3 Growth Companies With High Insider Ownership And Up To 105% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate through a period of heightened inflation fears and political uncertainty, U.S. equities have experienced notable declines, with small-cap stocks underperforming their large-cap counterparts. Amid this volatility, growth companies with high insider ownership can offer unique investment opportunities as they often reflect strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Servyou Software Group Co., Ltd. offers financial and tax information services in China, with a market cap of CN¥11.66 billion.

Operations: Revenue Segments (in millions of CN¥): Financial and tax information services: 2,345.67

Insider Ownership: 22.8%

Earnings Growth Forecast: 50.9% p.a.

Servyou Software Group's earnings are forecast to grow significantly at 50.94% annually, outpacing the CN market's 25%. Despite trading 20% below fair value, its low return on equity forecast (14.3%) and decreased profit margins (5% from 8.6%) may concern investors. Recent earnings showed a revenue increase to CNY 1.28 billion and net income rise to CNY 115.93 million, reflecting solid growth but highlighting margin pressures amidst high growth expectations.

- Click to explore a detailed breakdown of our findings in Servyou Software Group's earnings growth report.

- Upon reviewing our latest valuation report, Servyou Software Group's share price might be too optimistic.

C*Core Technology (SHSE:688262)

Simply Wall St Growth Rating: ★★★★★☆

Overview: C*Core Technology Co., Ltd. is a chip design company in China that provides IP authorization, chip customization, and independent chip and module products, with a market cap of CN¥9.11 billion.

Operations: C*Core Technology Co., Ltd. generates revenue through three primary segments: IP authorization, chip customization, and independent chip and module products in China.

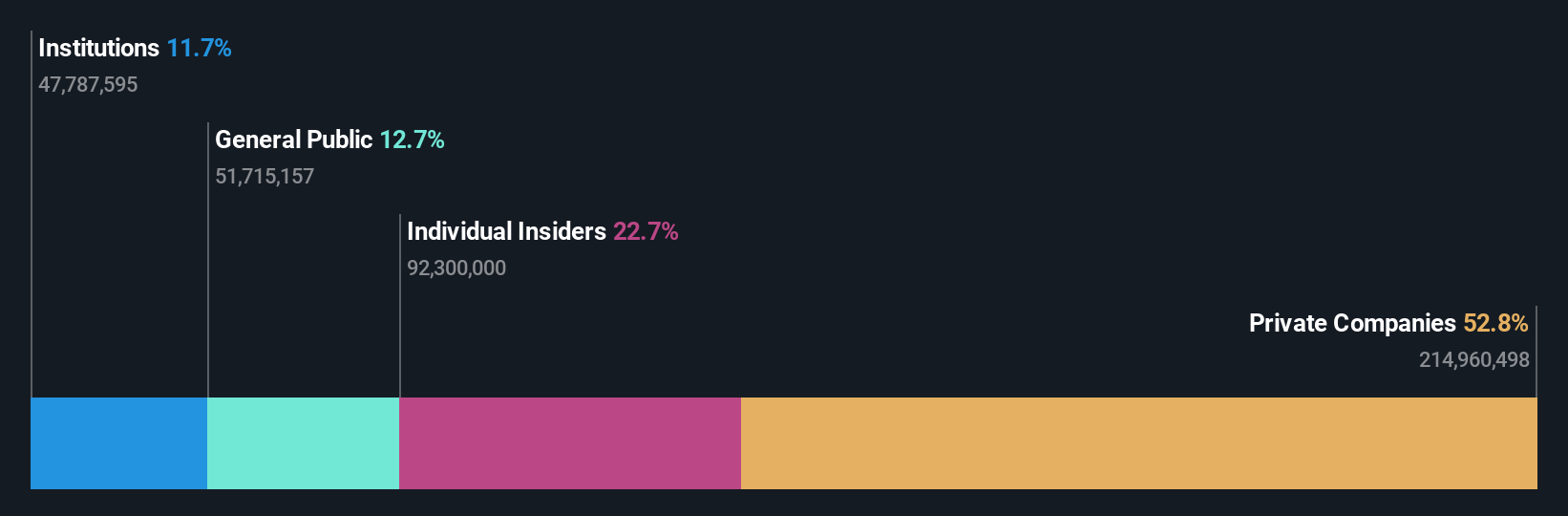

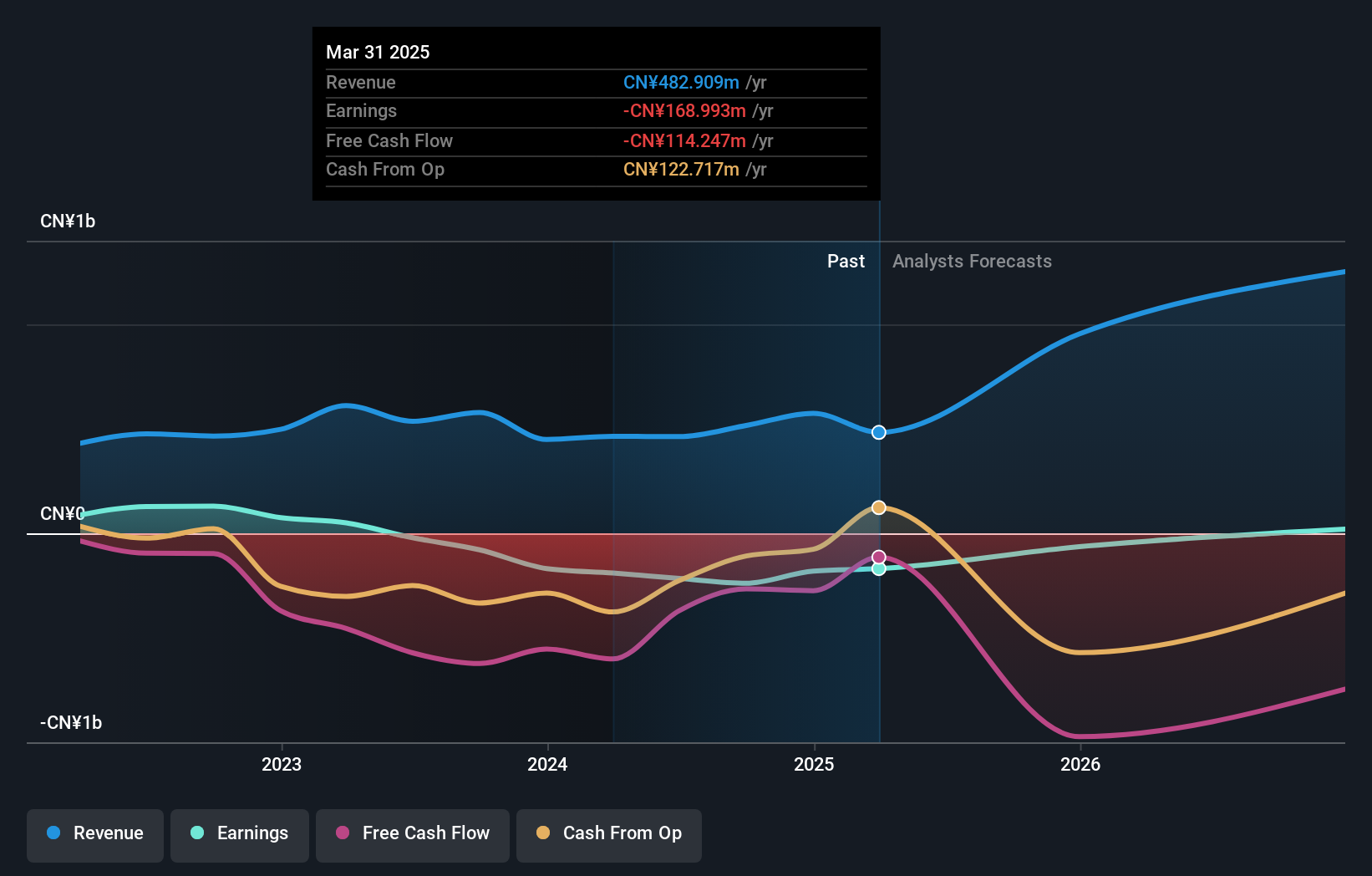

Insider Ownership: 15%

Earnings Growth Forecast: 105.7% p.a.

C*Core Technology is forecast to achieve significant growth, with revenue expected to increase by 40.1% annually, surpassing the CN market's average. Despite this, the company remains unprofitable with a net loss of CNY 127.31 million for the first nine months of 2024 and a low return on equity forecast at 1.9%. The recent buyback completion involved repurchasing shares worth CNY 33.6 million, indicating some shareholder value focus amidst its volatile share price history.

- Navigate through the intricacies of C*Core Technology with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of C*Core Technology shares in the market.

Guangdong Dowstone Technology (SZSE:300409)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Dowstone Technology Co., Ltd. specializes in producing and selling lithium battery, carbon, and ceramic materials both in China and internationally, with a market cap of CN¥8.30 billion.

Operations: The company generates revenue from the production and sale of lithium battery, carbon, and ceramic materials.

Insider Ownership: 26.2%

Earnings Growth Forecast: 60.5% p.a.

Guangdong Dowstone Technology has shown strong revenue growth, reporting CNY 6.11 billion for the first nine months of 2024, up from CNY 5.35 billion a year ago, and achieving profitability with a net income of CNY 147.09 million. The company's earnings are forecast to grow significantly at 60.48% annually over the next three years, outpacing the broader CN market's growth expectations. However, its financial position is challenged by debt not well covered by operating cash flow and volatile share price movements.

- Get an in-depth perspective on Guangdong Dowstone Technology's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Guangdong Dowstone Technology's current price could be inflated.

Next Steps

- Discover the full array of 1466 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603171

Servyou Software Group

Provides financial and tax information services in China.

High growth potential with excellent balance sheet.