- Taiwan

- /

- Semiconductors

- /

- TWSE:3592

3 Dividend Stocks Including Impro Precision Industries To Consider

Reviewed by Simply Wall St

In a week marked by global economic shifts, including rate cuts from the ECB and SNB, and anticipation of a potential Fed rate cut, markets have shown mixed performance with technology stocks like those in the Nasdaq Composite reaching new heights. As investors navigate these dynamic conditions, dividend stocks remain an attractive option for those seeking steady income amidst market volatility. In this context, identifying strong dividend-paying companies can be crucial for maintaining portfolio stability and generating consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.59% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Impro Precision Industries (SEHK:1286)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Impro Precision Industries Limited supplies casting products and precision machining parts across the Americas, Europe, and Asia with a market cap of HK$3.68 billion.

Operations: Impro Precision Industries Limited generates revenue from Sand Casting (HK$901.74 million), Surface Treatment (HK$87.25 million), Investment Casting (HK$1.88 billion), and Precision Machining and Others (HK$1.76 billion).

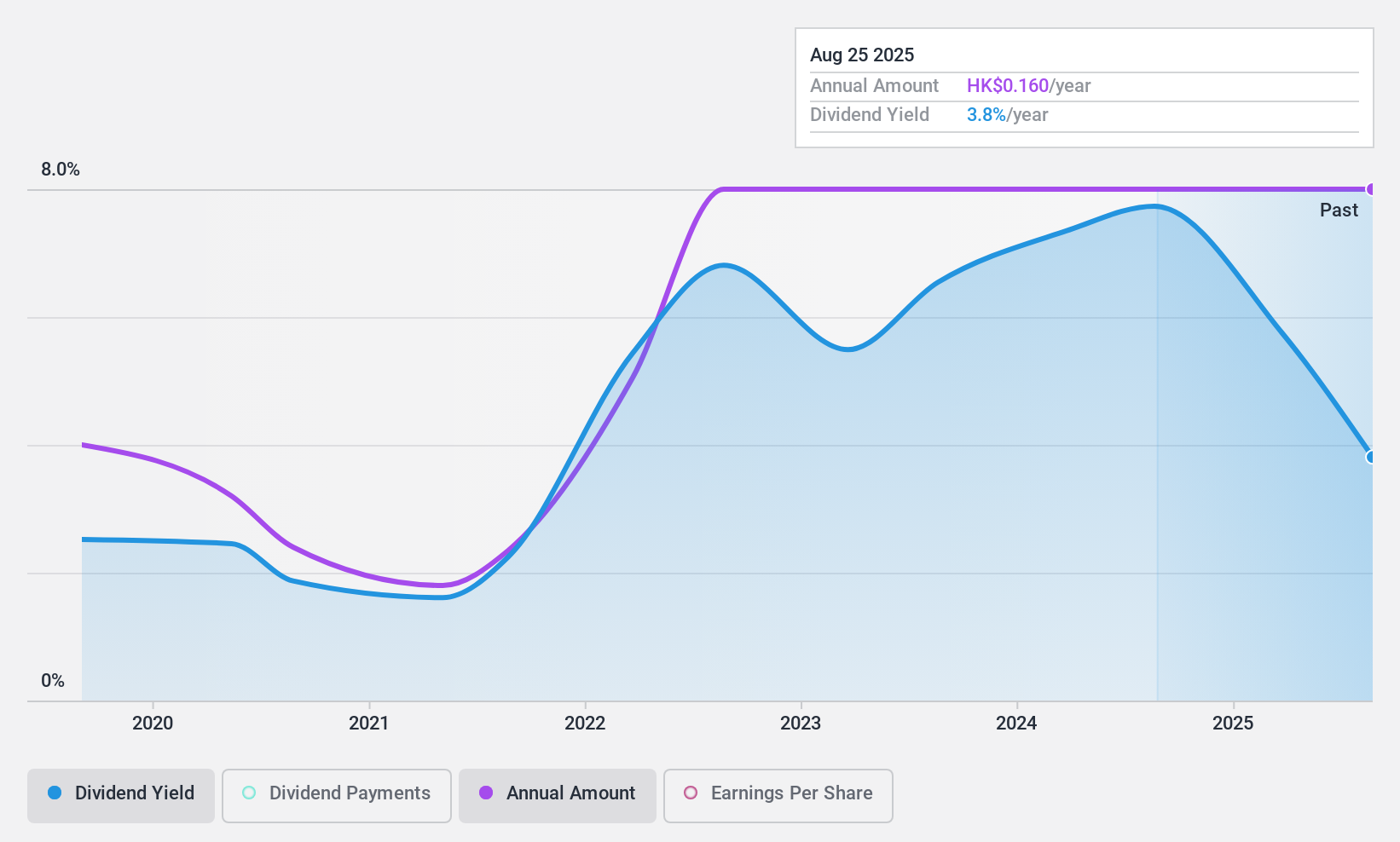

Dividend Yield: 7.8%

Impro Precision Industries' dividends are covered by earnings and cash flows, with a payout ratio of 51.5% and a cash payout ratio of 67.3%, respectively. Despite this coverage, its dividend yield of 7.8% is below the top tier in the Hong Kong market. The company has only paid dividends for five years, with payments being volatile and unreliable over this period. However, it trades at a significant discount to its estimated fair value.

- Click here to discover the nuances of Impro Precision Industries with our detailed analytical dividend report.

- The analysis detailed in our Impro Precision Industries valuation report hints at an deflated share price compared to its estimated value.

Tokyo Rope Mfg (TSE:5981)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyo Rope Mfg. Co., Ltd. is a company that produces and distributes wire ropes, steel cords, and carbon fiber composite cables both in Japan and internationally, with a market cap of ¥19.63 billion.

Operations: Tokyo Rope Mfg. Co., Ltd.'s revenue is derived from its manufacturing and sales activities in wire ropes, steel cords, and carbon fiber composite cables (CFCCs) across domestic and international markets.

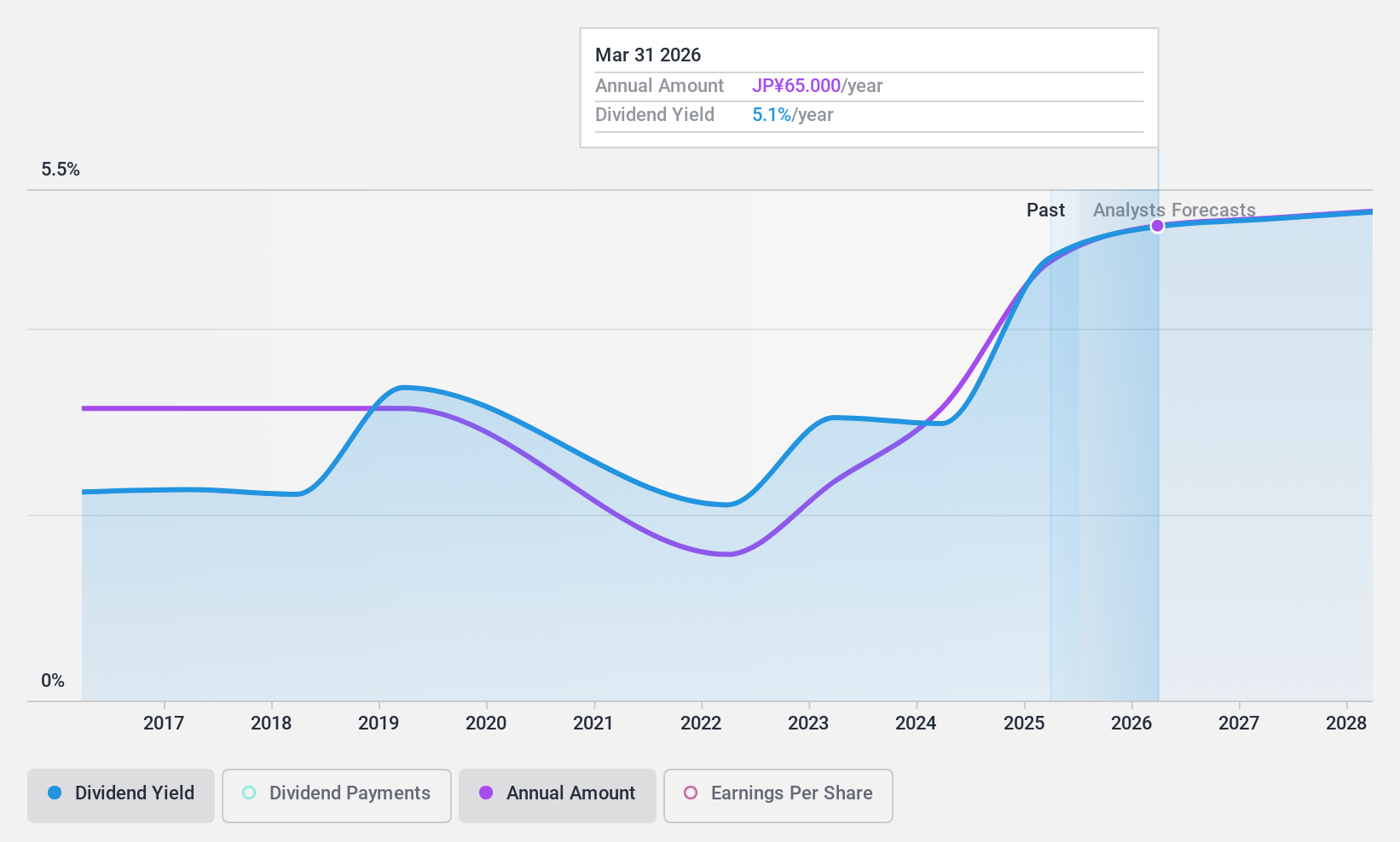

Dividend Yield: 4.7%

Tokyo Rope Mfg. has a dividend yield of 4.83%, placing it in the top 25% of Japanese dividend payers, yet its cash payout ratio is high at 98.1%, indicating dividends are not well covered by free cash flows. Despite recent volatility, dividends have increased over the past decade and are expected to rise to ¥60 per share for the fiscal year ending March 2025. A share repurchase program aims to enhance shareholder value amid fluctuating profit margins.

- Take a closer look at Tokyo Rope Mfg's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Tokyo Rope Mfg is priced lower than what may be justified by its financials.

Raydium Semiconductor (TWSE:3592)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Raydium Semiconductor Corporation designs, develops, and sells integrated circuits in Taiwan, China, Hong Kong, and internationally with a market cap of NT$28.14 billion.

Operations: Raydium Semiconductor Corporation generates NT$23.60 billion from its development, design, and sale of integrated circuits.

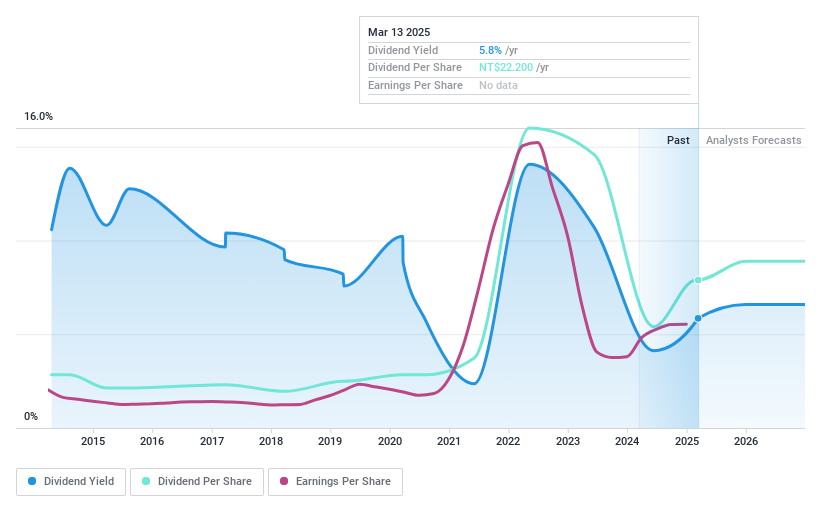

Dividend Yield: 4%

Raydium Semiconductor has demonstrated strong earnings growth, with Q3 2024 net income rising to TWD 537.18 million from TWD 441.53 million a year ago, supporting its dividend payments. Despite a history of volatility, dividends have increased over the past decade and are well covered by both earnings and cash flows, with payout ratios at 55.1% and 47.9%, respectively. However, the dividend yield of 3.98% is below Taiwan's top tier payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Raydium Semiconductor.

- Our valuation report unveils the possibility Raydium Semiconductor's shares may be trading at a discount.

Turning Ideas Into Actions

- Dive into all 1973 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3592

Raydium Semiconductor

Engages in the design, development, and sale of display drivers, sequential control, and power management integrated circuit (IC) products in China, Hong Kong, Taiwan, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives