In the current global market landscape, U.S. equities have faced declines amid inflation concerns and political uncertainties, while European stocks showed resilience with expectations of rate cuts by the ECB. Amidst this volatility, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking reliable returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.45% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1999 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

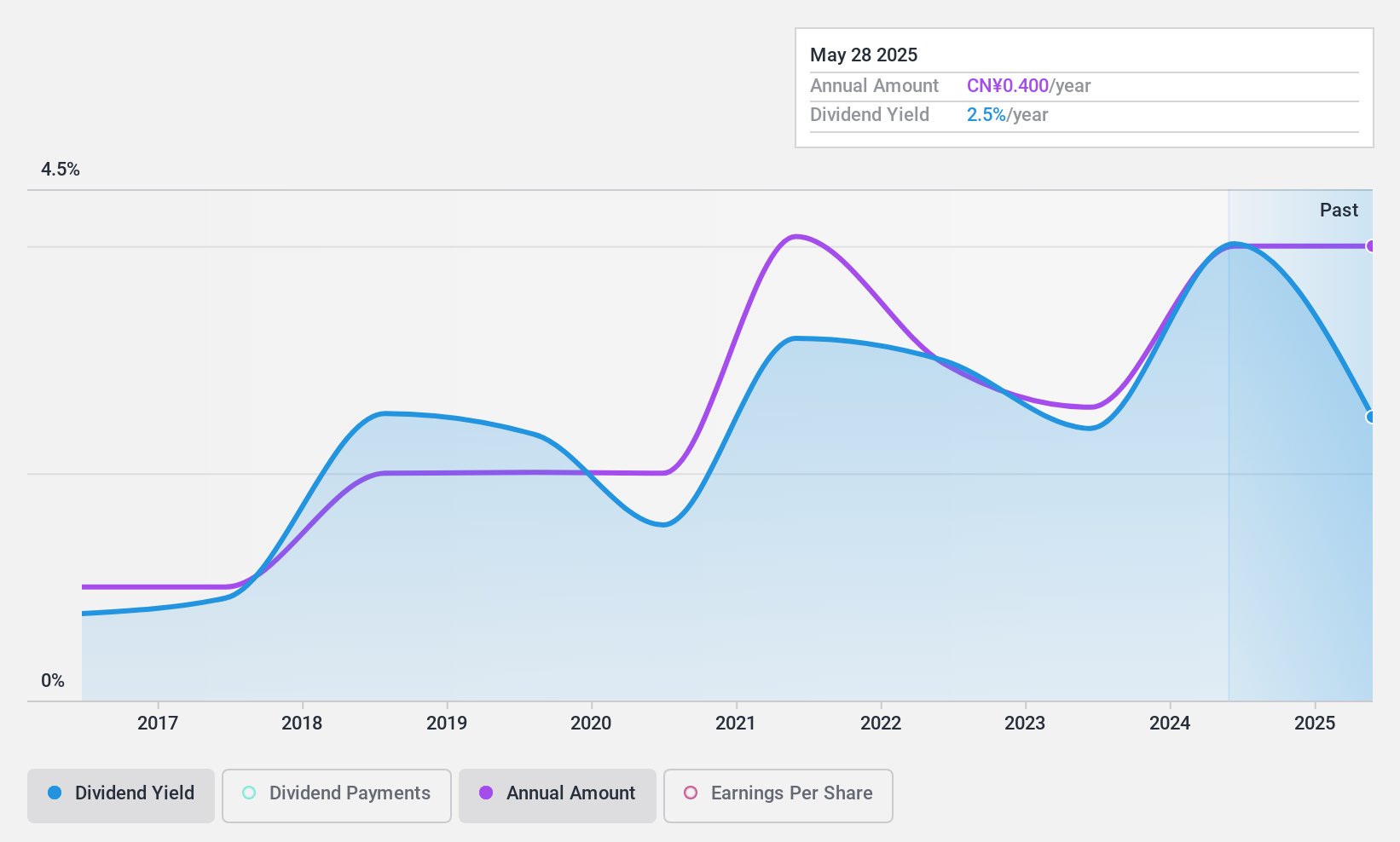

MeiHua Holdings GroupLtd (SHSE:600873)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MeiHua Holdings Group Co., Ltd is a synthetic biology company that offers amino acid nutrition and health solutions both in China and internationally, with a market cap of CN¥27.93 billion.

Operations: MeiHua Holdings Group Co., Ltd generates revenue primarily from its amino acid nutrition and health solutions business in China and international markets.

Dividend Yield: 3.6%

MeiHua Holdings Group Ltd. offers a dividend yield of 3.6%, placing it in the top 25% of CN market dividend payers. Despite an unstable track record, dividends are well-covered by earnings and cash flows, with payout ratios at 58% and 37.5%, respectively. Recent share buybacks worth CNY 287.74 million may support shareholder value, although revenue and net income have declined year-over-year for the nine months ended September 2024.

- Click to explore a detailed breakdown of our findings in MeiHua Holdings GroupLtd's dividend report.

- In light of our recent valuation report, it seems possible that MeiHua Holdings GroupLtd is trading behind its estimated value.

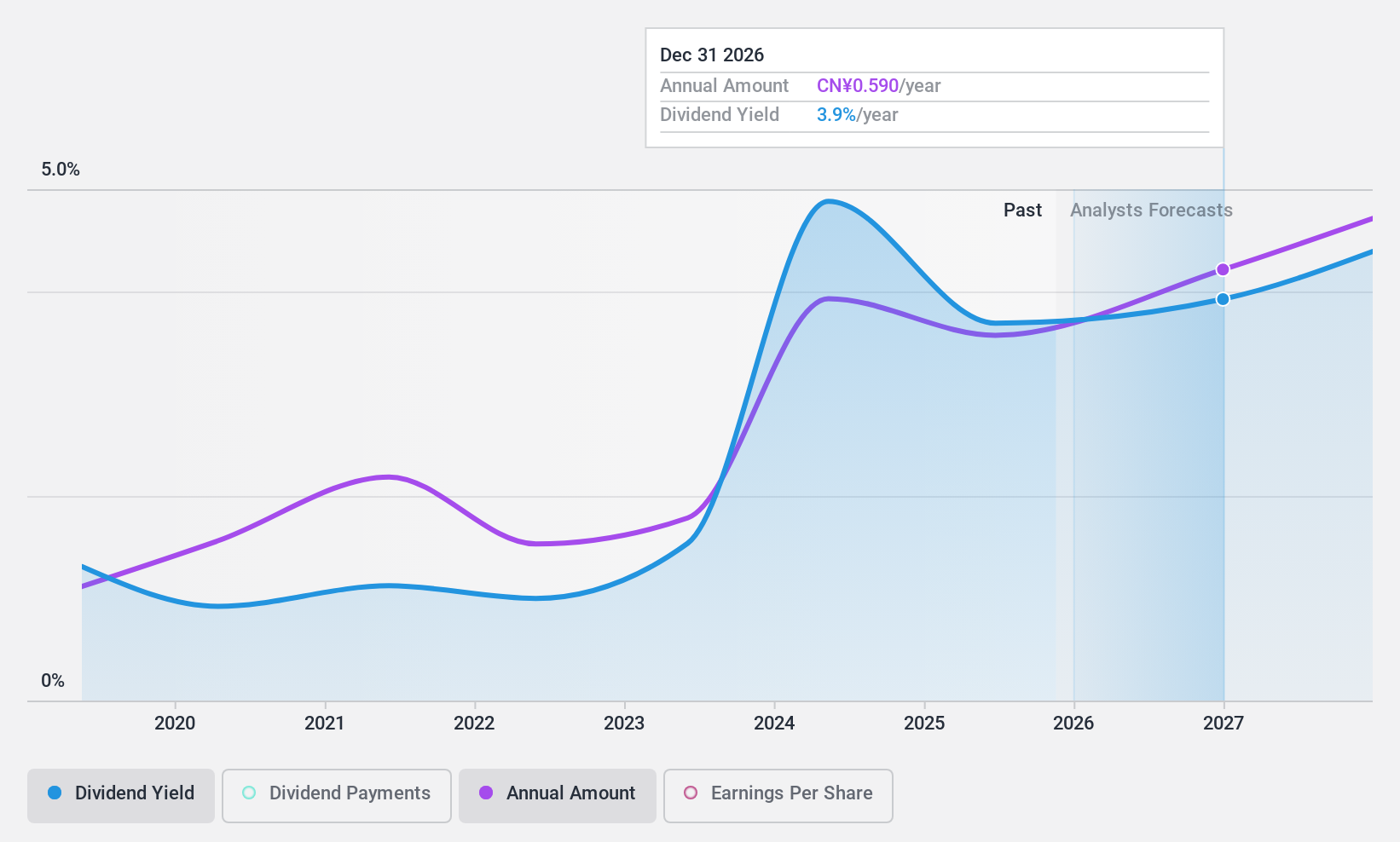

Qingdao Hiron Commercial Cold Chain (SHSE:603187)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Hiron Commercial Cold Chain Co., Ltd. operates in the commercial cold chain industry and has a market cap of CN¥4.20 billion.

Operations: Qingdao Hiron Commercial Cold Chain Co., Ltd. generates revenue from its Food Service Equipment segment, amounting to CN¥2.82 billion.

Dividend Yield: 5%

Qingdao Hiron Commercial Cold Chain's dividend yield of 5.02% ranks it among the top 25% of dividend payers in the CN market. Despite a volatile and unreliable dividend history over its six-year payment period, dividends are adequately covered by earnings and cash flows, with payout ratios at 63.9% and 59.2%, respectively. Recent financials show a decline in revenue to CNY 2.11 billion from CNY 2.50 billion, impacting net income for the nine months ended September 2024.

- Navigate through the intricacies of Qingdao Hiron Commercial Cold Chain with our comprehensive dividend report here.

- According our valuation report, there's an indication that Qingdao Hiron Commercial Cold Chain's share price might be on the cheaper side.

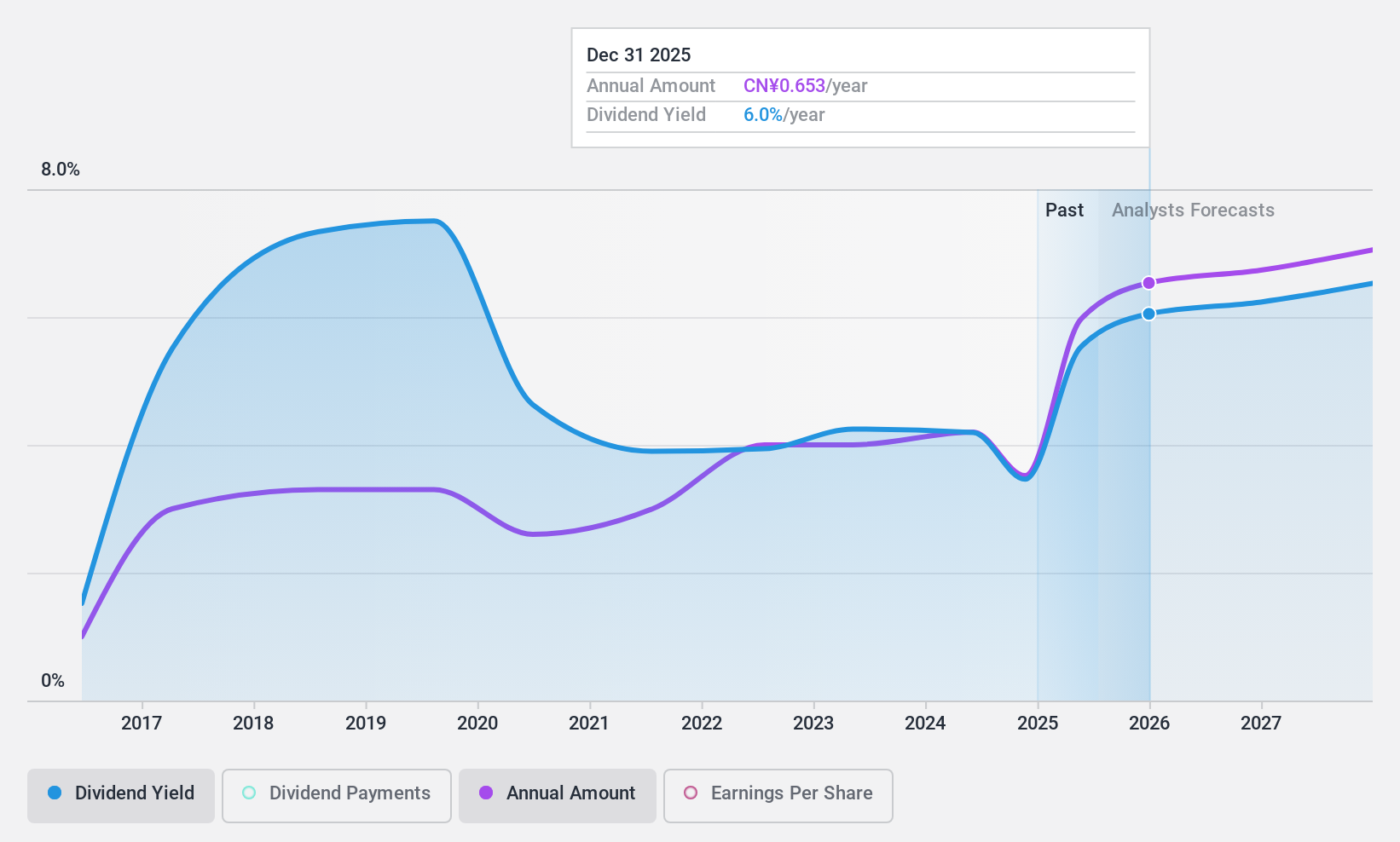

FIYTA Precision Technology (SZSE:000026)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FIYTA Precision Technology Co., Ltd. operates in the research, design, manufacture, sale, and service of watches under various brands in China and has a market capitalization of approximately CN¥3.85 billion.

Operations: FIYTA Precision Technology Co., Ltd.'s revenue is derived from its activities in the research, development, design, manufacture, sale, retail, and service of watches under brands like FIYTA, MOONYANG, JONAS&VERUS, Emile Chooriet, Beijing, and Jeep within China.

Dividend Yield: 4%

FIYTA Precision Technology's dividend yield of 4.04% places it in the top 25% of CN market payers, though its dividends have been volatile over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows with payout ratios of 61.9% and 43%, respectively. Recent financials reveal a decrease in revenue to CNY 3.04 billion from CNY 3.53 billion, affecting net income for the nine months ended September 2024.

- Get an in-depth perspective on FIYTA Precision Technology's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of FIYTA Precision Technology shares in the market.

Key Takeaways

- Dive into all 1999 of the Top Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000026

FIYTA Precision Technology

Engages in the research and development, design, manufacture, sale, retail, and service of watches under the FIYTA, MOONYANG, JONAS&VERUS, Emile Chouriet, Beijing, and Jeep brands in China.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives