- China

- /

- Semiconductors

- /

- SHSE:688608

Insider Favorites: 3 Growth Companies With Strong Ownership

Reviewed by Simply Wall St

In a week marked by choppy markets and inflation concerns, global indices have experienced notable fluctuations, with U.S. equities seeing declines amid political uncertainties and economic data releases. As investors navigate these turbulent times, stocks with substantial insider ownership can offer a unique perspective on potential growth opportunities, as they often reflect the confidence of those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 35.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medicover AB (publ) offers healthcare and diagnostic services in Poland, Sweden, and internationally with a market cap of SEK28.95 billion.

Operations: The company's revenue is primarily derived from Healthcare Services, generating €1.39 billion, and Diagnostic Services, contributing €631.90 million.

Insider Ownership: 11.1%

Earnings Growth Forecast: 35.6% p.a.

Medicover is experiencing robust revenue growth, forecasted at 12.7% annually, outpacing the Swedish market. Despite recent downsizing in Hungary, which involves divesting a low-margin €50 million business with no material impact on profits, the company maintains strong growth prospects. Earnings have grown significantly by 146.3% over the past year and are expected to continue rising at 35.6% per year. Insider activity shows more buying than selling recently, indicating confidence in future performance despite low return on equity forecasts and interest coverage issues.

- Unlock comprehensive insights into our analysis of Medicover stock in this growth report.

- In light of our recent valuation report, it seems possible that Medicover is trading beyond its estimated value.

Fawaz Abdulaziz Al Hokair (SASE:4240)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fawaz Abdulaziz Al Hokair & Company operates as a franchise retailer of fashion products across several countries including Saudi Arabia, Jordan, and the United States, with a market cap of SAR1.81 billion.

Operations: The company's revenue is primarily derived from its Fashion Retail segment at SAR4.77 billion, followed by F&B at SAR341.57 million, and Indoor Entertainment at SAR68.91 million.

Insider Ownership: 16.1%

Earnings Growth Forecast: 116.0% p.a.

Fawaz Abdulaziz Al Hokair is forecast to achieve above-average market growth, becoming profitable over the next three years with earnings expected to grow 115.98% annually. Despite a volatile share price and high debt levels, the company trades at good value relative to peers. Recent earnings show improvement, with third-quarter sales reaching SAR 1.17 billion and net income of SAR 18 million compared to a net loss previously, indicating progress toward profitability amidst negative equity challenges.

- Dive into the specifics of Fawaz Abdulaziz Al Hokair here with our thorough growth forecast report.

- Our expertly prepared valuation report Fawaz Abdulaziz Al Hokair implies its share price may be lower than expected.

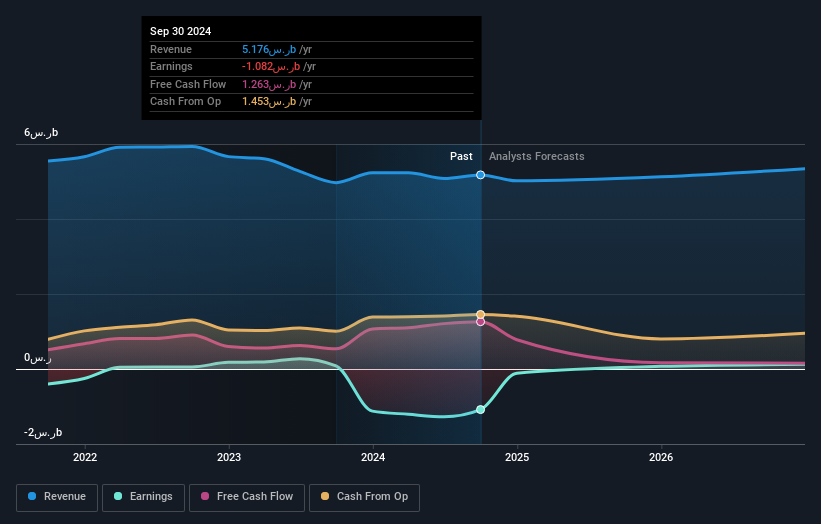

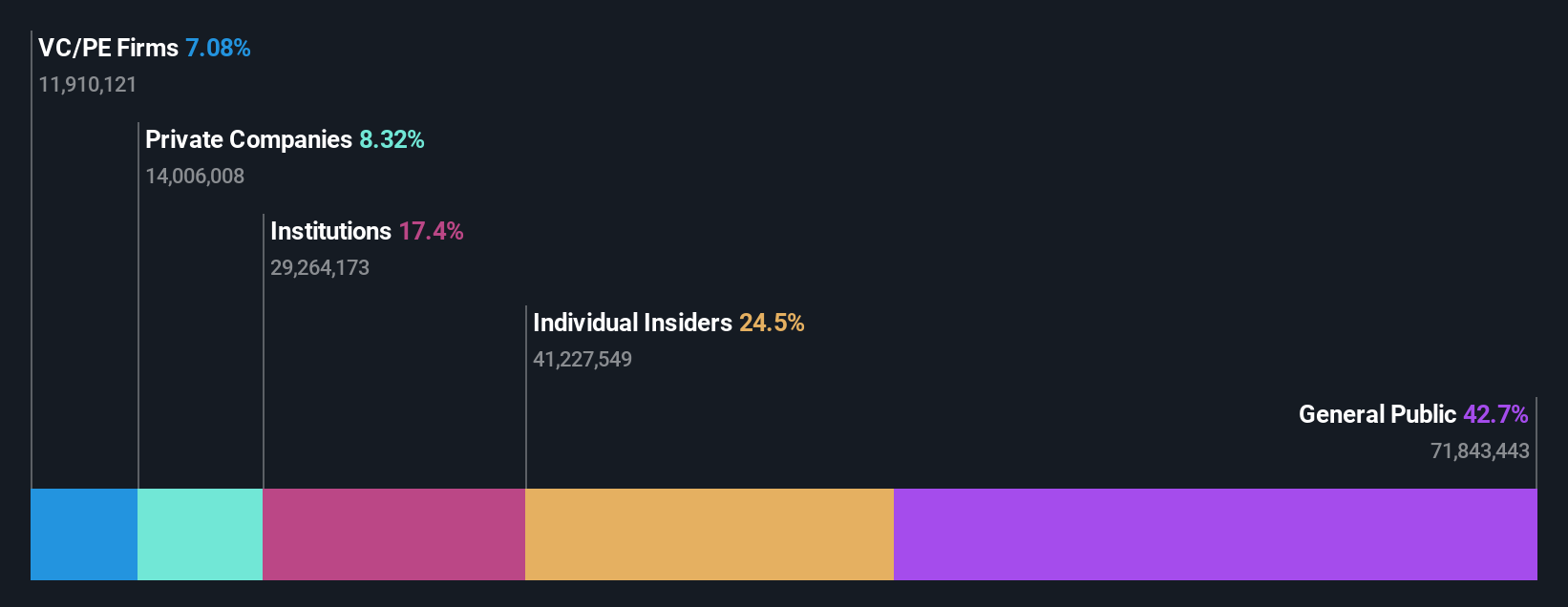

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bestechnic (Shanghai) Co., Ltd. focuses on the research, design, development, manufacture, and sale of smart audio and video SoC chips in China with a market cap of CN¥39.67 billion.

Operations: The company's revenue is primarily derived from its Integrated Circuit segment, amounting to CN¥3.09 billion.

Insider Ownership: 25.7%

Earnings Growth Forecast: 40% p.a.

Bestechnic (Shanghai) is poised for robust growth, with earnings forecasted to rise 40% annually, outpacing the Chinese market. Revenue is expected to grow 24.9% per year, supported by recent earnings showing significant improvement: sales reached CNY 2.47 billion and net income was CNY 289.1 million for the first nine months of 2024. Despite high share price volatility and low future return on equity projections, insider ownership remains strong without substantial insider trading activities recently reported.

- Take a closer look at Bestechnic (Shanghai)'s potential here in our earnings growth report.

- Our expertly prepared valuation report Bestechnic (Shanghai) implies its share price may be too high.

Summing It All Up

- Click this link to deep-dive into the 1444 companies within our Fast Growing Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Bestechnic (Shanghai), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bestechnic (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688608

Bestechnic (Shanghai)

Engages in the research, design, development, manufacture, and sale of smart audio and video SoC chips in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives