- China

- /

- Electronic Equipment and Components

- /

- SZSE:301195

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets have shown mixed signals with U.S. stocks closing out a strong year despite recent volatility, while economic indicators like the Chicago PMI and GDP forecasts suggest potential challenges ahead for small-cap companies. In this environment, identifying high-growth tech stocks requires careful consideration of their innovation potential and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Goodwill E-Health Info (SHSE:688246)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Goodwill E-Health Info Co., Ltd. focuses on the research and development of medical information software in China, with a market capitalization of approximately CN¥3.06 billion.

Operations: Goodwill E-Health Info Co., Ltd. specializes in developing medical information software, generating revenue primarily from software sales and related services. The company operates within the healthcare technology sector in China, leveraging its expertise to provide innovative solutions for medical data management and analysis.

Goodwill E-Health Info, navigating through a transformative phase in the healthcare tech sector, reported a significant shift with a net loss of CNY 41.26 million this year, contrasting sharply from last year's net income of CNY 18.03 million. Despite current unprofitability, the company is poised for robust future growth with expected revenue and earnings increases of 22.7% and 73.2% annually. This growth trajectory is bolstered by substantial R&D investments aimed at pioneering innovations in e-health solutions, aligning with industry trends towards digital health technologies. Recent strategic meetings and earnings calls suggest proactive management adjustments to navigate market challenges effectively. While the share price has shown volatility, Goodwill E-Health Info's commitment to expanding its technological capabilities could set a solid foundation for its anticipated profitability in the coming years, potentially outpacing average market growth rates significantly.

Shanghai Newtouch Software (SHSE:688590)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Newtouch Software Co., Ltd. is a software and information technology services company based in China with a market capitalization of CN¥3.69 billion.

Operations: Newtouch Software focuses on providing software and IT services, deriving its revenue primarily from these core operations. The company's business model centers around leveraging technology solutions to meet client needs in various sectors.

Shanghai Newtouch Software, amid a dynamic tech landscape, has demonstrated notable financial agility with its recent earnings report showing a revenue increase to CNY 1.38 billion from CNY 1.12 billion year-over-year. Despite a slight dip in net income from CNY 43.51 million to CNY 32 million, the company's aggressive R&D spending and strategic share repurchases—totaling 5,223,181 shares for CNY 61.71 million—underscore its commitment to innovation and shareholder value. These efforts are complemented by a private placement aimed at raising nearly CNY 300 million, highlighting confidence from major investors and setting the stage for continued expansion in software solutions.

Nanjing Bestway Intelligent Control Technology (SZSE:301195)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Bestway Intelligent Control Technology Co., Ltd. specializes in providing intelligent control solutions and has a market capitalization of CN¥3.84 billion.

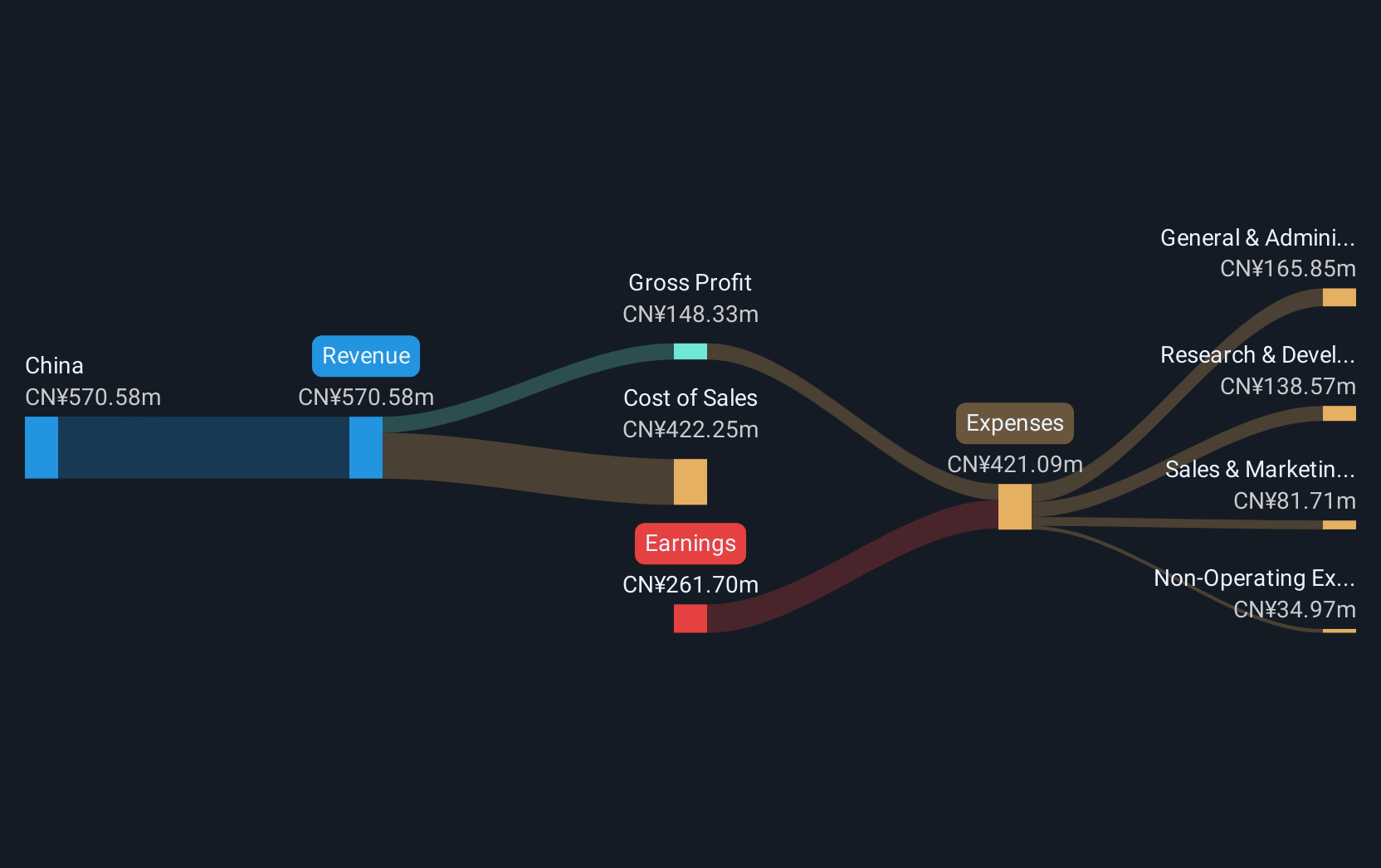

Operations: Bestway generates revenue primarily from its Computer Services segment, amounting to CN¥1.11 billion.

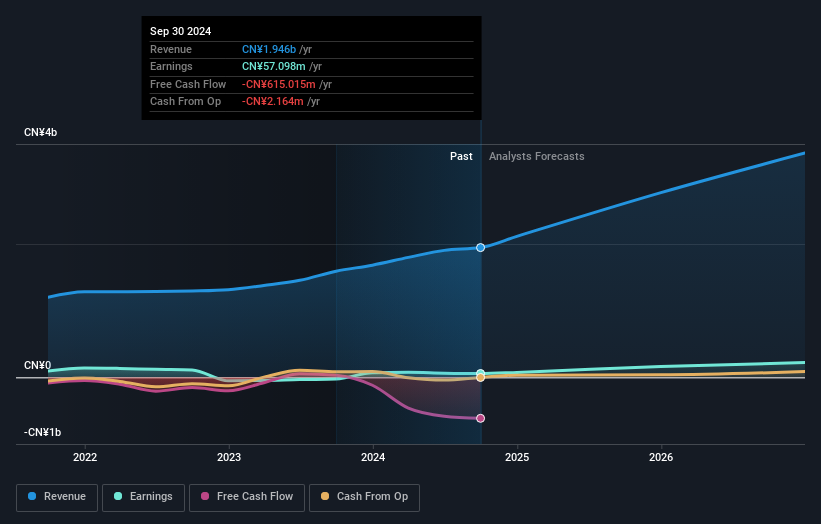

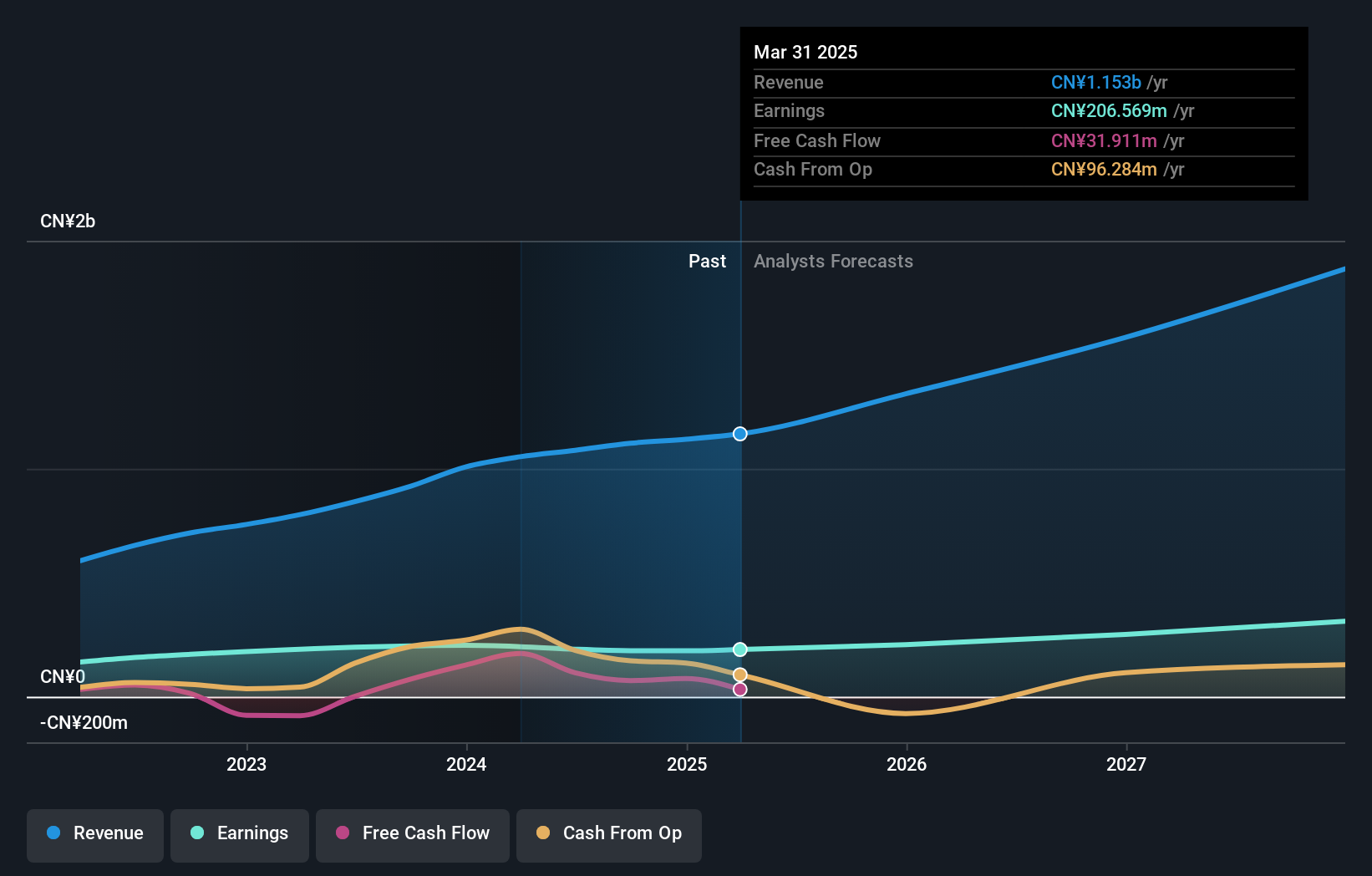

Nanjing Bestway Intelligent Control Technology has demonstrated a robust financial trajectory with its revenue growing to CNY 813.31 million, up from CNY 709.36 million year-over-year, showcasing a notable annualized revenue growth of 25.9%. Despite a slight decrease in net income to CNY 140.35 million from CNY 163.53 million, the company's commitment to innovation is evident in its R&D spending and strategic share repurchases—having bought back shares worth approximately CNY 49.99 million recently. These moves align with industry trends where tech firms are increasingly leveraging R&D investments to stay competitive in fast-evolving markets like intelligent control technology, ensuring they remain at the forefront of technological advances and market demands.

Seize The Opportunity

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1260 more companies for you to explore.Click here to unveil our expertly curated list of 1263 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Bestway Intelligent Control Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301195

Nanjing Bestway Intelligent Control Technology

Nanjing Bestway Intelligent Control Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives