- China

- /

- Semiconductors

- /

- SHSE:600206

Exploring Undiscovered Gems in Global Markets April 2025

Reviewed by Simply Wall St

In April 2025, global markets are grappling with heightened volatility as trade tensions between the U.S. and China escalate, impacting investor sentiment and leading to fluctuations in major indices like the S&P 500 and Russell 2000. Amid this uncertainty, small-cap stocks have shown resilience with modest gains despite broader market challenges, highlighting opportunities for investors seeking potential growth in under-the-radar companies. In such a dynamic environment, identifying promising stocks often involves looking for those that demonstrate robust fundamentals and adaptability to changing economic conditions—a crucial strategy when exploring undiscovered gems in global markets.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Top Union Electronics | 1.20% | 7.68% | 18.91% | ★★★★★★ |

| Soft-World International | NA | -0.79% | 6.29% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Formula Systems (1985) | 34.50% | 9.19% | 12.63% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 23.69% | 28.47% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| ShareHope Medicine | 37.64% | 3.29% | -7.06% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Grinm Advanced Materials (SHSE:600206)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Grinm Advanced Materials Co., Ltd. focuses on the R&D, manufacturing, and sale of advanced materials within China's nonferrous metals industry, with a market cap of CN¥13.50 billion.

Operations: Grinm Advanced Materials generates revenue primarily from the sale of advanced materials in China's nonferrous metals sector. The company reported a net profit margin of 8% in its latest financial period.

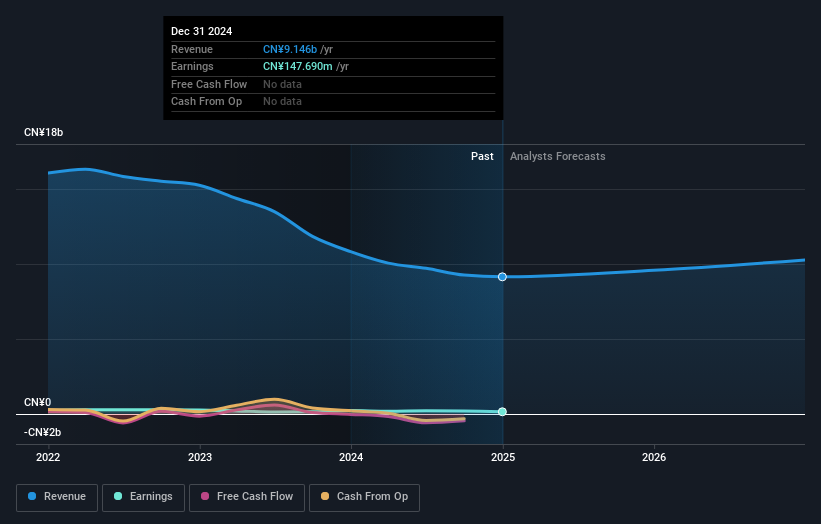

Grinm Advanced Materials, a smaller player in the semiconductor space, has demonstrated impressive earnings growth of 34.6% over the past year, outpacing the industry average of 8.9%. Despite this strong performance, their debt to equity ratio has risen from 2.6 to 28.9 over five years, indicating increased leverage. The company enjoys solid interest coverage with EBIT covering interest payments by 9.7 times, suggesting financial stability in managing its obligations. However, a large one-off gain of CN¥54M recently influenced its earnings results, which may not be sustainable moving forward without consistent operational improvements.

- Delve into the full analysis health report here for a deeper understanding of Grinm Advanced Materials.

Learn about Grinm Advanced Materials' historical performance.

Zhejiang Rongtai Electric MaterialLtd (SHSE:603119)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Rongtai Electric Material Co., Ltd. operates in the electric materials industry with a market capitalization of CN¥13.17 billion.

Operations: Rongtai Electric Material's revenue model centers on its operations in the electric materials sector. The company has a market capitalization of CN¥13.17 billion, reflecting its scale within the industry.

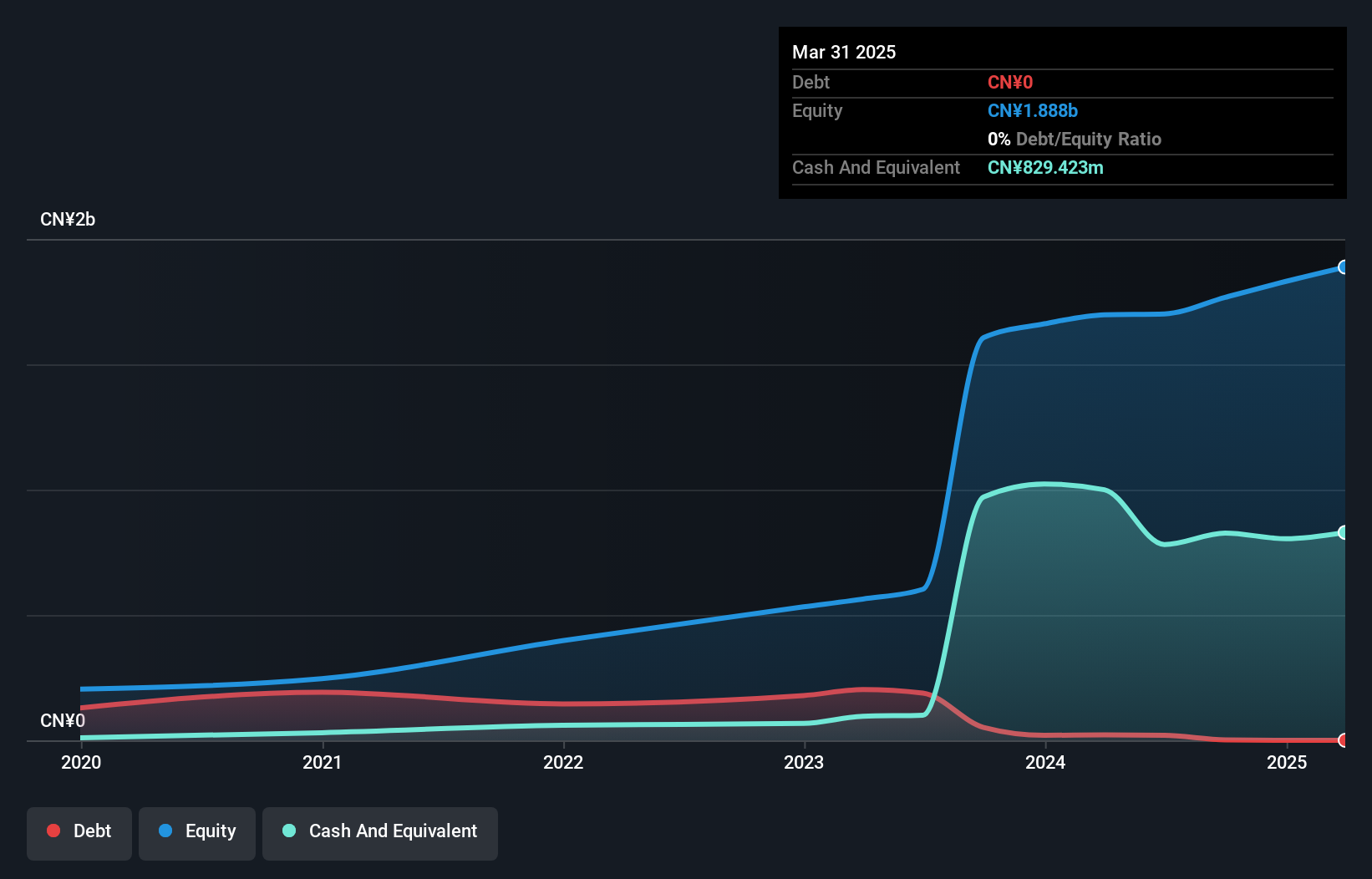

Rongtai Electric Material, a smaller player in the electrical industry, has shown impressive earnings growth of 40.8% over the past year, outpacing the industry's modest 0.2%. The company's financial health appears solid with more cash than total debt and high-quality earnings reported. Despite a volatile share price in recent months, Rongtai's future looks promising with forecasted annual earnings growth of 33.41%. Recent buybacks saw the company repurchase over a million shares for CNY 25.03 million by February 2025, signaling confidence from within and potentially enhancing shareholder value moving forward.

Guangdong Dongfang Precision Science & Technology (SZSE:002611)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Dongfang Precision Science & Technology Co., Ltd. focuses on the research, development, production, and sale of corrugated packaging equipment both domestically and internationally, with a market capitalization of approximately CN¥13.85 billion.

Operations: The company generates revenue primarily from its foreign and domestic operations, with foreign sales contributing approximately CN¥3.18 billion and domestic sales around CN¥1.80 billion.

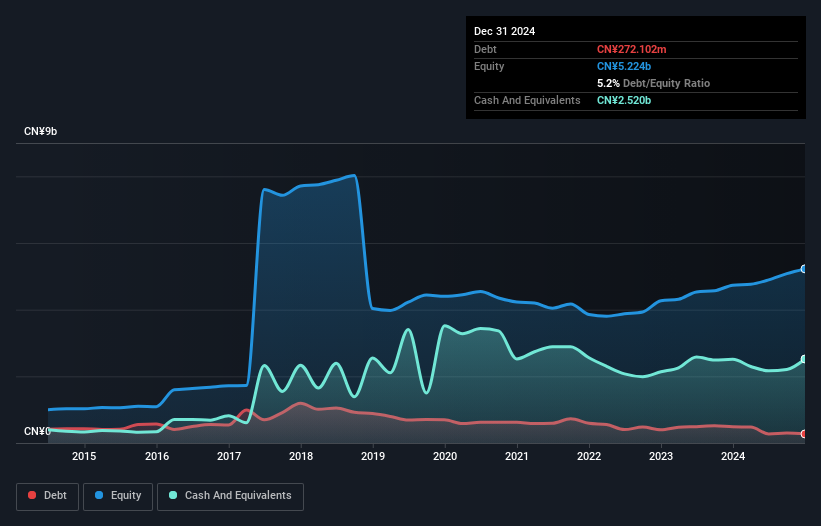

Dongfang Precision showcases a compelling profile with its price-to-earnings ratio at 28.8x, undercutting the broader CN market's 35.9x. The company's earnings rose by 15.5% over the past year, outpacing the Auto Components industry's growth of 10.1%. Despite a historical annual earnings drop of 33.1% over five years, recent performance suggests resilience and potential for recovery. Dongfang maintains a strong balance sheet, having reduced its debt-to-equity ratio from 15.8% to just 5.2%, and boasts high-quality past earnings alongside positive free cash flow—elements that could appeal to investors seeking robust financial health in this sector player.

Key Takeaways

- Get an in-depth perspective on all 3221 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600206

Grinm Advanced Materials

Engages in the research and development, manufacture, and sale of advanced materials in the nonferrous metals industry in China.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives