Undiscovered Gems on None Exchange to Explore in January 2025

Reviewed by Simply Wall St

As global markets enter 2025, investors are navigating a landscape marked by mixed performances across major indices and cautious economic forecasts. While the S&P 500 and Nasdaq Composite have shown impressive gains over the past two years, recent contractions in manufacturing indicators like the Chicago PMI highlight ongoing challenges for small-cap companies. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for uncovering undiscovered gems that may thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 12.21% | 17.40% | 21.14% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Guangxi Huaxi Nonferrous MetalLtd (SHSE:600301)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi Huaxi Nonferrous Metal Co., Ltd engages in the trading of steel, bulk commodities, and other products within China and has a market capitalization of approximately CN¥10.69 billion.

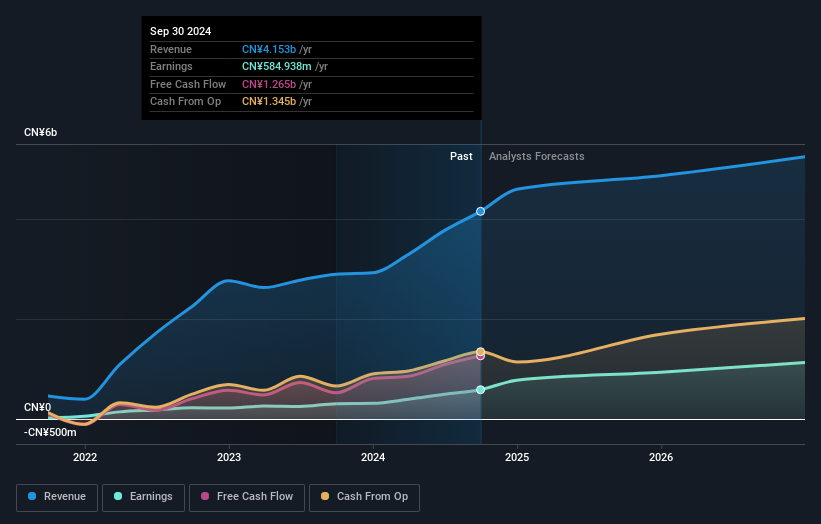

Operations: The company generates revenue primarily from trading activities in steel and bulk commodities. The chlorine alkali chemical industry segment contributes CN¥4.15 billion to its revenue stream.

Guangxi Huaxi Nonferrous Metal has shown impressive earnings growth of 90.9% over the past year, outpacing the chemicals industry average of -4.7%. The company trades at a significant discount—83% below its estimated fair value—indicating potential undervaluation compared to peers. Its debt to equity ratio rose from 0% to 28.3% in five years, yet interest payments are well-covered by EBIT at 26.3 times coverage, suggesting financial stability. Recent results show net income reaching CNY 540 million for nine months ending September 2024, up from CNY 269 million the previous year, reflecting robust operational performance.

Fortior Technology (Shenzhen) (SHSE:688279)

Simply Wall St Value Rating: ★★★★★★

Overview: Fortior Technology (Shenzhen) Co., Ltd. specializes in providing driver and control IC chips for diverse motor systems across Asian, North American, and European markets, with a market cap of CN¥13.65 billion.

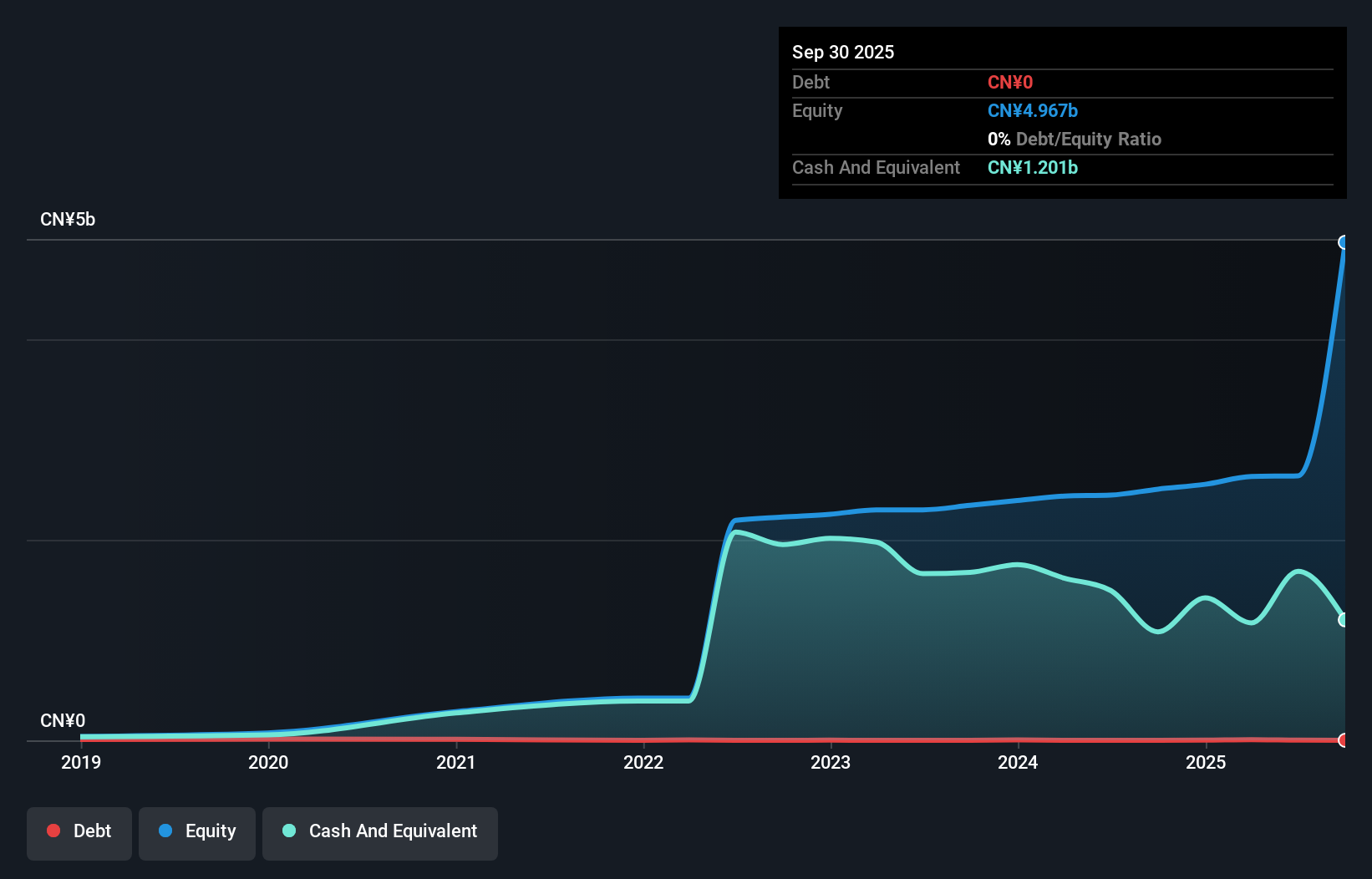

Operations: Fortior Technology generates revenue primarily from the sale of driver and control IC chips. The company's net profit margin shows a notable trend, reflecting its operational efficiency and cost management strategies.

Fortior Technology, nestled in the semiconductor industry, has been making waves with its impressive earnings growth of 56% over the past year, outpacing the industry's 13%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 17%, indicating a solid financial position. Despite a volatile share price recently, Fortior's net income rose to CNY 183.81 million from CNY 124.01 million last year for the first nine months of 2024. With basic earnings per share climbing to CNY 1.99 from CNY 1.34, Fortior seems poised for continued growth and profitability in its niche market segment.

Ningbo Kangqiang Electronics (SZSE:002119)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo Kangqiang Electronics Co., Ltd, along with its subsidiaries, specializes in the manufacturing and sale of semiconductor packaging materials in China, with a market capitalization of CN¥6.04 billion.

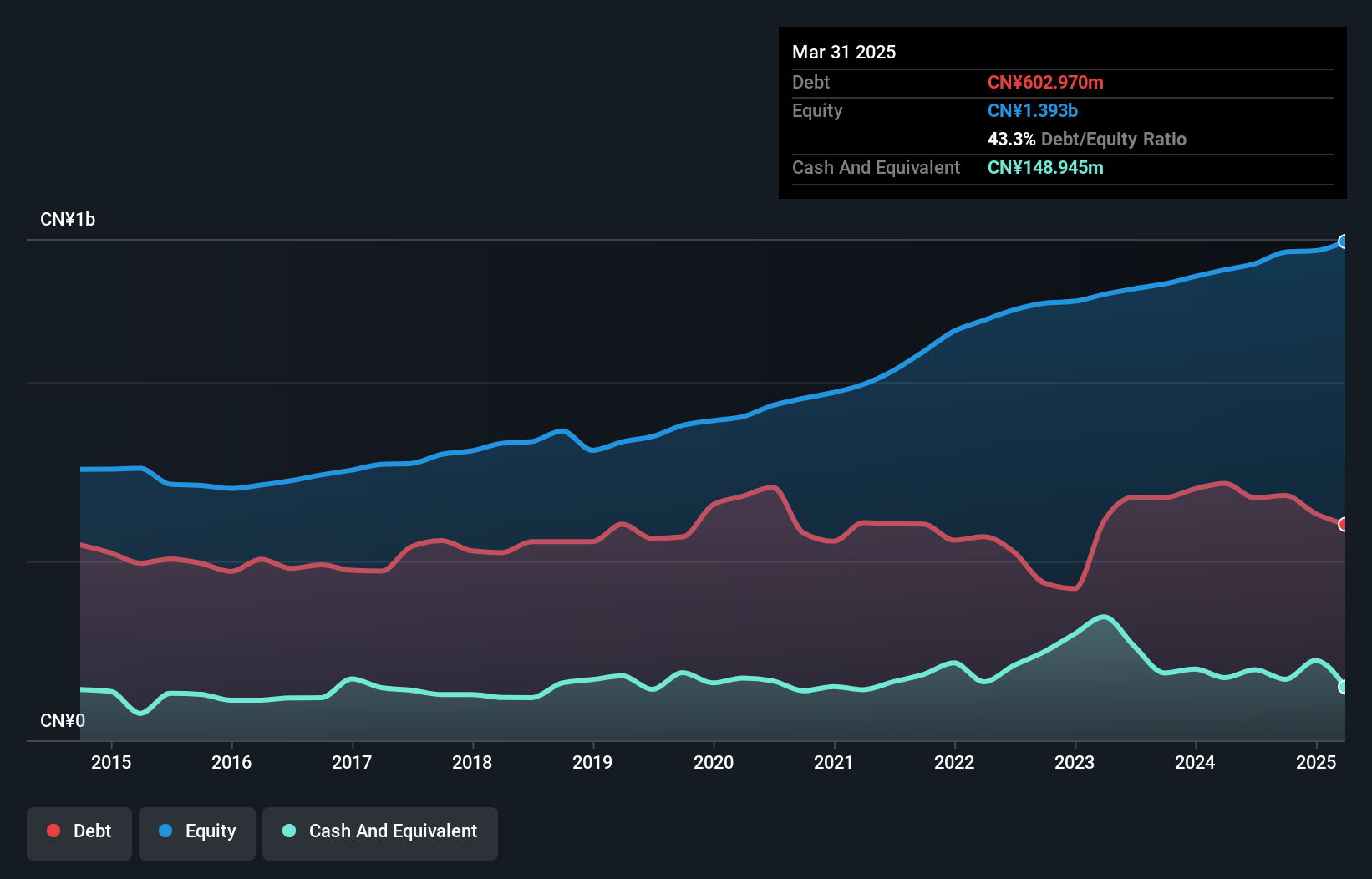

Operations: Ningbo Kangqiang Electronics generates revenue primarily through the sale of semiconductor packaging materials. The company's financial performance reveals a focus on cost management, with an emphasis on optimizing its net profit margin.

Ningbo Kangqiang Electronics, a promising player in the semiconductor space, showcases a robust financial profile with its debt-to-equity ratio improving from 64.6% to 50.1% over five years, indicating prudent financial management. Earnings surged by 53.9% last year, outpacing the industry's 12.9% growth rate and highlighting its competitive edge. Despite this impressive performance, earnings have dipped by an average of 1.7% annually over five years, suggesting some volatility in long-term growth trends. Recent reports show sales climbing to CNY 1,487 million from CNY 1,310 million year-over-year with net income reaching CNY 79 million compared to CNY 60 million previously.

- Click here to discover the nuances of Ningbo Kangqiang Electronics with our detailed analytical health report.

Gain insights into Ningbo Kangqiang Electronics' past trends and performance with our Past report.

Summing It All Up

- Click here to access our complete index of 4673 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600301

Guangxi Huaxi Nonferrous MetalLtd

Trades in steel, bulk commodities, and other products in China.

Outstanding track record and undervalued.