Undiscovered Gems with Promising Potential This January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets have shown mixed signals with major stock indexes experiencing moderate gains despite a dip in U.S. consumer confidence and manufacturing orders. While large-cap growth stocks have been at the forefront of recent rallies, small-cap indices like the S&P MidCap 400 and Russell 2000 also posted notable year-to-date increases, highlighting potential opportunities for discerning investors seeking undiscovered gems. In this environment, identifying promising stocks often involves looking beyond current market leaders to find companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

S&S Tech (KOSDAQ:A101490)

Simply Wall St Value Rating: ★★★★★★

Overview: S&S Tech Corporation is a company that manufactures and sells blank masks globally, with a market capitalization of ₩536.15 billion.

Operations: S&S Tech generates revenue primarily from S&S Tech Co., Ltd. with ₩158.48 billion and S&S Investment Co., Ltd. contributing ₩10.65 billion, while S&S Lab Co., Ltd. adds ₩1.56 billion to the total revenue stream.

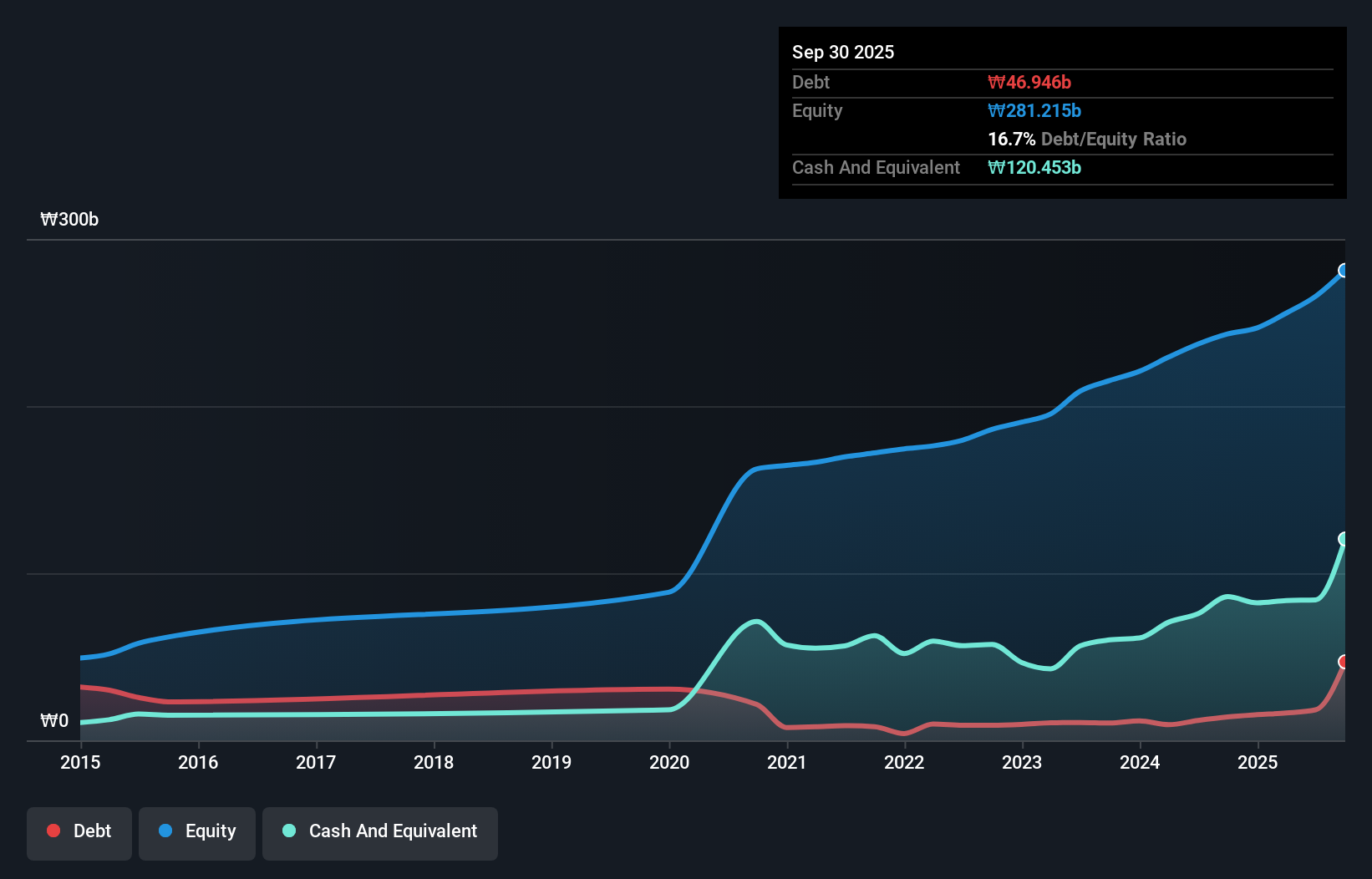

S&S Tech, a nimble player in the tech sector, has shown robust financial health with high-quality earnings and a debt-to-equity ratio dropping from 34.7% to 5.8% over five years. The company repurchased 81,084 shares for KRW 2,124 million recently, indicating confidence in its valuation. Despite sales figures being negligible at KRW 0.00029 million for Q3, net income surged to KRW 8,208 million from KRW 6,287 million last year. Earnings per share rose to KRW 391 from KRW 299 a year ago. With earnings growth forecasted at an impressive rate of over 45%, S&S Tech seems poised for continued advancement in its industry niche.

- Click to explore a detailed breakdown of our findings in S&S Tech's health report.

Examine S&S Tech's past performance report to understand how it has performed in the past.

Zhejiang Yankon Group (SHSE:600261)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Yankon Group Co., Ltd. focuses on the research, development, production, and sales of lighting appliances in China, with a market cap of approximately CN¥4.37 billion.

Operations: Yankon Group generates revenue primarily from its lighting and electrical industry segment, amounting to CN¥3.22 billion.

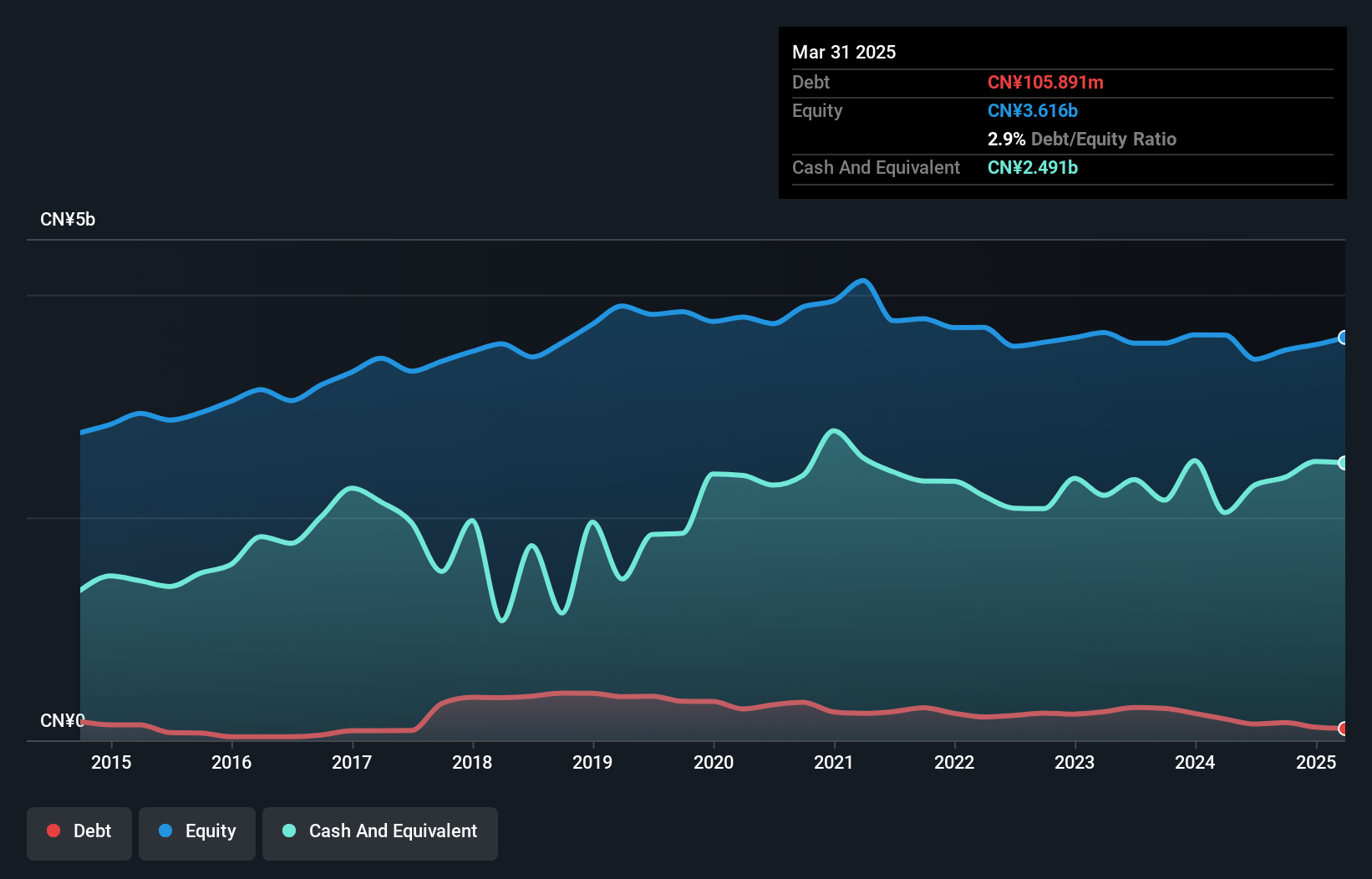

Zhejiang Yankon Group, a smaller player in the electrical industry, has shown notable resilience. Over the past year, earnings grew by 13%, outpacing the industry's 1% growth rate. However, over five years, earnings have decreased annually by 26%. The company reported a net income of CN¥151.83 million for nine months ending September 2024, up from CN¥143.53 million previously. A significant one-off gain of CN¥61.9 million impacted recent results but hasn't overshadowed its strong cash position and reduced debt-to-equity ratio from 9% to 5% over five years. Trading below fair value suggests potential upside opportunities for investors familiar with market nuances.

Guangxi Hechi Chemical (SZSE:000953)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangxi Hechi Chemical Co., Ltd engages in the research, development, production, and sale of chemical raw materials and preparations in China with a market capitalization of CN¥2.04 billion.

Operations: Guangxi Hechi Chemical generates revenue through the sale of chemical raw materials and preparations. The company's financial performance is influenced by its cost structure and market conditions. Its net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market dynamics.

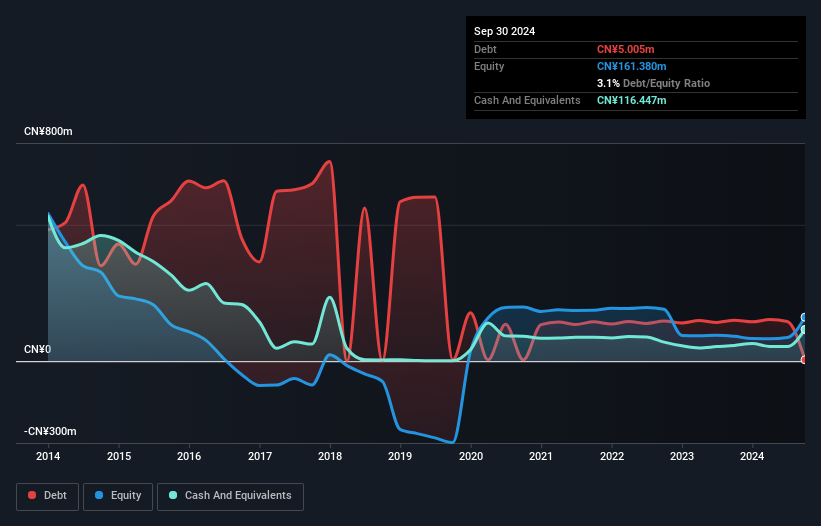

Guangxi Hechi Chemical, a smaller player in the chemical industry, has shown notable financial improvement. Five years ago, it had negative shareholder equity but now boasts positive equity with a satisfactory net debt to equity ratio of 11.5%. The company recently turned profitable with net income reaching CNY 79.29 million for the nine months ending September 2024 compared to a loss last year. Its price-to-earnings ratio of 30.4x is attractive compared to the broader market's 34.8x, hinting at potential value despite high non-cash earnings and ongoing free cash flow challenges. Additionally, it repurchased shares worth CNY 2.24 million recently, reflecting confidence in its own valuation strategy.

- Take a closer look at Guangxi Hechi Chemical's potential here in our health report.

Assess Guangxi Hechi Chemical's past performance with our detailed historical performance reports.

Key Takeaways

- Reveal the 4638 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000953

Guangxi Hechi Chemical

Researches, develops, produces, and sells chemical raw materials and their preparations in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives