- China

- /

- Tech Hardware

- /

- SZSE:001339

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are navigating a mixed landscape with U.S. stocks closing out a strong year despite recent profit-taking and economic indicators like the Chicago PMI showing contraction. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate resilience and innovation in the face of fluctuating market conditions and economic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

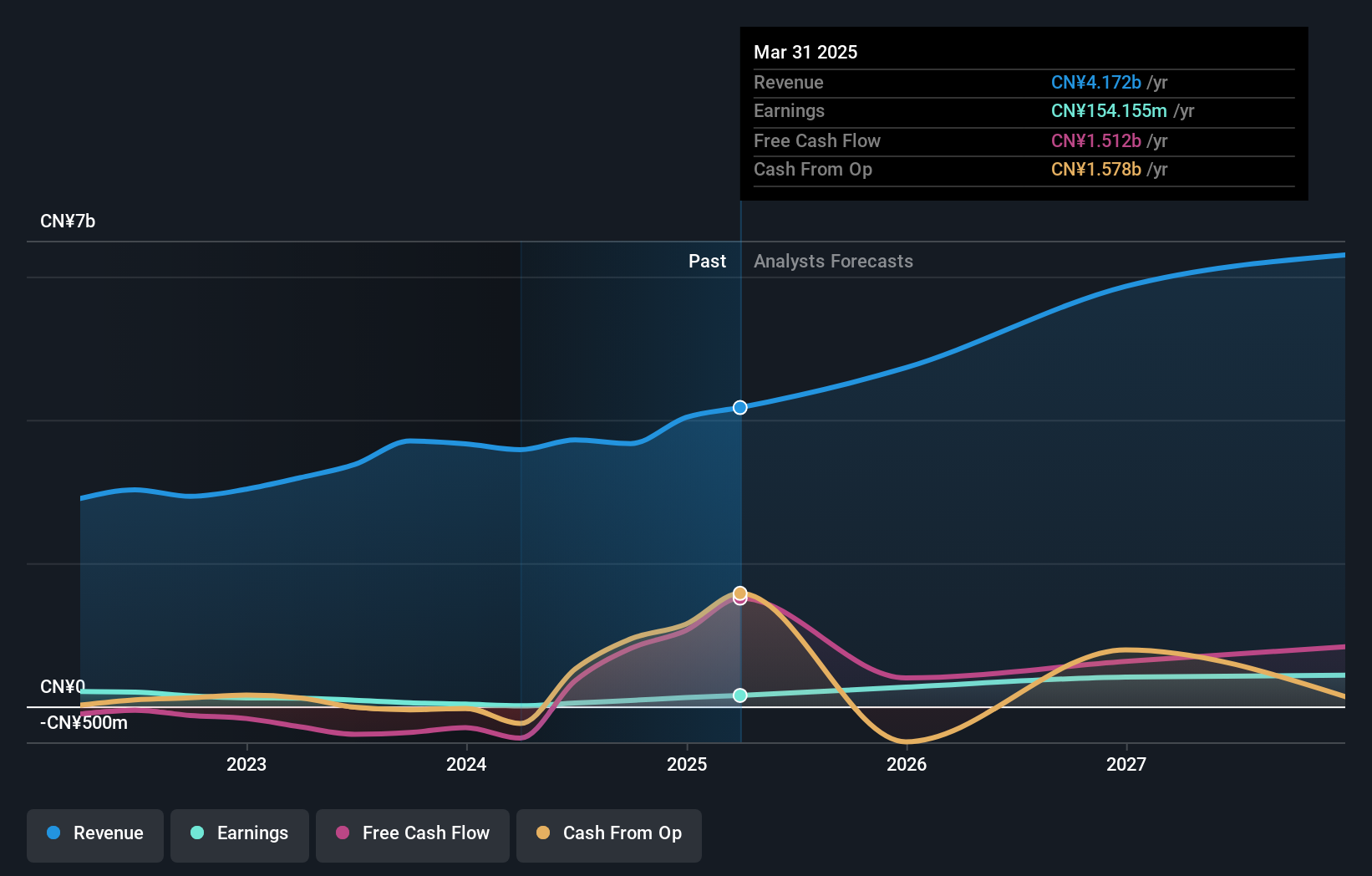

JWIPC Technology (SZSE:001339)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JWIPC Technology Co., Ltd. researches, develops, and manufactures IoT hardware solutions with a market capitalization of CN¥7.66 billion.

Operations: JWIPC Technology Co., Ltd. generates revenue primarily through the development and manufacturing of IoT hardware solutions. The company's market capitalization is CN¥7.66 billion, indicating its significant presence in the technology sector.

JWIPC Technology has demonstrated robust financial performance with a notable increase in net income from CNY 31.33 million to CNY 82.2 million over the past nine months, reflecting a growth of 162.3%. This surge is supported by consistent sales revenue, which slightly increased to CNY 2,781.26 million. The company's commitment to innovation is evident from its strategic decisions during shareholder meetings aimed at optimizing capital structure and enhancing shareholder value through stock repurchases and adjustments in repurchase pricing. Despite facing challenges in achieving high annual profit growth expectations above the market average, JWIPC continues to outpace industry earnings growth rates significantly, positioning itself as a resilient competitor in the tech sector with promising prospects for sustained financial health and market presence.

- Unlock comprehensive insights into our analysis of JWIPC Technology stock in this health report.

Examine JWIPC Technology's past performance report to understand how it has performed in the past.

Netac Technology (SZSE:300042)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Netac Technology Co., Ltd. focuses on the research, development, production, and sale of storage products both in China and internationally, with a market cap of CN¥4.11 billion.

Operations: Netac Technology Co., Ltd. generates its revenue primarily through the sale of storage products, leveraging its research and development capabilities to serve both domestic and international markets. The company operates with a market cap of CN¥4.11 billion, indicating a significant presence in the technology sector.

Netac Technology, amidst a challenging period, reported a significant revenue drop to CNY 587.93 million from CNY 1,033.57 million year-over-year and shifted from a net loss of CNY 36.8 million to CNY 68.2 million. Despite current unprofitability, the company is poised for recovery with projected annual earnings growth of 121.21% and revenue increases expected at an impressive rate of 55.5% per year, outpacing the CN market's average of 13.5%. This forecasted turnaround is critical as it navigates through its financial restructuring phase, aiming for profitability within three years amidst volatile market conditions.

Dongguan Tarry ElectronicsLtd (SZSE:300976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongguan Tarry Electronics Co., Ltd. operates in China, focusing on the manufacturing and sale of precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment with a market cap of CN¥5.86 billion.

Operations: The company generates revenue primarily from its manufacturing industry segment, amounting to CN¥2.24 billion. Its product offerings include precision die cutting products, foam protective film tapes, and assembly automation equipment.

Dongguan Tarry Electronics has demonstrated a robust financial performance with sales soaring to CNY 1.77 billion, nearly doubling from the previous year's CNY 925.06 million. This surge is complemented by a significant rise in net income from CNY 47.78 million to CNY 182.14 million within the same period, reflecting an annualized earnings growth of approximately 23.5%. Such growth underscores the company's ability to outperform sector trends and capitalize on market opportunities, despite not engaging in share repurchases recently as indicated by zero shares bought back in the latest quarter of 2024. This trajectory suggests that Dongguan Tarry is effectively navigating its competitive landscape, leveraging innovation and operational efficiency to enhance shareholder value.

- Click to explore a detailed breakdown of our findings in Dongguan Tarry ElectronicsLtd's health report.

Gain insights into Dongguan Tarry ElectronicsLtd's past trends and performance with our Past report.

Make It Happen

- Dive into all 1263 of the High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001339

JWIPC Technology

Researches, develops, and manufactures IoT hardware solutions.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives