- China

- /

- Semiconductors

- /

- SZSE:300303

Unveiling Undiscovered Gems on None in January 2025

Reviewed by Simply Wall St

As global markets navigate a period of heightened volatility, small-cap stocks have faced particular challenges, with the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainties. This environment underscores the importance of identifying resilient companies that demonstrate strong fundamentals and growth potential despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shanghai Emperor of Cleaning Hi-Tech (SHSE:603200)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Emperor of Cleaning Hi-Tech Co., Ltd offers water treatment and air duct cleaning services in China, with a market cap of CN¥4.12 billion.

Operations: Shanghai Emperor of Cleaning Hi-Tech generates revenue primarily through its water treatment and air duct cleaning services. The company's financial performance is highlighted by a market cap of CN¥4.12 billion.

Shanghai Emperor of Cleaning Hi-Tech has shown impressive earnings growth of 84.8% over the past year, outpacing the Commercial Services industry. Despite a slight dip in sales from CNY 380.74 million to CNY 374.6 million for the nine months ending September 2024, net income rose to CNY 48.4 million from CNY 37.19 million a year earlier, indicating improved profitability with basic earnings per share climbing to CNY 0.2768 from CNY 0.2138 previously. The company's debt-to-equity ratio increased from 11% to about 29% over five years, yet remains satisfactory at a net level of around 12%.

NORINCO International Cooperation (SZSE:000065)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NORINCO International Cooperation Ltd. is an engineering contractor operating across Asia, Africa, the Middle East, and internationally with a market cap of CN¥9.31 billion.

Operations: The company generates revenue primarily from engineering contracting services across various regions. It reported a total revenue of CN¥9.31 billion, with a net profit margin that reflects the efficiency of its operations in managing costs relative to income generated.

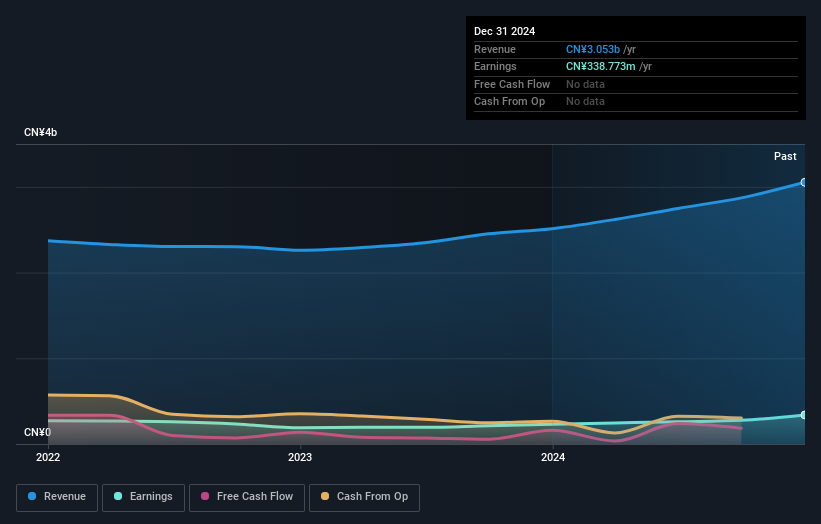

NORINCO International Cooperation, a promising player in the construction sector, has shown significant earnings growth of 19% over the past year, outpacing the industry average. The company's net income for the first nine months of 2024 reached CNY 757.51 million (approximately US$116.5 million), up from CNY 690.53 million in the previous year, with basic earnings per share rising to CNY 0.76 from CNY 0.69. Despite a slight dip in sales to CNY 14,121.64 million compared to last year's figures, NORINCO's price-to-earnings ratio remains attractive at 9.6x against a market average of 34x, suggesting good value for investors seeking opportunities outside mainstream options.

Shenzhen Jufei Optoelectronics (SZSE:300303)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Jufei Optoelectronics Co., Ltd. focuses on the research and development, manufacture, marketing, and sale of SMD LED devices across various international markets with a market cap of CN¥8.94 billion.

Operations: Jufei Optoelectronics generates revenue primarily through the sale of SMD LED devices across multiple international markets. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

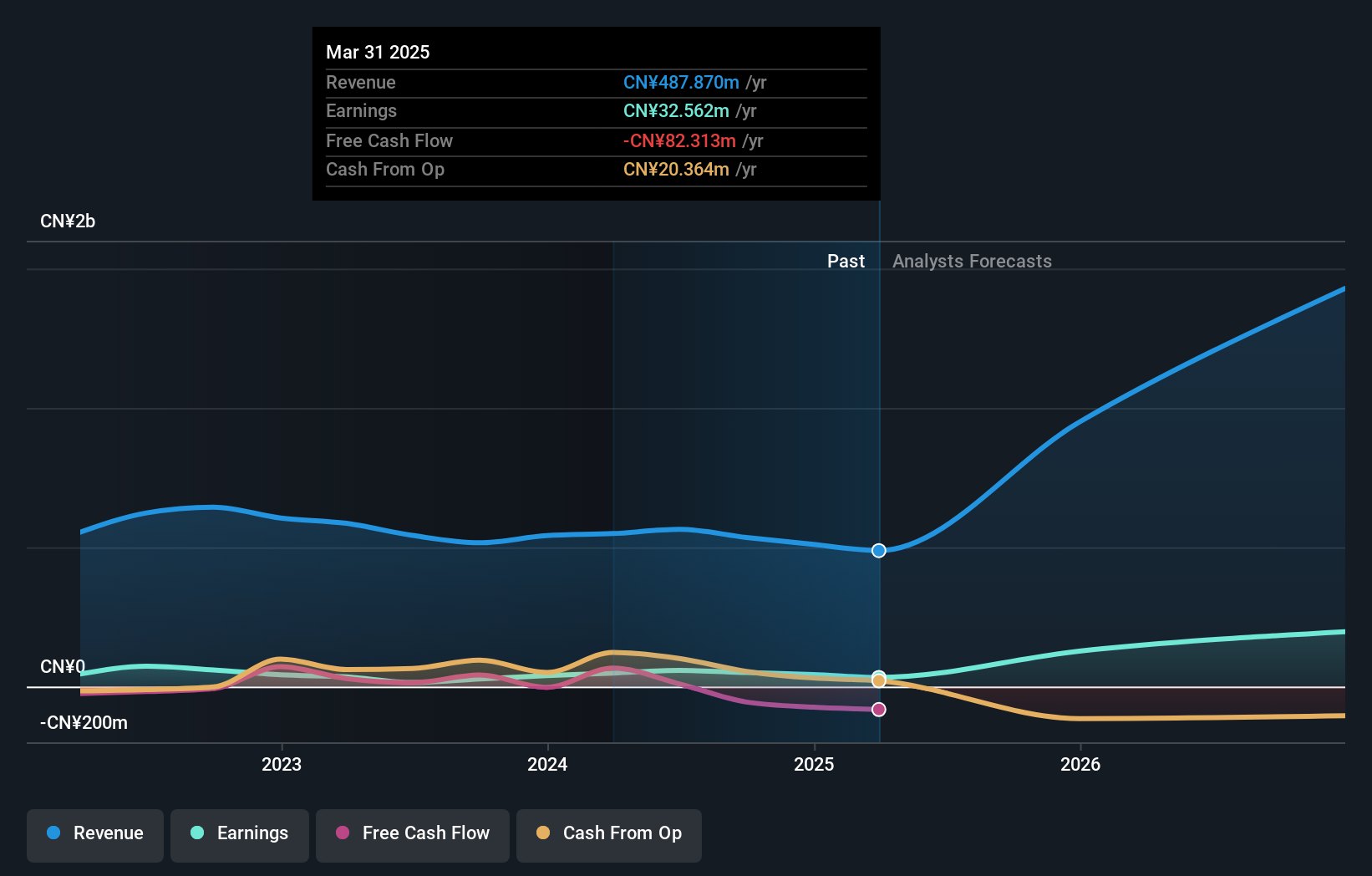

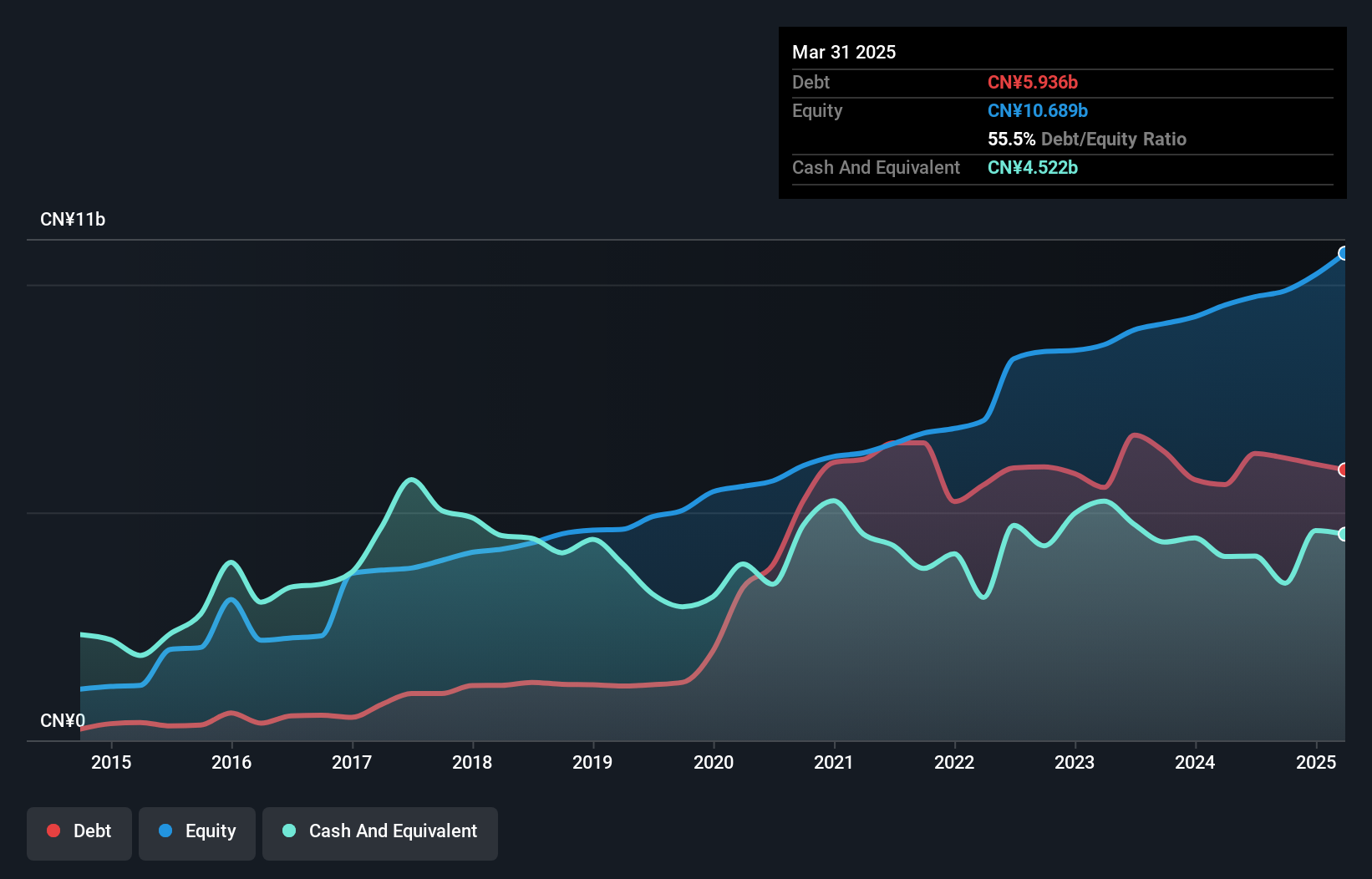

Shenzhen Jufei Optoelectronics, a small player in the semiconductor field, has shown impressive earnings growth of 29.6% over the past year, outpacing the industry's 12.9%. The company reported net income of CN¥228 million for the nine months ending September 2024, an increase from CN¥182 million in the previous year. Despite a debt-to-equity ratio rise from 6.3% to 14.6% over five years, it holds more cash than total debt, suggesting financial stability. With a price-to-earnings ratio of 32.9x below market average and positive free cash flow, Jufei seems well-positioned amidst industry volatility.

- Get an in-depth perspective on Shenzhen Jufei Optoelectronics' performance by reading our health report here.

Learn about Shenzhen Jufei Optoelectronics' historical performance.

Make It Happen

- Reveal the 4620 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300303

Shenzhen Jufei Optoelectronics

Engages in the research and development, manufacture, marketing, and sale of SMD LED devices in China, the United States, Europe, India, Japan, Korea, Taiwan, Turkey, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives