- China

- /

- Semiconductors

- /

- SZSE:300393

Even With A 29% Surge, Cautious Investors Are Not Rewarding Jolywood (Suzhou) Sunwatt Co.,Ltd.'s (SZSE:300393) Performance Completely

Jolywood (Suzhou) Sunwatt Co.,Ltd. (SZSE:300393) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

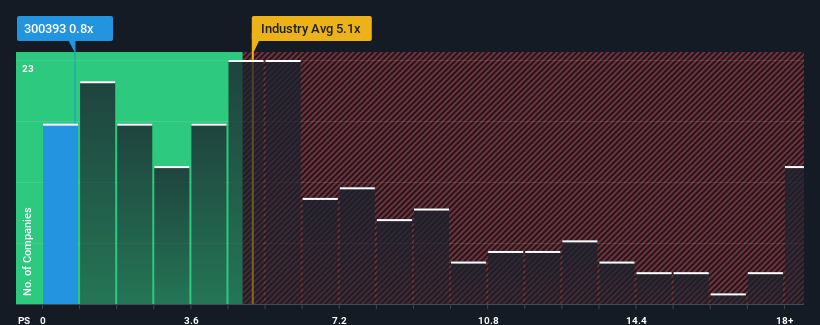

In spite of the firm bounce in price, Jolywood (Suzhou) SunwattLtd may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Semiconductor industry in China have P/S ratios greater than 5.1x and even P/S higher than 9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Jolywood (Suzhou) SunwattLtd

How Has Jolywood (Suzhou) SunwattLtd Performed Recently?

While the industry has experienced revenue growth lately, Jolywood (Suzhou) SunwattLtd's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jolywood (Suzhou) SunwattLtd.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Jolywood (Suzhou) SunwattLtd would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 77% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 69% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 36%, which is noticeably less attractive.

With this information, we find it odd that Jolywood (Suzhou) SunwattLtd is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Even after such a strong price move, Jolywood (Suzhou) SunwattLtd's P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Jolywood (Suzhou) SunwattLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 2 warning signs for Jolywood (Suzhou) SunwattLtd that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300393

Jolywood (Suzhou) SunwattLtd

Manufactures and sells integrated photovoltaic (PV) products worldwide.

Undervalued with high growth potential and pays a dividend.