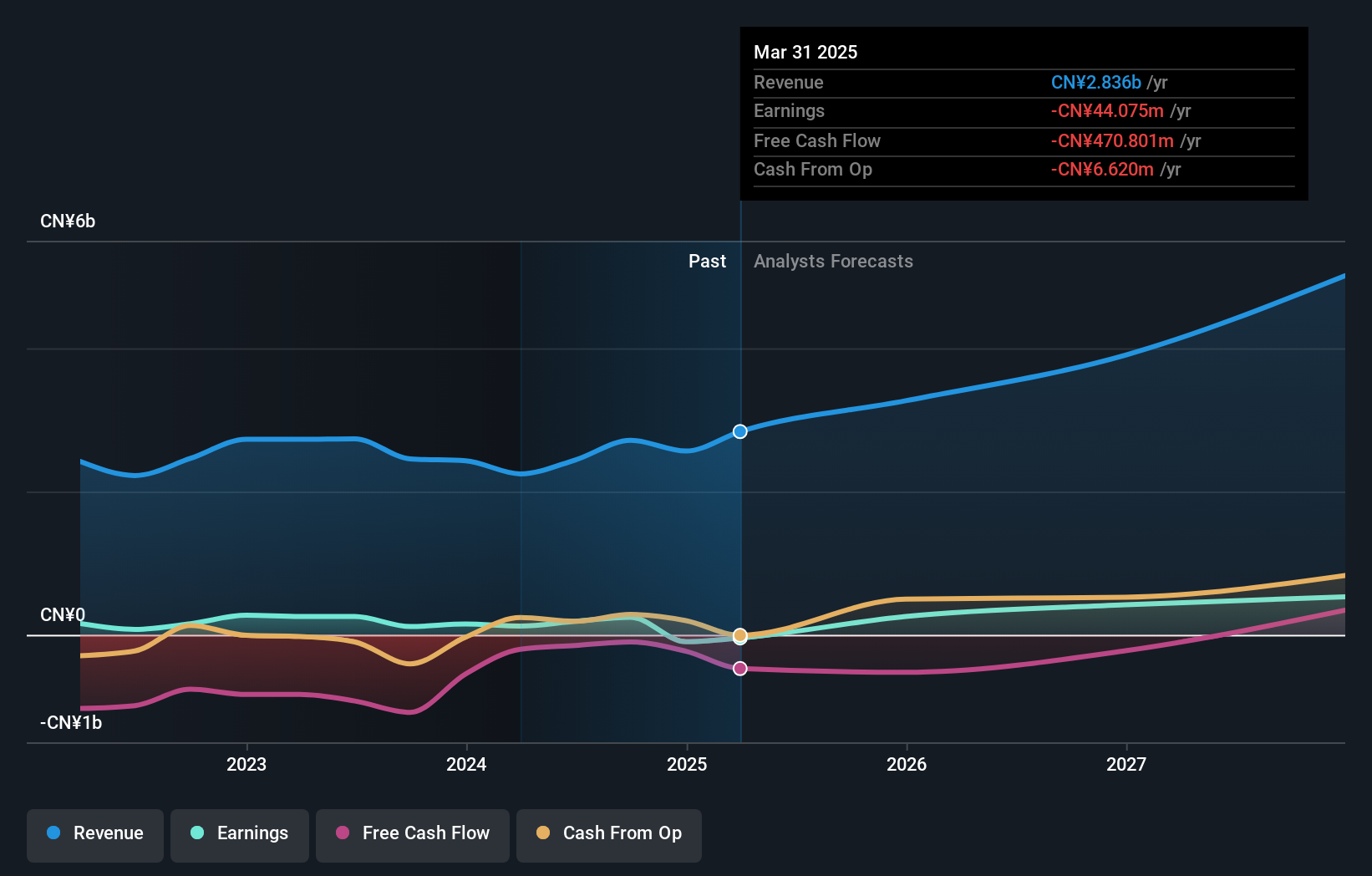

Wuhan Jingce Electronic Group has pivoted impressively in the tech sector, with a notable turnaround from a net loss of CNY 12.6 million to a net income of CNY 82.24 million within the year, reflecting an earnings growth of 111.8% which outstrips the industry's modest 1.9%. This resurgence is backed by increased sales, up from CNY 1,544.84 million to CNY 1,830.64 million, showcasing robust revenue growth at an annual rate of 20.1%. Despite challenges like highly volatile share prices and significant one-off gains impacting financial results (CNY 289.8M), the company's strategic focus on R&D could enhance its competitive edge in evolving electronic markets.

- Navigate through the intricacies of Wuhan Jingce Electronic GroupLtd with our comprehensive health report here.

Learn about Wuhan Jingce Electronic GroupLtd's historical performance.

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Giga-Byte Technology Co., Ltd. operates as a manufacturer and trader of computer peripherals and component parts across various regions including Taiwan, Europe, the United States, Canada, China, and globally, with a market cap of approximately NT$182.54 billion.

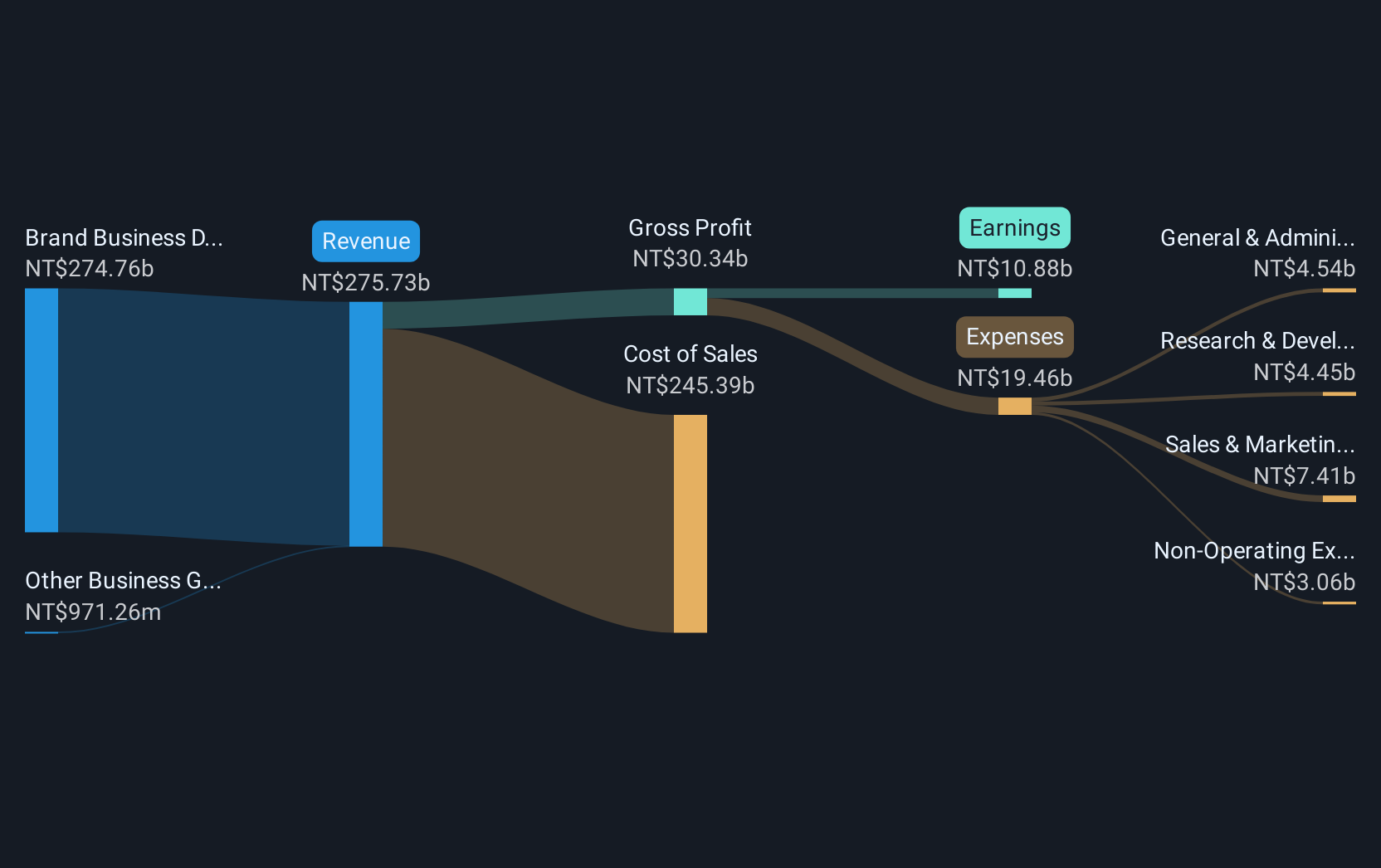

Operations: The Brand Business Division is a significant revenue driver for Giga-Byte Technology, generating NT$244.47 billion. The company's operations span manufacturing, processing, and trading of computer peripherals and component parts across multiple international markets.

Giga-Byte Technology has demonstrated significant financial momentum, with its recent earnings report revealing a jump in sales from TWD 37 billion to TWD 70.45 billion in just one quarter, and net income rising from TWD 1.48 billion to TWD 1.93 billion year-over-year. This growth trajectory is underscored by an impressive annual revenue increase of 17.2% and earnings growth forecast at 25.5% per annum, signaling robust market performance and potential for sustained expansion. Additionally, the firm's commitment to innovation is evident from its R&D investments, crucial for maintaining competitive advantage in the rapidly evolving tech landscape.

- Click here to discover the nuances of Giga-Byte Technology with our detailed analytical health report.

Explore historical data to track Giga-Byte Technology's performance over time in our Past section.

Summing It All Up

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1261 more companies for you to explore.Click here to unveil our expertly curated list of 1264 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qi An Xin Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688561

Qi An Xin Technology Group

A cyber-security company, provides cybersecurity products and services for government, enterprises, and other institutions in China and internationally.

Reasonable growth potential with mediocre balance sheet.