- China

- /

- Semiconductors

- /

- SHSE:688256

3 Elite Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amid recent market turbulence, with the S&P 500 Index experiencing its steepest weekly drop in 18 months due to economic slowdown concerns, investors are seeking stability and growth. In this environment, companies with high insider ownership often stand out as they signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Medley (TSE:4480) | 34% | 30.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Let's uncover some gems from our specialized screener.

Ambu (CPSE:AMBU B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ambu A/S develops, produces, and sells medical devices to hospitals, clinics, and rescue services worldwide with a market cap of DKK34.20 billion.

Operations: Ambu's revenue primarily comes from Disposable Medical Products, generating DKK5.26 billion.

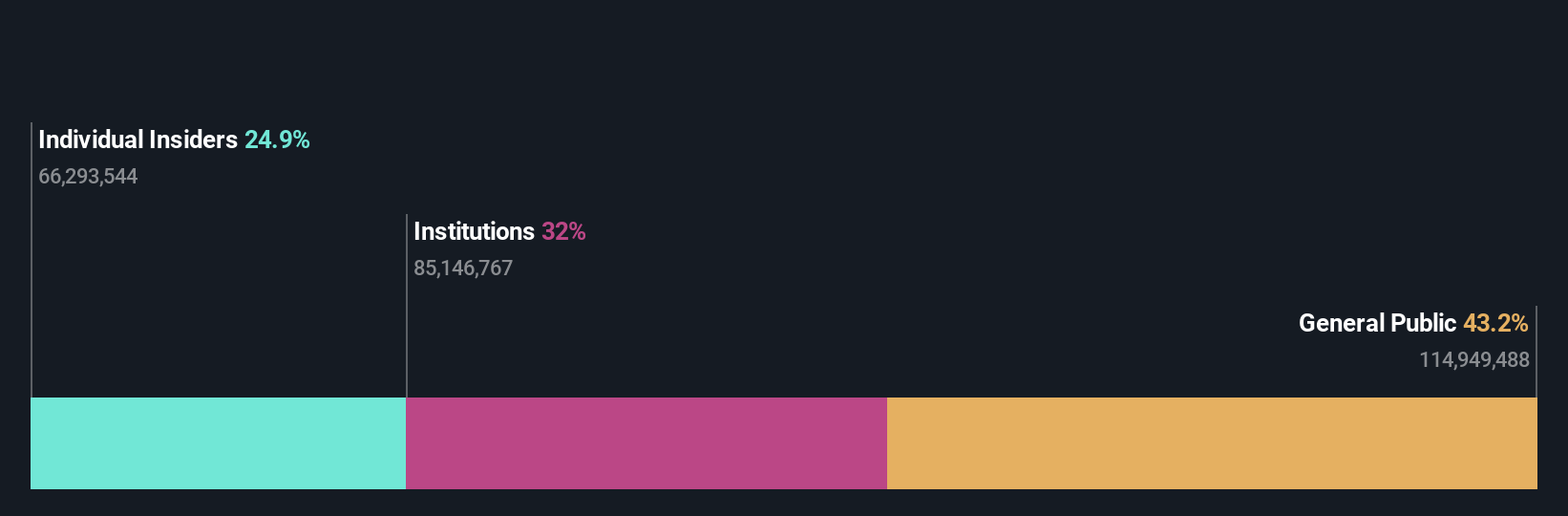

Insider Ownership: 24.9%

Ambu A/S, a growth company with high insider ownership, has shown significant earnings growth, becoming profitable this year. Its earnings are forecast to grow at 22.91% per year, outpacing the Danish market's 14.8%. Recent Q3 results reported sales of DKK 1.38 billion and net income of DKK 134 million, both up from last year. Despite being removed from the OMX Copenhagen 20 Index in June, Ambu raised its revenue guidance for FY2023/24 to 12-14%.

- Delve into the full analysis future growth report here for a deeper understanding of Ambu.

- Insights from our recent valuation report point to the potential overvaluation of Ambu shares in the market.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★☆

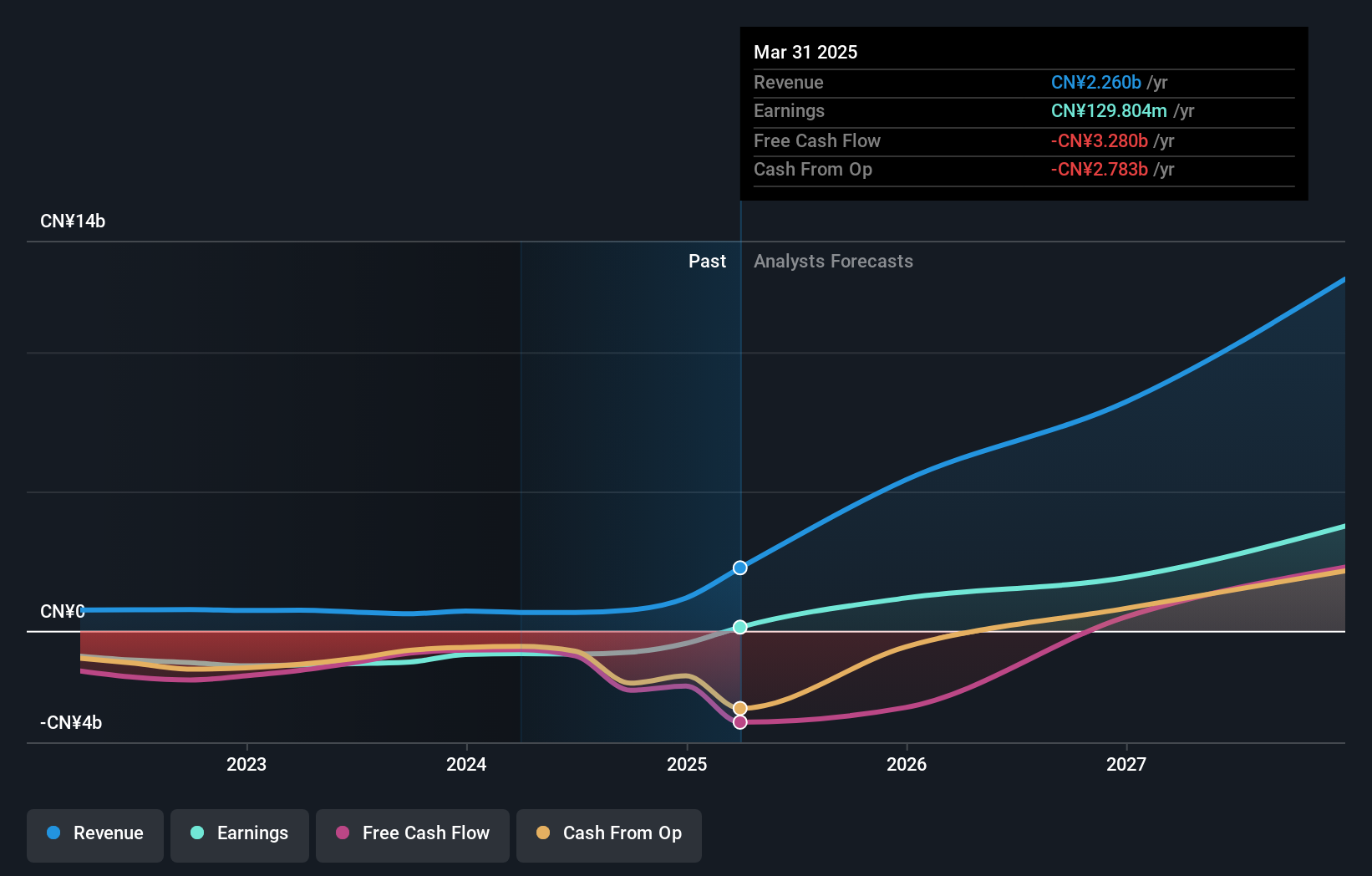

Overview: Cambricon Technologies Corporation Limited researches, develops, designs, and sells core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥89.21 billion.

Operations: Cambricon Technologies generates revenue from core chips used in cloud servers, edge computing, and terminal equipment in China.

Insider Ownership: 28.8%

Cambricon Technologies' revenue is forecast to grow 42.7% annually, significantly outpacing the Chinese market's 13.3%. Despite a high net loss of CNY 530.11 million for H1 2024, the company is expected to become profitable within three years. Recent volatility in its share price and a substantial buyback program worth up to CNY 40 million reflect ongoing strategic adjustments. Insider ownership remains high, reinforcing confidence in its long-term growth trajectory.

- Click here to discover the nuances of Cambricon Technologies with our detailed analytical future growth report.

- Our valuation report unveils the possibility Cambricon Technologies' shares may be trading at a premium.

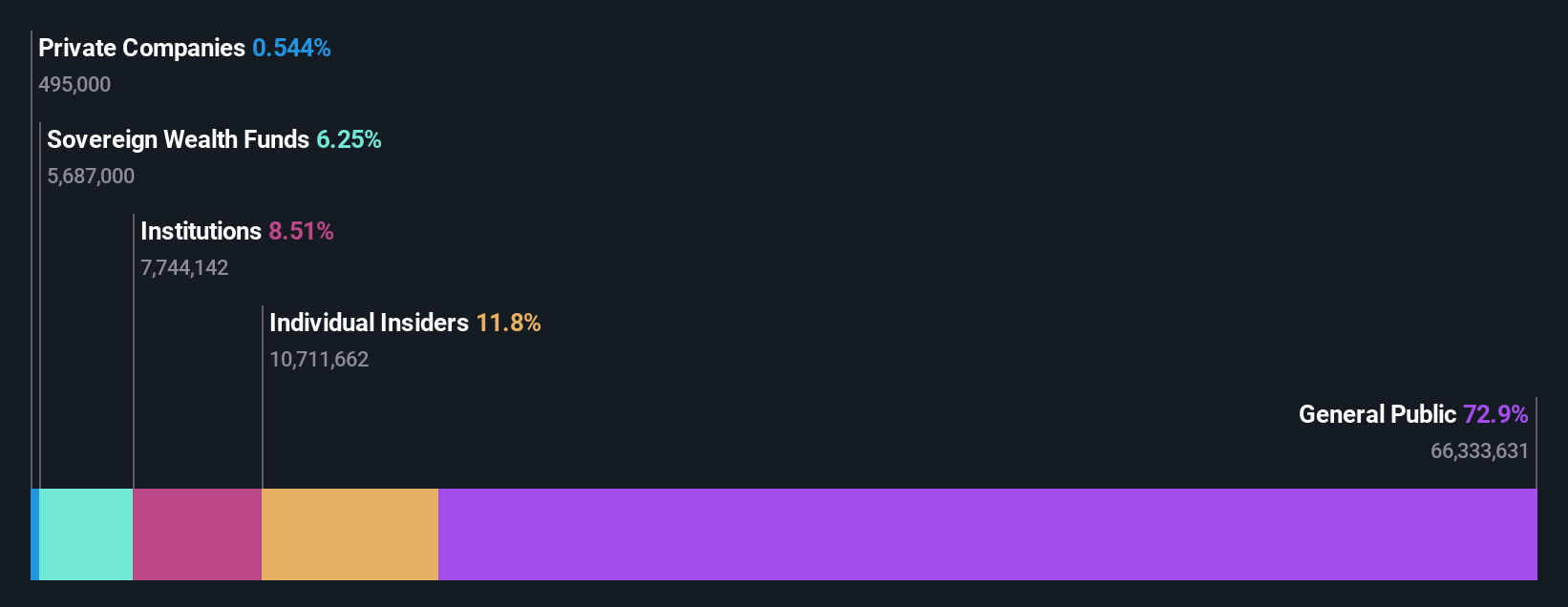

Kaori Heat Treatment (TWSE:8996)

Simply Wall St Growth Rating: ★★★★★★

Overview: Kaori Heat Treatment Co., Ltd. specializes in the research, development, manufacture, and sale of heat exchanger solutions globally and has a market cap of NT$36.11 billion.

Operations: Kaori Heat Treatment's revenue segments include NT$2.03 billion from Plate Heat Exchanger and NT$1.81 billion from Energy Conservation Product Segment (including Metal Products and Processing).

Insider Ownership: 12.4%

Kaori Heat Treatment's earnings are forecast to grow 48% annually, significantly outpacing the Taiwan market's 18.2%. Despite recent declines in quarterly sales (TWD 1,000.08 million) and net income (TWD 165.72 million), revenue is expected to increase by 38.5% per year, well above the market average of 11.6%. Trading at a slight discount to its estimated fair value and with high insider ownership, it presents a compelling growth opportunity despite recent volatility.

- Get an in-depth perspective on Kaori Heat Treatment's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Kaori Heat Treatment's current price could be inflated.

Next Steps

- Access the full spectrum of 1507 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

Flawless balance sheet with high growth potential.