As we enter 2025, global markets are experiencing mixed signals with the S&P 500 and Nasdaq Composite recording strong annual performances despite recent economic concerns such as a drop in the Chicago PMI and a lowered GDP forecast by the Atlanta Fed. In this context, high growth tech stocks remain an area of interest for investors looking to navigate these volatile conditions, focusing on companies that demonstrate robust innovation potential and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Fujian Foxit Software Development (SHSE:688095)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Foxit Software Development Joint Stock Co., Ltd. operates in the software and programming industry with a market capitalization of CN¥5.31 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to CN¥677.44 million.

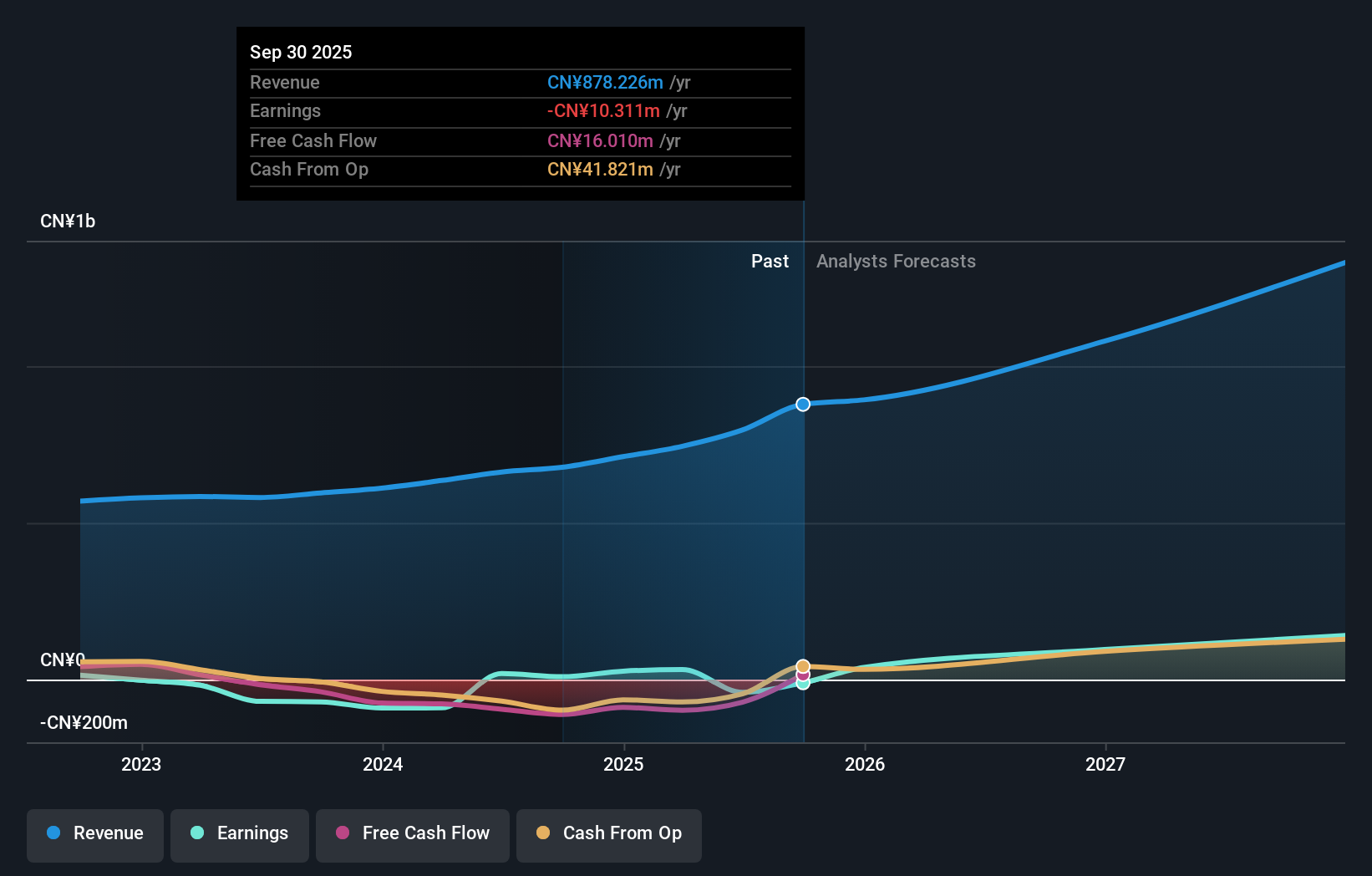

Fujian Foxit Software Development has demonstrated a robust turnaround, transitioning from a net loss to posting CNY 38.67 million in net income within the year, reflecting significant operational improvements. This shift is underscored by an 18.5% annual revenue growth, outpacing the broader Chinese market's 13.5% increase. The company's commitment to innovation is evident in its R&D investments, which are crucial for maintaining competitive edge in the rapidly evolving tech landscape. Despite challenges like high share price volatility and a forecasted low Return on Equity of 3.3%, Fujian Foxit's recent earnings growth of 108.5% annually signals strong potential for future profitability and market position strengthening, especially considering its strategic focus on expanding software solutions amidst growing digital transformation trends.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sharetronic Data Technology Co., Ltd. is a company that provides wireless IoT products both in China and internationally, with a market cap of CN¥24.28 billion.

Operations: Sharetronic Data Technology specializes in wireless IoT products, generating revenue from both domestic and international markets. The company's operations focus on developing and supplying advanced IoT solutions, contributing to its significant market presence.

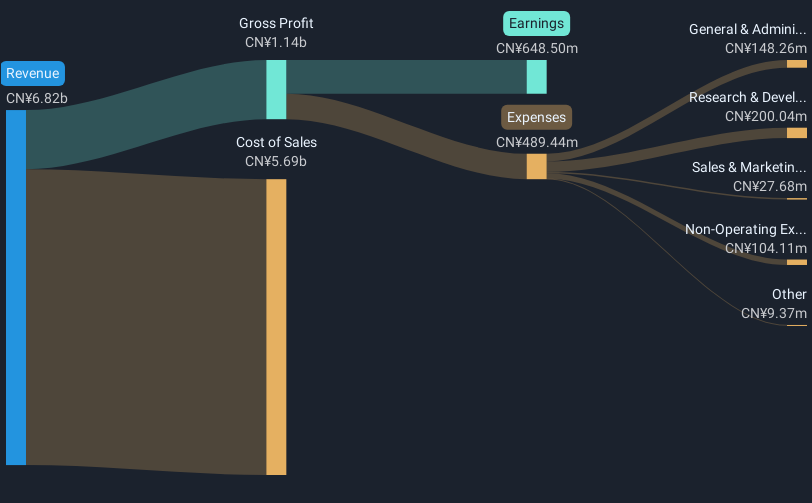

Sharetronic Data Technology has recently been spotlighted for its inclusion in the Shenzhen Stock Exchange Component and A Share Indexes, reflecting a growing market recognition. This acknowledgment coincides with an impressive earnings report for the nine months ending September 2024, where revenues surged to CNY 5.39 billion from CNY 3.23 billion year-over-year, and net income climbed to CNY 557 million from CNY 196 million. These financial milestones underscore a robust annual revenue growth rate of 22.8% and an explosive earnings increase of over 207% in the past year alone, significantly outpacing the broader tech industry's performance. The company's strategic expansions and operational enhancements suggest promising prospects, especially with a forecasted Return on Equity of an impressive 22.4% in three years' time, positioning it well within a highly competitive technology sector.

Wuhan Kotei InformaticsLtd (SZSE:301221)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuhan Kotei Informatics Co., Ltd. focuses on delivering integrated software solutions for intelligent networked vehicles in China, with a market capitalization of CN¥3.78 billion.

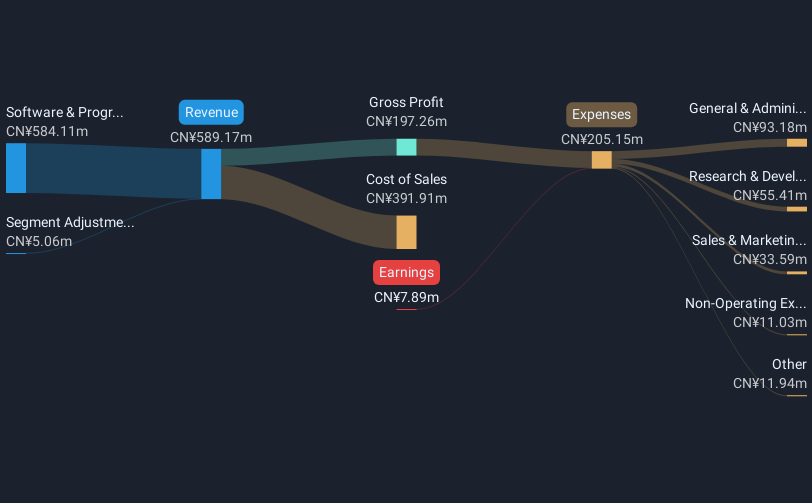

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to CN¥584.11 million.

Wuhan Kotei Informatics has demonstrated resilience and adaptability in a fluctuating tech landscape, evidenced by its revenue growth of 14.7% annually. Despite recent setbacks like being dropped from the S&P Global BMI Index, the company's commitment to innovation is clear with an expected shift into profitability within three years, supported by a forecasted annual profit growth of 57.1%. The firm's strategic focus on enhancing software capabilities could redefine its market standing, especially as it navigates past unprofitability towards generating positive free cash flows.

Turning Ideas Into Actions

- Access the full spectrum of 1263 High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688095

Fujian Foxit Software Development

Fujian Foxit Software Development Joint Stock Co., Ltd.

Flawless balance sheet with reasonable growth potential.