- Taiwan

- /

- Tech Hardware

- /

- TWSE:3005

Exploring 3 High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts from the ECB and SNB, the Nasdaq Composite has reached a new milestone, surpassing 20,000 for the first time amidst mixed performances across other major indices. In this environment of fluctuating economic indicators and shifting investor sentiment, identifying high growth tech stocks with potential often involves looking for companies that demonstrate strong innovation capabilities and resilience in adapting to evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1316 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Samsung SDI (KOSE:A006400)

Simply Wall St Growth Rating: ★★★★☆☆

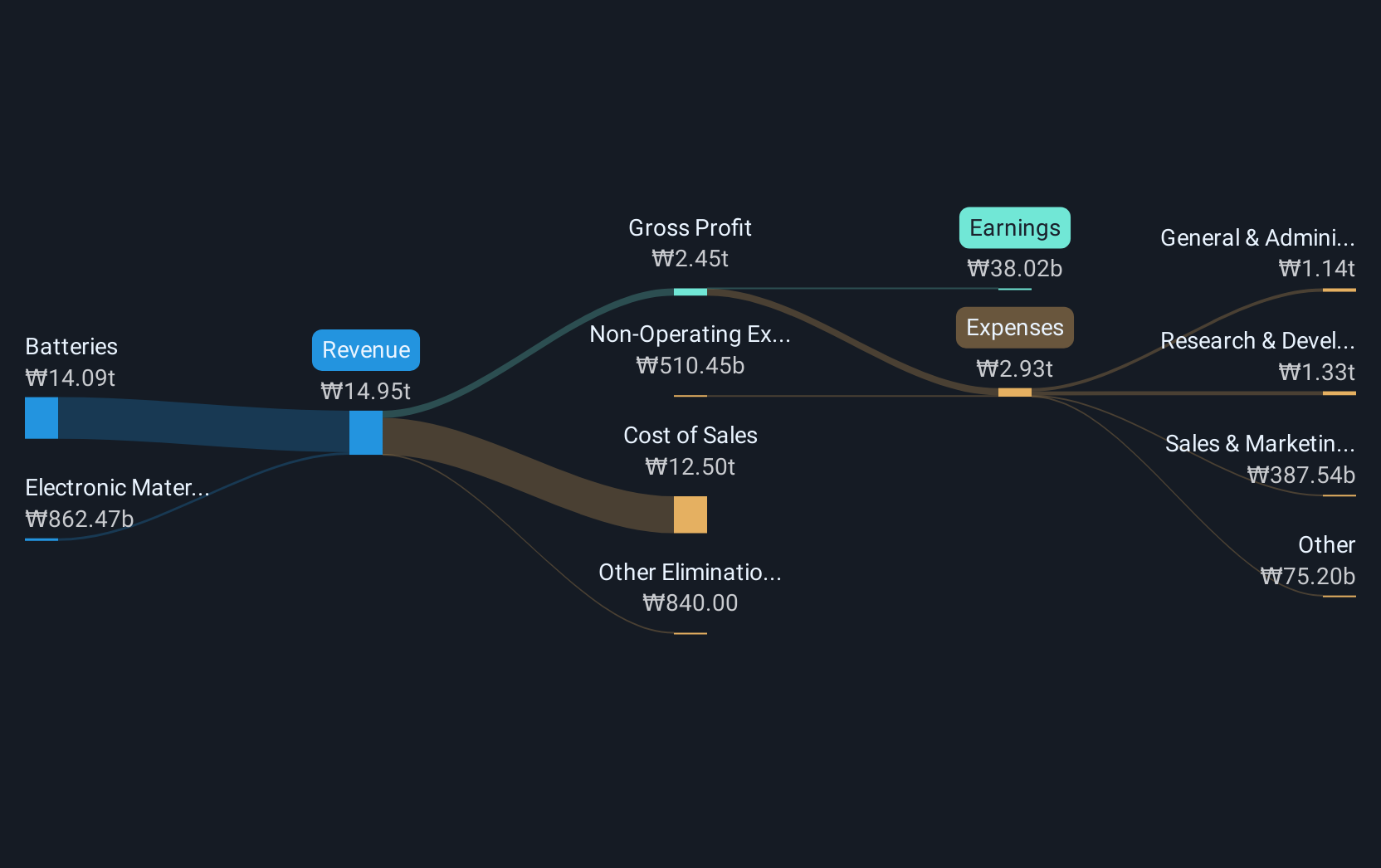

Overview: Samsung SDI Co., Ltd. manufactures and sells batteries globally, with a market cap of ₩16.84 trillion.

Operations: Samsung SDI generates revenue primarily from its Energy Solution segment, contributing approximately ₩17.13 trillion, and its Electronic Material segment, which adds around ₩2.26 trillion. The company's operations span South Korea, Europe, China, North America, and Southeast Asia.

Samsung SDI, amid a challenging landscape, has demonstrated robust financial agility with an expected earnings growth of 23.4% annually, outpacing the broader Korean market's average of 12.6%. This growth is supported by significant R&D investment, which not only fuels innovation but also aligns with industry demands for advanced battery solutions and materials technology. Recent engagements at global tech conferences underscore their strategic focus on expanding market influence and showcasing technological advancements. Despite a revenue growth forecast (12.8% per year) that lags behind high-growth benchmarks, Samsung SDI's commitment to research and development spending—which remains a cornerstone for future competitiveness in the electronic sector—positions it as a key player to watch in evolving high-tech ecosystems.

Getac Holdings (TWSE:3005)

Simply Wall St Growth Rating: ★★★★☆☆

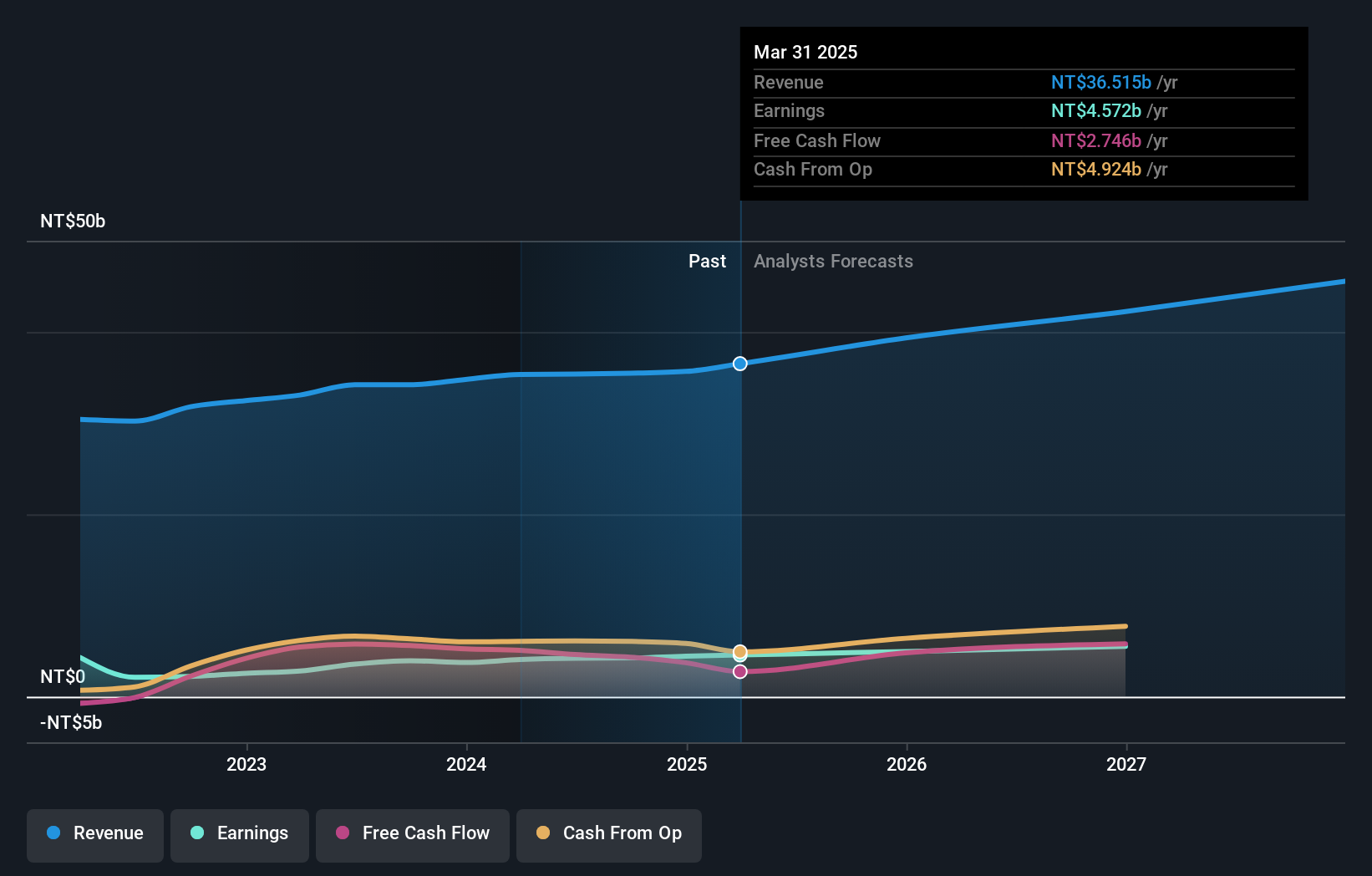

Overview: Getac Holdings Corporation, with a market cap of NT$65.52 billion, engages in the research, development, manufacturing, and sales of notebook computers and related products across China, the United States, Europe, and other international markets.

Operations: The company generates revenue primarily from three segments: electronic parts (NT$18.43 billion), machine parts (NT$13.61 billion), and aerospace fasteners (NT$3.43 billion).

Getac Holdings has demonstrated a consistent growth trajectory, with revenue increasing by 1.80% year-to-date and earnings growing by 11.3% annually, outpacing the broader Taiwanese market's average. This growth is buoyed by strategic partnerships, like the recent one with Secure Passage, enhancing its footprint in critical sectors such as law enforcement and utilities. Furthermore, Getac’s commitment to innovation is evident from its R&D investments which have strategically aligned with evolving technological demands, ensuring sustained growth in a competitive landscape.

- Take a closer look at Getac Holdings' potential here in our health report.

Explore historical data to track Getac Holdings' performance over time in our Past section.

Flexium Interconnect (TWSE:6269)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flexium Interconnect, Inc. is involved in the design, development, manufacture, and sale of flexible printed circuit boards across Taiwan, China, the rest of Asia, Europe, and the Americas with a market capitalization of approximately NT$20.52 billion.

Operations: Flexium Interconnect, along with its subsidiaries, focuses on producing flexible printed circuit boards for various global markets. The company operates in Taiwan, China, and other regions across Asia, Europe, and the Americas.

Flexium Interconnect's recent performance reflects significant challenges, with a shift from net income to a net loss as detailed in their latest quarterly report, highlighting sales dropping to TWD 6.42 billion from TWD 8.01 billion year-over-year. Despite these setbacks, the company is poised for recovery with expected revenue growth at 3.9% annually, outpacing the Taiwanese market average of 2.3%. This optimism is further bolstered by forecasts of an impressive annual earnings growth rate of 75.7%, suggesting potential resilience and adaptability in its operational strategy amidst tough market conditions.

- Delve into the full analysis health report here for a deeper understanding of Flexium Interconnect.

Assess Flexium Interconnect's past performance with our detailed historical performance reports.

Where To Now?

- Embark on your investment journey to our 1316 High Growth Tech and AI Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3005

Getac Holdings

Researches, develops, manufactures, and sells notebook computers and related products in China, the United States, Europe, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion