- China

- /

- Specialty Stores

- /

- SHSE:601888

China Tourism Group Duty Free Corporation Limited (SHSE:601888) Stock Catapults 36% Though Its Price And Business Still Lag The Market

China Tourism Group Duty Free Corporation Limited (SHSE:601888) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

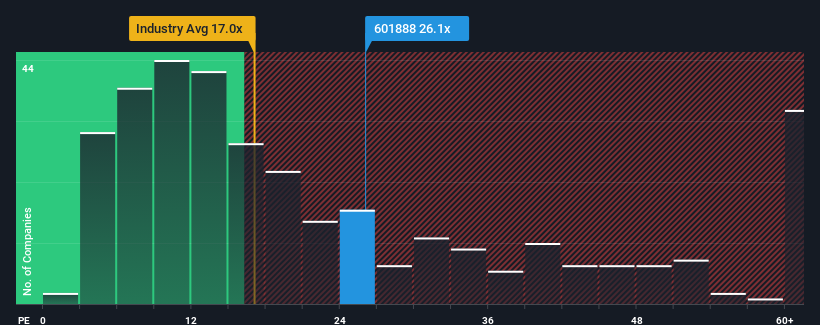

In spite of the firm bounce in price, China Tourism Group Duty Free may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 26.1x, since almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 64x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for China Tourism Group Duty Free as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for China Tourism Group Duty Free

How Is China Tourism Group Duty Free's Growth Trending?

In order to justify its P/E ratio, China Tourism Group Duty Free would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 22% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 45% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 14% each year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 19% per year growth forecast for the broader market.

With this information, we can see why China Tourism Group Duty Free is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite China Tourism Group Duty Free's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that China Tourism Group Duty Free maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for China Tourism Group Duty Free that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601888

China Tourism Group Duty Free

Engages in duty-free travel retail business in China.

Excellent balance sheet established dividend payer.