3 Stocks Estimated To Be Up To 42.9% Undervalued Offering A Potential Discount

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are keenly observing opportunities that may arise from recent fluctuations. Amid these conditions, identifying undervalued stocks becomes crucial as they can offer potential discounts and strategic entry points for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$633.00 | MX$1257.07 | 49.6% |

| Fevertree Drinks (AIM:FEVR) | £6.605 | £13.12 | 49.7% |

| Elekta (OM:EKTA B) | SEK61.05 | SEK121.91 | 49.9% |

| Atlas Arteria (ASX:ALX) | A$4.83 | A$9.65 | 50% |

| Zhende Medical (SHSE:603301) | CN¥20.99 | CN¥41.92 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.14 | A$6.25 | 49.8% |

| TSE (KOSDAQ:A131290) | ₩43100.00 | ₩85771.31 | 49.8% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$94.43 | US$187.71 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.91 | €5.81 | 49.9% |

| iFLYTEKLTD (SZSE:002230) | CN¥45.21 | CN¥89.80 | 49.7% |

Let's review some notable picks from our screened stocks.

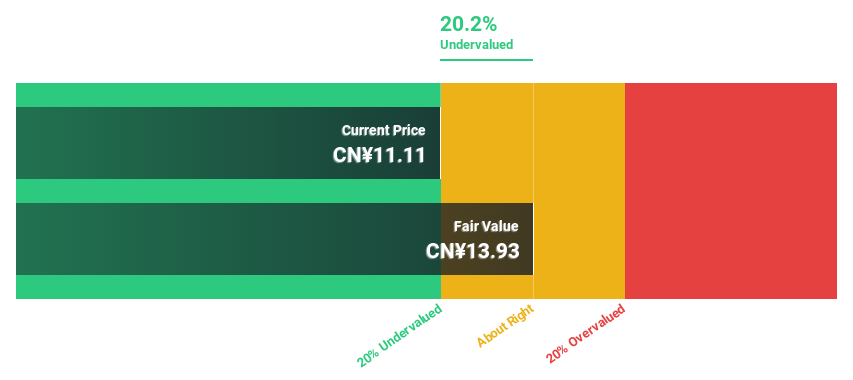

Jinhui Mining Incorporation (SHSE:603132)

Overview: Jinhui Mining Incorporation Limited is involved in the exploration, mining, processing, and sale of lead, zinc, silver, and other mineral resources in China with a market cap of CN¥11.09 billion.

Operations: The company's revenue is derived from the exploration, mining, processing, and sale of lead, zinc, silver, and other mineral resources within China.

Estimated Discount To Fair Value: 17.5%

Jinhui Mining Incorporation is trading 17.5% below its estimated fair value, with earnings and revenue forecasted to grow significantly above the market rate at 37.1% and 36.2% per year, respectively. Despite a high level of debt and a dividend not well-covered by free cash flows, the company's recent nine-month earnings report shows substantial growth in sales (CNY 1.10 billion) and net income (CNY 349.99 million).

- Our comprehensive growth report raises the possibility that Jinhui Mining Incorporation is poised for substantial financial growth.

- Navigate through the intricacies of Jinhui Mining Incorporation with our comprehensive financial health report here.

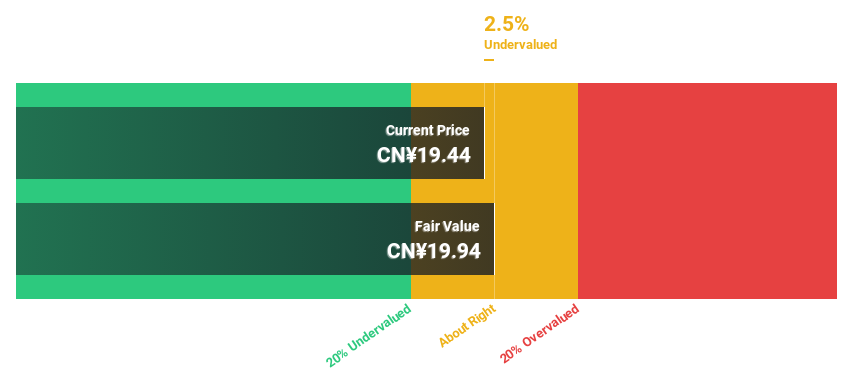

Hualan Biological Vaccine (SZSE:301207)

Overview: Hualan Biological Vaccine Inc. focuses on the research, development, production, and sale of vaccines in China with a market cap of CN¥10.99 billion.

Operations: Hualan Biological Vaccine Inc. generates its revenue through the research, development, production, and sale of vaccines within China.

Estimated Discount To Fair Value: 10.8%

Hualan Biological Vaccine is trading at CN¥17.78, slightly below its estimated fair value of CN¥19.94, with expected revenue growth of 28% per year, surpassing the market average. Earnings are forecasted to grow significantly at 33.3% annually over the next three years, despite a recent decline in nine-month sales (CN¥957.36 million) and net income (CN¥267.36 million) compared to the previous year’s figures.

- The analysis detailed in our Hualan Biological Vaccine growth report hints at robust future financial performance.

- Dive into the specifics of Hualan Biological Vaccine here with our thorough financial health report.

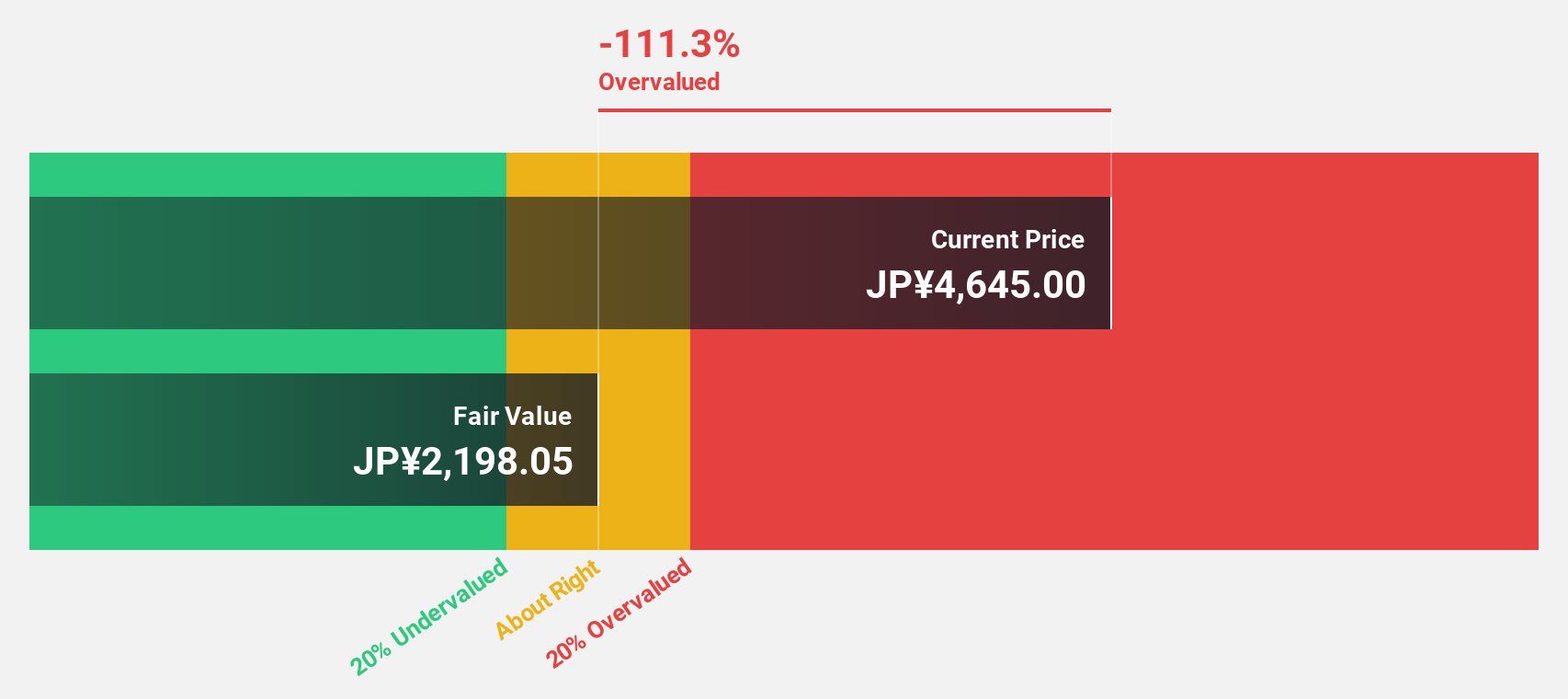

Money Forward (TSE:3994)

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan, with a market cap of ¥261.44 billion.

Operations: The company's revenue segment is primarily derived from its Platform Services Business, which generated ¥38.47 billion.

Estimated Discount To Fair Value: 42.9%

Money Forward is trading at ¥4,955, significantly below its estimated fair value of ¥8,676.08. Despite a forecasted operating loss for the fiscal year ending November 2024, its earnings are expected to grow by 57.71% annually and become profitable within three years—surpassing market growth rates. However, recent executive changes and high share price volatility may impact investor confidence in the short term.

- In light of our recent growth report, it seems possible that Money Forward's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Money Forward.

Seize The Opportunity

- Gain an insight into the universe of 896 Undervalued Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hualan Biological Vaccine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301207

Hualan Biological Vaccine

Engages in the research, development, production, and sale of vaccines in China.

High growth potential with excellent balance sheet and pays a dividend.