As global markets navigate a choppy start to the year, marked by stronger-than-expected U.S. labor market data and ongoing inflation concerns, small-cap stocks have notably underperformed their large-cap counterparts, with indices like the Russell 2000 dipping into correction territory. In this environment of uncertainty and fluctuating investor sentiment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★☆ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

NEXON Games (KOSDAQ:A225570)

Simply Wall St Growth Rating: ★★★★☆☆

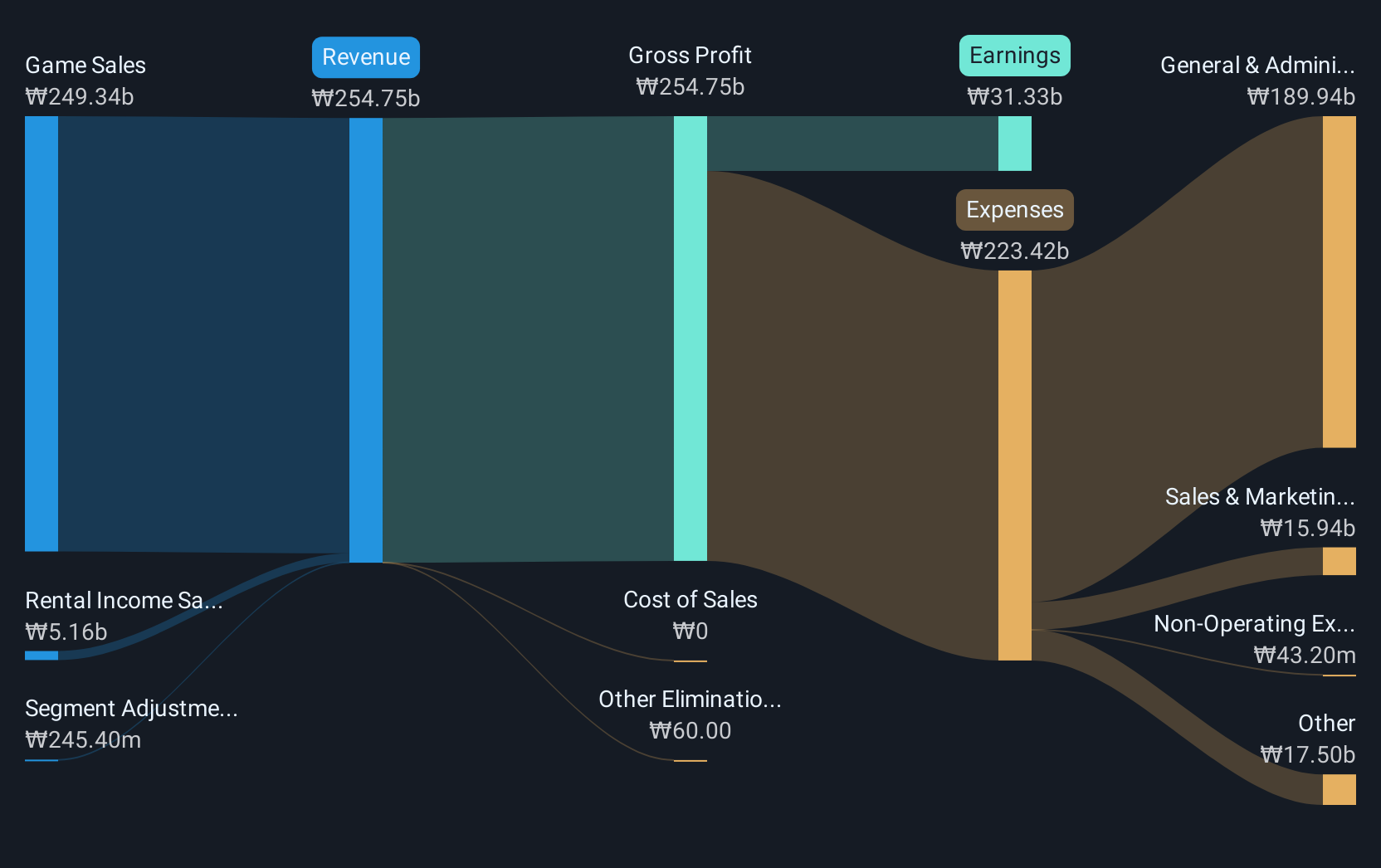

Overview: NEXON Games Co., Ltd. is a South Korean game developer with international operations and a market capitalization of approximately ₩870.62 billion.

Operations: The company primarily generates revenue through game sales, amounting to approximately ₩245.04 billion. Game development is the core focus, contributing significantly to its financial performance.

NEXON Games, amidst a dynamic tech landscape, demonstrates robust growth with its earnings expected to surge by 53.82% annually, outpacing the broader Entertainment industry's decline. With a strategic focus on R&D—evident from their significant investment which aligns closely with revenue growth—NEXON is poised to enhance its gaming technologies further. This commitment is mirrored in their revenue trajectory, growing at 13.3% per year, surpassing the KR market average of 9.2%. Moreover, the company's ability to maintain high-quality earnings amidst industry fluctuations speaks volumes about its operational resilience and innovation-driven approach.

- Get an in-depth perspective on NEXON Games' performance by reading our health report here.

Gain insights into NEXON Games' past trends and performance with our Past report.

Sinch (OM:SINCH)

Simply Wall St Growth Rating: ★★★★☆☆

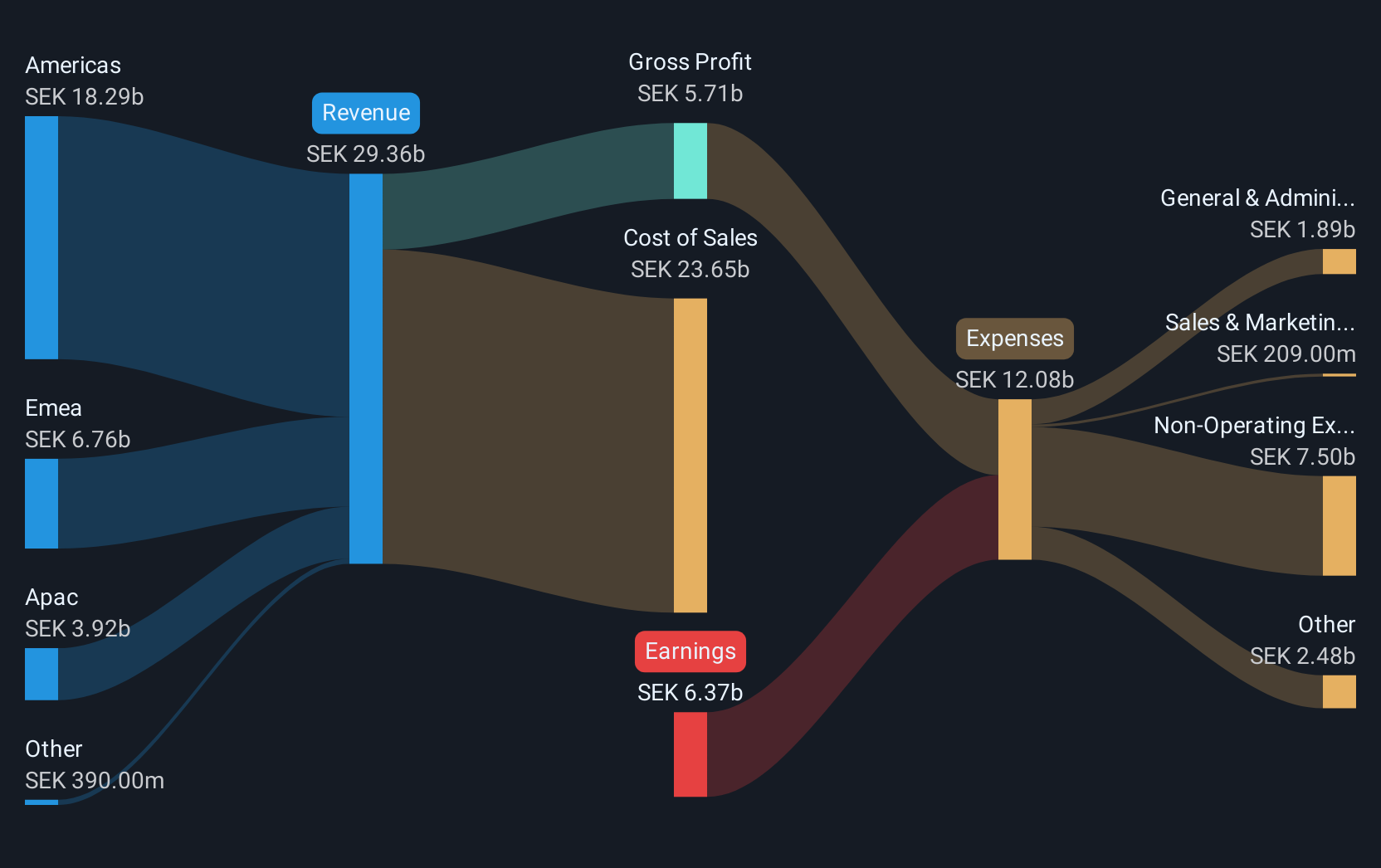

Overview: Sinch AB (publ) offers cloud communications services and solutions for enterprises and mobile operators across various countries including Sweden, France, the UK, Germany, Brazil, India, Singapore, and the US with a market cap of SEK17.19 billion.

Operations: The company generates revenue primarily through its cloud communications services and solutions tailored for enterprises and mobile operators. It operates across several countries, including Sweden, France, the UK, Germany, Brazil, India, Singapore, and the US.

Sinch, navigating through a volatile tech landscape, is on a trajectory to shift from unprofitability towards promising financial health with an expected profit surge of 96.15% annually. This growth is underpinned by strategic expansions in North America, led by newly appointed SVP David Ruggiero, who brings extensive sales expertise from industry giants like Microsoft and Cisco. Despite recent challenges marked by significant impairment charges and a net loss in the latest quarter, Sinch's steady revenue growth at 3.5% per year outpaces Sweden's market average significantly. The firm’s focus on both organic and inorganic growth strategies—highlighted by its readiness to engage in new mergers and acquisitions—reflects its adaptive approach in the competitive communication solutions sector.

- Delve into the full analysis health report here for a deeper understanding of Sinch.

Explore historical data to track Sinch's performance over time in our Past section.

Xiamen Amoytop Biotech (SHSE:688278)

Simply Wall St Growth Rating: ★★★★★★

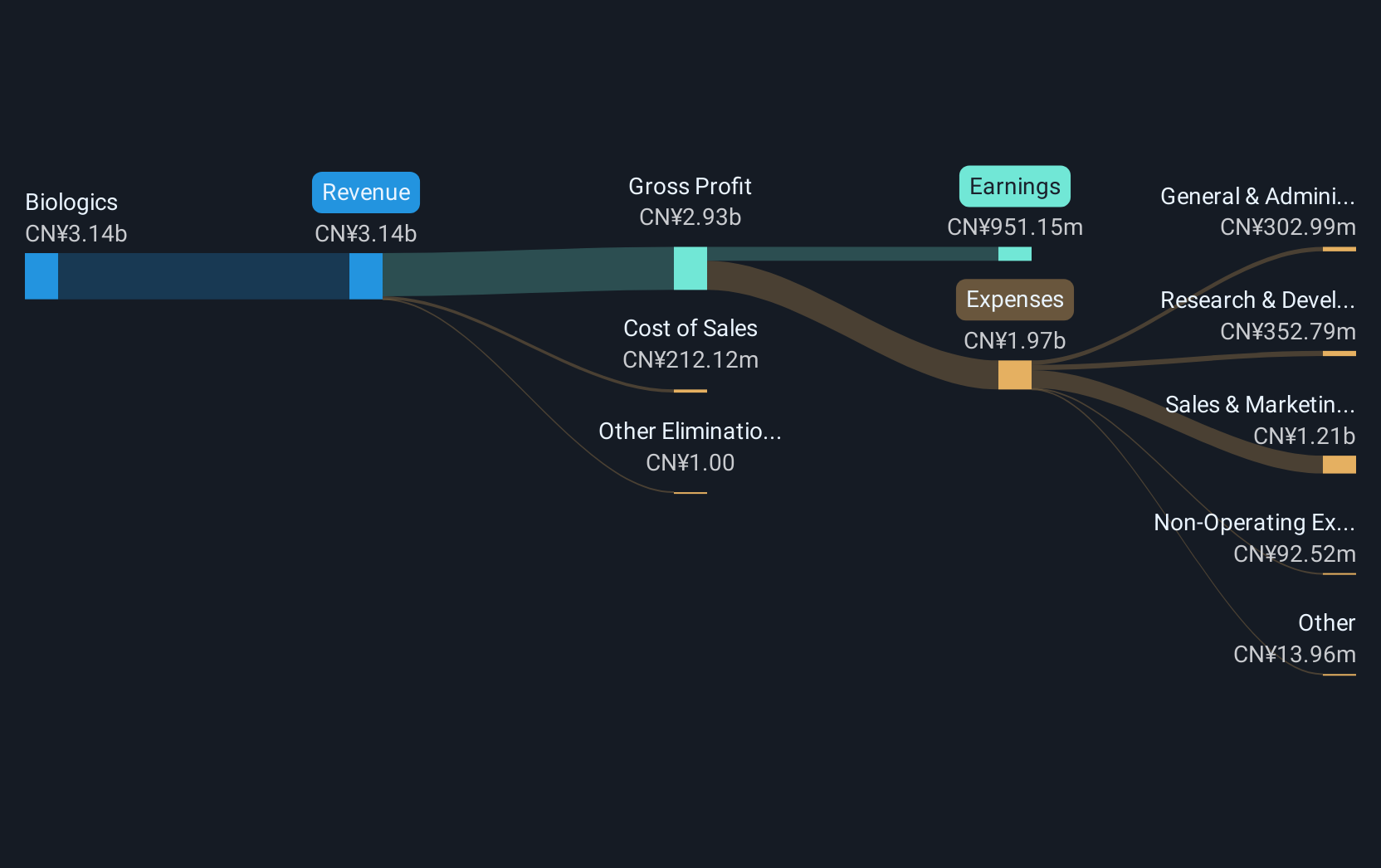

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China and has a market cap of CN¥29.44 billion.

Operations: Amoytop Biotech generates revenue primarily from its biologics segment, amounting to CN¥2.60 billion. The company is involved in the research, development, production, and sale of recombinant protein drugs within China.

Xiamen Amoytop Biotech has demonstrated robust growth, with revenue escalating by 28.5% annually and earnings surging by 31.7% per year, outpacing the Chinese market's average. This growth trajectory is supported by a substantial investment in R&D, which is evident from the firm dedicating a significant portion of its revenue to these activities; however, specific figures are not provided. The company's recent financial results reveal a marked increase in net income to CNY 554.15 million from CNY 368.91 million year-over-year, reflecting efficient operational execution and strategic focus on core biotechnological advancements. These factors collectively underscore Xiamen Amoytop’s potential within the high-growth biotech sector despite broader market uncertainties.

Key Takeaways

- Unlock our comprehensive list of 1234 High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688278

Xiamen Amoytop Biotech

Engages in research, development, production, and sale of recombinant protein drugs in China.

Exceptional growth potential with flawless balance sheet.