Undiscovered Gems And 2 Other Hidden Stocks With Strong Potential

Reviewed by Simply Wall St

In a market environment marked by choppy conditions and inflation concerns, small-cap stocks have recently underperformed, with the Russell 2000 Index dipping into correction territory. Despite these challenges, the resilient labor market and cautious Federal Reserve outlook suggest that opportunities still exist for discerning investors willing to explore lesser-known equities. Identifying a good stock in such times often involves looking for companies with strong fundamentals that can withstand economic headwinds while offering growth potential in their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shiyue Daotian Group (SEHK:9676)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shiyue Daotian Group Co., Ltd. focuses on manufacturing and selling pantry staple food in the People's Republic of China, with a market capitalization of approximately HK$5.58 billion.

Operations: The company's primary revenue stream is from rice products, generating CN¥3.80 billion, followed by whole grain, bean, and other products at CN¥1.04 billion. Dried food and other products contribute CN¥422.83 million to the overall revenue.

Shiyue Daotian Group, a small player in its field, recently turned profitable, which is notable given the Food industry's -3.3% performance. The company's interest payments are well covered by EBIT at 16.3 times, indicating financial stability despite a volatile share price over the past three months. With more cash than total debt, Shiyue Daotian's balance sheet appears robust; however, it has not been free cash flow positive recently with figures showing US$-12.72 million as of mid-2024 and capital expenditures at US$203.78 million during the same period suggesting ongoing investments or expansions might be impacting liquidity.

- Click here to discover the nuances of Shiyue Daotian Group with our detailed analytical health report.

Assess Shiyue Daotian Group's past performance with our detailed historical performance reports.

Suzhou Secote Precision ElectronicLTD (SHSE:603283)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Secote Precision Electronic Co., LTD specializes in providing automation solutions in the People’s Republic of China and has a market capitalization of CN¥11.33 billion.

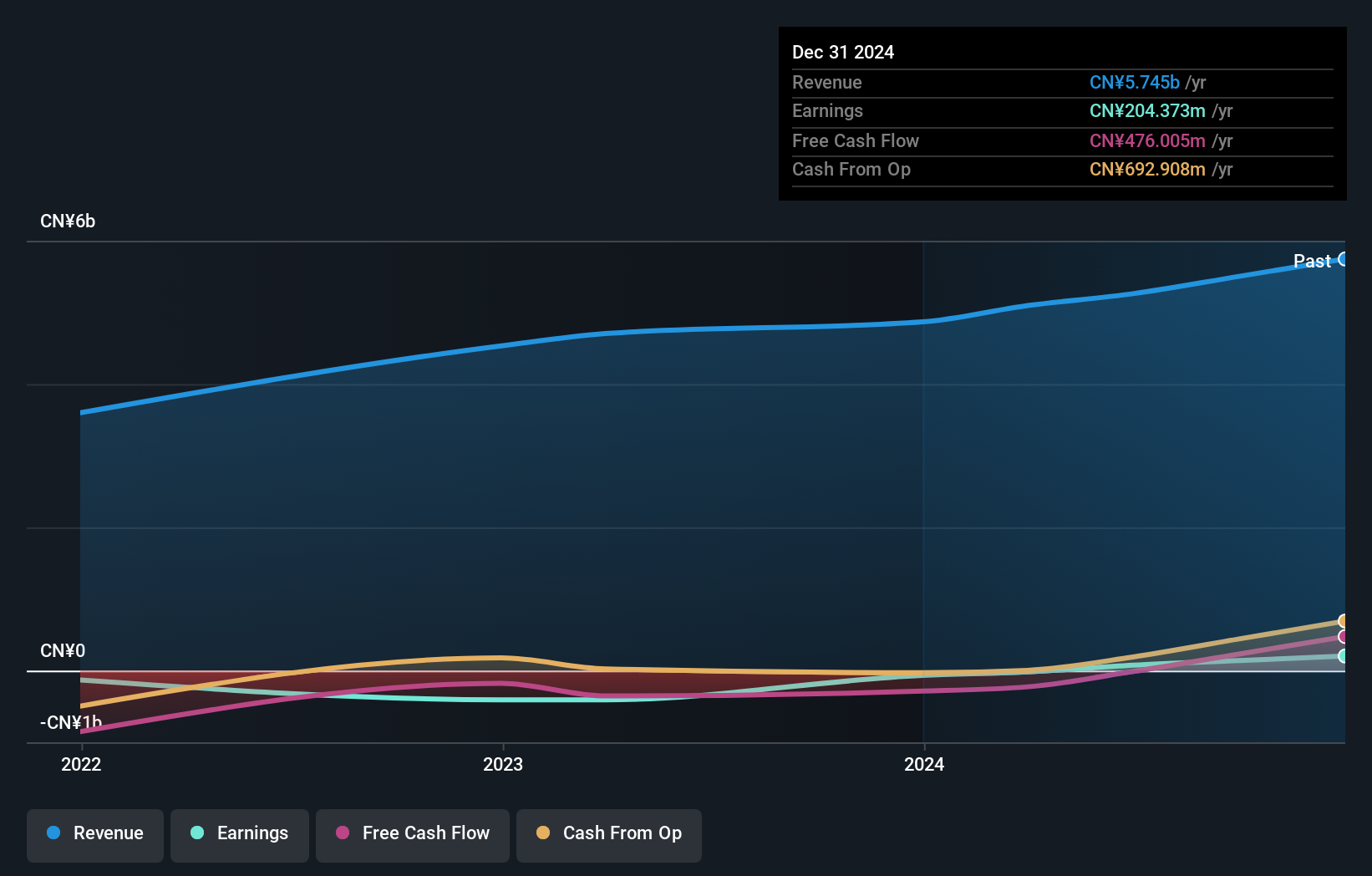

Operations: Secote generates revenue primarily from its Intelligent Manufacturing Equipment segment, which accounts for CN¥5.02 billion.

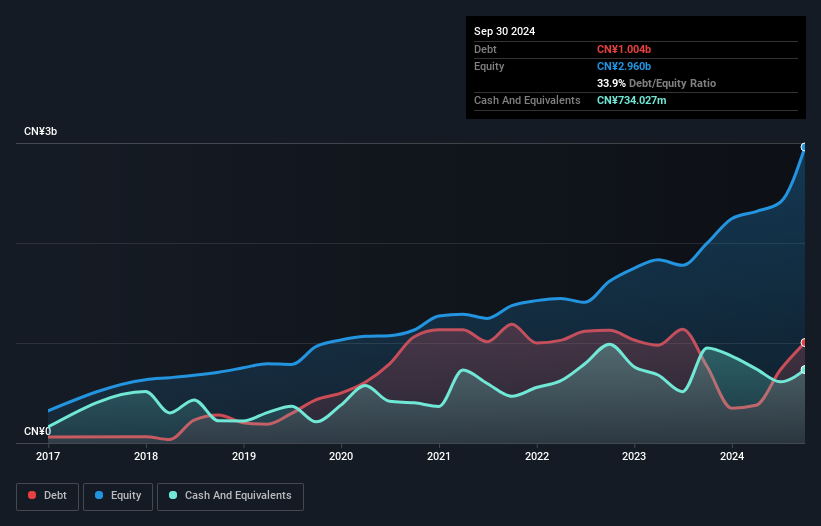

Suzhou Secote, a nimble player in the precision electronics space, showcases robust financial health with a net debt to equity ratio of 9.1%, comfortably below industry norms. The company's earnings surged by 60% over the past year, outpacing its sector's average growth rate of -0.06%. Trading at a price-to-earnings ratio of 15.2x against the broader CN market's 34.1x, it offers good value for investors seeking opportunities in smaller firms. Recent reports indicate revenue climbed to CNY3.19 billion from CNY2.62 billion last year, while net income reached CNY475 million compared to CNY399 million previously.

Linktel Technologies (SZSE:301205)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Linktel Technologies Co., Ltd. specializes in the research, development, production, and sale of optical transceiver modules both in China and internationally, with a market cap of CN¥8.95 billion.

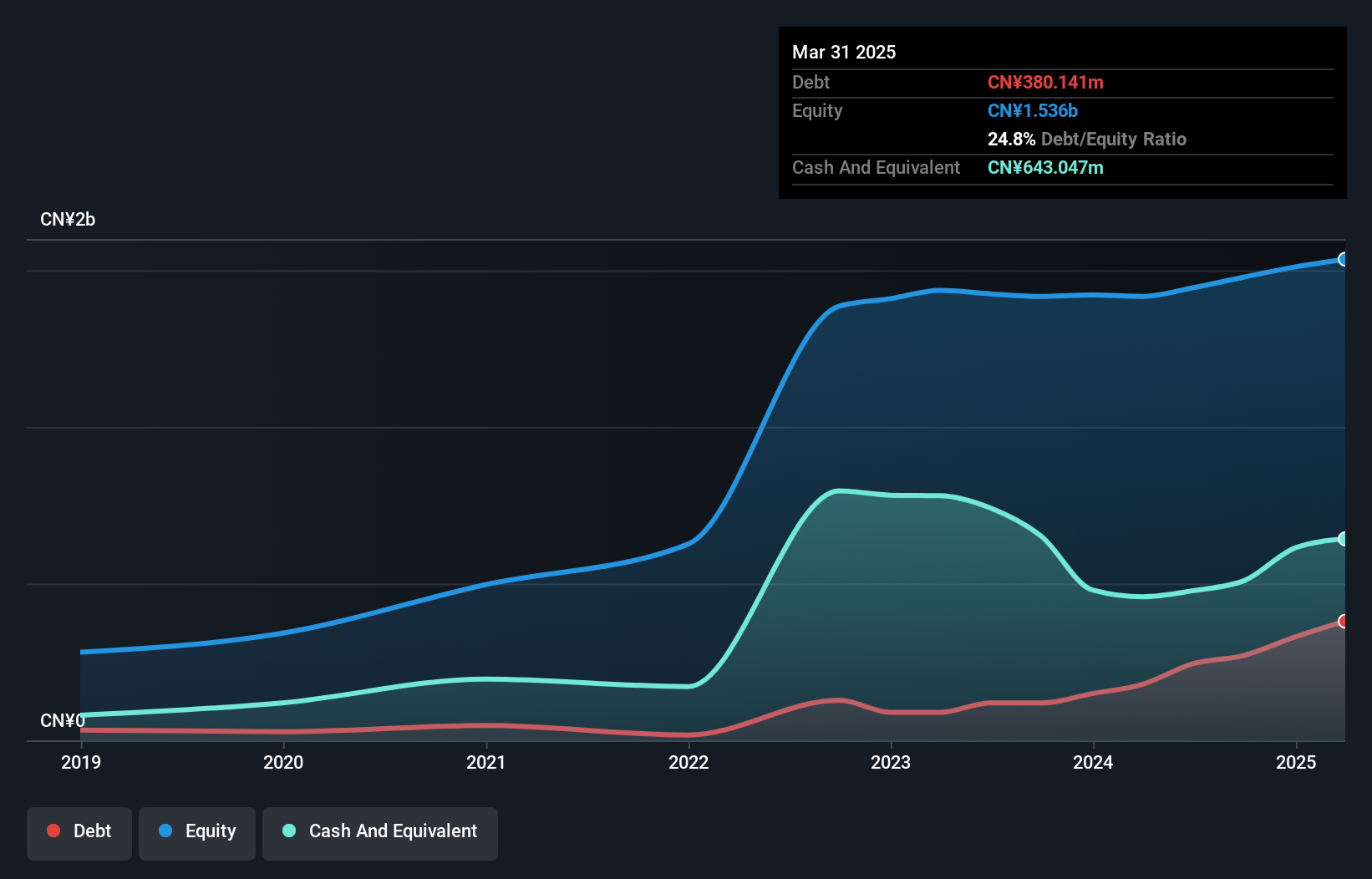

Operations: Linktel generates revenue primarily from the optical communication industry, amounting to CN¥806.88 million. The company's financial performance is reflected in its market cap of CN¥8.95 billion.

Linktel Technologies, a smaller player in the electronics sector, has shown impressive earnings growth of 47% over the past year, outpacing the industry average of 1.8%. Despite a higher debt to equity ratio now at 18.3%, Linktel remains profitable with more cash than total debt. Recent earnings for nine months ending September 2024 revealed sales of CNY 642.59 million and net income at CNY 62.26 million, significantly up from last year's figures of CNY 441.43 million and CNY 21.41 million respectively. However, free cash flow remains negative suggesting room for improvement in financial management strategies moving forward.

- Take a closer look at Linktel Technologies' potential here in our health report.

Gain insights into Linktel Technologies' past trends and performance with our Past report.

Next Steps

- Click this link to deep-dive into the 4620 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603283

Suzhou Secote Precision ElectronicLTD

Provides automation solutions in the People’s Republic of China.

Solid track record with excellent balance sheet.