As global markets navigate a choppy start to 2025, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly observing economic indicators that might influence Federal Reserve policies and broader market sentiment. In this environment of uncertainty, identifying promising stocks often involves looking for companies with resilient fundamentals and growth potential that can withstand or capitalize on current economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jiangsu Cai Qin Technology (SHSE:688182)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Cai Qin Technology Co., Ltd focuses on the research, development, production, and sale of microwave dielectric ceramic components in China and internationally, with a market cap of CN¥6.84 billion.

Operations: The company generates revenue primarily from the communication equipment manufacturing segment, amounting to CN¥376.27 million.

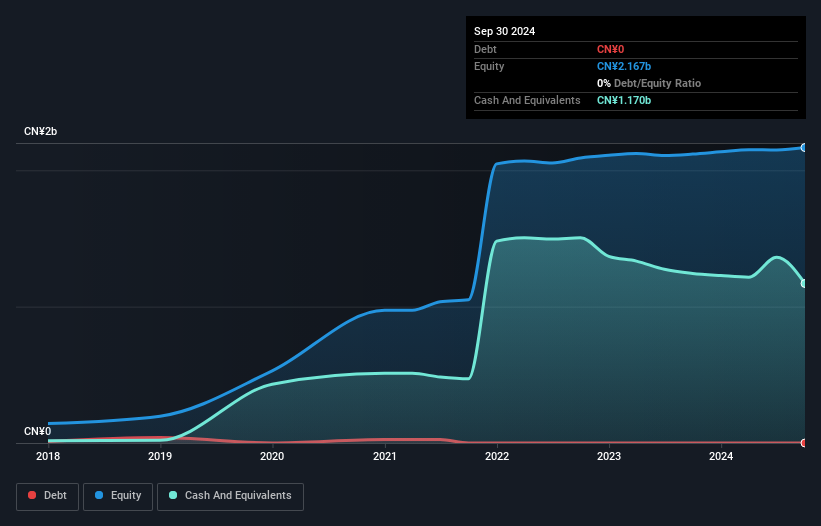

Jiangsu Cai Qin Technology showcases a compelling profile with its debt-free status, highlighting financial prudence. Over the past year, earnings surged by 45%, outpacing the electronic industry's 1.8% growth rate, which underscores its robust performance. Despite this recent upswing, earnings have seen a significant decline of 67.8% annually over five years. For the nine months ending September 2024, revenue reached CNY 269 million from CNY 263 million previously, while net income jumped to CNY 50 million from CNY 30 million last year. With high-quality earnings and no debt concerns, future prospects seem promising amidst industry challenges.

Tibet Cheezheng Tibetan Medicine (SZSE:002287)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tibet Cheezheng Tibetan Medicine Co., Ltd. operates in the pharmaceutical industry, focusing on traditional Tibetan medicine, with a market cap of CN¥10.88 billion.

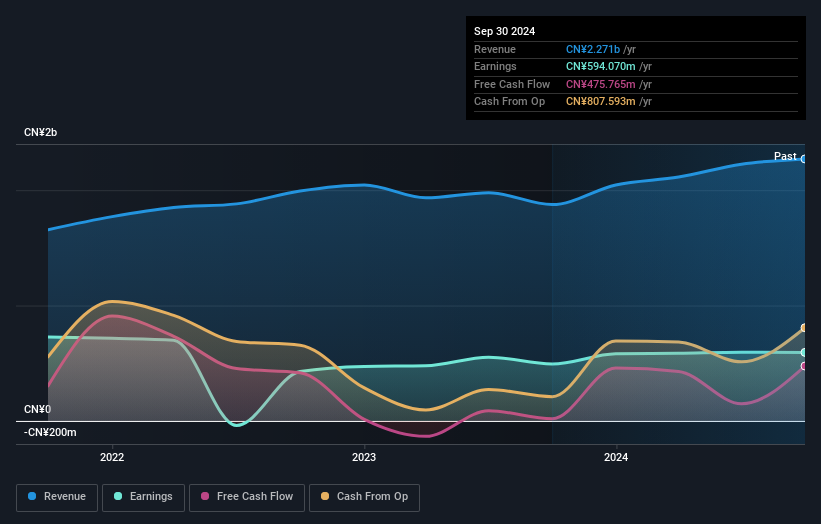

Operations: Tibet Cheezheng Tibetan Medicine generates revenue primarily from its pharmaceutical products, particularly traditional Tibetan medicine. The company focuses on optimizing its cost structure to enhance profitability. Its financial performance is reflected in a notable net profit margin trend, which provides insight into its operational efficiency and cost management practices.

Tibet Cheezheng Tibetan Medicine, a notable player in the pharmaceutical sector, has shown impressive earnings growth of 20.4% over the past year, outpacing the industry average of -2.5%. With a debt to equity ratio rising from 13.8% to 47.3% over five years, it still maintains more cash than its total debt, indicating financial resilience. The company is trading at 40.1% below its estimated fair value and reported net income of CN¥393 million for the nine months ending September 2024 compared to CN¥380 million previously. A recent dividend proposal highlights shareholder returns with a payout of CN¥2.20 per share for ten shares.

Yamabiko (TSE:6250)

Simply Wall St Value Rating: ★★★★★★

Overview: Yamabiko Corporation, along with its subsidiaries, is engaged in the manufacturing and sale of agricultural machinery across Japan, Europe, the United States, and other international markets with a market cap of ¥100.72 billion.

Operations: Yamabiko Corporation generates revenue primarily from the sale of Small Outdoor Working Machines, which account for ¥178.55 billion, and Agricultural Management Machines, contributing ¥37.22 billion. The General Industrial Machinery segment adds another ¥29.99 billion to its revenue streams.

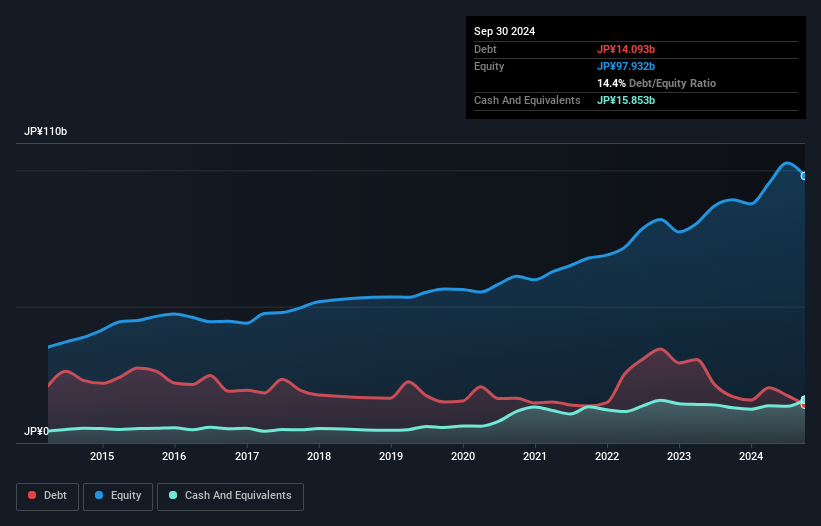

Yamabiko, a notable player in the machinery sector, has shown impressive earnings growth of 88.4% over the past year, far outpacing the industry's 1.7%. The company sports a favorable price-to-earnings ratio of 7.7x compared to Japan's market average of 13.3x, suggesting it may be undervalued. Over five years, its debt-to-equity ratio improved from 26.6% to 14.4%, indicating stronger financial health and reduced leverage concerns. With EBIT covering interest payments by a substantial margin (79.9x), Yamabiko's profitability appears robust and sustainable for future endeavors in this competitive industry landscape.

- Delve into the full analysis health report here for a deeper understanding of Yamabiko.

Review our historical performance report to gain insights into Yamabiko's's past performance.

Taking Advantage

- Investigate our full lineup of 4620 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Cheezheng Tibetan Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002287

Tibet Cheezheng Tibetan Medicine

Tibet Cheezheng Tibetan Medicine Co., Ltd.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives