- China

- /

- Consumer Services

- /

- SZSE:300592

High Insider Ownership Fuels Growth Stocks In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape of fluctuating interest rates and mixed economic signals, the Nasdaq Composite has emerged as a standout performer, reaching record highs amid broader market declines. With growth stocks continuing to outperform value stocks for the third consecutive week, investors are increasingly focusing on companies where high insider ownership aligns with robust growth potential. In such an environment, insider ownership can be a key indicator of confidence in a company's long-term prospects, making these stocks particularly compelling for those looking to capitalize on sustained growth trends.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Oscotec (KOSDAQ:A039200)

Simply Wall St Growth Rating: ★★★★★★

Overview: Oscotec Inc. is a biotechnology company involved in drug development, functional materials, and dental bone graft materials, with a market cap of approximately ₩936.04 billion.

Operations: The company's revenue is primarily derived from its New Drug Business Division, which generated ₩28.19 billion, followed by the Medical Business Sector with ₩2.41 billion, the Food Business at ₩1.13 billion, and Functional Materials contributing ₩245.91 million.

Insider Ownership: 26.1%

Revenue Growth Forecast: 52.6% p.a.

Oscotec's recent earnings report showed a significant turnaround with net income of KRW 16,903.49 million for Q3 2024 compared to a loss last year, reflecting its strong growth trajectory. Analysts forecast high revenue growth at 52.6% annually, surpassing the market average. The company is expected to become profitable within three years with a robust return on equity projected at 23.4%. Despite substantial insider ownership, no recent insider trading activity was reported.

- Get an in-depth perspective on Oscotec's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Oscotec shares in the market.

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

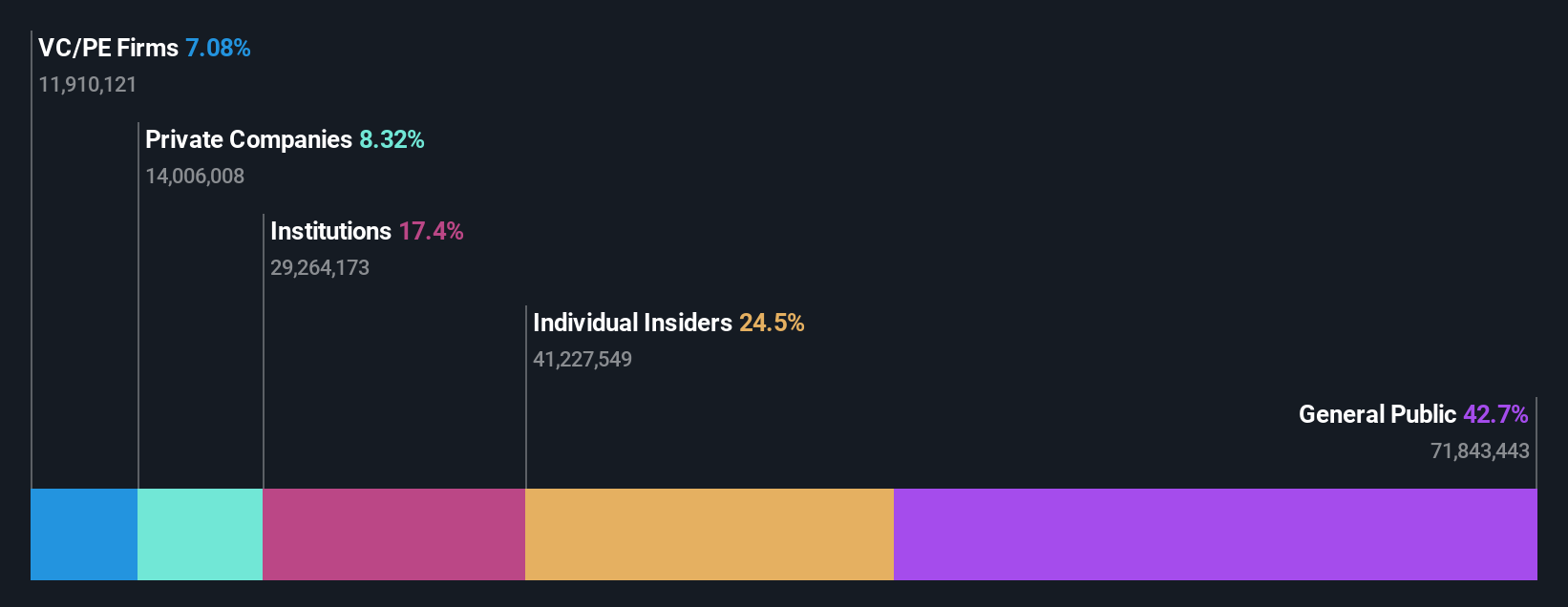

Overview: Bestechnic (Shanghai) Co., Ltd. focuses on the research, design, development, manufacture, and sale of smart audio and video SoC chips in China with a market cap of CN¥36.31 billion.

Operations: The company generates revenue primarily from its Integrated Circuit segment, amounting to CN¥3.09 billion.

Insider Ownership: 25.7%

Revenue Growth Forecast: 24.3% p.a.

Bestechnic (Shanghai) reported strong earnings growth, with net income reaching CNY 289.1 million for the first nine months of 2024, up from CNY 117.77 million a year ago. Revenue is forecast to grow significantly at 24.3% annually, outpacing the Chinese market average of 13.7%. Despite high revenue and earnings growth expectations, the company's return on equity is projected to be low in three years at 9.4%. No recent insider trading was noted.

- Dive into the specifics of Bestechnic (Shanghai) here with our thorough growth forecast report.

- Our valuation report unveils the possibility Bestechnic (Shanghai)'s shares may be trading at a premium.

Huakai Yibai TechnologyLtd (SZSE:300592)

Simply Wall St Growth Rating: ★★★★★☆

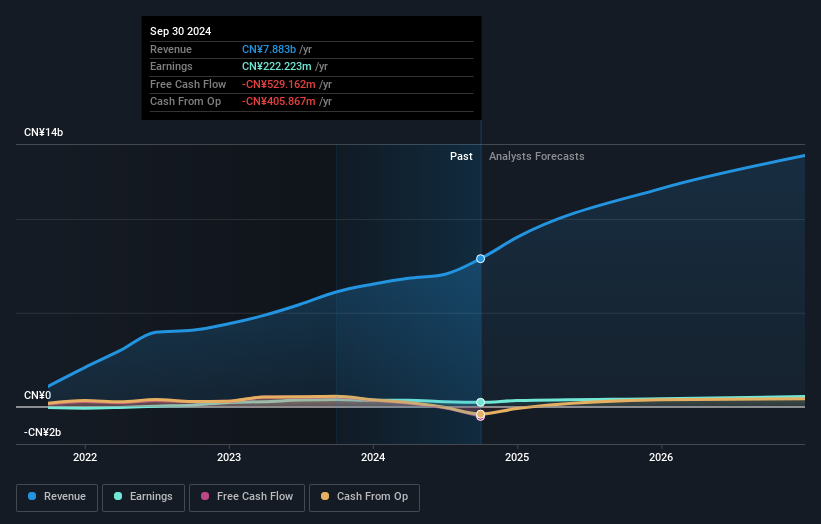

Overview: Huakai Yibai Technology Co., Ltd. offers environmental art design services for indoor spaces in the People’s Republic of China and has a market capitalization of approximately CN¥6.47 billion.

Operations: Huakai Yibai Technology Co., Ltd. generates its revenue through providing environmental art design services for indoor spaces within China.

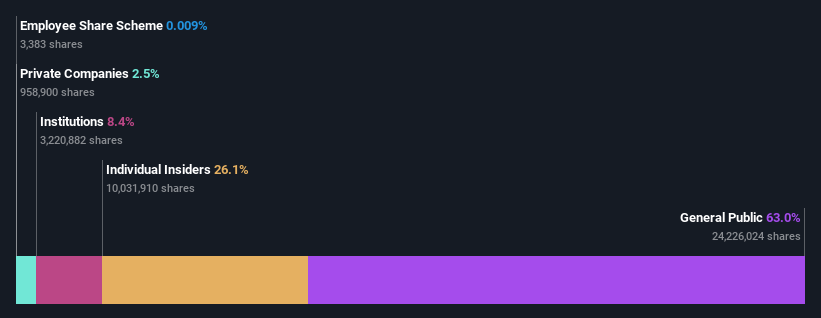

Insider Ownership: 29.2%

Revenue Growth Forecast: 22.9% p.a.

Huakai Yibai Technology's insider ownership has recently shifted, with Zhuang Junchao and Hu Fanjin acquiring stakes of 5.91% and 5.75%, respectively, from Luo Ye for over CNY 240 million each. The company's revenue is forecast to grow significantly at 22.9% annually, surpassing the Chinese market average of 13.7%. However, profit margins have declined from last year, and earnings per share have also decreased despite expected strong future growth in earnings and revenue.

- Click to explore a detailed breakdown of our findings in Huakai Yibai TechnologyLtd's earnings growth report.

- In light of our recent valuation report, it seems possible that Huakai Yibai TechnologyLtd is trading beyond its estimated value.

Where To Now?

- Explore the 1501 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Huakai Yibai TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huakai Yibai TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300592

Huakai Yibai TechnologyLtd

Provides environmental art design services for indoor spaces in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives