Why Teyi Pharmaceutical GroupLtd's (SZSE:002728) Shaky Earnings Are Just The Beginning Of Its Problems

Investors were disappointed by Teyi Pharmaceutical Group Co.,Ltd's (SZSE:002728 ) latest earnings release. We did some analysis, and found that there are some reasons to be cautious about the headline numbers.

See our latest analysis for Teyi Pharmaceutical GroupLtd

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Teyi Pharmaceutical GroupLtd increased the number of shares on issue by 14% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Teyi Pharmaceutical GroupLtd's EPS by clicking here.

How Is Dilution Impacting Teyi Pharmaceutical GroupLtd's Earnings Per Share (EPS)?

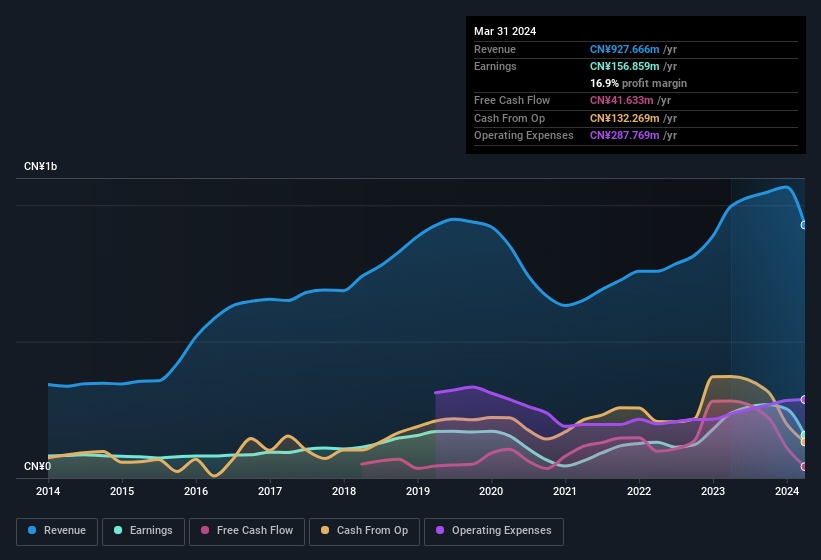

As you can see above, Teyi Pharmaceutical GroupLtd has been growing its net income over the last few years, with an annualized gain of 151% over three years. In comparison, earnings per share only gained 115% over the same period. Net income was down 34% over the last twelve months. But the EPS result was even worse, with the company recording a decline of 36%. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If Teyi Pharmaceutical GroupLtd's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Teyi Pharmaceutical GroupLtd's Profit Performance

Teyi Pharmaceutical GroupLtd issued shares during the year, and that means its EPS performance lags its net income growth. Because of this, we think that it may be that Teyi Pharmaceutical GroupLtd's statutory profits are better than its underlying earnings power. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Teyi Pharmaceutical GroupLtd at this point in time. Every company has risks, and we've spotted 2 warning signs for Teyi Pharmaceutical GroupLtd (of which 1 is a bit unpleasant!) you should know about.

Today we've zoomed in on a single data point to better understand the nature of Teyi Pharmaceutical GroupLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teyi Pharmaceutical GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002728

Teyi Pharmaceutical GroupLtd

Engages in the research and development, production, and sale of Chinese patent medicines, pharmaceutical preparations, raw materials, and products in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)