- China

- /

- Communications

- /

- SZSE:300628

3 Reliable Dividend Stocks To Consider With At Least 3.7% Yield

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities declining amid inflation concerns and political uncertainty, investors are seeking stability in the face of fluctuating indices and economic data. In such an environment, dividend stocks can offer a measure of reliability through consistent income streams, making them an attractive option for those looking to weather market volatility while potentially benefiting from steady yields.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.45% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1999 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

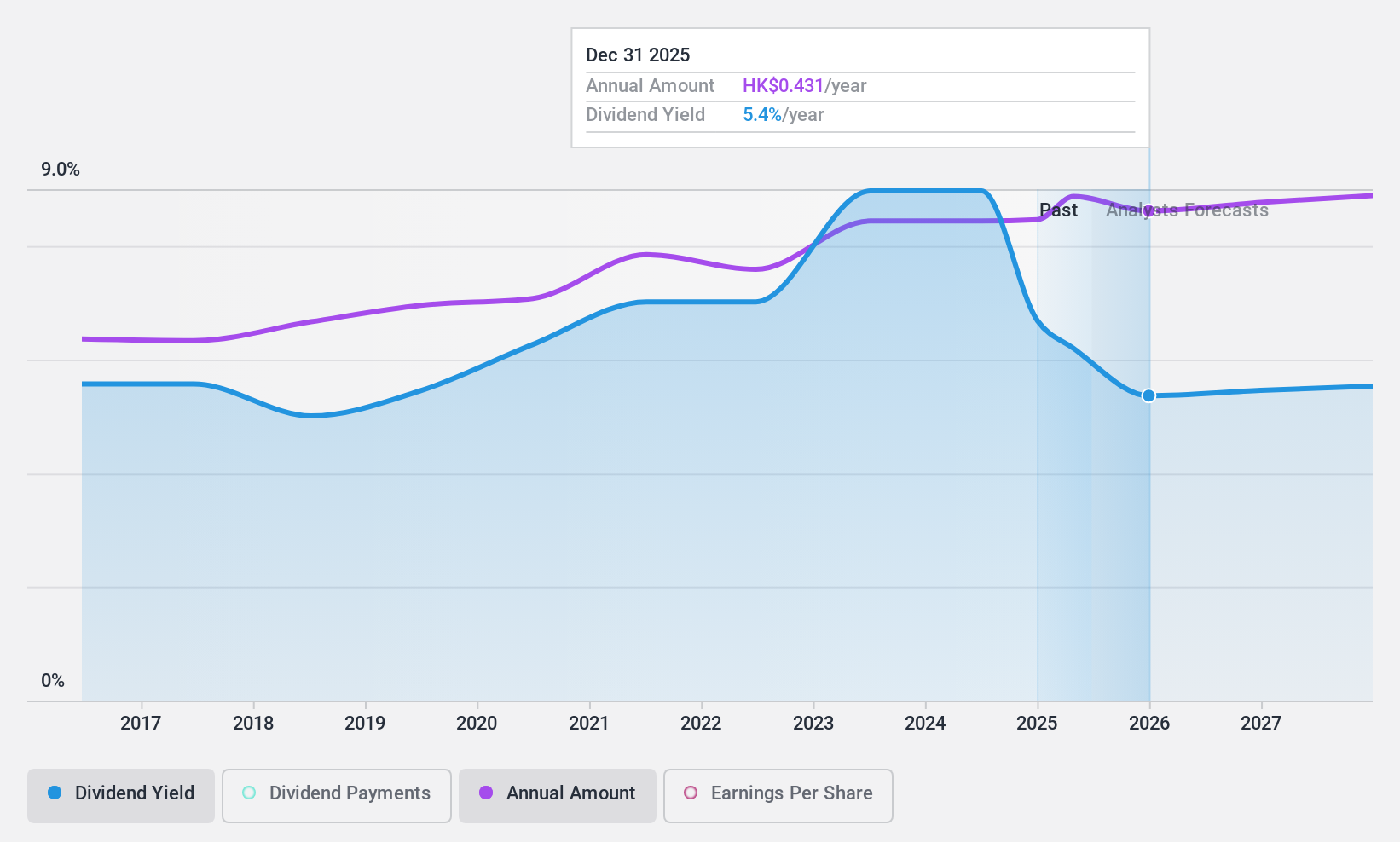

China Construction Bank (SEHK:939)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Construction Bank Corporation provides a range of banking and financial services to individuals and corporate clients both in the People's Republic of China and internationally, with a market cap of approximately HK$1.53 trillion.

Operations: China Construction Bank Corporation generates revenue through its diverse offerings of banking and financial services tailored to both individual and corporate clients within China and across international markets.

Dividend Yield: 6.9%

China Construction Bank offers a stable dividend profile, with dividends consistently paid and increased over the past decade. The current payout ratio of 45.9% indicates sustainability, and future projections suggest further coverage improvement to 30.5%. Despite trading at a significant discount to its estimated fair value, the dividend yield of 6.85% is below top-tier payers in Hong Kong. Recent events include interim dividends and executive changes, but these have not disrupted its reliable dividend payments.

- Dive into the specifics of China Construction Bank here with our thorough dividend report.

- Our expertly prepared valuation report China Construction Bank implies its share price may be lower than expected.

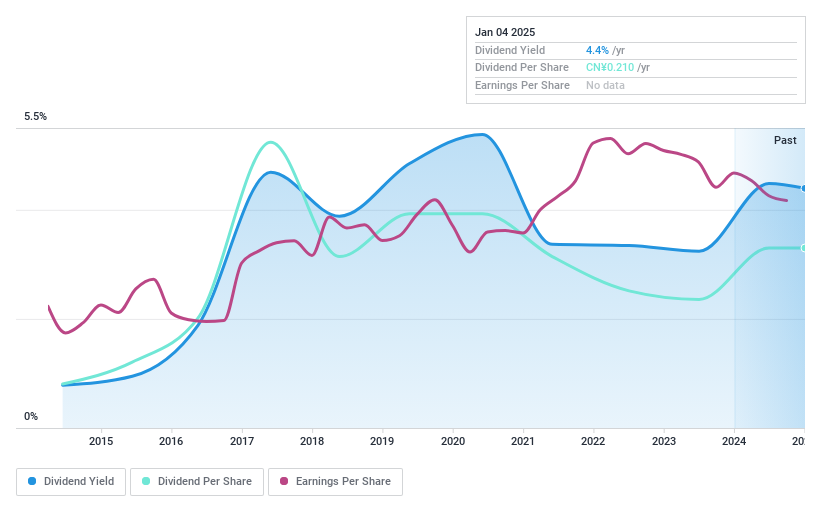

Wuchan Zhongda GroupLtd (SHSE:600704)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wuchan Zhongda Group Co., Ltd. operates as a provider of bulk commodity supply chain integration services both in China and internationally, with a market capitalization of CN¥24.51 billion.

Operations: Wuchan Zhongda Group Co., Ltd. generates revenue through its bulk commodity supply chain integration services in China and internationally.

Dividend Yield: 4.4%

Wuchan Zhongda Group's dividend yield of 4.36% ranks in the top 25% of CN market payers, yet its sustainability is questionable due to a lack of free cash flow coverage despite a low payout ratio of 34.6%. Dividend payments have been volatile over the past decade, indicating unreliability. Recent share buybacks totaling CNY 111.53 million may impact future dividends, as net income has decreased compared to last year’s figures.

- Get an in-depth perspective on Wuchan Zhongda GroupLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Wuchan Zhongda GroupLtd's shares may be trading at a premium.

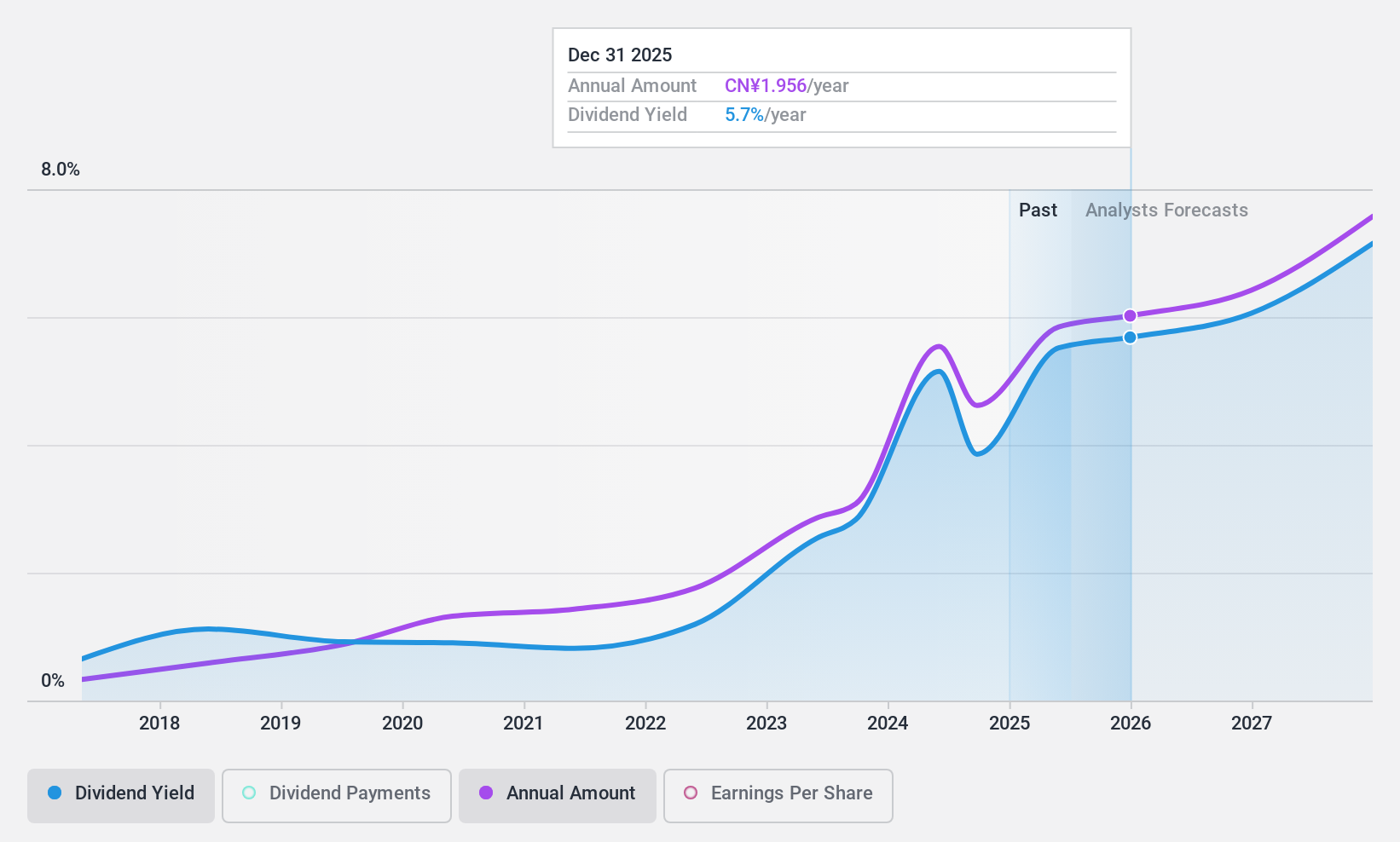

Yealink Network Technology (SZSE:300628)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yealink Network Technology Co., Ltd. offers voice conferencing, voice communications, and collaboration solutions globally and has a market cap of CN¥47.18 billion.

Operations: Yealink Network Technology Co., Ltd. generates revenue from its Internet Telephone segment, amounting to CN¥5.23 billion.

Dividend Yield: 3.8%

Yealink Network Technology's dividend yield of 3.76% places it in the top 25% of CN market payers, with dividends covered by both earnings and cash flows at a payout ratio of 77%. Despite being undervalued, trading at 39% below fair value, its dividend history is less reliable due to volatility over eight years. Recent earnings growth is strong, with net income reaching CNY 2.06 billion for the first nine months of 2024.

- Unlock comprehensive insights into our analysis of Yealink Network Technology stock in this dividend report.

- According our valuation report, there's an indication that Yealink Network Technology's share price might be on the cheaper side.

Next Steps

- Access the full spectrum of 1999 Top Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300628

Yealink Network Technology

Provides voice conferencing, voice communications, and collaboration solutions worldwide.

Very undervalued with outstanding track record and pays a dividend.