- India

- /

- Consumer Durables

- /

- NSEI:SFL

November 2024's Top Stock Selections Possibly Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed earnings reports and economic data, major indices like the Nasdaq Composite and S&P 500 have experienced volatility, highlighting a shift in investor sentiment. Amidst this backdrop of cautious optimism and strategic positioning, identifying stocks that may be undervalued becomes crucial for investors seeking opportunities in an uncertain environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1979.00 | ¥3936.25 | 49.7% |

| On the Beach Group (LSE:OTB) | £1.522 | £3.03 | 49.8% |

| SEI Medical (SET:SEI) | THB5.80 | THB11.54 | 49.7% |

| SciDev (ASX:SDV) | A$0.615 | A$1.23 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.88 | €5.74 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.01 | US$545.05 | 49.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1418.00 | ₩2821.10 | 49.7% |

| Orascom Development Holding (SWX:ODHN) | CHF3.90 | CHF7.79 | 49.9% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.90 | CN¥127.14 | 49.7% |

| Cellnex Telecom (BME:CLNX) | €32.50 | €64.80 | 49.8% |

Let's uncover some gems from our specialized screener.

Sheela Foam (NSEI:SFL)

Overview: Sheela Foam Limited manufactures and sells polyurethane foams and mattresses both in India and internationally, with a market cap of ₹92.81 billion.

Operations: The company's revenue primarily comes from the Furniture & Fixtures segment, amounting to ₹33.69 billion.

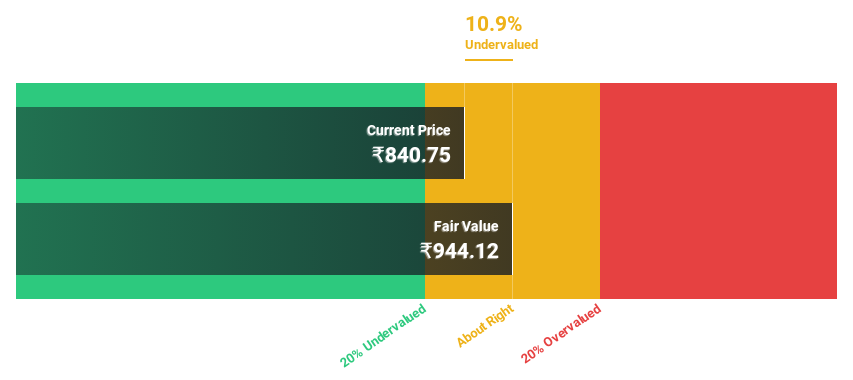

Estimated Discount To Fair Value: 10%

Sheela Foam is trading at ₹853.8, below its estimated fair value of ₹948.86, indicating potential undervaluation based on cash flows. Despite revenue growth forecasted at 12% annually, profit margins have decreased from 7% to 4.5%. Earnings are expected to grow significantly by over 41% per year, outpacing the Indian market's growth rate of 17.9%. Recent earnings showed increased sales but a decline in net income compared to last year.

- In light of our recent growth report, it seems possible that Sheela Foam's financial performance will exceed current levels.

- Dive into the specifics of Sheela Foam here with our thorough financial health report.

StarPower Semiconductor (SHSE:603290)

Overview: StarPower Semiconductor Ltd. researches, develops, produces, and sells power semiconductor components worldwide with a market cap of CN¥23.19 billion.

Operations: The company's revenue is primarily derived from power semiconductor devices, totaling CN¥3.46 billion.

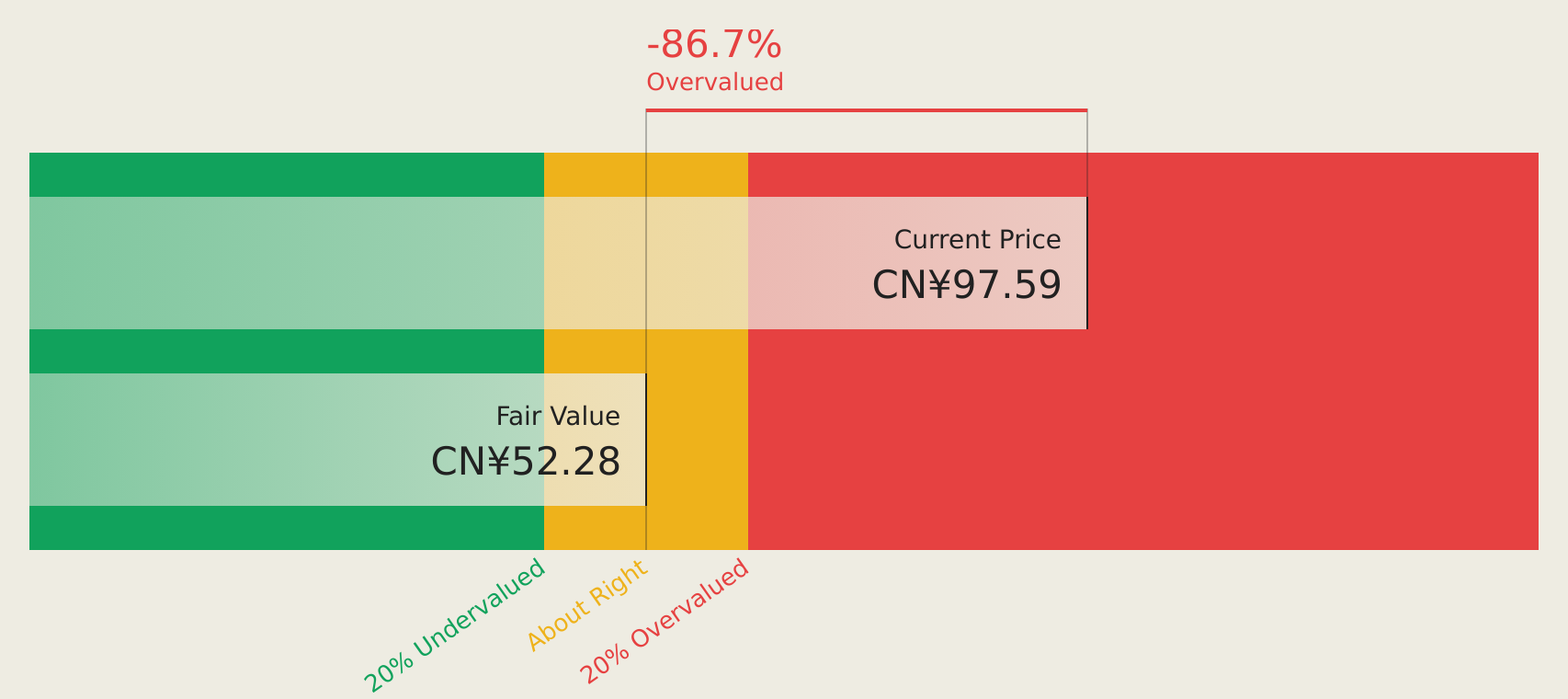

Estimated Discount To Fair Value: 16.7%

StarPower Semiconductor is trading at CNY 96.86, below its estimated fair value of CNY 116.29, suggesting potential undervaluation based on cash flows. Despite a decline in recent earnings, revenue is forecasted to grow at 21.8% annually, faster than the Chinese market average of 14%. Earnings are expected to increase by 23.6% per year but remain below the broader market's growth rate of 26.1%. The dividend coverage by free cash flows is weak.

- According our earnings growth report, there's an indication that StarPower Semiconductor might be ready to expand.

- Get an in-depth perspective on StarPower Semiconductor's balance sheet by reading our health report here.

WinWay Technology (TWSE:6515)

Overview: WinWay Technology Co., Ltd. designs, processes, and sells optoelectronic product test fixtures and integrated circuit test interfaces globally, with a market cap of NT$47.46 billion.

Operations: The company's revenue is primarily derived from the manufacture and sales of photoelectric product testing tools, amounting to NT$3.99 billion.

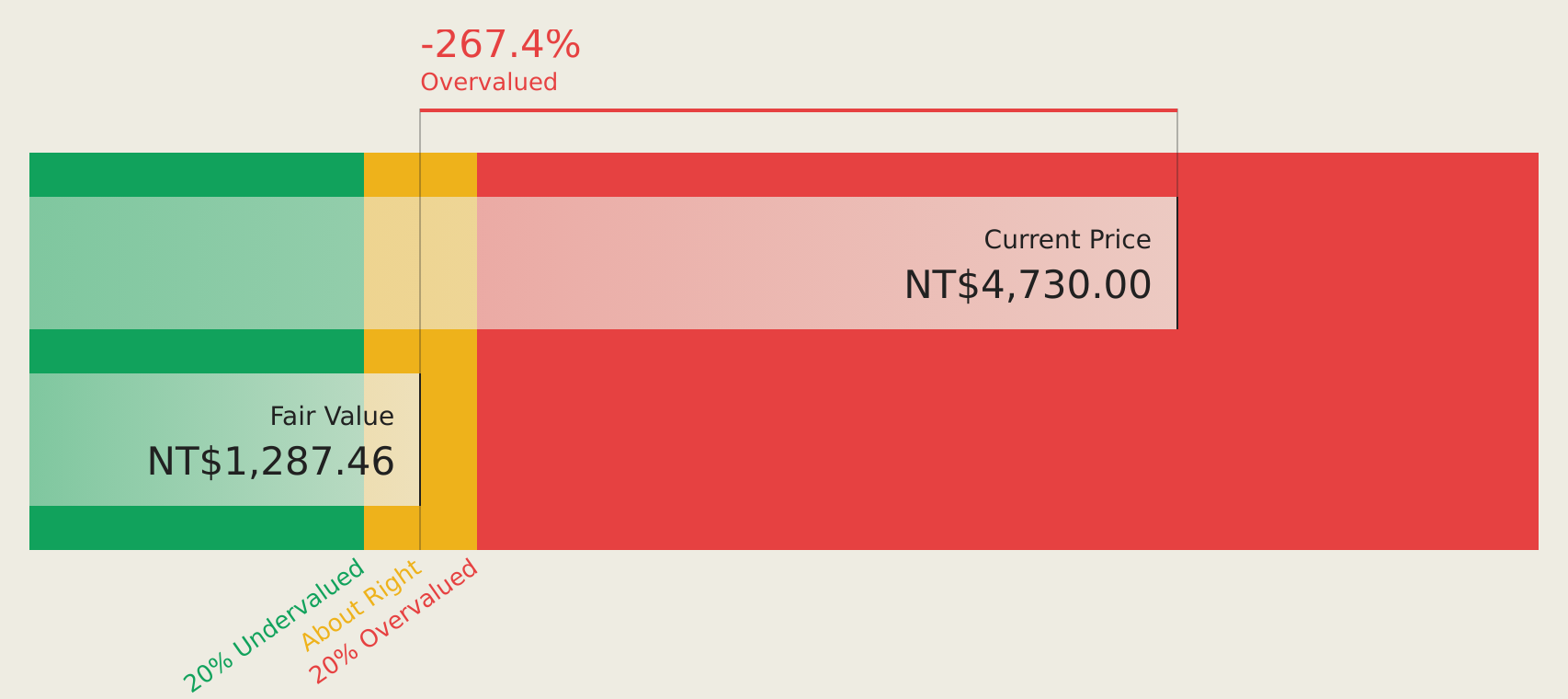

Estimated Discount To Fair Value: 10.7%

WinWay Technology, trading at NT$1365, is priced below its estimated fair value of NT$1529.26, indicating it may be undervalued based on cash flows. Earnings and revenue are forecasted to grow significantly at 66.4% and 46.3% per year respectively, outpacing the Taiwan market averages. However, ongoing legal issues concerning trade secrets could pose risks to financial stability despite no immediate impact reported on operations or finances so far.

- Our earnings growth report unveils the potential for significant increases in WinWay Technology's future results.

- Navigate through the intricacies of WinWay Technology with our comprehensive financial health report here.

Where To Now?

- Delve into our full catalog of 936 Undervalued Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SFL

Sheela Foam

Engages in the manufacture and sale of polyurethane foams and mattresses in India and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives