- China

- /

- Semiconductors

- /

- SHSE:603290

3 Stocks That May Be Undervalued Based On Analyst Estimates In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, marked by inflation concerns and political uncertainties, investors are closely watching for signs of stability amid fluctuating indices. With U.S. equities experiencing declines and small-cap stocks underperforming, the search for potentially undervalued opportunities becomes even more pertinent. In this environment, identifying stocks that may be undervalued based on analyst estimates can offer a strategic approach to navigating market volatility and capitalizing on potential growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥27.91 | CN¥55.68 | 49.9% |

| Alltop Technology (TPEX:3526) | NT$265.00 | NT$529.04 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.31 | 50% |

| FINDEX (TSE:3649) | ¥920.00 | ¥1836.04 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP578.96 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥20.94 | CN¥41.78 | 49.9% |

| Mobvista (SEHK:1860) | HK$8.05 | HK$16.06 | 49.9% |

| TaewoongLtd (KOSDAQ:A044490) | ₩12880.00 | ₩25739.32 | 50% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Prodways Group (ENXTPA:PWG) | €0.608 | €1.21 | 49.9% |

Let's review some notable picks from our screened stocks.

StarPower Semiconductor (SHSE:603290)

Overview: StarPower Semiconductor Ltd. is engaged in the research, design, development, production, and sale of power semiconductor components globally with a market cap of CN¥20.09 billion.

Operations: The company's revenue is primarily generated from its Power Semiconductor Devices segment, amounting to CN¥3.46 billion.

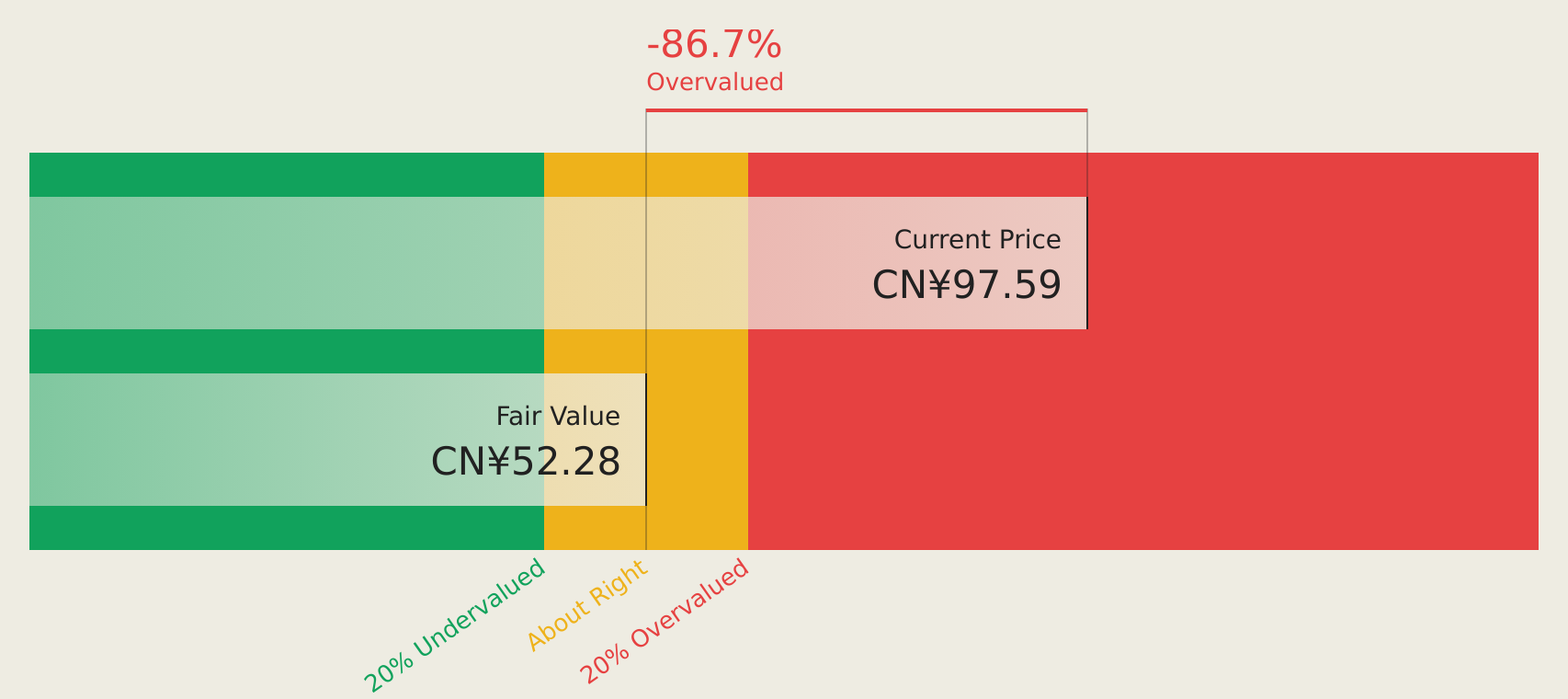

Estimated Discount To Fair Value: 42%

StarPower Semiconductor is trading at CN¥84.71, significantly below its estimated fair value of CN¥146.13, indicating undervaluation based on discounted cash flow analysis. Despite recent index removals and a decline in nine-month net income to CN¥423.32 million from the previous year's CN¥658.22 million, the company demonstrates strong revenue growth prospects at 20.9% annually, outpacing the Chinese market average of 13.9%. However, its dividend coverage by free cash flow remains weak.

- The analysis detailed in our StarPower Semiconductor growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of StarPower Semiconductor.

Thunder Software TechnologyLtd (SZSE:300496)

Overview: Thunder Software Technology Co., Ltd. develops operating-system products for a global market, including China, Europe, the United States, and Japan, with a market cap of CN¥24.32 billion.

Operations: Thunder Software Technology Co., Ltd. generates revenue from its operating-system products across diverse international markets, including China, Europe, the United States, and Japan.

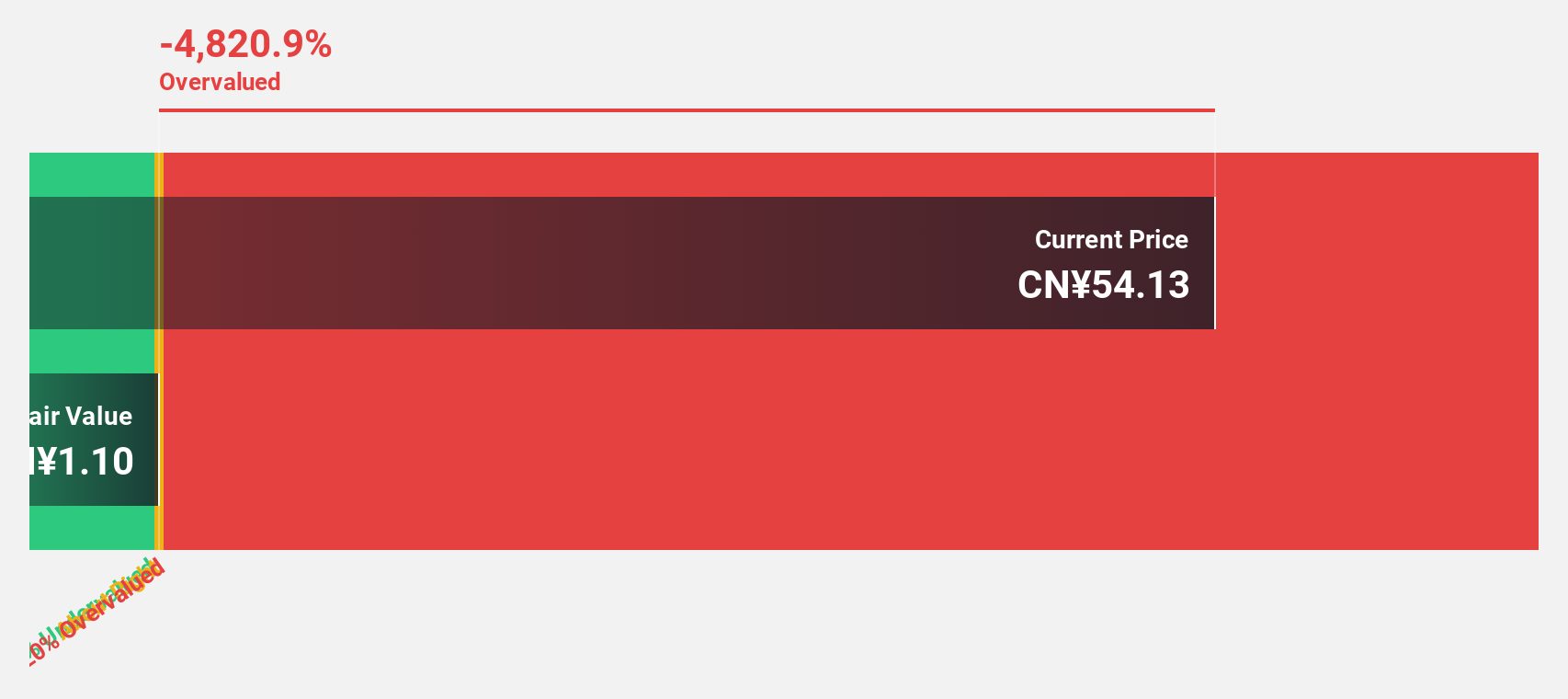

Estimated Discount To Fair Value: 21%

Thunder Software Technology Ltd. is trading at CN¥53.71, below its estimated fair value of CN¥68, suggesting it may be undervalued based on discounted cash flow analysis. Despite a drop in nine-month net income to CN¥151.97 million from last year's CN¥605.98 million, earnings are forecast to grow significantly at 73.7% annually over the next three years, outpacing the Chinese market average of 25.3%. A strategic partnership with HERE Technologies enhances its position in intelligent navigation systems.

- Our expertly prepared growth report on Thunder Software TechnologyLtd implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Thunder Software TechnologyLtd's balance sheet by reading our health report here.

Nishi-Nippon Financial Holdings (TSE:7189)

Overview: Nishi-Nippon Financial Holdings, Inc. manages and operates banks and companies offering financial and non-financial solutions in Japan, Hong Kong, China, and Singapore with a market cap of ¥274.72 billion.

Operations: The company's revenue primarily comes from its banking segment, which generated ¥166.42 billion.

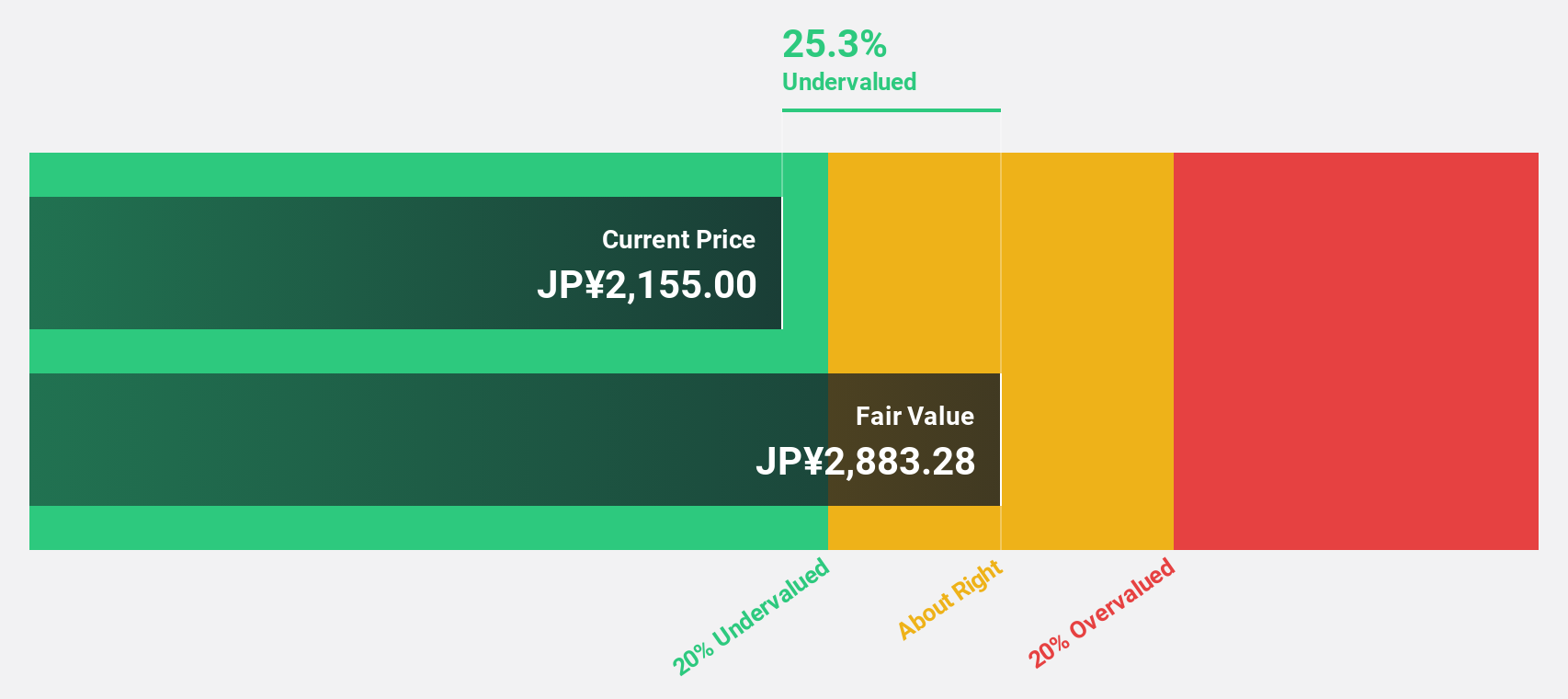

Estimated Discount To Fair Value: 43.9%

Nishi-Nippon Financial Holdings, trading at ¥1,990, is significantly undervalued with a fair value estimate of ¥3,544.30. Despite a low allowance for bad loans (29%) and an unstable dividend track record, the company forecasts strong earnings growth of 24.4% annually over three years—outpacing the Japanese market's 8%. Recent share buybacks worth ¥1.99 billion further enhance shareholder returns and capital efficiency as part of its strategic financial management initiatives.

- The growth report we've compiled suggests that Nishi-Nippon Financial Holdings' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Nishi-Nippon Financial Holdings.

Make It Happen

- Explore the 877 names from our Undervalued Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603290

StarPower Semiconductor

Researches, designs, develops, produces, and sells power semiconductor components worldwide.

Undervalued with excellent balance sheet.