- China

- /

- Semiconductors

- /

- SHSE:688262

C*Core Technology Co., Ltd. (SHSE:688262) Looks Just Right With A 29% Price Jump

Despite an already strong run, C*Core Technology Co., Ltd. (SHSE:688262) shares have been powering on, with a gain of 29% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

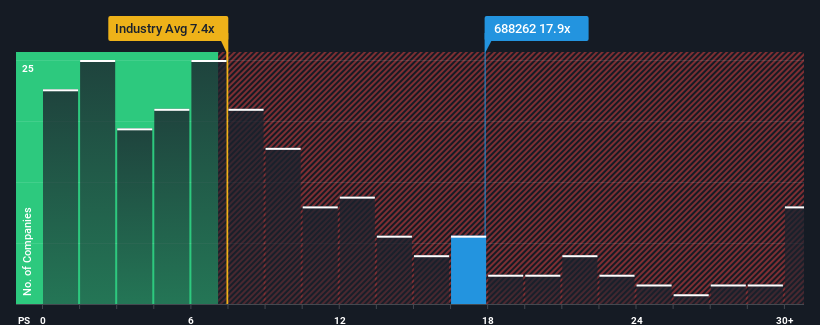

Since its price has surged higher, C*Core Technology's price-to-sales (or "P/S") ratio of 17.9x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 7.4x and even P/S below 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for C*Core Technology

What Does C*Core Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, C*Core Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on C*Core Technology will help you uncover what's on the horizon.How Is C*Core Technology's Revenue Growth Trending?

In order to justify its P/S ratio, C*Core Technology would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 75% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 42%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why C*Core Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On C*Core Technology's P/S

C*Core Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that C*Core Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 1 warning sign for C*Core Technology you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688262

C*Core Technology

A chip design company, offers IP authorization, chip customization, and independent chip and module products in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives