- China

- /

- Specialty Stores

- /

- SZSE:301088

Earnings Troubles May Signal Larger Issues for RumereLtd (SZSE:301088) Shareholders

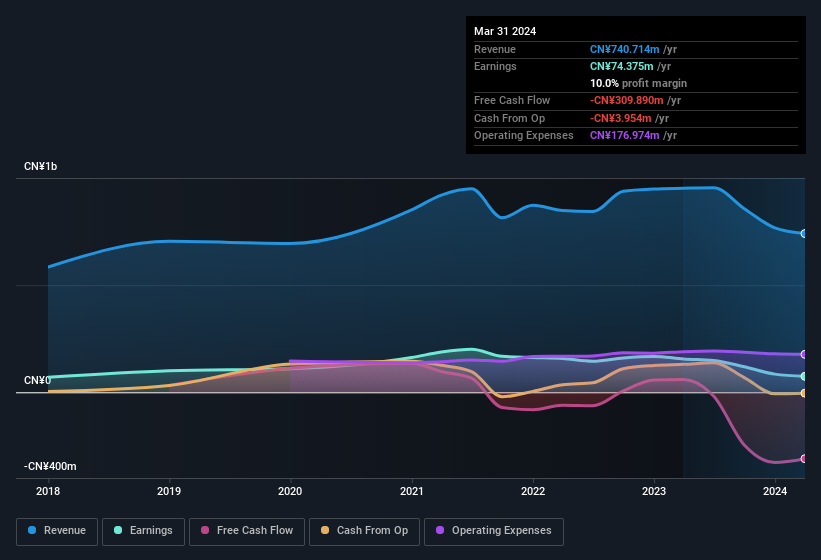

Despite Rumere Co.,Ltd.'s (SZSE:301088) most recent earnings report having soft headline numbers, its stock has had a positive performance. Our analysis suggests that there are some positive factors lying below the troubling profit numbers which investors are finding comfort in.

Check out our latest analysis for RumereLtd

A Closer Look At RumereLtd's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

For the year to March 2024, RumereLtd had an accrual ratio of 0.46. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. In the last twelve months it actually had negative free cash flow, with an outflow of CN¥310m despite its profit of CN¥74.4m, mentioned above. We saw that FCF was CN¥60m a year ago though, so RumereLtd has at least been able to generate positive FCF in the past. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

RumereLtd's profit suffered from unusual items, which reduced profit by CN¥69m in the last twelve months. If this was a non-cash charge, it would have made the accrual ratio better, if cashflow had stayed strong, so it's not great to see in combination with an uninspiring accrual ratio. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. In the twelve months to March 2024, RumereLtd had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On RumereLtd's Profit Performance

RumereLtd saw unusual items weigh on its profit, which should have made it easier to show high cash conversion, which it did not do, according to its accrual ratio. Based on these factors, it's hard to tell if RumereLtd's profits are a reasonable reflection of its underlying profitability. So while earnings quality is important, it's equally important to consider the risks facing RumereLtd at this point in time. For example, RumereLtd has 3 warning signs (and 2 which are significant) we think you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301088

RumereLtd

Primarily engages in the research and development, production, and online sale of its own clothing brand products and jewellery in China.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion