- China

- /

- Construction

- /

- SZSE:002081

3 Promising Penny Stocks With Market Caps Over US$900M

Reviewed by Simply Wall St

Global markets have been experiencing volatility, with U.S. equities declining due to inflation concerns and political uncertainties, while small-cap stocks continue to underperform. In this context, identifying promising investment opportunities requires a keen eye for financial health and potential growth, even among lesser-known stocks. Penny stocks, though considered niche investments today, still hold potential for growth when backed by robust financials. This article explores several such penny stocks that stand out due to their strong balance sheets and long-term prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$40.41B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$526.87M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.715 | MYR443.74M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.976 | £744.58M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR292.11M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$140.36M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,710 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Jointown Pharmaceutical Group (SHSE:600998)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jointown Pharmaceutical Group Co., Ltd offers pharmaceutical supply chain services in China and has a market cap of CN¥23.92 billion.

Operations: The company has not reported any revenue segments.

Market Cap: CN¥23.92B

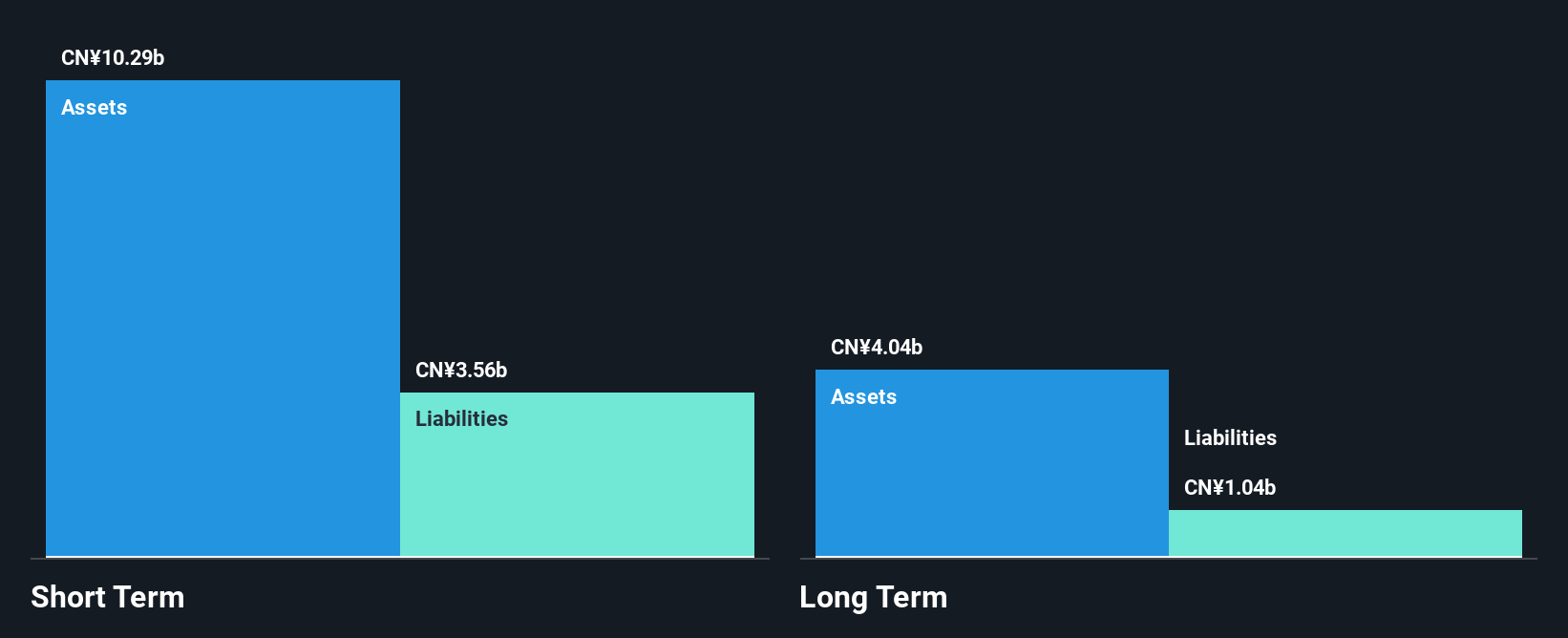

Jointown Pharmaceutical Group, with a market cap of CN¥23.92 billion, is trading at a favorable price-to-earnings ratio of 11.7x compared to the broader Chinese market's 34.1x, suggesting potential value for investors. The company has maintained stable short-term financial health, with assets exceeding liabilities and more cash than total debt. Recent strategic partnerships, such as the agreement with BGM Group for licorice-based products, highlight Jointown's focus on expanding its product offerings and market presence. Despite these positives, earnings have declined by 3.2% annually over five years and recent earnings growth was negative at -5.7%.

- Take a closer look at Jointown Pharmaceutical Group's potential here in our financial health report.

- Gain insights into Jointown Pharmaceutical Group's outlook and expected performance with our report on the company's earnings estimates.

Suning UniversalLtd (SZSE:000718)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suning Universal Co., Ltd is a real estate development company in China with a market cap of CN¥6.89 billion.

Operations: Suning Universal Co., Ltd does not report specific revenue segments.

Market Cap: CN¥6.89B

Suning Universal Co., Ltd, with a market cap of CN¥6.89 billion, has shown mixed financial performance recently. The company's revenue increased to CN¥1,738.02 million for the first nine months of 2024 compared to the previous year, yet net income declined slightly to CN¥354 million. Despite stable weekly volatility and satisfactory debt levels with a net debt to equity ratio of 11.2%, Suning's return on equity remains low at 1.5%. The dividend yield is not well covered by earnings or cash flows, and significant one-off losses have impacted recent results, affecting profit margins negatively from last year’s figures.

- Get an in-depth perspective on Suning UniversalLtd's performance by reading our balance sheet health report here.

- Understand Suning UniversalLtd's track record by examining our performance history report.

Suzhou Gold Mantis Construction Decoration (SZSE:002081)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suzhou Gold Mantis Construction Decoration Co., Ltd. operates in China, focusing on the design and construction of interior decoration, curtain walls, furniture, and landscape, with a market cap of CN¥8.87 billion.

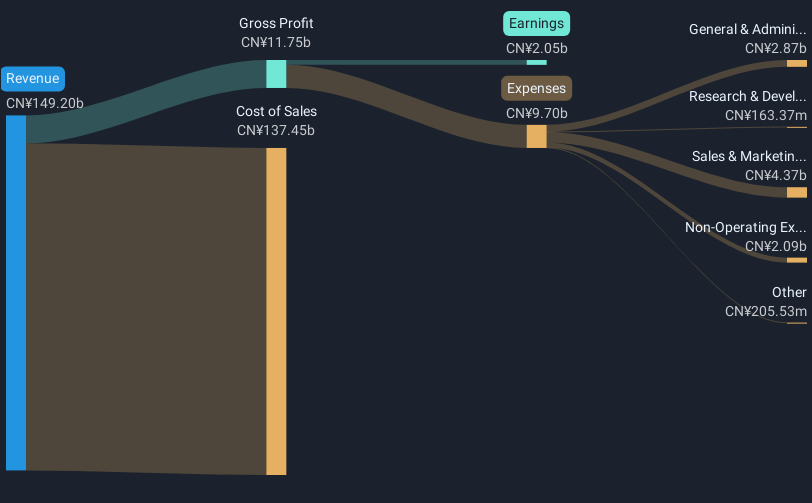

Operations: The company generates its revenue primarily from operations within China, amounting to CN¥18.33 billion.

Market Cap: CN¥8.87B

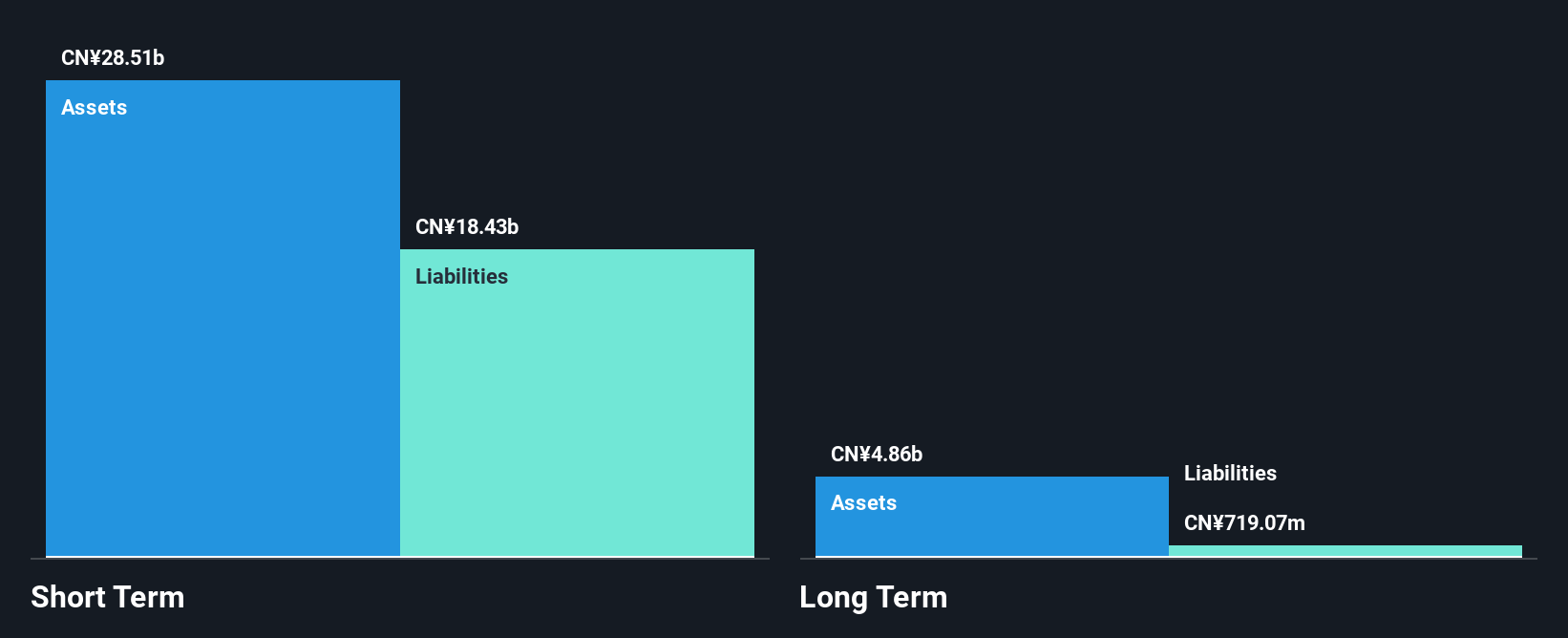

Suzhou Gold Mantis Construction Decoration Co., Ltd. faces challenges with declining earnings, forecasted to decrease by 1.3% annually over the next three years. Despite having more cash than debt and short-term assets exceeding liabilities, recent financial performance shows a drop in revenue to CN¥14.62 billion for the first nine months of 2024 from CN¥16.47 billion last year, with net income also decreasing significantly. The company's price-to-earnings ratio is below the market average, indicating potential value; however, low return on equity and profit margins suggest profitability issues persist amidst stable volatility and reduced debt levels over five years.

- Click to explore a detailed breakdown of our findings in Suzhou Gold Mantis Construction Decoration's financial health report.

- Assess Suzhou Gold Mantis Construction Decoration's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Take a closer look at our Penny Stocks list of 5,710 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002081

Suzhou Gold Mantis Construction Decoration

Engages in the design and construction of interior decoration, curtain walls, furniture, and landscape in China.

Excellent balance sheet average dividend payer.