- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

High Insider Stakes In November 2024's Top Growth Stocks

Reviewed by Simply Wall St

As global markets react to the recent U.S. elections, major indices have reached record highs amid expectations of accelerated earnings growth and reduced corporate taxes under a Republican-led government. This environment of optimism and regulatory easing provides fertile ground for growth companies, particularly those with high insider ownership, which can signal confidence in their long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

Let's explore several standout options from the results in the screener.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥179.82 billion.

Operations: Cambricon Technologies generates revenue through its core chip offerings for cloud servers, edge computing, and terminal equipment within China.

Insider Ownership: 28.7%

Earnings Growth Forecast: 65.5% p.a.

Cambricon Technologies is experiencing significant revenue growth, with a forecasted increase of 46.2% annually, outpacing the broader Chinese market. Despite reporting a net loss of CNY 724.49 million for the first nine months of 2024, this marks an improvement from last year's loss. The company is expected to become profitable within three years, reflecting above-average market growth potential. However, its share price remains highly volatile and insider trading activity has been minimal recently.

- Navigate through the intricacies of Cambricon Technologies with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Cambricon Technologies shares in the market.

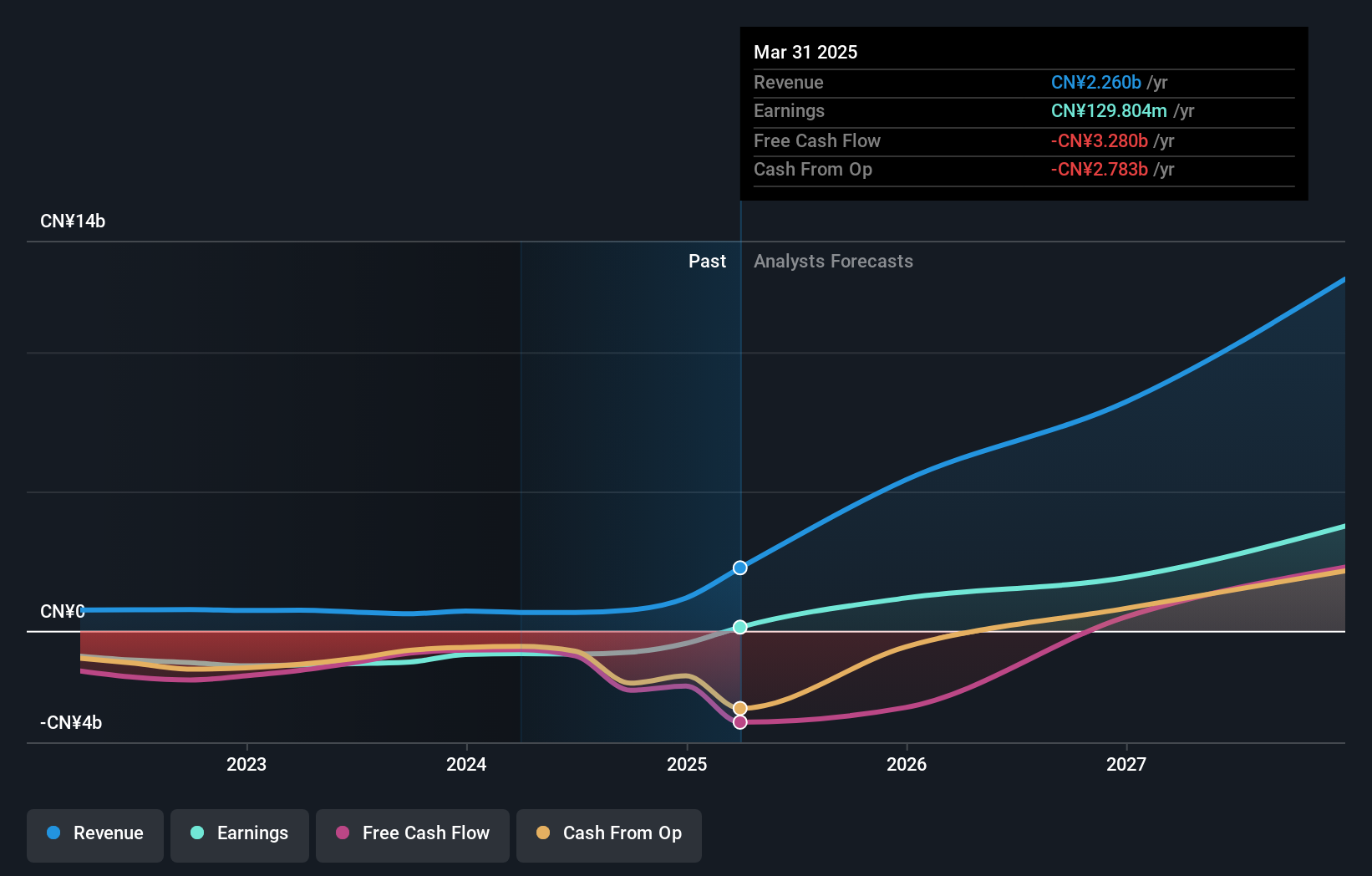

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. operates as a technology services provider, focusing on IT consulting, solutions, and outsourcing services with a market cap of CN¥64.32 billion.

Operations: The company's revenue segments are not specified in the provided text.

Insider Ownership: 23.8%

Earnings Growth Forecast: 55.8% p.a.

iSoftStone Information Technology (Group) is experiencing substantial revenue growth, reporting CNY 22.21 billion for the first nine months of 2024, up from CNY 12.83 billion a year ago. However, net income has decreased significantly to CNY 75.94 million from CNY 352.31 million last year, indicating pressure on profit margins now at just 1%. Despite high volatility in its share price recently and low forecasted return on equity of 7.9%, earnings are expected to grow significantly above market rates at an annual rate of over 55%.

- Get an in-depth perspective on iSoftStone Information Technology (Group)'s performance by reading our analyst estimates report here.

- The analysis detailed in our iSoftStone Information Technology (Group) valuation report hints at an deflated share price compared to its estimated value.

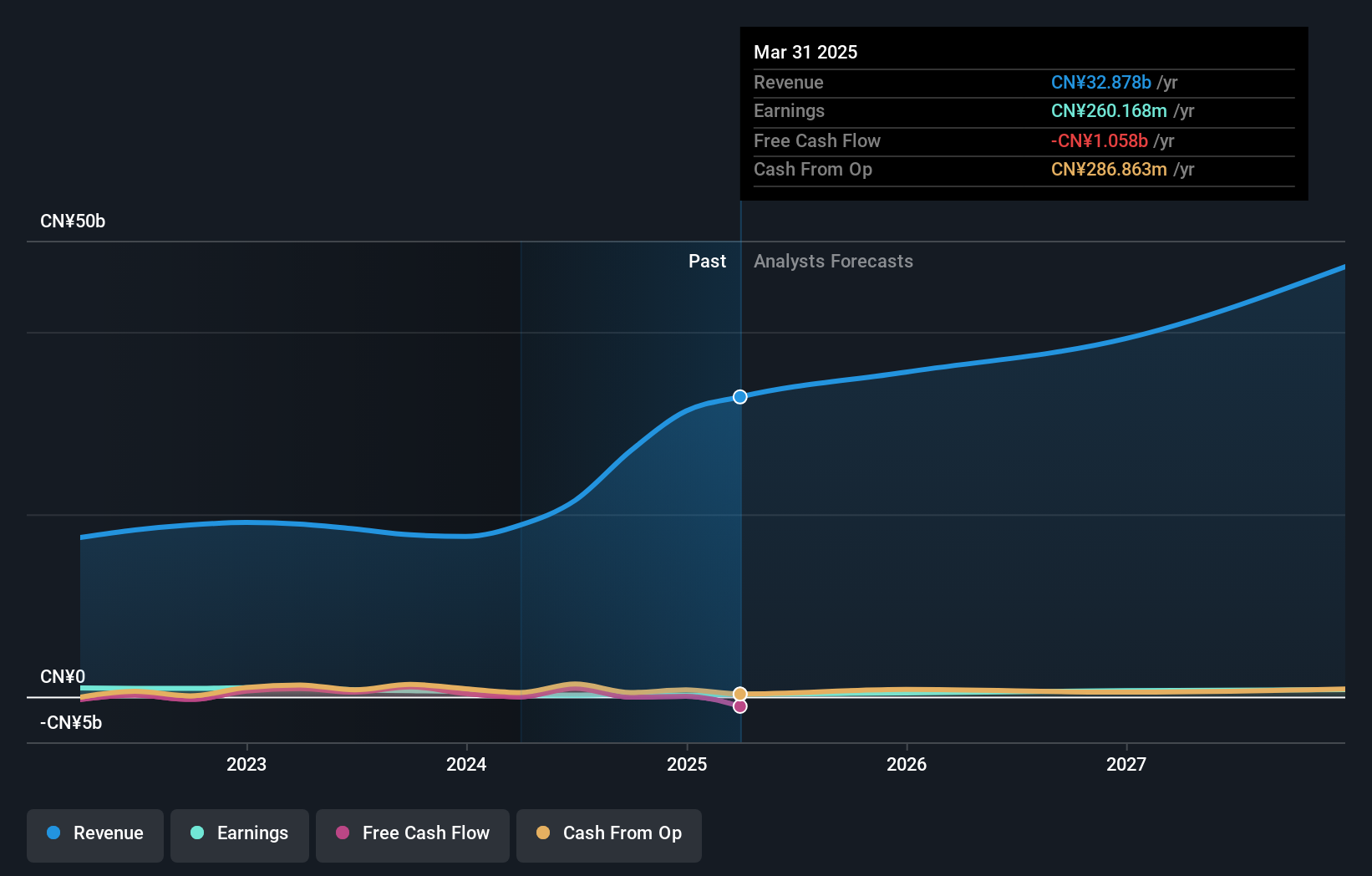

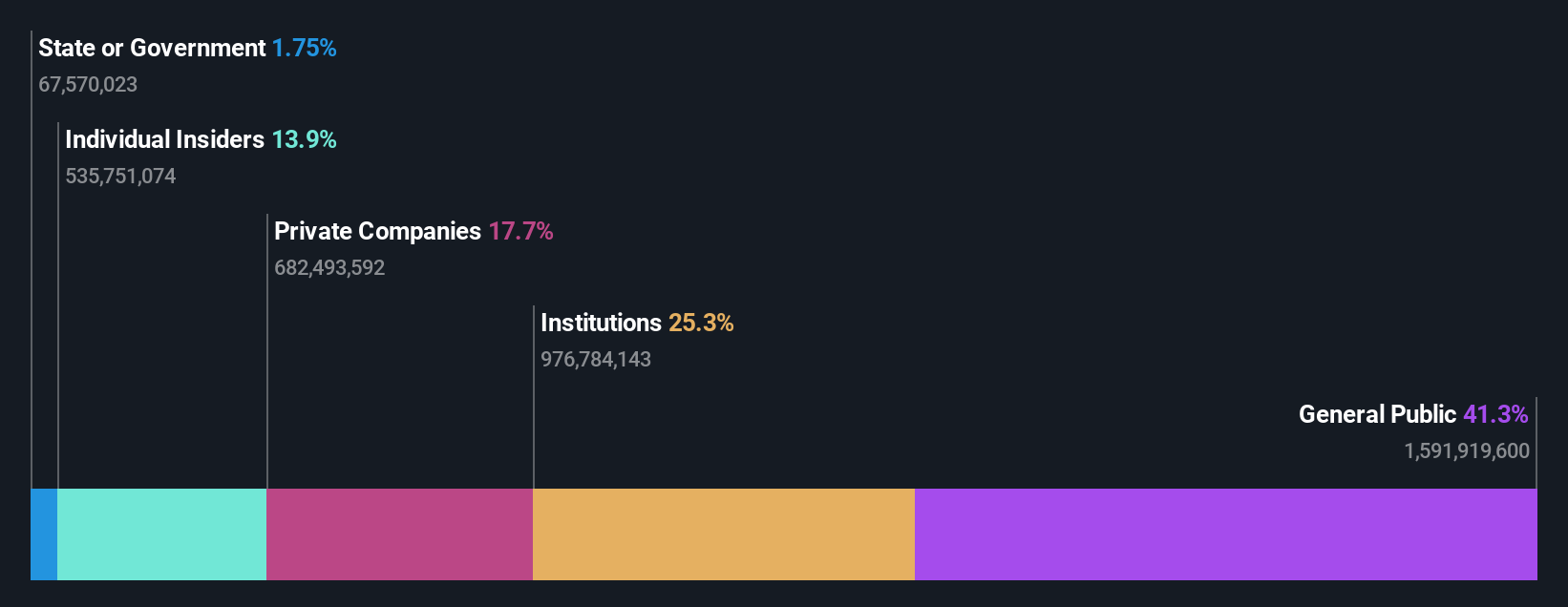

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations spanning Asia, the Americas, Europe, and other international markets, and has a market cap of approximately NT$1.26 trillion.

Operations: The company's revenue primarily comes from The Electronics Sector, which generated NT$2.50 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 19.6% p.a.

Quanta Computer's revenue is forecast to grow rapidly at 36.1% annually, outpacing the TW market's growth of 12.7%, though earnings are expected to increase at a slightly slower rate of 19.6%. The company maintains a reliable dividend yield of 2.74%. Recent activities include closing a $1 billion private placement for unsecured overseas convertible bonds maturing in September 2029, indicating strategic financial maneuvers to support growth initiatives.

- Delve into the full analysis future growth report here for a deeper understanding of Quanta Computer.

- Our expertly prepared valuation report Quanta Computer implies its share price may be too high.

Taking Advantage

- Explore the 1530 names from our Fast Growing Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures and sells notebook computers in Asia, the Americas, Europe, and internationally.

Very undervalued with high growth potential and pays a dividend.