Investors Still Aren't Entirely Convinced By Zhejiang Jolly Pharmaceutical Co.,LTD's (SZSE:300181) Earnings Despite 32% Price Jump

Zhejiang Jolly Pharmaceutical Co.,LTD (SZSE:300181) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 48%.

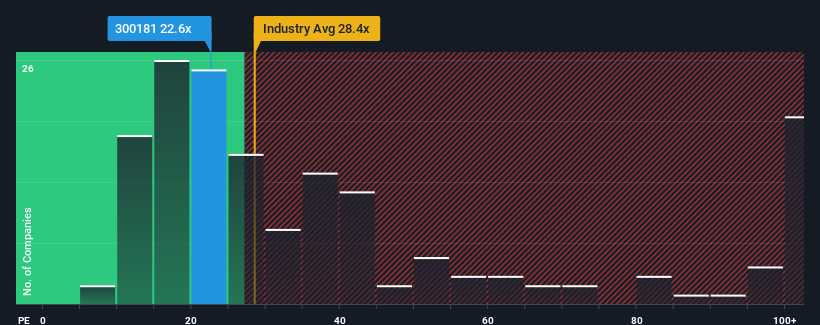

Although its price has surged higher, Zhejiang Jolly PharmaceuticalLTD may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.6x, since almost half of all companies in China have P/E ratios greater than 32x and even P/E's higher than 62x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Zhejiang Jolly PharmaceuticalLTD has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Zhejiang Jolly PharmaceuticalLTD

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhejiang Jolly PharmaceuticalLTD's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 34%. Pleasingly, EPS has also lifted 189% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 19% each year over the next three years. That's shaping up to be similar to the 18% per annum growth forecast for the broader market.

In light of this, it's peculiar that Zhejiang Jolly PharmaceuticalLTD's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Zhejiang Jolly PharmaceuticalLTD's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Zhejiang Jolly PharmaceuticalLTD's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Zhejiang Jolly PharmaceuticalLTD is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Zhejiang Jolly PharmaceuticalLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jolly PharmaceuticalLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300181

Zhejiang Jolly PharmaceuticalLTD

Engages in the research, production, and marketing of Chinese medicinal products in the People’s Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.