Amidst a backdrop of accelerating U.S. inflation and stock indexes nearing record highs, investors are navigating a complex economic landscape. With the Federal Reserve maintaining a cautious stance on interest rates, market participants are closely examining opportunities that offer potential growth despite economic uncertainties. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still present significant opportunities when backed by solid financials. In this article, we explore three penny stocks that combine balance sheet strength with promising potential for growth, offering investors an intriguing avenue to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.61M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$45.35B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$142.2M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.38 | £336.16M | ★★★★☆☆ |

Click here to see the full list of 5,686 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Ercros (BME:ECR)

Simply Wall St Financial Health Rating: ★★★★★☆

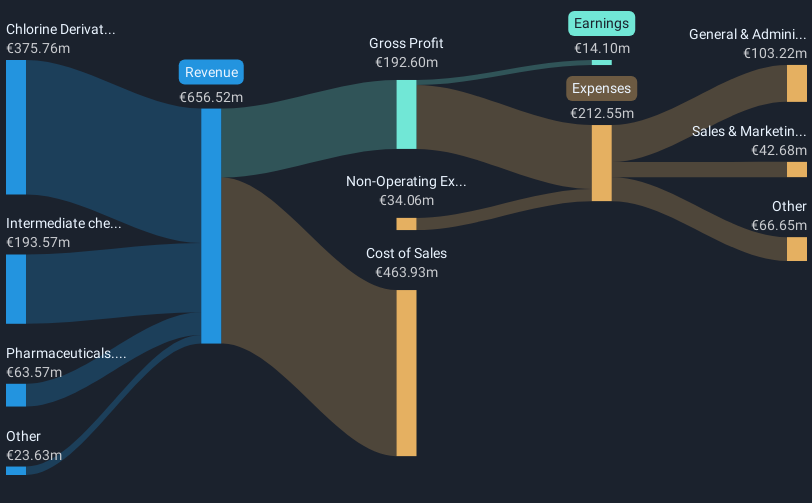

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €298.99 million.

Operations: The company's revenue is primarily derived from its Chlorine Derivatives segment, which accounts for €375.76 million, followed by Intermediate Chemicals at €193.57 million, and Pharmaceuticals contributing €63.57 million.

Market Cap: €299M

Ercros, S.A. presents a mixed picture for investors interested in penny stocks. The company's net profit margins have decreased slightly to 2.1%, and it experienced negative earnings growth of -33.5% over the past year, impacted by a large one-off gain of €3.5 million. Despite these challenges, Ercros maintains a satisfactory net debt to equity ratio of 36.3% and its short-term assets exceed both short- and long-term liabilities, indicating strong liquidity management with €234.8 million in short-term assets against €105 million in liabilities. However, its Return on Equity remains low at 4.1%, suggesting limited efficiency in generating profits from shareholders' equity.

- Take a closer look at Ercros' potential here in our financial health report.

- Learn about Ercros' historical performance here.

Rongan PropertyLtd (SZSE:000517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rongan Property Co., Ltd. develops and sells real estate properties in China, with a market cap of CN¥6.40 billion.

Operations: The company generates revenue of CN¥25.98 billion from its operations in China.

Market Cap: CN¥6.4B

Rongan Property Co., Ltd. offers a complex outlook for penny stock investors. Despite being unprofitable with increasing losses at 32.7% annually over five years, it maintains strong liquidity, as short-term assets of CN¥27.1 billion exceed both short- and long-term liabilities significantly. The company's debt management shows improvement, with a reduced debt to equity ratio from 142.8% to 38.3%, and its net debt to equity ratio is satisfactory at 10.3%. However, the dividend yield of 15.92% is not well covered by earnings, raising sustainability concerns amidst ongoing profitability challenges and negative return on equity of -4.92%.

- Unlock comprehensive insights into our analysis of Rongan PropertyLtd stock in this financial health report.

- Examine Rongan PropertyLtd's past performance report to understand how it has performed in prior years.

Chongqing Lummy Pharmaceutical (SZSE:300006)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chongqing Lummy Pharmaceutical Co., Ltd. focuses on the research, development, manufacture, and sale of pharmaceutical products in China with a market cap of CN¥4.09 billion.

Operations: The company's revenue primarily comes from its operations in China, amounting to CN¥856.48 million.

Market Cap: CN¥4.09B

Chongqing Lummy Pharmaceutical presents a mixed picture for penny stock investors. The company has recently turned profitable, with earnings growing at 28.9% annually over five years, although its return on equity remains low at 1.8%. Debt management is strong, with cash exceeding total debt and operating cash flow covering debt well. However, the share price has been highly volatile recently, and past financial results were impacted by a large one-off loss of CN¥30.7 million. Despite trading significantly below estimated fair value, potential investors should consider these factors alongside the seasoned management team and board experience.

- Click here to discover the nuances of Chongqing Lummy Pharmaceutical with our detailed analytical financial health report.

- Understand Chongqing Lummy Pharmaceutical's track record by examining our performance history report.

Seize The Opportunity

- Jump into our full catalog of 5,686 Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300006

Chongqing Lummy Pharmaceutical

Engages in the research and development, manufacture, and sale of pharmaceutical products in China.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives